Cost Leadership

Walmart’s main business strategy focuses on building and maintaining cost leadership in the market. The company’s slogan reads, “Everyday low price”. This highlights its main focus on cost leadership. The strategy entails offering the same market products offered by rival firms at lower costs, but without compromising the quality.

Walmart manages to achieve this objective by relying on a highly efficient supply chain management that only avails products to the consumers at the right time when they need them. This eliminates additional costs that come from holding stock within the company’s premises (Schermerhorn 223).

Walmart uses a sophisticated technology to interconnect its operations with those of the suppliers. In essence, information about stock levels within the company is relayed in real time. The sophisticated IT system relays the information to the suppliers immediately every time consumers purchase a commodity from the retailer. This makes it possible for the suppliers to monitor the stock-levels at any given time.

Thus, restocking occurs at the opportune time just when the clients need the products and in the exact quantity. The ‘in-time’ logistics in the company has been the main reason behind its cost leadership in the market.

The retailer also sells products in smaller quantities to allow its customers to pay less (Schermerhorn 223). Walmart acquires goods packed in large quantities, but it repacks them in much smaller quantities for sale at reduced prices. This sustains its “Everyday low prices” slogan.

The true meaning of the slogan would not be achieved if the firm decided to sell the commodities in the large packaged quantities that it acquires from the supplier.

Differentiation Strategy

Walmart pursues a differentiation strategy whose main objective is to offer products and services that are unique in the market. Although the firm is not involved in manufacturing, Walmart stocks products that are specifically packaged in branded material. The company has invested heavily in repackaging materials to enable it achieve the differentiation mission.

Additionally, Walmart offers unique warranties that other rival retailers in the market do not offer (Daft 253). This creates a unique feeling among the consumers, making them believe that the experience is only available in Walmart and not from any other retailer.

Acquisition Strategy

Walmart has focused its efforts on market acquisition as a way of expanding its market presence. The firm considers acquiring other already existing retailer firms in foreign markets and maintaining their original names to cope with the globalization phenomenon and increasing market competition among rival retailers.

This is the case in most conservative markets where a foreign trade name may not augur well with the company. Walmart also considers acquiring and merging with other businesses outside the retail industry as a way of expanding its portfolio.

This also helps in spreading the company’s risks evenly (Daft 255). Walmart, for instance, acquired Kosmix, which is a social mobile platform. Walmart operates under the ASDA trade name in the United Kingdom after the latter was acquired in 1999 by Walmart.

Product Quality Concerns

Walmart has instituted a mechanism that focuses on maintaining high product quality. All Walmart stores around the world are required to fulfill the Global Food Safety Initiative (GFSI). This GFSSI procedure calls on all food suppliers to be subjected to the factory audit checks as a way of ensuring that the products meet the desired quality.

The retailer has worked together with The Sustainability Consortium (TSC) since 2009 as a means of developing measurement, as well as reporting systems.

The target is to enhance product sustainability and eliminate problems attached to product quality. In this arrangement, TSC performs research on metrics and the reporting systems. The research, in turn, helps Walmart to engage suppliers while clearly understanding the products sold.

In recent times, however, there have been rising concerns over poor quality of products sold by Walmart. For instance, the fresh foods sold by the firm have been found to suffer from poor quality. This problem is mainly linked to another challenge being faced by the firm, the challenge of staffing and related issues (Weiss 472).

Walmart’s fresh foods have only managed a low market share in comparison to other market players. This could be an indicator of the worsening product quality concerns.

Labor Practices

Walmart has been involved in accusations with labor union bodies, religious organizations, and community groups over its labor practices and policy. The retailer was taken to court over what its accusers termed as discrimination of its staff along race and gender. Three women employees filed a sex discrimination complaint against the retailer in 2012, accusing Walmart of failing to promote them because they are women.

The accusations leveled against the company also mention the fact that female employees generally earn less compared to their male counterparts (Daft 122). Workers in the firm have also accused their employer of failing to observe acceptable labor practices, resulting in poor conditions of work in the various stores owned by the retailer.

Business Ethics

Walmart considers ethics as the strongest aspect of its success in business. The organizational structure has an established global ethics office whose main mandate is to promote its culture of integrity (Walmart para 1).

The office also develops and helps in upholding the policies that relate to ethical behavior concerning all the stakeholders. Ethics education is offered on a routine basis to the employees. In this case, all workers undergoing training in the firm are subjected to consistent integrity lessons.

