Introduction

Julphar Pharmaceutical Company is one of the leading organizations in the pharmacological industry in the United Arab Emirates (UAE) and the Gulf. It is headquartered in Ras AI Khaima, although it has many branches in various regions. It was founded on March 30, 1980, and it has been in operation for more than 40 years (Julphar, 2021b).

The firm was established at the time when the country was making a transition from the herbal medicines used in the past to the pharmaceutical drugs that are extensively used in contemporary times. The company distributes its medical products to more than 50 countries across five continents of the world (Julphar, 2021b). Julphar has more than 5000 employees who have been working to ensure the firm’s success (Julphar, 2021b, para. 3). It is important to access the financial performance of the company to gauge its potential to prospective investors.

The organization’s goal over the years has been to offer affordable, innovative, and high-quality healthcare solutions to customers in the global market. The company has three main business units which include the General Medicines, Julphar Diabetes, and the Julphar Life, which is the customers’ division. The firm has 16 main accredited facilities in Asia, Africa, and the Middle East (Julphar, 2021b, para. 2). These production locations are responsible for the manufacturing of more than one million boxes of medicine every day (Julphar, 2021b). Thus, it is an important company championing for the health of people in the respective markets.

Financial Ratios

Short-term Solvency

The short-term solvency, also referred to as the liquidity ratio, is an important financial instrument used by organizations. The liquidity ratios help in measuring the organization’s capacity to sustain its short-term debt obligations. Some of the common liquidity ratios that Julphar Pharmaceutical and other companies consider in their financial statements include working capital ratio, cash ratio, quick ratio, and current ratio (Durrah, Rahman, Jamil & Ghafeer, 2016). Thus, it is important to assess some of these ratios to determine the company’s ability to handle its short-term debts.

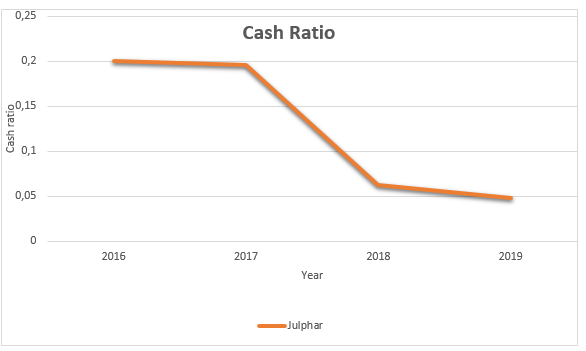

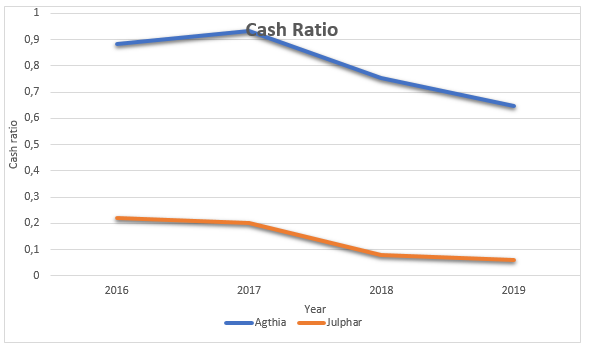

Cash Ratio

Cash ratio is also referred to as the cash asset ratio; it is a ratio of the organization’s cash and assets (their cash equivalent) to their total liabilities. The ratio is significant in financial analysis because it shows the extent to which the readily accessible funds can settle the current debts of the firm (Goel, 2015). It is mainly utilized by creditors to check how fast the organization in consideration of settling its liabilities and cover them in the short-term.

- Cash Ratio = Cash/Current Liability

Example: cash ratio in 2019 = 0.04776604=58.8/1259.3 (amount in AED millions)

Table 1. Julphar Cash Ratio from 2016 to 2019 (Julphar, 2021a)

Note: The values are expressed in AED million

As indicated in Table 1, from 2016 to 2019, the company had a cash ratio of less than one. This is an implication of its cash and cash equivalents being not sufficient to clear its current liabilities at the time. These cash ratios over the four-year period were not lucrative to most creditors and could have barred the company from getting short-term loans. A negative trend recorded by the company over the four years is shown in the Graph 1.

