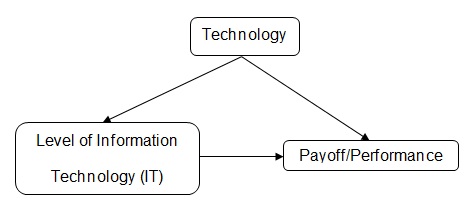

Refined conceptual framework

The study required data on the levels of adoption of IT to be collected in order to determine whether its increase or decrease leads to a subsequent increase or decrease in the level of payoffs or profits from the business venture. Different organizations adopt technology at different times or at different capacities hence the effect or outcome differs considerably. Those that easily adopt it are more successful compared to those that do not easily adopt them.

The dependent variable in the current study would be the level of information technology adoption in different firms. The dependent variable is usually altered by the researcher during the study. Depending on the level of adoption of the information technology by the organizations, the level of performance and success in terms of profitability would be assessed. The performance of the organizations would be the dependent variable in this case and it would be studied to determine its relationship to the level of adoption. The dependent variable will be a measure of what is to be collected in the field and it is believed that it is greatly altered by the other variable which is the independent one.

The mediating variable in this study is technology since it explains the relationship between the dependent and independent variables of the hypothesis in this research. The reason why different levels of payoff are expected for different levels of adoption of information technology is because of the presence or effects of technological advancements. Other companies that have not adopted information technology in their practices and business ventures do not experience the benefits that come with its adoption. Previous research has suggested that the adoption of an electronic marketplace has an effect on the transaction cost and market structure (Lee & Clark, 1996).

Information technology is important since it improves the effectiveness of the organization’s transactions hence reduces the costs incurred during such activities during purchases. However, this must be coupled with good management strategies in order to realize the full potential of IT adoption.

Hypotheses

- H1: Level of adoption of Information Technology has an effect on the performance levels in corporations in terms of payoffs.

- H0: The level of adoption of Information Technology does not have an effect on the performance levels in corporations in terms of payoffs.

The variables or constructs in this hypothesis are likely to yield a positive relationship because the level of information technology adoption may determine the level of performance in terms of payoffs in the organization. The benefits from IT to organizations have been studied and it has been determined that it profits the companies if well adopted and in the corporate market, it has been used to improve the effectiveness of their transactions (Loh & Venkatraman, 1992). Other similar studies have also concluded that IT can be used successfully to trade items online (Clarke & Jenkins, 1993).

Different companies have different levels of adoption of information technology since not all firms readily embrace technology as it advances. The world, including the business world, is in an ever-changing place and firms might have their different perceptions of it. Those that readily embrace and adopt it are in a better position in facing competition than those that do not. Such firms experience greater profits and improve performance. With the different levels of adoption, depending on the flexibility of the organization, the companies will experience different levels of benefits in terms of payoffs from the information technology. This would be reflected in the number of profits obtained due to the adoption of information technology and in the effectiveness of the services.

Summary of what was learned

It has been learned that information technology is important in every organization if the firm needs to experience greater profits. The benefits from IT go beyond the tangible form since some are intangible and unrealized by many corporations. The attempt by some firms to measure profitability using economic analysis only gives estimates of the profits but cuts off a large portion of the benefits from IT.

It can also be learned that electronic market systems are very much adopted by many corporations and they are meant to make the firms improve the effectiveness of their transactions. Many companies and corporations have introduced an electronic market system to the industry and have succeeded in managing it for the good of the company. However, others have not succeeded in using it or have not successfully been adopted in other areas due to the slow nature of adoption. This means that there are a number of barriers to this venture.

Various authors have attempted to analyze the reasons for the failure of the electronic systems to be adopted successfully. This was made possible through the assessment of the risk of the financial implication of the process of adoption. Suggestions to address this issue were then provided by the authors.

The importance of IT has also been realized in terms of trade whereby some firms have realized greater successes in online trading. This is whereby firms seek to sell their commodities over the computer network without actually taking their goods to the marketplace. This system has been successfully introduced in Australia where livestock trading schemes have been developed to trade livestock over the internet. The use of IT to trade livestock in Australia has been successful and this is an encouragement to any businessman who feels that there is a product that he would want to trade without actually taking it to the market place (Neo, 1992).

It has been learned that the electronic market has been used severally for the purpose of competitive gains. However, little has been done to describe the reality of situations in the event that an electronic market is introduced and implemented. An assumption that underlies this venture is that strategic IT is put in place to enable the firm to compete in the business world. Little has also been done to study how the government uses information technology initiatives to alter the industrial structure for the purpose of regulation.

The paper that addressed the case study of an industry in Singapore was meant to provide a real-case scenario whereby an electronic market was used to alter the market structure of pig trade. This was done in order to shape the market to ensure efficiency and to deal with the social issue. The results describe the impacts of the electronic market and various lessons from the case study have been highlighted. The research looked at whether the electronic market could be used to alter the current market structure.

It has been learned that information technology greatly contributes to the organization’s agility. When an organization invests more in information technology and information systems, it would experience greater agility. However, it should be noted that IT is not always advantageous since it might prove to be a hindrance or an impediment to the organization’s agility.

For an organization to succeed in the management of information technology resources and realize agility, it must develop superior firm-wide capabilities in information technology. The measure of the company’s agility in information may be in three forms, which include the information technology infrastructure adopted, the companies’ spanning capabilities with reference to information technology and its proactive stance in accordance with information technology.

It has been realized that for firms to successfully compete in a highly dynamic marketplace, companies have to adapt and align their information technology systems and strategies frequently. Various issues such as the need for a fine-grained approach had not been addressed in previous studies. This approach is useful for the assessment of the specific areas of misfit between the organization’s information systems capabilities and its competitive strategies.

Information technology is observably and evidently a weapon of choice when it comes to the business fight. Organizations that readily embrace technology have a much greater chance of experiencing greater success in terms of performance and profitability than those that do not. Information technology aids in making work much easier and hence reduces some of the losses involved in transactions.

As a firm embraces technology, it targets a greater proportion of potential customers since most move with technology. Those companies that do not change their systems with the changing environment would be lucky to sell their products to the lesser majority consisting of the conservative lot. This would mean fewer profits or even losses. Firms that embrace technology and integrate it into their systems are more likely to compete in the current market than those that do not. The less fit in the industry is always eliminated because only the fit survive.

References

Clarke, R., & Jenkins, M. (1993). The strategic intent of on-line trading systems: A case study in national livestock marketing. Journal of strategic Information System, 2(1), 57-76.

Lee, H., & Clark, T. (1996). Impact of electronic marketplace on transaction cost and market structure. International Journal of Electronic Commerce, 1(1), 127-149.

Loh, L., & Venkatraman, N. (1992). Determinants of Information Technology Outsourcing: A cross-sectional Analysis. Journal of Management Information Systems, 9(1), 7-24.

Neo, B. (1992). The implementation of an electronic market for pig trading in Singapore. Journal of Strategic Information Systems, 1(5), 278-288.