Reported cases of financial statement frauds have been rearing over the last ten years causing the employees, creditors, lenders, and shareholders to suffer a great deal and to some extent leading to bankruptcy (Skalak et al., 2011). Some of the reported cases include Parmalat, Xerox, Global Crossing, Adelphia, Tyco, WorldCom, and Enron, but the most recent fraud case is Overstock.com committed in the fiscal 2009. Over the past financial years, Overstock.com management has claimed that the company has either recorded minimal losses or generated profit compared to other years. It however emerges that Overstock.com apparently violates various accounting principles to create a positive picture about the company’s financial performance.

The management of Overstock.com disclosed the latest financial report claiming that compared to the financial year 2008 first quarter reported loss of $4.70 million; the company just generated a loss of $2.10 million in the fiscal 2009 first quarter. In actual sense, the asserted financial performance progress claim was indeed unimproved. For instance, Overstock.com used the 2004 cash in debt gains of $1.90 million and another $1.90 million profits from the preceding periods to inflate the gains and minimize the incurred losses. The 2009-reported losses of $2.10 million materialize to be a financial fraud (The fraud files blog, 2009). In its financial statement, the company restated the cut down debt gains twice to minimize the losses.

Since 2003, the management of Overstock.com has been making recurring errors in its financial reporting through irregularities and financial accounts manipulations. A cargo shipper made un-booked refunds belonging to year 2008 fourth quarter to Overstock.com, but this amount was recorded in the first quarter of the fiscal 2009.

Misappropriation fraud

Frauds relating to misappropriation occur when the organizational workforce or third parties deceivingly misuse their positions or ranks to embezzle assets from the corporation. Individuals working in a corporation to whom the organization has entrusted its assets may commit such type of fraud (Singleton & Singleton, 2010). For instance, the perpetrators assigned to handle the assets on behalf of the corporation and for the organization’s interest include company’s board members, workforce, or directors (Heitger, Mowen & Hansen, 2007). Misappropriation fraud is involved with actions such as intellectual property theft, stealing formulas, data, and patents belonging to a company, payroll fraud, inventory, assets, and monetary thefts, and forging checks (Nikolai, Bazley & Jones, 2009).

A recent case of asset misappropriation fraud occurred at Koss Corporation. The perpetrator, Sachdeva ‘Sue’ Sujata worked in this company for 12 years starting from 1997 to 2009 holding the chief finance officer position. By December 2009 when the fraudulent funds transfer scheme was discovered, the perpetrator had embezzled $40.90 million from this publicly traded corporation. In the fiscal 2009, December after the perpetrator had been arrested, it was though that only $4.50 million had been misappropriated (Marquet, 2011). After an intervening investigation was performed, it was realized that the fraud was huge. In January 2010, the company terminated Sachdeva contract after estimating that the loss could only $20.00 million. After being indicted, it has been revealed that the loss of the Koss Company has incurred due to this fraudulent misappropriation totaled to $34.50 million.

Using the fraud triangle to explain the financial statement fraud cause

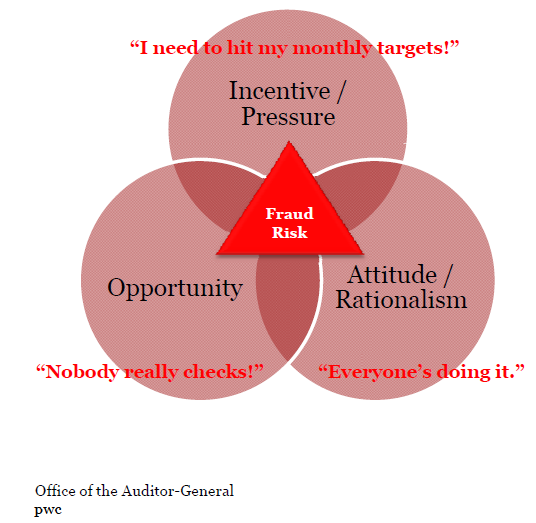

For detecting and preventing any frauds, the reasons for committing frauds are necessary to be known. In 1950s, Donald Cressey mad survey and he found three reasons to commit frauds and summarized them in Fraud Triangle (Singleton et al 2010, p. 44- 47). Further, PWC have made a Public Sector Fraud Awareness Survey, they found the same reasons of committing frauds, and they are as follows:

- Incentive/ Pressure: perpetrators have incentives or pressure to misconduct.

- Opportunity: perpetrators have an opportunity of committing frauds to earn more funds as it is easy for them to commit frauds and conceal it.

- Attitude/ Rationalization: perpetrators believe that they are able to justify their misconduct.

The above-mentioned reasons are applied in these two companies: Overstock.com and Koss Corporation.