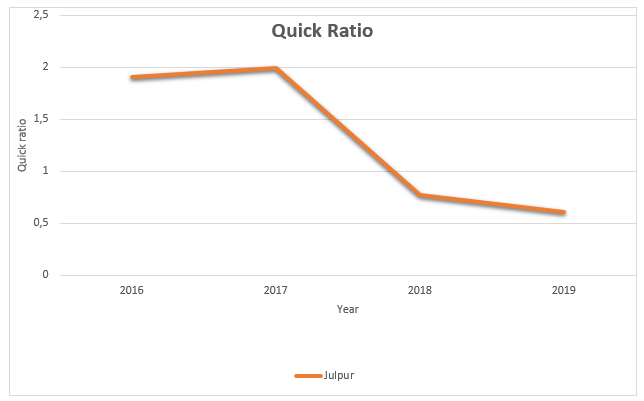

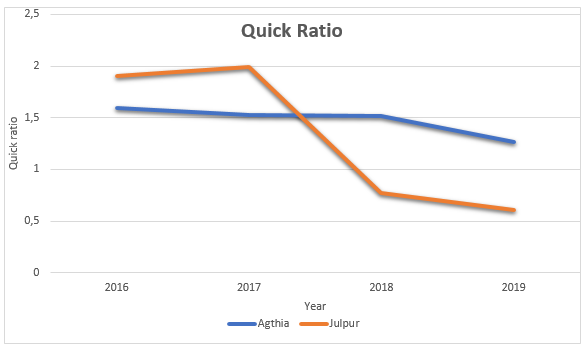

Quick Ratio

The cash ratio also tests the company’s ability to meet its short-term financial obligations, hence, showing its short-term position. However, unlike the former, it shows the organization’s capacity to meet the short-term financial obligations which it has with the aid of the assets that are most liquid within the firm. The quick ratio is also referred to as the acid test ratio. It is specifically designed to give immediate results (Goel, 2015). To calculate the quick ratio, the current assets, inventories and the current liabilities are needed. The formula below is used to compute the ratio:

Quick Ratio (QR) =

- (Current Assets – Inventory)/Current Liability or,

- (Current Assets – Inventory – Prepaid Expenses)/Current Liabilities

For instance, in the year 2016 the quick ratio for Julphar is calculated as, QR = (Current Assets – Inventory)/818.9

Table 2 below shows the quick ratio recorded by the company from the year 2016 to 2019.

Table 2. Quick Ratios (Julphar, 2021a).

Note: The values are expressed in AED million.

As shown in Table 2, the quick ratio has been reducing from the year 2017 to 2019. As seen in Graph 2, the decline in the value may be an indication of the company’s deteriorating ability to settle its short-term debts over the years. The reducing acid test ratio is likely to scare away potential creditors supposing the company’s inability to pay its debts or failure to make its obligations as required.

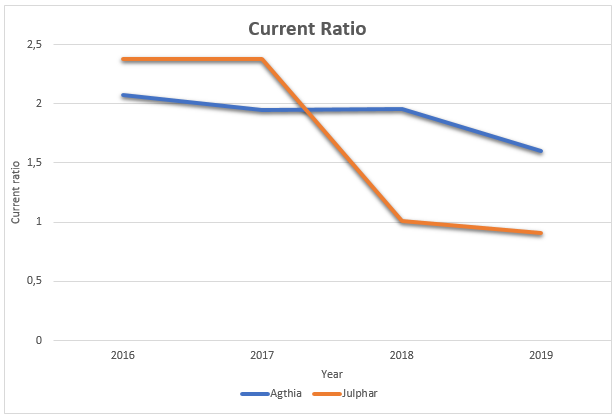

Current Ratios

It is another important liquidity ratio which reveals the organization’s capacity to settle its due financial debts within a year. It is instrumental to various stakeholders including financial analysts because it reflects the company’s ability to pay its debts using the current assets in the current time (Goel, 2015). Julphar Pharmaceutical current ratio is published to give an overview of the organization short-term solvency. To calculate it the formula below is used:

- Current Ratio = Current Asset/Current Liability

Table 3 below shows the current ratio recorded by the company over the four-year period.

Table 3. Current Ratios (Julphar, 2021a).

Note: The values are expressed in AED million.

As seen in Table 3, Julphar’s current ratio was relatively high in the first two years of observation before it reduced by almost a half in 2018 and maintained the decrease in 2019. As depicted in Graph 3, the financial data gives an indication of how in the first three years the company had more assets than the debts it was supposed to settle within the year. However, in the fourth year of consideration, the short-term liability had increased, and they exceeded the assets.

In conclusion, the liquidity ratios analyzed shows the company’s short-term financial capacity is not enough to cater for the debts that are supposed to be met within a year. All the three indicators give an indication of how in the past four years the company has had more liabilities than both its cash and assets. These results have a negative impact on its borrowing power since these are the major indicators that creditors consider when giving short-term debts.

According to the management financial report of 2018, the loans are taken for the purpose of acquiring working capital requirements, corporate borrowing, and purchase of factory equipment and machinery (Julphar, 2021a). This slightly provides enlightenment on why the company has more short-term liabilities compared to assets and cash.

Long-Term Solvency Ratios

These are important financial measures taken into consideration by the company when releasing its financial statements. Using these ratios, it is possible to make assessment of the company’s ability to repay its long-term debts and the interests that they have accrued over the period before payment. These ratios are also called solvency ratios in the financial segment. Like the liquidity ratios there are various types of long-term ratios. They include but are not limited to total debt, equity and long-term debt ratios.

