Introduction

The theory of production and trade affirms that there exists no country, which is able to produce all commodities that its citizens require. This means that the country has to rely on other countries for supply of the other goods that the country does not produce or rather produces in quantities that are much lower than its demand.

At the same time, there could be other nations, which are in need of what the country produces in excess. This therefore makes the country export what it produces in surplus while being forced to import what it requires but is in deficit within the country.

As such, when a country exchanges goods and services with other countries for money, or other goods, international trade is said to have taken place. The exchange can be between two countries, economic blocs or even between continents.

International trade brings in concepts of foreign exchange. This arises where the trading countries do not use a common currency. During importation, the importer is required to convert their local currencies so as to make purchases in the currency of the exporting country.

On the other hand, payments to exporters are made in the local currency, and therefore the exporter is also required to convert the money into his or her country’s local currency. Currencies of different countries have different exchange rates against currencies of other countries.

The amount of a given currency that will be used to purchase a single unit of another currency is called the exchange rate. Under normal market situations, the exchange rate of a particular currency against another currency keeps on fluctuating, depending on the demand and supply of that currency.

The government controls the quantity supplied of a currency in a given country directly or indirectly. Therefore, the supply remains relatively constant and its curve becomes a straight vertical line.

The quantity supplied of that country’s currency determines demand for the currency. When more quantity is supplied, the demand for that currency will fall, and when less is supplied of that country, the demand will rise (Greenaway, 2011).

There is a need for a country to control its currency exchange rates in order to maintain a stable balance of payment. To achieve this objective, there are four regimes that dictate the exchange rates. An exchange rate regime refers to the policies employed to determine the exchange of a currency against another currency (Gandolfo, 2002). There are basically four exchange rate regimes:

- Floating, also known as flexible exchange rates

- Pegged, also known as fixed exchange rates

- Managed floating exchange rates

- Exchange controls

Each individual exchange rate regime has its own characteristics as outlined below.

Flexible, also known as Floating exchange rate regime

Under the flexible exchange rate regime, forces of demand for and supply of a given currency determines the exchange rate. This forces play just like in an ordinary free market of goods and services, the difference being only that the good in subject is now becomes a particular currency held in bank deposits.

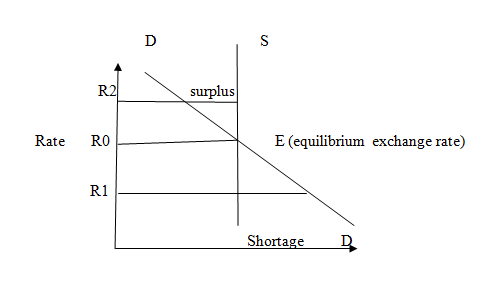

As pointed earlier, the amount of local currency supplied in a country is determined by the government. This implies that the supply of the foreign currency will be fixed, and only its demand that will vary as illustrated below

Fig 1

In the diagram above, the forces of demand and supply will fix the exchange rate at R0. “This rate is referred to as the equilibrium exchange rate, and the quantity demanded of the currency will be equal to the quantity supplied of that currency” (Greenaway, 2011, p.96).

When the demand for Euros decreases, the quantity supplied will be more than the demand and this will result into a surplus as shown in fig 1. On the other hand, when the demand for Euros increases, the quantity supplied will be less than the demand and this will result into a shortage as shown.

If the Euros are being exchanged against the dollars, a surplus in the supply of Euros will lead to depreciation. The exchange rate will be higher at R2, which implies that the value of the Euro against the dollar will have gone down.

On the other hand, when there is a shortage in the supply of the Euro, appreciation of the Euro occurs. The exchange rate will come down to R1, and this implies that the value of the Euro against the dollar will be higher (Greenaway, 2011).

Pegged/ Fixed Exchange Rate regime

Under the fixed exchange rate regime, the exchange rates are fixed by Central banks and other financial agencies found in countries with strong economic base such as the US. The forces of demand and supply still exist in the markets, but they do not necessarily determine the exchange rate (Ghosh & Wolf, 2002).

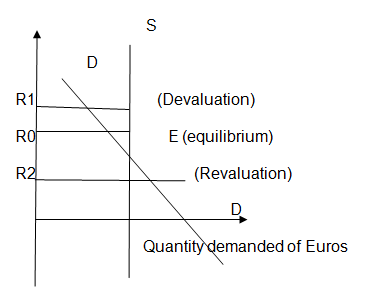

Fig 2

As shown in the diagram, the equilibrium exchange rate as determined by the forces of demand and supply is R0. When then government (through the central bank and other exchange rate agencies) fix the exchange rate at R1, there will be a surplus in the supply of the Euros and more people will be willing to exchange the Euros for dollars.