Incentives

In terms of Overstock.com, Overstock.com management was under pressure to prove to the stakeholders that the company was indeed viable for investment (Kranacher, Riley, & Wells, 2010). In fact, it was motivated by the fact that the stakeholders need to see a good financial performance as opposed to losses that have been reported in the previous years (The fraud files blog, 2009). Thus, Overstock.com employees were pressurized to conceal the company’s poor performance through manipulating the financial records and restating some of the figures that the corporation initially reported and accounted for to present a positive picture of its financial performance (Nguyen, 2010).

Regarding Koss Corporation, the misappropriation fraud committed by Sachdeva accrued because the financial officer felt the need to live a luxurious lifestyle like other prominent people. For instance, the urge to own a resort, home and other overgenerous luxurious items increased her expenses. The need to meet all the financial debts or bills motivated Sachdeva to misappropriate Koss Corporation funds by authorizing the channeling of finance into her personal account through electronic fund transfer (Marquet, 2011). Besides, the desire to have material goods barren and simultaneously she did not have enough funds implied that Sachdeva had to issue five-hundred cashier checks from the accounts of the corporation to settle such expenses.

Opportunities

Being in the managerial position gave Overstock.com management the capacity to commit the financial statement fraud. For instance, since the financial statements manipulators had access to all the accounting information and records, it was believed that the frauds could be committed and concealed easily (Wells, 2007). In fact, it emerges that the company’s workforce had access to Overstock.com financial records in their normal jobs course. Therefore, it was an opportunity to them to earn more by committing frauds and concealing them as it was hard to be skeptical.

For Koss Corporation, Sujata was the principal accounting officer, secretary, and vice president of finance of Koss Corporation. Holding such a high profile position made it possible for Sujata to access all the financial information and records besides conducting and directing the channeling of funds into accounts that could benefit her (Rich et al., 2011). For example, Sachdeva knew all the weaknesses of the corporation. Therefore, she confidently gave five-hundred cheques from the corporation’s account to settle her own expenses. Furthermore, access to financial information and records was an opportunity for her to authorize a minimal of two hundred and six wire transfers of cash to her personal credit account from the account of Koss Corp (Marquet, 2011).

Rationalization

Prior to committing the financial statement fraud in Overstock.com, the management of Overstock.com was well informed that the financial performance of the company was poor and this could possibly deter potential investors to invest in Ovestock.com and it would be hard to raise money. Thus, it might have been said that committing this type of financial fraud is justifiable (Mowen, Hansen & Heitger, 2011). In fact, since the corporation trusted the actions of Overstock.com management, the management utilized that opportunity to be dishonest by reconciling their misappropriation actions with the trust bestowed in them. The management was convinced that committing financial fraud was okay to save the company’s reputation and for survival purposes (Rezaee & Riley, 2011).

With regard to Sujata Sachdeva, she believed that she deserved living a luxurious lifestyle, as she is the president of Koss Corporation. Perpetrators believe that owning homes, resorts, and personal luxury items including jewelry, luxury clothes and shoes, Mercedes Benz automobiles and other luxurious items was justifiable (Marquet, 2011). Thus, the desire to possess such luxury items drove Sujata to issue in excess of five-hundred banker cheques and approve two-hundred and six monetary transmits from Koss Corporation depository books to cater for her operating expenditure and settle her US credit card-bills.

The way of preventing and detecting frauds through Internal Control System

The company’s risk management and internal control schemes might have detected and prevented the financial frauds through various ways. First, it should check the opportunities, which may motivate individuals to commit fraud. Besides, the financial information should not be accessible to all employees who might be motivated to commit fraud. In case such information is easily accessible to anybody, then it would be easy for the forensic accountant to detect that the employees might have been motivated to commit or perpetrate frauds (Singleton & Singleton, 2010). Accessibility of financial information signify weak internal control systems that present an opportunity for the stakeholders to access such vital information and perpetrate fraudulent acts. To prevent fraud, the companies should restrict access to assets, financial information, and institute proper financial control and monitoring systems.

The corporation can prevent fraudulent opportunities through initiating great appraisal processes and morals, extensive oversight of management besides instituting tight internal control measures. By limiting the opportunities for committing frauds, the company can reduce the chances of fraudulent activities. The companies can detect frauds if there are motivations, and pressure on the employees to produce positive financial results even when the companies perform poorly (Weygandt, Kimmel, & Kieso, 2009).

How forensic accountant detect frauds

A forensic accountant could have detected incidences of fraud if there are monetary misappropriations and the financial reporting principles are flawed or not followed. Besides, it is easy for the forensic accountant to detect unreported frauds by observing the nature of the management oversight and the implemented internal controls. When management oversight is poor and the internal control systems are weak, then there is the possibility that fraud has been committed in the companies (Albrecht et al., 2011). Furthermore, the forensic accountant can detect incidences of fraud in case it is established that employees can easily access vital financial information and records. Moreover, the forensic accountant can detect frauds by making comparison between the actual assets and the financial information. For instance, the accountant compared between the actual amount of cash in hand and amount shown in the financial records and he/she need to prepare a bank recompilation monthly. Further, the accountant should check the physical existence of assets with its records on a regular basis as to detect any fictitious assets and he/she needs to ensure that the invoices of assets purchases are issued on the name of company to avoid any assets overstatement.