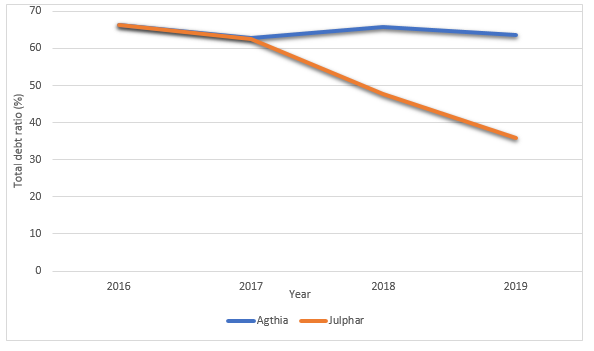

Total Debt Ratio

This refers to the proportion of total assets to overall assets and is usually expressed as a percentage or decimal. It is also referred to as debt-to-assets ratio, and it is fundamental tool used by potential investors and different creditors. It is the company’s assets financing which are financing its debts at any given time. Thus, the higher its value the higher the liabilities of the company. When the ratio is below one, it is a clear indication that most of the organization’s assets are funded by equity and not liability. To calculate the total debt ratio the following formula is applicable:

- Total Debt Ratio = (Total Debt – Total Expenditure)/Total Asset;

however, net debt is given by Total liability – Cash and Cash Equivalent.

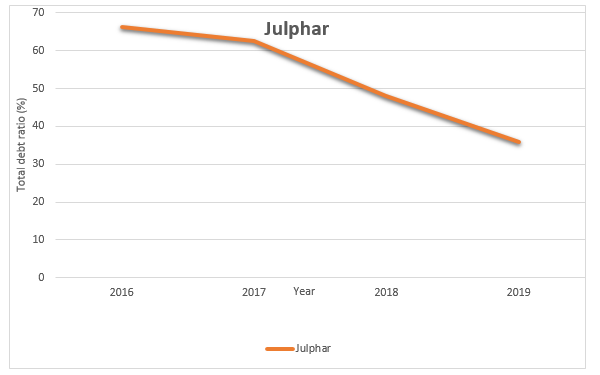

Table 4 below shows the Julphar’s total debt ratio over the four years of study.

Table 4. Total Debt Ratios (Julphar, 2021a).

Note: The values are expressed in AED million.

The total debt ratio is less than 100% implying that the assets of the company are more than its liabilities.

Equity Ratio

It is a critical indicator for determining the amount of leverage that the organization uses. It utilizes the amount of equity and the investment in assets to indicate how best the firm is able to manage its credits and fund the requirement gaps. Contrary to the total debt ratio, when it is low it means that the company mainly utilized debts to avail most of its assets (Easton, McAnally, Sommers, & Zhang, 2018). Therefore, when the ratio is high it means that the managers were able to accumulate most of the assets with a relatively small amount of debt (Paramasivan & Subramanian, 2020). To calculate the equity ratio the following formula is applied:

- Equity ratio = Total Equity/Total asset

The 2019 equity ratio = 878/2450.4 = 35.830885%

Table 5 below shows Julphar Pharmaceutical Company equity ratio from 2016 to 2019.

Table 5. Equity Ratios (Julphar, 2021a).

Note: The values are expressed in AED million.

As shown in Graph 5, the company records a reducing equity ratio suggesting that the organization major assets are becoming more dependent on the debts and not the stock. Dependence on debt implies that the organization is not financially stable at the time of analysis. The reducing trend is a bad indicator that may scare away creditors and investors.

Long-term Debt Ratio

The long-term debt ratio is a solvency ratio that is helpful in determining a company’s leverage. It gives a reflection of the assets that the company would need to liquidate for it to pay off its long-term debts. When the ratio is below 0.5, it is considered to be healthy. However, every industry has a different standard that the companies should maintain. When the ratio is expressed as a percentage, it gives the proportion of the assets of the company that would be surrendered or sold to settle the debts at any given point of time. The long-term debt is calculated by the formula below:

- Long Term Debt = Long-term debt/(long term debt + Total Equity) = Long-term Debt/Total Assets

For example: Julphar Long-term debt ratio for 2016 = 348.3/3473.4 = 10.027639%

Table 6. Long term debt (Julphar, 2021a).

In the year 2016, the long-term debt ratio for the company was below 50%, thus, implied that the company was in a better financial position. However, from the graph it is evident that the ratio has been rising from the year 2016. This trend shows that the company is accruing debts faster that it is paying them off for the period of observation. Furthermore, the rising trend in the ratio also shows that the company is not using other means of generating growth such as grants and charitable donations. Therefore, for Julphar to attract more investors it should work towards reducing the ratio.

Times Interest Earned Rate

This as critical coverage ratio that measures the company’s ability to settle its debts using the current income that it is making. It is a critical ratio because it shows the number of times in which the firm could use its earnings (before tax) to cover for the interest charges. Organizations that record consistency in their annual earnings are more likely to be considered by creditors as opposed to those that have fluctuating earnings. To calculate the ratio the formula below is utilized:

- Times Interest Earned = EBIT (Earnings Before Interest and Tax)/Interest

- EBIT = Revenue – Expense Excluding Tax and Interest

For example, the Times Interest Earned ratio for 2019 = (301.5 – 347.77)/20.5 = -2.25 x

Table 7. Times Interest Earned Ratio (Julphar, 2021a)

The company records a reducing time interest ratio from the year 2016 al through to the year 2019. This is an indication that the company’s cash after paying its debts are continuously reducing. The reducing earnings of the company are responsible for the reducing ratio. The negative trend scares of not only creditors but also potential business people who wish to invest in the company.

