Executive Summary

The fast food industry in Oman is undergoing remarkable revolution, which has emanated from change in consumer behaviour. The emergence of the information age has increased the level of information amongst consumers. Subsequently, consumers are making informed choices in their purchase decision-making process. One of the industries that have been affected by these changes relates to the food industry.

Consumers are increasingly inclining towards the consumption of healthy food products. Subsequently, there is a high market potential for investors in the food industry. In order to tap this market potential, Shake Burgers intends to enter the Oman fast food industry.

The firm will specialise in offering freshly produced, healthy, and unique burgers. The burgers will be produced using the Omani way in order to differentiate them from the competitors’ products. Shake Burgers will target consumers aged between 15 to 40 years due to the high rate at which people in that bracket are consuming fast foods. The firm will be strategically located at Muscat, Oman.

Business opportunity

Market gap

The fast food sector has experienced remarkable growth over the past few decades. A study conducted by Food & Hospitality Oman (2014) shows that the sector is ranked amongst the fastest emerging markets for fast foods in the Gulf Cooperation Council (GCC) region.

Another study conducted by Alpen Capital (2011) shows that Oman food sector accounted for 7.1% of the total food consumed in the GCC region, which ranked the country third (Hardy 2014). The industry’s growth has been stimulated by a number of factors, which include an increase in the consumers’ purchasing power, especially amongst the young generation, and a rise in the level of inbound tourism.

It is estimated that the number of tourists’ arrivals in Oman will increase by 38.7% by the end of 2017, which is estimated to reach1.45 million tourists. Subsequently, the volume of tourist spending will increase to US$2.96 billion, which indicates the market potential for growth (Alpen Capital 2011).

However, the local and multinational industry players such as Kentucky Fried Chicken and McDonalds have mainly focused on providing customers with fast food products of western taste. Some of the fast food firms in the market such as McDonalds have inclined towards the provision of carbohydrate and vitamin-rich burgers as opposed to protein-rich burgers.

Additionally, the fast foods are made from highly processed and refined sugars (Skills You Need 2014). Subsequently, the market has largely ignored the provision of fast food products with an Omani taste, which represents a significant market gap.

Product offering

Shake Burgers will specialise in the production of protein rich burgers. The burgers will be specially produced from beef, chicken, and camel meat in order to align with the growth in preference for protein-rich products (Morelli 2002). Furthermore, the burgers will also be comprised of organic vegetables.

The firm will ensure that the burgers take into account the Western and Omani tastes in order to appeal to diverse consumer groups (Hitt, Ireland & Hoskisson 2009). The tangible offerings will include a main course, which will entail organic beef burger, organic chicken burger, and camel meat burger.

The burger products will also be comprised of organic vegetable sauce, which will be made of garlic mayo and spicy homemade sauce. However, all the burgers will be grilled in the Omani way in order to create a unique taste. Moreover, the burgers will be served alongside different drinks such as soft drinks [beer and Coca-Cola soft drinks] and milk shake [camel milk shake, banana milk shake, and dates].

The firm will create an attractive ambience as illustrated by the image in appendix 1 in order to attract customers. This goal will be achieved by employing effective interior design (Hoshmand 2009). The store will also be fitted with free Wi-Fi. Moreover, the firm will offer services associated with birthday parties.

Feasibility: Micro-market analysis

Target market size

The concept of targeting will be adopted in order to increase the firm’s level of profitability. Fahy (2000) contends that market targeting enables an organisation to focus its marketing activities to a specific market segment rather than focusing on the overall market.

The firm will adopt demographic market segmentation (Rae 2011). Some of the demographic market segmentation variables that the firm will adopt include age, occupation, and level of income (McDonald & Dunbar 2012).

The firm appreciates the view that all consumers can consume burgers regardless of their age group. However, considering the firm’s goal to maximise its level of profitability, Shake Burger’s core target market will be comprised of consumers aged between 15 years and 40 years. The firm’s decision to target this market group arises from identification of the market potential (Ingram 2010).

