Introduction

In the past few years, the American market has encountered several of the toughest hitches in its lifetime. First, the outbreak caused an abrupt collapse in the GDP. Nevertheless, the market recovered considerably faster than most people predicted. Inflation results from this discrepancy between market demand and supply, which pushes costs progressively higher. Powell, the head of the Federal Reserve, has revealed that the institution is ready to respond to ongoing economic success by hiking interest rates more than initially anticipated (Smialek, 2023). The country’s central bank, the Federal Reserve, is crucial to the economy’s stability since it controls inflation and promotes maximum job growth.

Why the Fed Decided to Raise the Interest Rate

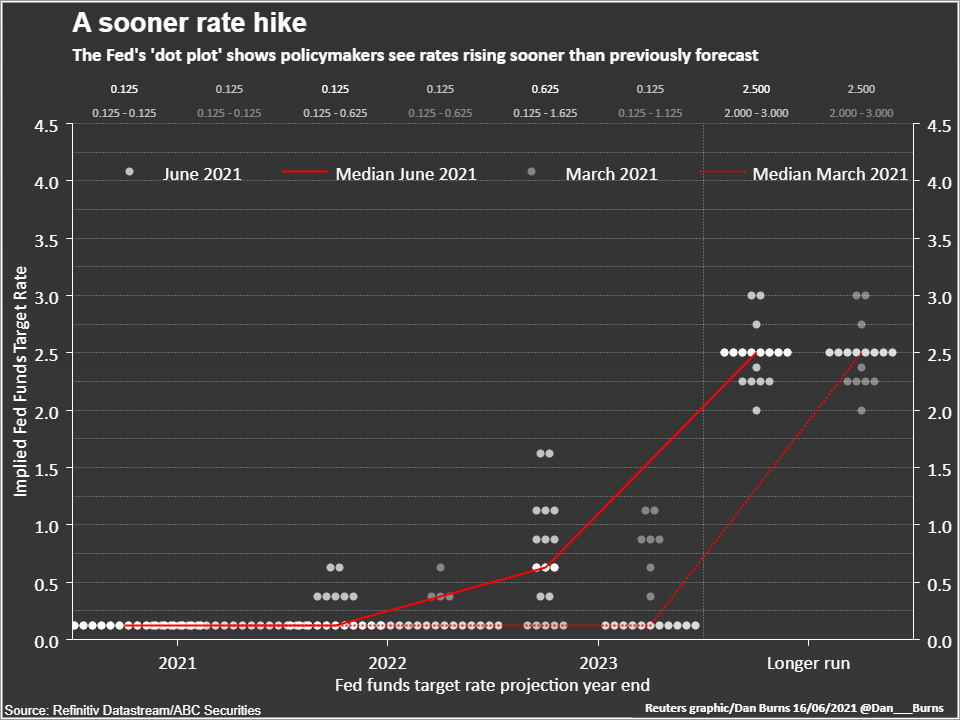

To stop inflation, the Fed agreed to raise interest rates. In reaction to recent good data, Powell predicts that the Federal Reserve may consider hiking lending rates further than anticipated. Additionally, the Fed is willing to take more drastic action if new evidence indicates that more stringent precautions are required to manage inflation (Schneider & Dunsmuir, 2023). The Fed predicted this rise in 2021, as shown in the Figure below.

The most recent economic figures have exceeded expectations, indicating that the final interest rate level will be greater than initially predicted. While Powell acknowledged that the warm season and other weather changes may have contributed to a portion of the surprise economic growth, he added that it could also hint that the Fed has taken additional steps to contain inflation.

Authorities may even return to higher rate rises than the future quarter-percentage-point stages planned. There is a risk of financial turmoil whenever the economy is booming and hot due to inefficiencies, including price rises and asset values that may become beyond control. Once this happens, the Fed gets involved by instituting interest rate hikes, which aid in reducing economic activity and sustaining consistent growth.

The Federal Reserve cannot help fix supply issues, yet it may help reduce inflation by reducing consumption. When the Federal Reserve increases its standard interest rate, all types of loans become pricier. This aids in both demand and supply, eventually rebalancing. When raising the public funding goal rate, the Fed anticipates boosting the price of credit through the panel. Every person is charged more in interest since greater lending charges make borrowing more costly for both organizations and customers.

The amount of money financial institutions charge for short-term borrowing is based on the Federal Reserve fund percentage. Since borrowing charges rise with a growing ratio, financiers such as financial institutions and other businesses might not be as ready to take loans. Initiatives necessitating funding are suspended by those who cannot make the sophisticated payments or are unwilling to do so. Customers should be encouraged to save funds to obtain higher interest rates. As a consequence, the quantity of money circulating is reduced, which helps to curtail price rises and slow financial activities, sometimes known as cooling off the market.