Cash Coverage Ratio (Long term)

It is a fundamental ratio that aids organizations in determining the cash which is available to pay for the interest expense of the borrowers. It is calculated by considering the EBIT and adding it to other non-cash expenses such as depreciation. The ratio gives a reflection of the cash that remains after the company has met its debt obligations. The formula for calculating the ratio is given below:

Table 8. Cash Coverage Ratio (Julphar, 2021a).

It is evident that the cash average ratio of the company has been reducing over the years. This is an indication that the liabilities of the organization are considerably increasing and the cash available will not be enough to settle them if the trend continuous. The financial position of the company as revealed by the ratio show that the company is experiencing financial challenges.

Fixed Asset Turnover

This is a critical ratio that illuminates the company’s capacity to generate sales using the fixed assets that it owns. The fixed assets that include the amount of equipment, plant, and property, less the depreciation that have been accumulated over the time of consideration. When the ratio is high, it indicates that the organizations is effectively utilizing its fixed assets to generate revenue. The ratio is significant in assessing the financial position of the company similar to the profitability rations. It is calculated by the formula below:

- Fixed Asset Turnover Ratio = Sales/Net Fixed Asset

- Net Fixed Asset = Total Assets – Depreciation

For example, the Fixed Asset Turnover ratio for Julphar in 2016 = 1454.5 / (3473.4 – 88.5) = 0.4297

Table 9. Fixed Asset Turnover Ratio (Julphar, 2021a).

The was ratio was at a relatively constant level for the first 3 years before it took a sharp decline in in the last year. This means that the amount of fixed assets that were being used to generate sales was level for the first three years before it dropped in the year 2019. Since the ratios in all the years are below 0.5 it means that the company has more liabilities compared to its equity. Therefore, the ratio raises a concern to the creditors as well as the potential and existing investors in the organization.

Asset Management Ratios

Asset management or inventory ratios are used when evaluating how effectively or efficiently a company is managing its assets to produce sales. There are several asset management ratios that should be analyzed while making decisions on investment in a company. Some of the asset management ratios that are discussed include day’s sales in receivables, day’s sales in inventory, total asset turnover, inventory turnover ratio, receivables turnover, and fixed asset turnover.

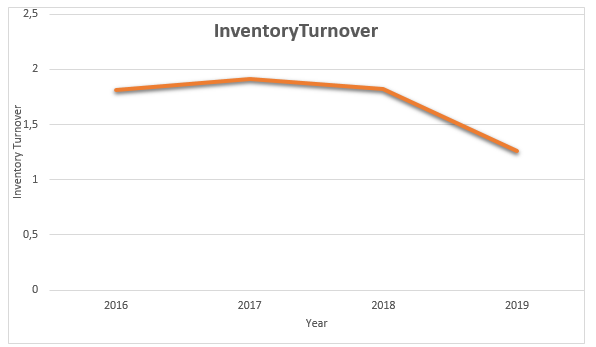

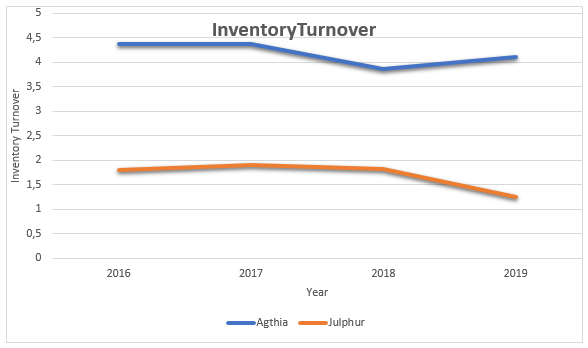

Inventory Turnover Ratio

It efficiently shows how the company is managing its inventory as compared to the cost of goods that it sells within an average inventory. The ratio gives a reflection of the number of times when the firms inventory can be sold within a given time frame such as one year. When the ratio is high, it implies that the organization is efficient in its management of the stock of goods that it needs to sell in the market. Inventory turnover is calculated using the formula below.

- Inventory Turnover = Cost of Goods Sold/Inventory

Example: Inventory Turnover in 2016: 703.8/387.2 = 1.81766529

Table 10 below shows the Inventory Turnover from 2016 to 2019.

Table 10. Inventory Turnover (Julphar, 2021a).

Note: The values are expressed in AED million.

Inventory turnover measures a company’s efficiency in controlling its merchandise. It shows the company’s ability to effectively sell all the inventory it buys. Since the ratio shows efficiency, a high inventory turnover ratio shows the company does not waste resources buying and storing non-sellable products.

According to Table 10, Julphar’s inventory turnover ratio has been decreasing from 2017 to 2019 showing that the company’s management and control of merchandise has been deteriorating. Despite the fact that the company has been increasing its liability significantly over the four-year period, it is still doing well in terms of its management and control of the products that it takes to the market. This is a clear indication that the company still has a potential to perform better in the industry.

Days’ Sales in Inventory

It is calculated using the formula shown below.

- Days’ Sales in Inventory = 365/Inventory Turnover

Example: Days’ Sales in Inventory in 2016; 365/1.81766529 = 200 days

Table 11 below shows the Days’ Sales in Inventory from 2016 to 2019

Table 11. Days’ Sales in Inventory (Julphar, 2021a).