To maintain the exchange rate at R1, the government will purchase the surplus Euros from the market and hold them in its foreign exchange reserve. This will continue until eventually the quantity of Euros supplied will be equal to the quantity of Euros demanded. A new equilibrium exchange rate will therefore be set at R1. Pegging the exchange rate at a higher rate than the equilibrium exchange rate is called devaluation.

On the other hand, when the government sets a lower exchange rate, as shown in R2 in fig 2, there results a shortage in the supply of Euros. The demand for the Euros will increase and exert pressure on the new price.

In order to prevent the exchange rate from going back to the equilibrium, the government provides more Euros to counteract the shortage from its foreign exchange reserves. Pegging the exchange rate at a lower level is called revaluation.

Under the pegged exchanged rate regime, the government is therefore constantly involved in fixing the desired exchange rates, which are not necessarily in line with the market forces of demand and supply. It is responsible for maintaining the rates at the chosen rates through interventions, either a devaluation or revaluation (Greenaway, 2011).

Managed floating exchange rates regime

This regime combines some aspects of flexible exchange rates regime together with other aspects of pegged exchange rates regime. This means that forces of demand and supply are allowed to play their role, and at the same time, the government also intervenes to create some required situations.

There are usually changes in the exchange rates, either increasing or decreasing and end up being either temporary or permanent. Temporary changes in the exchange rates are called fluctuations. They usually cause uncertainty in the trends of market movements.

Therefore, it becomes difficult for policy makers and investors to make good decisions since they are not able to predict future occurrences. When this occurs, the government or other exchange rate agencies are supposed to intervene and maintain a stable foreign currency exchange rate.

When the changes in the exchange rates are permanent, the government is not supposed to intervene, but rather allow a new equilibrium rate to be established by the market forces of demand and supply. These new exchange rates are then supposed to be adopted.

On the other hand, when the changes in the exchange rates are temporary, the government is supposed to intervene and try to stabilize them. However, it is difficult to determine whether a change in the exchange rates will remain permanently or whether it is just temporary.

This means that the government will not necessarily take full devaluation or revaluation, but rather try to moderate the changes. The government tries to act in line with the movement of the exchange rates (Mussa, 2000).

Lack of full devaluation or revaluation provides room for the government to respond appropriately, whether the changes turn out to be temporary or permanent. Managed floating exchange rate regimes are also referred to as dirty exchange rate regimes.

Exchange Controls

Under this regime, formulated monetary policies are employed to influence the exchange rates so as to match desired levels. This regime is different from fixed currency exchange rate regimes in that there are no specific fixed rates that the government focuses on maintaining.

The adjustments are dependent on the balance of payment, rates of interest and market objectives desired by the central bank. The adjustments can be done directly, whereby the government is directly involved in setting the desired exchange rates, or indirectly through controlled market operations. This regime also combines some elements of both fixed and floating exchange rate regimes.

Impacts of Exchange Rate Regimes on Macroeconomic Activities

Each individual exchange rate regime has its own advantages and disadvantages, which affect the economy in very different ways. The regime chosen for a given economy affects the economy in a way different from that another regime will do in the same economy (Ghosh & Wolf, 2002). The fixed exchange rate regime, for example, promotes international trade.

The stable exchange rates so created results into certainty in that economy. Exporters and importers are relieved the burden of dealing with unstable exchange rates, and they can therefore, arrange their trade activities more efficiently.

They are more assured of profits as compared to economies with flexible exchange rates. International trade and foreign investments play a critical role in the growth of an economy, and therefore this regime may be preferred in a hypothetical economy.

In addition, fixed exchange rates also promote international investments. Capital lenders and investors will be willing to put their long-term investments in economies where the exchange rates are not fluctuating.

Furthermore, these stable exchange rates will also assist the investors and other policy makers in formulating valid decision, based on the information obtained from the currency markets. This will in turn, have an impact of increasing the total GDP, and consequently boost the growth of that economy (Mussa, 2000).

Fixed exchange rates also assist by removing market and economy speculations. Investors are relieved the burden of frequently moving their assets from one economy to another due to the panic caused by unstable markets. This further promotes economic growth in the economy where the investors retain their capital.

In economies where fixed exchange rates are maintained, the economic stability will reduce inflation, as policy makers will be able to monitor movements in the exchange rates, formulate, and implement appropriate policies.

The economy is generally put under control and long-term decisions on how to manage it can be made. In addition, the stable economy will also provide investors with a good platform for making appropriate business decisions (Ghosh & Wolf, 2002).

One of the disadvantages of fixed exchange rate regime is that it lacks independence. To maintain a stable rate of exchange, market forces are not allowed to play their role in the market. The projected exchange rates therefore do not reflect the correct exchange value of the currency it is being measured against.