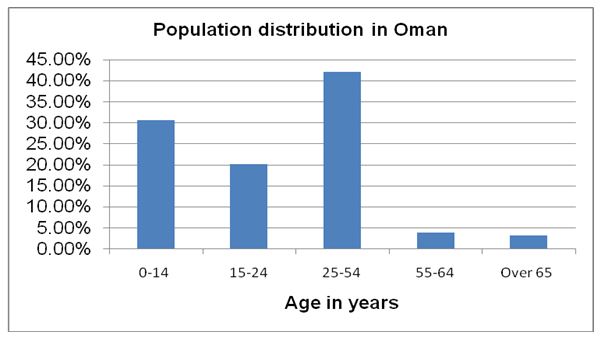

Table 1 below illustrates the Oman’s age structure according to 2013 statistics. Graph 1 shows that a significant proportion of the country’s population is comprised of consumers aged between 0 to 54 years, which the firm intends to target.

Table 1

Current trends

The fast food industry is characterised by a significant change in consumption patterns. The emergence of affluent young consumers has led to an increment in preference for protein-rich diet, as opposed to carbohydrate-rich diet (Alpen Capital 2014). This trend is expected to be sustained into the future.

Moreover, the high rates of workforce participation and urbanisation have led to the emergence of a hectic lifestyle amongst consumers (Karubaran, Sami, Ahmad, Al-Abed & Syed 2012).

However, consumers prefer healthy ready-to-eat products. The preference of healthy fast foods has arisen from the increased association of the foods with the rising cases of obesity and other diseases associated with poor eating habits (Karubaran et al. 2012).

The firm has identified a trend whereby university students and the working class, who constitute a significant proportion of Shake Burgers’ target market, are experiencing an increment in the level of workload from school and their workplaces (Rafidah, Azizah, Norzaidi, Chong & Noraini 2009). Thus, the majority of these customers do not have ample time to prepare their meals.

Currently, Oman is ranked amongst the middle-income economies (Alpen Capital 2014). The country’s economy is mainly dependent on oil resources. However, Muscat is increasingly diversifying its economy by investing in privatisation and industrialisation programs. Subsequently, there is a high probability of increment in the population’s purchasing power.

Dynamics

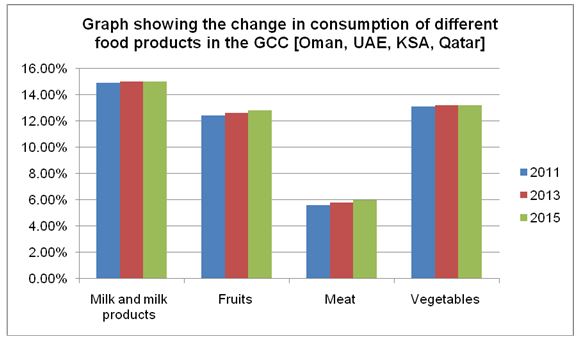

The global food industry is undergoing a remarkable transformation arising from change in consumer behaviour (EuroMonitor 2013). Some of the functional foods that consumers are increasingly consuming include vegetables such as carrots, broccoli, and tomatoes, which enhance the consumers’ physiological activities.

Moreover, urban consumers are shifting towards the consumption of protein and fat-rich products (Alpen Capital 2014). This aspect has led to the growth in demand for meat, milk, dairy, and vegetable products. It is estimated that the total food consumption in the GCC countries such as Oman, the UAE, KSA, and Qatar will increase in the future as illustrated by the graph below.

Target profile

The firm’s target profile is based on the findings of a primary market research. The study adopted mixed research design, which entailed using qualitative and quantitative research design. The research was conducted using the Academic Mintel website.

An effectively designed questionnaires as illustrated in appendix 5 was administered to the selected respondents online in an effort to understand their opinion regarding fast food products. Thirty respondents [30] were selected from the target population. Below is a profile of the respondents.

- Age; 15-40 years.

- Occupation; 25 students [10 college and 15 university students], 15 working class.

- Prefer consuming fast foods frequently.

Target consumer behaviour

Most consumers in the GCC countries including Oman have undergone remarkable change in their consumption patterns due to increased awareness on the risks associated with unhealthy eating habits. Shane (2013) emphasises that the GCC countries are ranked amongst the regions with the highest rates of obesity.