Note: The values are expressed in AED million.

Days’ sale in inventory shows the number of days a company or firm takes to sell its inventories. It is an efficiency ratio showing how fast a company can sell its inventories. Fewer days’ sale in inventory indicates shorter days or period a company takes to sell its stock. Julphar’s days’ sales in inventory since 2016 have been decreasing implying that the company is properly managing its commodities in the market. Selling the products within a shorter period indicates that the company is able to realize profits faster. Since most investors are profit oriented, they prefer investing in organizations that have fewer day’s sales in inventory.

Receivables Turnover

Receivables turnover, also called the debtors turnover ratio, shows the company’s ability to collect money owed by clients. It helps understand how a company manages its short-term debt to customers. It is calculated using the formula below.

- Receivables Turnover = Sales/Accounts Receivable

Example: Receivable Turnover in 2016; 1454.5/1344.0 = 1.08221726

Table 12 below shows Receivables Turnover from 2016 to 2019.

Table 12. Receivables Turnover Line Graph (Julphar, 2021a).

Note: The values are expressed in AED million.

As shown in Table 12, the receivables turnover since 2016 has been decreasing for Julphar Pharmaceutical Company. Higher receivables turnover ratio indicates efficient collection of accounts receivables while lower receivable turnovers indicate poor collection strategies of short-term debts. As seen in Graph 12, the decreasing ratios show a slowing trend in debt collection for Julphar.

Days’ Sales in Receivables

It is calculated using the formula below.

- Days’ Sales in Receivables = 365/Receivables Turnover

Example: Days’ Sales in Receivables in 2016; 365/1.08221726 = 337 days

Table 13. Days’ Sales in Receivables (Julphar, 2021a).

Note: The values are expressed in AED million.

Days’ sales in receivables measures the average number of days a company or firm takes to collect payments after sales. Higher numbers of days’ sales in receivables shows that a company is taking long to collect its payments after making sales. The average and acceptable days’ sales in receivables for a company should be 45 days regardless of the amount of the receivables. As shown in Table 13, Julphar’s days’ sales in receivables have been on the rise since 2016 implying that the organization is not managing well its receivables.

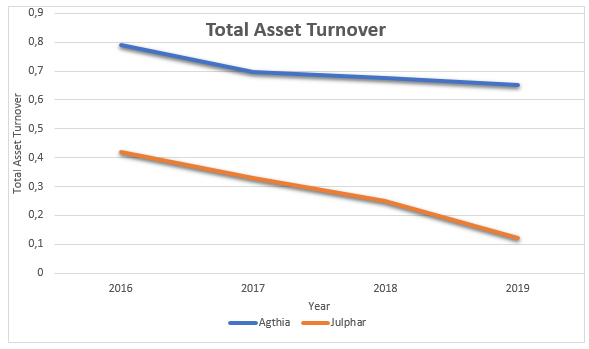

Total Asset Turnover

Total asset turnover ratio, also known as asset turnover, is an efficiency measure that measures a company’s ability to produce sales from its assets. A company’s asset turnover ratio can be used when comparing its effectiveness with a competitor company. The industry in which an organization is operating informs whether the asset turnover is efficient or not, thus, a perfect ratio in the utility industry may be a poor one in the retail industry. The formula for calculating the total asset turnover is given below:

- Total Asset Turnover = Sales/Total Assets

The Table 14 below shows the total asset turnover for Julphar from 2016 to 2019.

Table 14. Total Asset Turnover (Julphar, 2021a).

Note: The values are expressed in AED million.

Higher total asset turnover ratios for a company indicate efficiency in the utilization of assets to produce sales. According to Table 14, Julphar’s total asset turnover ratio has been decreasing since 2016 indicating that the company’s efficiency in generating sales from its assets has been declining. The ratios can be compared with competitor company to test if it operates more efficiently than its competitors.

Profitability Ratios

These are some of the most important indicators that investors greatly consider before making investment decisions. The potential investors are able to study the company’s profit trends because these measures can be obtained from the financial statements that the public limited companies are obligated to publish (Easton et al., 2018). The common financial ratios that are taken into consideration by investors include the profit margin, return on assets and the return on equity.

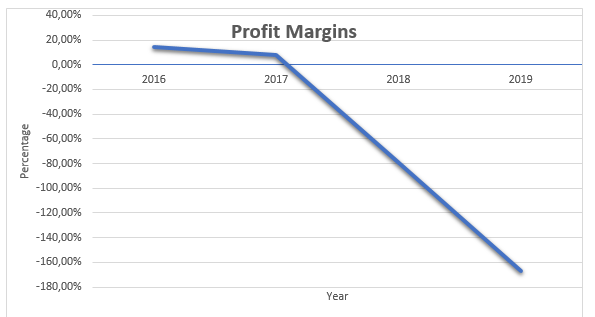

Profit Margin

It is a key indicator that informs on the profitability of the organization by considering the proportion of the organization’s profits to its revenue. It is an important tool because it compares the profits earned to the sales of the company over some time period, hence, revealing how well the organization is managing its finances (Palepu, Healy, Wright, Bradbury, & Coulton, 2020). To calculate the profit margins the formula below is applied; it is expressed as a percentage:

- Profit Margin = Net Income/Sales

For instance, the profit margin for the year 2019 is calculated as

Profit margin = -503/301.5 = -166.898%

Table 15. Profit Margins (Julphar, 2021a).