Furthermore, maintaining stable exchange rates requires active management of the rates whereby the government, through the central bank is forced to intervene and counteract excess demand or supply. This is done through revaluation or devaluation. This regime also fails to reflect current changes in the rates that take place in the market over some time (Gandolfo, 2002).

The flexible exchange rate regime also has its positive and negative macroeconomic impacts. First, this regime helps countries in dealing with situations of balance of payment (BOP) differences. It is suitable in correcting deficits that arise from international trade.

In such situations, the value of that currency falls in relation to the currency of the trading partner. This automatically creates a new equilibrium, and therefore the deficit is automatically eliminated.

In addition, flexible exchange rates remove restrictions that hinder free flow of capital and finished goods between countries. This promotes free international trade, in which the market forces of demand and supply of a particular currency dictate the exchange rate.

In turn, the increased free trade is likely to boost growth in that country’s economy. Furthermore, removal of the monetary policies will attract more foreign investors, and this will provide more employment opportunities to the local citizens.

Flexible exchange rates do not require the government to maintain official foreign currency reserves since devaluation is not required. In effect, this increases International liquidity.

Countries will not hold reserve currencies of other countries, which eventually reduce inflation. International monetary institutions such as IMF will also not be required to maintain huge currency reserves (Qureshi & International Monetary Fund, 2010).

Since flexible exchange rates rely on forces of demand and supply, cases of surplus or shortages will automatically be cleared. Desirable rates of interest will also be dictated by demand and supply forces, and therefore government monetary policies will not be required. The economy under this regime is therefore self-driven.

On the other hand, flexible exchange rates create conditions of uncertainty in the market. The rates keep on fluctuating from time to time, and this has an effect of discouraging international trade.

The discouragement arises because of the higher risks of incurring losses when operating under uncertain market conditions. It also scares away investors, which lead to slower economic growth. The resulting slow economic growth implies fewer employment rates and a decrease in a country’s GDP.

Moreover, the flexible exchange rates encourage speculations. This leads to frequent inflows and outflows of capital, and eventually destabilizes the whole economy.

Investors shy away from making investments and consequently the world liquidity increases. When the liquidity is too high, interest rates tend to rise, people end up losing jobs, and the investments made tend to go down (Mussa, 2000).

Under flexible exchange rate regimes, it becomes unable for the government to intervene in the market, either through revaluation or through devaluation. This is likely to cause inflation to the economy due to absence of control. The inflation rate may escalate to alarming levels, leading to an adverse economic performance.

Under managed exchange rate regimes, the government is involved in exercising some protectionism, which favors local industries. Its occasional interventions in the currency exchange market create room for formulation and implementation of desired policies.

For instance, the government may undertake revaluation to increase demand of locally produced goods or services in the international market. By so doing, local industries are provided with a favorable environment to conduct their operations. In this scenario, more employment opportunities are also created and the economy is likely to grow at a faster pace.

On the other hand, the government may wish to devalue its currency against external currencies, in order to increase the country’s capacity of importing. This will be preferable when the country’s imports supersede the exports. A stronger local currency will enable the country to afford the imports more “cheaply”.

However, it is important to note that these slight involvements of the government in fixing the exchange rate affect the balance of payment. There is likelihood of deficits or surplus, which could have been avoided if the economy was operating under the flexible exchange rates regime.

In order to enjoy the advantages of the different exchange rate regimes, many economies tend to employ a mixture of two or more regimes. This means that the benefits of markets’ demand and supply forces as well as devaluation and revaluation are involved.

Therefore, the economy is allowed to go freely through market adjustments, and at the same time, the government is able to intervene and implement corrective measures to achieve desired rates of economic growth.

Conclusion

It can thus be concluded that the concept of exchange rates plays a critical role in determining the success of a country’s economy. It is therefore very important to understand the four regimes, and implement the regime that will best suit a country’s economy.

The different advantages and shortcomings of the various regimes may also make it necessary for an economy to combine two or more regimes, depending on the market requirements.

As pointed out, concept of exchange rates is an important tool in international trade. Good understanding of this concept is also important for any country that aims at maintaining a steady pace of economic growth, though controlling inflation (Gandolfo, 2002).

Reference List

Gandolfo, G. (2002). International finance and open-economy macroeconomics: With 3 tables. Berlin: Springer.

Ghosh, A. R., Gulde, A.-M., & Wolf, H. C. (2002). Exchange rate regimes: Choices and consequences. Cambridge: MIT Press.

Greenaway, D. (2011). The world economy: Global trade policy 2010. Chichester, West Sussex: Wiley-Blackwell.

Mussa, M. (2000). Exchange rate regimes in an increasingly integrated world economy. Washington, DC: International Monetary Fund.

Qureshi, M. S., Tsangarides, C. G., & International Monetary Fund. (2010). The Empirics of exchange rate regimes and trade: Words vs. deeds. Washington, DC: International Monetary Fund.