Introduction

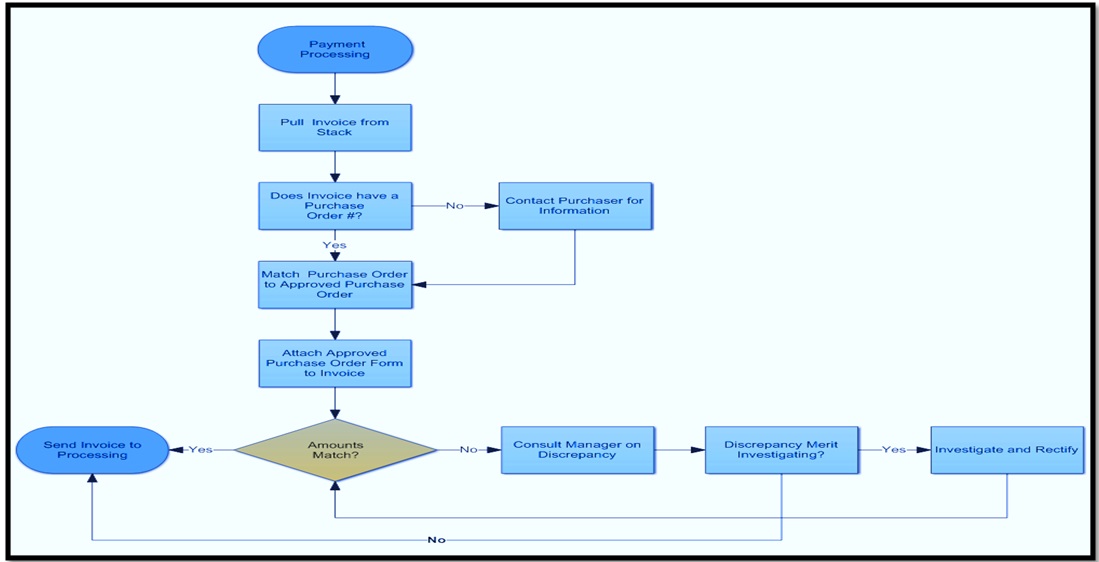

A workflow diagram is an important tool for displaying the interrelation between different departments and steps to complete an activity cycle. This essay presents a workflow diagram of payment processing in the Everest Health Center. The payment processing flowchart is for the purchase of health equipment by an individual or corporate client. The steps involved are putting the invoice from the stack, verification of the invoice, marching the purchasing order, approval, confirming if the amount in the invoice and purchasing order match, and sending the invoice for processing. The workflow chart was created from the above information to capture the actual payment processing activities at the center (see chart 1 and table 1).

Table 1: Flowchart explanation.

Metric for Measuring the Flowchart Soundness

The metric used to measure the soundness of the flow chart is the time taken to receive and process an invoice (Horner, 2013). The entire process should not go for more than two days. Another metric is the accuracy and efficiency in payment processing (Sostrin, 2013). This is measured by the number of invoice approvals against rejections (Harrison & Wicks, 2013).

Areas of Improvement and Proposed Change

The second and third steps (marching and approval of the invoice) should be merged into one function to avoid duplication of duty. At present, the verification process is repeated in two stages, which is a waste of time and company resources (Nobes, 2014). Through a merger into a single step, the company might avoid wastage of the labor resource that could be channeled to other important areas within the finance department (McGonigle & Mastrian, 2018). For instance, the supervisor accountant could do the matching and verification at once followed by the paymaster’s clearance. This will shorten the time taken between approval and processing.

Summary and Conclusion

Apparently, the awareness of a workflow of different activities is important in tracking and understanding the processes involved to complete an order cycle. As discussed above, a workflow enables an organization to understand its operational sequence to identify efficiencies and inefficiencies. The entire process could be subjected to feedback metrics for improvements or complete change. Everest’s workflow process in invoice processing is effective. However, merging the second and third steps would reduce time and labor resource wastages.

References

De-George, R. (2013). Business ethics. New York, NY: Pearson Education Limited.

Harrison, J., & Wicks, A. (2013). New ways of measuring company performance. Journal of Economic Behaviour & Organization, 61(4), 653-667.

Horner, D. (2013). Accounting for non-accountants (9th ed.). New York, NY: Kogan Page Limited, Philadelphia, PA.

McGonigle, D., & Mastrian, K. (2018). Nursing informatics and the foundation of knowledge (4th ed.). Burlington MA: Jones and Bartlett Learning.

Nobes, C. (2014). Accounting: AA very short introduction. Oxford, UK: Oxford University Press.

Sostrin, J. (2013). Beyond the job description. New York, NY: Macmillan.