Note: The values are expressed in AED million.

As shown in Table 15, the first two years had a positive profit margins implying that the organization made profits. In the year 2016 the profit margin was 14.6% showing that for every AED of sales generated Julphar made an income of 0.146 AED. In the year 2017 the company’s profit margin was at 8.22% indicating that for every single AED of sales 0.822 AED of income was made. For 2018 and 2019 the negative profit margin shows that the cost of production of the company is higher than the sales made within the period.

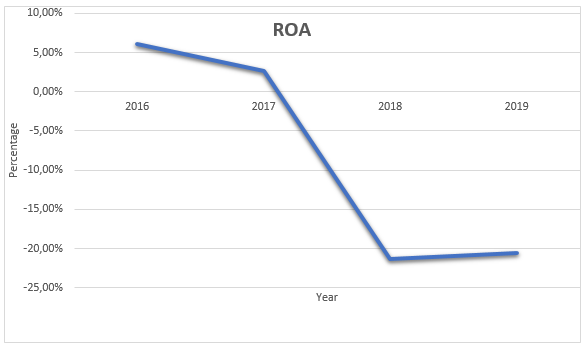

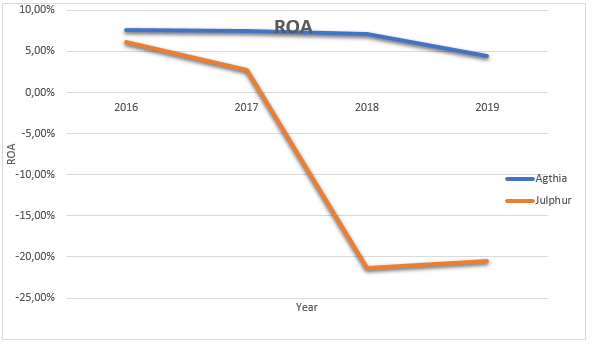

Return on Assets (ROA)

This is a measure that is used to indicate the extent to which a particular organization is profitable in relation to its total assets. Through this indicator, the investors, financial analysts, and the firm’s managers are able to have a clear picture of how the organization is utilizing its assets to generate earnings (Paramasivan & Subramanian, 2020). Like the previous ratio, it is expressed as a percentage. It is calculated as:

- ROA = Net Income/Total Assets

For example, the ROA for 2019 = -503.2/2450.4= -20.535%

Table 16 below shows the company’s ROA

Table 16. ROA (Julphar, 2021a).

Note: The values are expressed in AED million.

AS seen in Table 16, the financial data shows that the company’s ROA has been declining from the year 2016. The ratio is critical in communicating how effectively the company is changing the money that it is investing into net income. As seen in Graph 16, Julphar is on a reducing trend, which means that the company is not effective in turning its investments into profit. The decline in ROA is a concern to the investors and scares away potential businesspeople who can invest their money in the business.

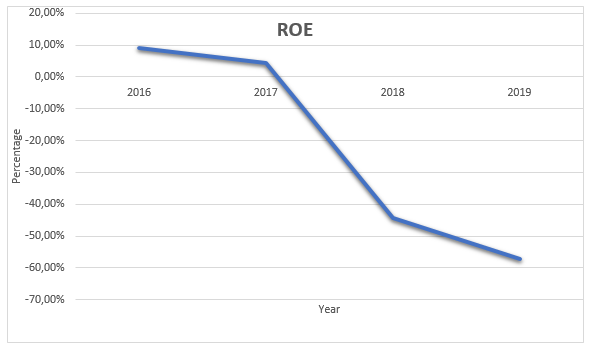

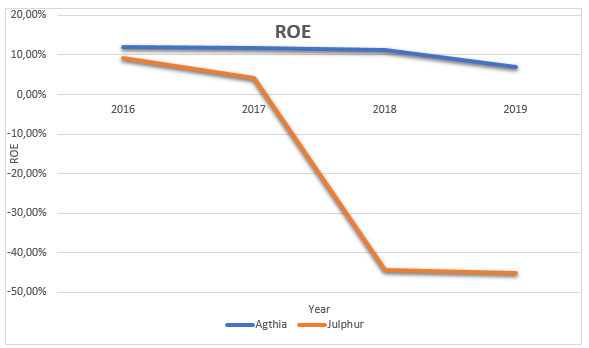

Return of Equity (ROE)

It is also considered as the return on net assets. It is a ratio of net income to shareholder equity. The value of the shareholders equity is obtained by subtracting the company debt from the assets. The ROE can be used to gauge the competitive advantage of the company because it can be compared to the industry’s average. It also gives a prediction on how the firm is utilizing its equity to encourage the growth of the business (Palepu et al., 2020). The return on Equity is calculated as net income / total Equity expressed as a percentage. For example, the ROE for 2019 is -503.2/878= -57.31207%.

Table 17. ROE (Julphar, 2021a).