Walmart supports a special award related to business ethics, the Integrity in Action Award, to further emphasize on the need to enhance business ethics (Walmart para 1).

The award is offered in recognition of individuals or associates of the firm who demonstrate a greater level of integrity through their consistent actions. Such recognized associates must also have inspired others to do the right thing while dealing with Walmart in one way or the other.

The retailer practices integrity itself when selecting winners for the award by allowing the associates to conduct their own voluntary nominations. The resultant global votes determine the perfect recipient of the award. Walmart also takes consideration of each of the countries where the firm has a presence (Walmart para 3).

Market Share

The retailer has the biggest market share compared to its competitors in the USA, which is Walmart’s traditional market. Walmart’s heavy presence throughout the country and its business model that makes it stock virtually all kinds of commodities have been critical in sustaining market share leadership.

On the global front, Walmart serves up to 94 million customers every week through its 5,651 established stores in 26 countries.

However, a paltry 5.5% market share was registered in the year 2011 in China where the company is still in its early stages of development. The failure by Walmart to register a strong market share in China is attributable to the conservative nature of the Chinese. Market share growth in India has also been hampered in recent years following decisions by authorities in the country to shift foreign direct investment.

The North-American market of Canada has equally posed great challenges to Walmart. The Dollarama Inc. is emerging as the fiercest competitor in the mass retail market in the rich Canadian market. Walmart trails Dollarama with the second best market share of 26%.

This percentage of market share is 16 points less the share of Dollarama, which stands at 42% market dominance. Target Corp. is the third with a market share of 23% (Bloomberg News, 2012, para 1).

However, Walmart’s subsidiary ASDA in the UK maintains an 18% market share, which is the second biggest in the country. Tesco still maintains the largest market share in the UK retail industry, standing at 30.2% overall (“Walmart: Update on International Markets” para 5). The African market equally has a strong Walmart presence of more than 300 stores that spread across 12 countries in the continent.

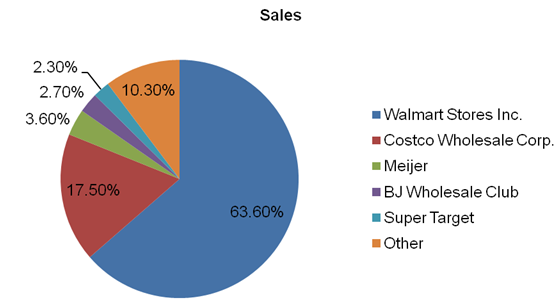

Massmart, which is Walmart’s subsidiary in the region with a 51% stake ownership, has the fastest growing market rate, especially in the sub-Saharan region (“Walmart: Update on International Markets” para 6). The pie chart below depicts Walmart’s market share situation in the traditional US market.

Source: Catala para 3

The chart shows that Walmart has a commanding share of more than half the market size. The second strongest competitor, Costco Wholesale Corp., does not even command a third of the market size.

Advertising Strategies

Walmart is adopting the use of technology in its advertising. In this strategy, the company focuses on developing a mobile app to reach its targeted markets. Shoppers using the app are able to see additional content, such as product information and the recipe.

The company’s target is to reach a larger number of existing and potential buyers by exploiting the growing popularity of mobile devices as a result of the advancement in the ICT platform. The mobile app is a more interactive way of advertising because it allows the user to obtain more details about products and services.

Walmart has adopted the use of popular social media platforms to create market awareness to further utilize the power of technology in its advertising. For instance, the firm has a Facebook page where a large community of customers and potential buyers meet virtually and discuss issues about their retailer.

This increases market awareness because of the strong word of mouth power as customers share their experiences amongst each other.

The company also uses the opportunity to communicate directly with individual customers while seeking to address some of the unique issues that affect them, thus learning more about the tastes and preferences of their customers. The company’s use of the social media platform in advertising also helps it to maintain its operating costs at a lower level, thus building on its competitive edge more.

Evaluation of the Analysis

Walmart has a greater potential of expanding in Asia and should be considered as Tech-Shield’s best choice as far as investing is concerned. Its cost leadership focus and strategy will attract more buyers in the region, resulting in higher profits. Most Asian economies are still considered as developing and have a weaker buying power compared to North America and Europe.

Walmart will utilize its low price policy to attract more buyers with inferior disposable income and make the firm to benefit from the resultant economies of scale. Tech-Shield will receive a bigger dividend rate coming from the huge profits amassed. This will be positive for the growth of the company.