However, consumers have become increasingly knowledgeable following developments in Information Communication Technology (ICT). Thus, consumers are making informed choices in their purchase decision-making process, which is evidenced by the high rate at which consumers are inclining towards the consumption of healthy foods (Skills You Need 2014).

Feasibility: Macro-market drivers

PESTEL analysis

Political environment

The firm’s success will be subject to the prevailing political environment in Oman (Ghuman 2010). First, the level of political risk in Oman is moderate in comparison to other countries in the Middle East. Additionally, the relatively high level of political stability in Oman will enable the firm to operate in a serene business environment.

Furthermore, the Oman government has implemented well-defined tax incentives, which are aimed at fostering the establishment of sustainable and profitable business through entrepreneurship. Thus, Shake Burgers will benefit from the tax incentives by venturing into the Oman’s food industry.

Economic environment

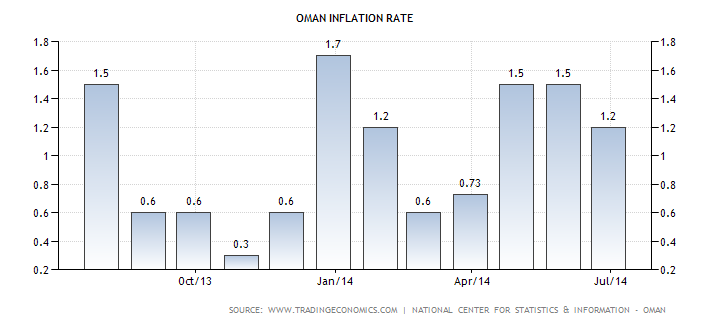

The Omani economy continues to experience economic growth due to the strong oil prices. Additionally, the high rate at which the Oman government is advocating for economic diversification will stimulate the country’s economic growth (Trading Economics 2014). Subsequently, there is a high probability of the country experiencing a new generation of affluent consumers due to their high purchasing power (Hair 2008).

Furthermore, the consumers’ purchasing power will be enhanced by the relatively low rate of inflation in the country. By the end of June 2014, the country’s inflation rate was estimated to be 1.2%. The graph below illustrates the fluctuation in the Omani rate of inflation over the past two years (Trading Economics 2014).

The country’s ascension into the World Trade Organisation (WTO) will improve trade relations with other member states. Furthermore, the recently signed Trade Facilitation Agreement (TFA) of the WTO will enhance trade with the WTO member states. One of TFA’s provisions entails an improvement in custom procedures at the point of entry through cooperation of the member states (James 2014).

Therefore, the firm will be in a position to import the necessary food products such as meat, cereals, and milk products from the member states conveniently. Additionally, the firm’s operations will be facilitated by the WTO’s choice of Oman as the ideal hub for distributing goods in other parts of the GCC region (James 2014).

Social environment

A significant proportion of the Omani population is comprised of citizens aged between 1 to 54 years. This age group accounts for 92.9% of the total population (Alpen Capital 2014). This aspect shows that the country is characterised by a substantial market size that Shake Burgers can exploit.

Furthermore, the country has also experienced a significant increment in the number of consumers who are inclining towards the consumption of fast foods. This trend has emanated from change in the consumers’ lifestyle. Moreover, the country is also experiencing an increment in the number of tourists and expatriates especially from the Western countries.

Thus, the country’s social structure is undergoing remarkable transformation, which the firm can exploit through the provision of unique and healthy fast food products (Alpen Capital 2011).

Technology

The high rate of technological development presents a perfect opportunity for the firm to succeed in the Omani food industry. For example, the emergence of food processing and handling technologies will enable the firm to produce burgers in a clean environment. Subsequently, the firm will be in a position to enhance its customers’ safety by minimising the likelihood of food-borne diseases (Ferrell & Hartline 2011).

The technological development being experienced in the contemporary business environment has encouraged consumers to become knowledgeable in terms of technology (Fernando 2011). Therefore, consumers are increasingly using different information communication technologies in their purchasing process (Hotelier Middle East 2013).

For example, consumers have adopted mobile and Facebook ordering. Furthermore, consumers are increasingly demanding convenient service delivery. Therefore, Shake Burgers will be required to invest in emerging technologies in order to align with the prevailing market trends (Forbes 2014).