As shown in Table 17 above, the company has been recording a declining ROE over the four years. This decline means that the company’s management has been making poor decisions in its investments. For instance, there is a high possibility that the company has been investing most of its resources in unproductive assets. This can scare away more potential investors and discourage the existing ones.

Market Value Measures

Market value ratios are very important aspects considered by current and potential investors in determining if company’s shares have been underpriced or over-priced. They are used to determine current share prices of company stocks held publicly (Subramanyam, 2014). The most important market value measures that are considered for Julphar Pharmaceutical Company are price to earnings ratios and earning per share.

Price to Earnings (PE) Ratio

It is calculated as current market price of a share, dived by earnings per share reported.

- PE Ratio= Price per Share/Earnings per Share

Example: Price to earnings (PE) ratio for 2016; 3.584 / 0.32015 = 11. 19475 x

Table 18 below shows the price to earnings (PE) ratio from 2016 to 2019

Table 18. Price to Earnings Ratio (Julphar, 2021a).

Table 18 above shows that the company’s price to earnings ratio have increased in 2016. In 2017 it was highest, then decreased again and remained going down during 2018 and 2019, indicating that the market’s confidence in the future of the organization shares is low, hence low bids.

Earnings per share (EPS)

Earnings per share (EPS) is a market value ratio also called net income per share. It is used to measure the amount of net income earned per share of the outstanding stock. It shows how shareholders are profiting in the current market situation. It is calculated as shown in the formula below:

- Earnings per Share (EPS) = Net Income/Outstanding Stock

Example: Earning per share in 2016 = 212.1 / 662.5 = 0.32015

Table 19 below shows the earnings per share (EPS) from 2016 to 2019

Table 19. Earnings Per Share (Julphar, 2021a).

Earnings per share (EPS) ratios are similar to profitability ratios. The higher the earnings per share ratio, the higher the profitability of the company and hence more profits to the shareholders (Subramanyam, 2014). As seen in Table 19, the firm’s earnings per share ratio have been reducing since 2016 with negative EPS values experienced in 2018 and 2019. Graph 19 shows that the company is moving in the wrong direction in terms of profitability resulting in low returns to its shareholders.

Comparison of the Companies

It is essential to make comparison between the profitability of Julphar Pharmaceutical with its competitors in the industry. Agthia is an Abu Dhabi Based company dealing with essential food and beverage goods to consumers in Turkey, the Middle East and across the Gulf cooperation Council (GCC) countries. As a competitor of Julphar Pharmaceutical it is important to compare the profit ratios of the two companies.

Furthermore, comparing their liquidity position can also help in making sound decision on which company to invest. Both organizations are championing the health of people in their respective markets. It is wise to finance a company that is more profitable because it bears a higher chance of reward to the stakeholders. The market trends can help to make projection of the possible outcomes in the near future. Thus, it is vital to analyze their profitability to determine the most lucrative investment options between the two organizations.

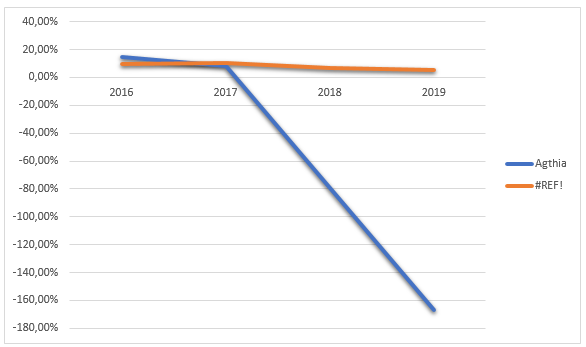

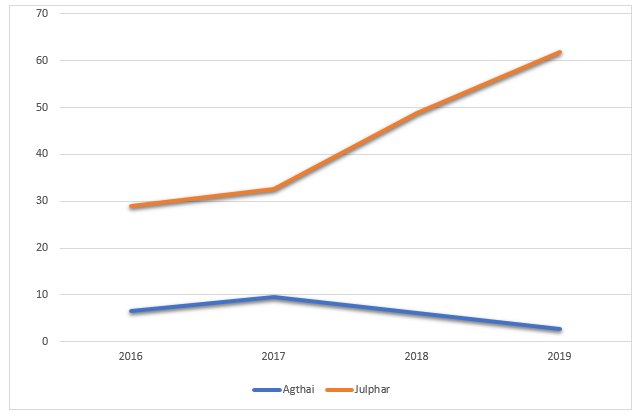

Profit margin

Table 20. Profit Margins (Julphar, 2021a).

As seen in Graph 20, Agthia’s profit margin is higher than that of Julphur over the four-year period. The line graphs show that both companies record a decrease in the last two years although for the latter the margin does not reduce to a negative figure. This implies that for all the sales made in the four-year period Agthia has made profits while Julphar made huge losses from 2018 to 2019.

Table 21 below shows the Return on Assets (ROA) for the two companies from 2016 to 2019.

Table 21. ROA (Julphar, 2021a).

It is vivid that in the four years of analysis the two companies experienced a reducing ROE. This implies that both of them are failing in turning the investment that it has into net profit (Sultan, 2014). However, despite the decline Agthia has not recorded any losses in the four years. It is, thus, more financially vibrant than the former.