The Number of Times the Fed Has Raised the Rate

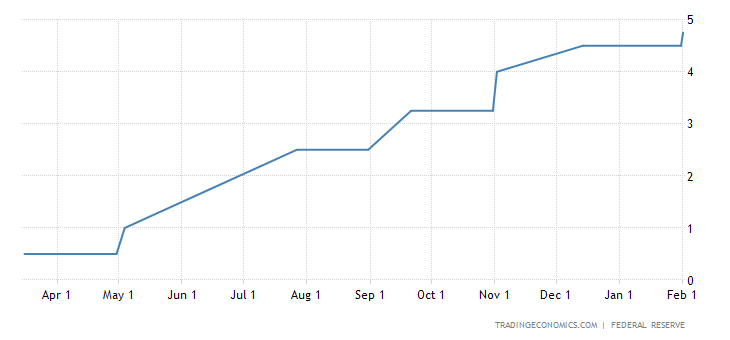

To slow price increases, Federal Reserve officials raised interest rates for the eighth time since March 2022. The central bank announced a quarter-point rate hike as it wrapped up its first conference of 2023, the lowest change since March 2022. The Federal Reserve’s policy rate has increased from practically zero a year earlier to a 4.5 to 4.75 % threshold (Smialek & Simonetti, 2023). This action represented a significant pullback from the Fed’s action last year when it increased the cost of borrowing at the quickest rate since the 1980s to rein in spiraling inflation.

The Fed’s recommended price increase measure was 5% in December, a decrease from its all-time high of about 7% in June, indicating that price increases had finally eased (Smialek & Simonetti, 2023). The Fed’s interest rate has been rising since April 2022, as illustrated in Fig. 2. Since interest rates are now high, financial institutions are progressively changing their policies while they observe how customers and firms are impacted by their rising borrowing costs.

General Public Views About the Fed’s Moves

The aggressive inflation led to various responses from the general public. Senators provided a wide range of questions and harsh criticism in response to concerns regarding whether the Fed was correctly detecting the impact of rising prices or if pricing could be reduced without severely damaging economic progress. Republicans concentrated on the potential contribution of elevated company earnings to ongoing inflation. They focused on whether the energy plan was limiting stock and maintaining charges above what was necessary, and whether judicious use of government expenditures could benefit the Fed.

Massachusetts Senator Elizabeth Warren alleged that the Federal Reserve risked people’s lives by raising interest rates (Schneider & Dunsmuir, 2023). These increases would cause the jobless rate to rise by over a percentage point, a deficit often linked with a global recession.

Bond markets quickly corrected after Powell’s comments, which practically guaranteed that Fed policymakers would construct an elevated breakpoint for the Federal Reserve’s standard overnight cost of borrowing at the impending March 21-22 session. Shareholders increased their wagers that the Fed might endorse a mid-point rate increase once they meet in fourteen days (Schneider & Dunsmuir, 2023). The present level of the bank’s policy rate is between 4.50% and 4.75%. Officials predicted the level would rise to a maximum of about 5.1% in December; analysts anticipate that rate to go at least 0.5 percent higher than presently. Stock markets continued to decline after suffering early losses, with the Standard and Poor’s 500 index down by less than and over 1.5% by the day’s close (Schneider & Dunsmuir, 2023).

The return on the 2-year bond increased beyond 5%, reaching its highest level since 2007; the U.S. dollar likewise increased (Schneider & Dunsmuir, 2023). According to Brown, a financial analyst, Powell was quite hawkish in his remarks. Brown stated that a positive monthly employment statement on Friday could probably result in appeals for a higher ultimate rate.

According to Citigroup analyst Andrew Hollenhorst, it would be a mistake to pause now, a phrase that Fed policymakers normally detest. In essence, Citigroup anticipates the Fed keeping its baseline funds rate indefinitely at an expected range of 5.5%-5.75%, greater than the present 4.5%-4.75% and significantly higher than market values of 4.75%-5% (Cox, 2023). According to Hollenhorst, Federal Reserve officials will likely maintain their course by delaying rate increases at the next summit (Cox, 2023). This would lead the community and the markets to believe that the Fed’s resolution to combat inflation will only be in force during turbulence in the general economy or the fiscal markets.

Conclusion

The Fed’s main instrument for managing inflation is its ability to influence lending rates. The Fed has raised its rates for the eighth time since March 2022, and consequently, the general public has had both positive and negative opinions on this move. The Fed funds rate influences the cost of borrowing for finance-related organizations, which impacts individuals.

References

Cox, J. (2023). Something broke, but the Fed is still expected to go through with rate hikes. CNBC. Web.

Saphir, A., Schneider, H., & Marte, J. (2021). Fed signals higher rates in 2023, bond-buying taper talks as virus fades. Reuters. Web.

Schneider, H., & Dunsmuir, L. (2023). Fed’s Powell sets the table for higher and possibly faster rate hikes. Reuters. Web.

Smialek, J. (2023). Fed chair opens the door to faster rate moves and a higher peak. The New York Times. Web.

Smialek, J., & Simonetti, I. (2023). The Fed raises rates a quarter point and signals more ahead. The New York Times. Web.

United States fed funds RATE2023 data – 1971-2022 historical – 2024 forecast. Trading Economics. (2023). Web.