Legal environment

In an effort to stimulate economic growth, the Omani government has adopted an open economic system, which has increased trade with other countries in the GCC and world. Subsequently, the firm will be in a position to import food materials required for its operation more efficiently. The Omani government is committed to fostering an enabling environment for working.

This goal has been achieved by simplifying the legal procedures during the establishment of a business. On average, it is possible to start a business within 34 days as opposed to the world average of 48 days (James 2014).

Additionally, the government has set relatively low tariff rates in its trade policy with its trade partners such as the US through the Free Trade Agreement. The country’s business environment is fostered by moderate corporate tax and low duty on products (Food Export Association of the Midwest 2011).

Feasibility: competitive environment and direct competitors

Porter’s five forces

- Threat of new entrant; (moderate to high) the industry is characterised by a moderate threat of entry due to the prevailing profitability potential. Moreover, the industry is experiencing an increment in demand for food products that are aligned with the Muslim culture. Furthermore, the barriers to entry into the market are relatively low due to the low financial requirements.

- Bargaining powers of suppliers; (moderate to high) the Omani food industry mainly depends on imports from the US and Europe. Subsequently, the suppliers have the capacity to influence the price of the food products. The food prices may also be affected by the global price fluctuations. Additionally, the suppliers bargaining power is increased by the low supplier concentration.

- Threat of substitute; (high) a number of local and multinational companies dominate the fast food market in Oman. The entry of multinational fast food companies such as KFC and McDonalds has increased the number of fast food products in the market. Thus, consumers have an opportunity to make a choice from a wide range of products.

- Buyer bargaining power; (high) firms in the fast food market are adopting product line extension strategies in pursuit for higher profitability. Consequently, consumers are presented with a wide range of products (Phillips & Gully 2013). Additionally, the product variation has led to a significant reduction in the switching cost.

- Rivalry; (high) the industry is experiencing a significant increment in the intensity of competition due to the high consumer purchasing power and the change in the consumers’ lifestyle.

Feasibility: sustainability

Unique selling point

Shake Burgers will focus at attaining a high competitive advantage by developing a number of unique selling propositions [USP].

- Customer service; the firm will ensure that customers are optimally served.

- Store ambience; the firm’s store will be designed effectively in order to attract customers.

Critical success factors

The firm’s competitive advantage will be based on a number of factors as listed below.

Start-up financing

Shakes Burgers will be established using personal savings and donations from family members. The initial start-up capital is estimated to be US$ 80,000. I will contribute $ 5,000 from my personal savings while my parents will assist me in raising $75,000. This amount will be used in leasing the premises within which the firm will be set up.

The firm will start with an inventory worth US$25,000, which will be sourced from the local market. In a bid to ensure consistency of supply and timely replenishment of stock, Shakes Burgers will enter a contract with the local suppliers. It is estimated that the firm’s profit margin will be 30% after the first year of operation as illustrated in appendix 4.

Post start-up financing

It is projected that Shakes Burger will achieve financial sustainability within the first year of its operation, which will emanate from its unique product offering. Furthermore, the firm’s effectiveness in implementing the critical success factors will enhance its profitability. It is projected that sales will increase over time.

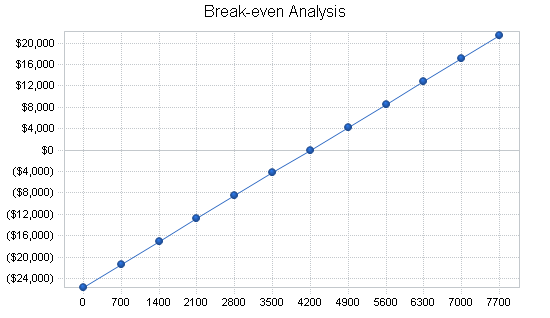

In order to reach the break-even point, the firm will be required to sell 4,200 units. The breakeven revenue is estimated to be US$35,280, which is estimated to be attained within 6 months of the firm’s operation. In order to achieve this goal, it is assumed that the average revenue per unit will be US$ 8.39, while the average variable cost per unit is estimated to be US$ 2.29. The graph below illustrates the firm’s breakeven point.