Return on Equity

Table 22. ROE (Julphar, 2021a)

The ROE is on a declining trend for both companies implying that their managers are making decisions that are continuously decreasing their net profits. For Agthia the ratio has reduced but it has not changed to a negative value. It means that the company’s profit has reduced in the recent years, but it is yet to make significant losses (Sultan, 2014). Thus, the financial ratios show that the latter organization is making more profits compared to the former.

Comparison Based on Other Ratios

Table 23. Agthia’s Inventory Turnover (Agthia, 2021).

From Table 23, it is evident that Agthia has a high inventory turnover ratio which implies that the firm’s management is effective in its management of stock. Compared to Julphar’s inventory turnover, which is much lower, it is evident that Agthia is selling its stock more. Investing in a company with a higher inventory turnover is a better decision because it is likely to result in more profits.

Table 24. Agthia’s Total Asset Turnover (Agthia, 2021).

As seen in Table 24, it is accurate to say that asset turnover of Agthia is relatively higher compared to that of Julphar. Since both companies are operating in the same industry, it means that the former has a stable management which ensures proper utilization of the company’s assets to enhance sales. Therefore, investing in Agthia based on the asset turnover ratio is a better decision.

Agthia’s Liquidity Position

Table 25. Agthia’s Cash Ratios from 2016 to 2019 (Agthia, 2021).

Table 26. Agthia’s Quick Ratios from 2016 to 2019 (Agthia, 2021)

Table 27. Agthia’s Current Ratios from 2016 to 2019 (Agthia, 2021)

The cash ratio of Agthia over the four years is less than 1, meaning that the cash equivalent is not sufficient to settle its current liabilities. However, compared to Julphar Pharmaceuticals, its cash ratios are constant and not taking a decreasing trend. Agthia’s quick ratio is equally constant and not taking a negative direction as compared to Julphar’s.

The trend implies that even though both companies are not able to settle their current debts, Agthia is in a better position. The current ratios of Agthia are greater than 1 in the period of study. The negative trend means that the current assets of the company are more than its current liabilities. The short-term solvency ratios show that the latter company is more effective in settling its short-term debts than its former competitor, Julphar.

Table 28. Agthia’s Debt Ratio (Agthia, 2021).

The total debt ratio is less than 100% implying that the assets of the company are more than its liabilities. Compared to the ratios of Julphar, the company’s debt ratios are smaller showing that it has more of assets than debt. Therefore, Agthia is in a better position to settle its debts using its assets. It is, thus, a better investment option compared to the competitor.

Table 29. Agthia’s Equity Ratio (Agthia, 2021).

As seen in Table 29 above, it is clear that Agthia records an equity ratio of more than 50%. This high ratio recorded implies that the company is consecutive and most of its fundings are from equity and debt. Compared to the equity ratios of Julphar, which are on a decreasing trend, it is right to conclude that Agthia is the most lucrative business to invest since it is more financially stable.

Agthia long-term debt ratio

Table 30. Agthia Long-Term Debt Ratio (Agthia, 2021)

Table 31. Times Interest Earned Ratio (Agthia, 2021)

Compared to Julphar, Agthia’s long term ratios are better. This means that investing in the latter company is the best idea for any investor striving to make an investment decision between in the industry. Agthia is able to cater for its long-term debts and its assets are also enough steer production and sales.

Conclusion

In summary, Julphar is having a negative performance and the company is embracing more debts that it cannot sustain. The financial ratios have shown that the management is not making the right decisions with the resources of the organization. For the competitor, the case is not different because it has been recording a reduction in profit.

However, the major significant difference is the fact that Agthia has not yet recorded losses compared to Julphar. Therefore, investing in Julphar is risky at this point since there is a huge possibility of making losses. Investing in Agthia may be less risky especially if the management has strategies in place to address the factors resulting in reduced profits.

References

Agthia. (2021). Results & presentations: Annual reports. Web.

Durrah, O., Rahman, A. A. A., Jamil, S. A., & Ghafeer, N. A. (2016). Exploring the relationship between liquidity ratios and indicators of financial performance: An analytical study on food industrial companies listed in Amman Bursa. International Journal of Economics and Financial Issues, 6(2), 435-441.

Easton, P. D., McAnally, M. L., Sommers, G. A., & Zhang, X. J. (2018). Financial statement analysis & valuation. Boston, MA: Cambridge Business Publishers.

Goel, S. (2015). Financial ratios. New York: Business Expert Press.

Julphar. (2021a). Julphar Gulf pharmaceutical industries – Annual reports. Web.

Julphar. (2021b). Julphar Gulf pharmaceutical industries – What we do. Web.

Palepu, K. G., Healy, P. M., Wright, S., Bradbury, M., & Coulton, J. (2020). Business analysis and valuation: Using financial statements. United States: Cengage AU.

Paramasivan, C., & Subramanian, T. (2020). Financial management. India: New Age International.

Subramanyam, K. R. (2014). Financial statement analysis. New York: McGraw Hill Education.

Sultan, A. S. (2014). Financial statements analysis-measurement of performance and profitability: Applied study of Baghdad soft-drink industry. Research Journal of Finance and Accounting, 5(4), 49-56.