The low price policy pursued by Walmart has seen the company introduce a new business modality of selling products in smaller quantities.

This will further attract customers towards the firm because most of them will find buying products from Walmart to be a more affordable practice. The more customers will appreciate the retailer, the more it will have its chances of making huge profits and increase the potential for Tech-Shield to get better returns.

The differentiation strategy by Walmart equally increases the potential of the company to make better profits. Walmart stands a better chance to attract more customers and make higher sales than its rivals because of the increased market competition within the retail industry. Buyers increasingly feel that whatever commodity or service they purchase from Walmart is unique, thus they get attached more to the firm.

The attachment increases their level of satisfaction and enhances their loyalty towards the firm. Walmart is poised to maintain high profitability for longer periods given such a positive business environment. The company can, therefore, sustain to pay attractive returns to all its shareholders for long.

The acquisition strategy that is pursued by Walmart is another significant consideration that should influence Tech-Shield’s decision to invest in Walmart. Walmart is sure of expanding in the market in many other countries in the world through the acquisition approach.

The experience that the company has gathered over the years through its subsequent acquisition of different retailers to gain access into new foreign markets eliminates the possibility of making over ambitious plans to a great assistance.

Such successful acquisitions in high potential markets will translate to a larger market for both firms. Walmart will register bigger profit margins because of the expanded market. This will enable Tech-Shield to earn higher returns as one of the shareholders.

Walmart’s future prospect is still promising, although its global market share has been threatened in some regional markets. The retailer still enjoys a strong lead in the highly lucrative US market. The US market contributes a significant profit portion to Walmart’s overall corporate profit. Walmart has maintained a strong market share position in other significant European markets, such as the UK.

This portrays the company’s strong market position going forward. Going with this trend, it is appropriate to conclude that no other global retailer brand will find it easy to topple Walmart as the global leader in terms of the overall market share. Walmart’s extensive global expansion is unrivaled.

This goes further to highlight Walmart’s potential of sustained industry leadership in as far as the overall market share is concerned. To this extent, a decision by Tech-Shield to invest in the company is the most strategic because of definite greater market revenue, which transforms to higher returns.

Recommendation

I suggest that Tech-Shield should invest in Walmart. Walmart has a positive business profile that reassures a higher return on the part of Tech-Shield. There is no present threat to Walmart’s growing global market, strong market leadership in the highly valuable US market, and the sustainable cost leadership strategy that it has implemented.

This implies that the strong market leadership position that Walmart enjoys is set to prevail for long. In turn, a move by Tech-Shield to invest in Walmart will see it earn good returns for a long period. This will eventually improve Tech-Shield’s capital base.

Conclusion

Walmart offers the best investment alternative for Tech-Shield. The company’s cost leadership strategy gives a greater market growth assurance. The firm is capable of maintaining its operating costs at a low level compared to many of its industry rivals. This is a significant aspect in as far as building a competitive edge in the market is concerned.

This will continue attracting more buyers for the company and maintaining the already existing customers. It also gives the company the confidence that profitability will remain high. The strong business ethics that focuses on maintaining integrity amongst the entire firm’s associates also gives hope for a greater business fortune for the firm.

Integrity is a critical aspect that attracts customers and enables them to build strong loyalty towards the firm. Walmart will evidently reap maximum profits as it strives to enhance integrity. This will, in turn, trickle down to Tech-Shield as a shareholder. However, it is critical to note that Walmart also faces potential distractions that could derail its future ambitions in case no efforts are made to rectify them.

As a shareholder in the firm, Tech-Shield should push for a renewed commitment on the part of Walmart to address the concerns of poor labor practices.

Workers are significant players towards the greater performance of a firm, thus Walmart should ensure that it focuses on improving the plight of the workers before concentrating on the external customers. The firm should equally put additional measures in place to ensure quality concerns raised over its products are addressed fully.

Works Cited

“Walmart: Update on International Markets.” Guru Focus. 2012. Web.

Catala, Raymond. Walmart Market Share Analysis, n.d. Web.

Daft, Richard. New Era of Management, Mason, OH: Cengage, 2008. Print.

Schermerhorn, John. Management, Hoboken, NJ: Wiley, 2010. Print.

Walmart. Home. 2013. Web.

Weiss, Joseph. Business Ethics: A Stakeholder and Issues Management Approach, Mason, OH: Cengage, 2008. Print.