Feasibility: Managerial capabilities

Personal capabilities

The success of the new venture will be enhanced by my entrepreneurial capabilities such as risk taking, hard work, and market research skills. I will exploit my risk taking characteristics in ensuring that the venture is successful. This goal will be achieved through investing in product improvement, which will be enhanced by my effective market research skills.

Thus, I will understand how to make the necessary adjustments to the product. However, I will be required to improve my leadership skills in order to ensure that the other internal stakeholders in the firm such as managers are motivated adequately. Nurturing the leadership skills will aid in fostering teamwork (Moore, Justin, William & Leslie 2006).

Execution of Critical success factors

The firm’s success in implementing the critical success factors will depend on the effectiveness with which different roles are established and implemented as illustrated in the chart below.

Appendices

Appendix 1: Shakes Burger interior design

Appendix 2

Marketing budget.

Appendix 3

Breakeven chart.

Appendix 4

Income statement.

Appendix 4

Projected Cash flow statement.

Reference List

Alpen Capital: GCC food industry 2011. Web.

EuroMonitor: Food processor and blender manufacturing industry. 2013. Web.

Fahy, D. 2000, Foundations of marketing, McGraw-Hill International Limited, London.

Food Export Association of the Midwest: Middle East market profile. 2011. Web.

Ghuman, K. 2010, Management: concepts practice and cases, Tata McGraw-Hill, New Delhi.

Hair, C 2008, Essentials of marketing, Cengage, London.

Ferrell, O. & Hartline, M. 2011, Marketing strategy, Cengage Learning, Mason.

Fernando, A. 2011, Business environment, Pearson, New Delhi.

Food and Hospitality Oman: Oman 2014. Web.

Forbes: How restaurants are using technology to deliver better customer service 2014. Web.

Gotimer, J. 2008, Customer satisfaction is worthless, customer loyalty is priceless: how to make them love you, keep you coming back, and tell everyone they know, Bad Press, Austin.

Hardy, J. 2014, GCC food sector offers great prospects. Web.

Hitt, M., Ireland, D. & Hoskisson, R. 2009, Strategic management: competitiveness and globalisation; concepts and cases, Southwestern, Mason.

Hoshmand, R. 2009, Business forecasting, Routledge, New York.

Hotelier Middle East: The hotelier Middle East awards 2013. Web.

Index Mundi: Oman demographic profile 2013. Web.

Ingram, D. 2010, About process selection and facility layout operations management. Web.

James, A. 2014, SMEs can take advantage of trade facilitation agreement. Web.

Karubaran, G., Sami, A., Ahmad, Q., Al-Abed, A. & Syed, A. 2012, ‘Social and psychological factors affecting eating habits among university students in a Malaysian medical school; a cross sectional study’, Nutritional Journal, vol. 11, no. 48, pp. 11-48.

McDonald, M. & Dunbar, I. 2012, Market segmentation; how to do it and how to profit from it, John Wiley & Sons, Chichester.

Porter, M. 2008, Competitive strategy; techniques for analysing industries and competitors, Simon and Schuster, New York.

Moore, C., Justin, L., William, P. & Leslie, P. 2006, Small business management; an entrepreneurial emphasis, Cengage Learning, London.

Morelli, N. 2002, ‘Designing product/service systems; a methodical exploration’, Design Issues, vol.18, no.3, pp. 3-17.

Phillips, J. & Gully, S. 2013, Human resource management, Cengage Learning, Mason.

Rae, D. 2011, Entrepreneurship; from opportunity to action, Palgrave McMillan, New York.

Rafidah, K., Azizah, A., Norzaidi, M., Chong, S. & Noraini, I. 2009, ‘The impact of perceived stress and stress factors on academic performance of pre-diploma science students; a Malaysian study’, International Journal of Scientific Research in Education, vol. 2, no. 1, pp. 13-26.

Shane, D. 2013, GCC states among the world’s most obese. Web.

Skills You Need: Diet and nutrition 2014. Web.

Trading Economics: Oman inflation rate 2014. Web.

Witt, B. & Meyer, R. 2010, Strategy process, content, context; an international perspective, Cengage Learning, Andover.