Vertical Analysis of Fly-by-Nite Corporation financial statement

From Fly-by-Nite Corporation financial statement, it emerges that the total current assets in the fiscal 2001 were $950,000 whereas the non-current assets were $1,805,000. Thus, the company’s total assets by the end of that financial period were $2,755,000. In contrast, under the shareholders equity and liabilities, the reported company’s total current liabilities were $1,010,000, total liabilities were $1,380,000, and total equity was $1,375,000 as at 30 June 2001. The summation of the shareholder equity and liabilities are $2,755,000.

In the fiscal 2002, the financial statement for Fly-by-Nite Corporation shows that the total current assets were $1,225,000 whilst the company’s total assets by the end of 30 June 2002 were $3,260,000. Conversely, under the shareholders equity and liabilities, the reported company’s total current liabilities were $1,060,000, total liabilities were $1,425,000, and the total equity was $1,835,000 as at 30 June 2002. By the end of this year, the summation of the shareholder’s equity and liabilities were $3,260,000.

The Fly-by-Nite Corporation financial statement indicates that the total current assets in the fiscal 2003 were $1,205,000, but the non-current financial assets were $2,795,000. Therefore, the corporation’s total assets by the end of June 30 2003 financial period were $4,000,000. In contrast, under the shareholders equity and liabilities, the reported total current liabilities were $680,000, the total liabilities were $1,040,000, and total equity was $2,960,000 as at 30 June 2003. When the shareholder’s equity and liabilities are summed up, they add up to $4,000,000.

Horizontal Analysis of Fly-by-Nite Corporation financial statement

From Fly-by-Nite financial statement, it is apparent that total current assets fluctuated across the period under study. For instance, in the fiscal 2001, total current assets were $950,000 whereas in the financial years 2002 and 2003, total assets were $1,225,000 and $1,205,000 respectively. That is, from 2001 to 2002, total current assets increased by $275,000, but the amount decreased by $20,000 from the fiscal 2002 to 2003. However, total assets increased steadily across these fiscal years. In the financial year 2001, total assets were $2,755,000 though the figure increased by $505,000 in 2002. From the year 2002 to 2003, there was an increase of $740,000 in total assets to $4,000,000. Total assets increased by $1,245,000 from 2001 to 2003.

The financial statement for Fly-by-Night Corporation shows that total current liabilities increased from $1,010,000 to $1,060,000 in 2001 and 2002. Nevertheless, total current liabilities decreased by $380,000 from 2002 to 2003. Total current liabilities decreased by $330,000 between the fiscal 2001 and 2003. On the other hand, total liabilities increased from $1,380,000 to $1,425,000 from 2001 to 2002, but declined to $1,040,000 in the fiscal 2003. Total equity however increased across the period under from $1,375,000 to $1,835,000 and $2,960,000 in the fiscal 2001, 2002, and 2003 respectively. From 2001 to 2002, total shareholders’ equity and liabilities increased from $2,755,000 to $3,260,000, but increased to $4,000,000 from 2002 to 2003.

Unusual relationships from the vertical and horizontal analysis

The increase in prepaid expenses and other from $55,000 to $150,000 and a drastic decline to $65,000 across the fiscal 2001, 2002, and 2003 appear to be very unusual. The type of fraud scheme that might have been committed is asset misappropriation (Gibson, 2012). Responsible personnel must have also reported the wrong financial figures in the fiscal 2003, giving rise to the possibility of committing a financial statement fraud. The decline in unearned revenue across the years under study is another unusual correlation, which might have resulted misappropriation schemes (Zack, 2012).

References

Albrecht, W, Albrecht, C, Albrecht, C & Zimbelman, M 2011, Fraud examination, Cengage Learning, Boston, MA.

Marquet, C 2011, The top 10 embezzlement cases in modern US history, Marquet International Publishers, New York. Web.

Gibson, C 2012, Financial reporting and analysis, Cengage Learning, Boston, MA.

Heitger, D, Mowen, M, & Hansen, D 2007, Fundamental cornerstones of managerial accounting, Cengage Learning, Boston, MA.

Kranacher, M, Riley, R, & Wells, J, 2010, Forensic accounting and fraud examination, John Wiley & Sons, Hoboken, New Jersey.

Mowen, M, Hansen, D & Heitger, D 2011, Cornerstones of managerial accounting, Cengage Learning, Boston, MA.

Nguyen, K 2010, Financial statement fraud: motives, methods, cases, and detection, Universal-Publishers, Boca Raton, Florida.

Nikolai, L, Bazley, J & Jones, J 2009, Intermediate accounting, Cengage Learning, Boston, MA.

Office of the Auditor-General New Zealand 2011, Public Sector Fraud Awareness Survey-Findings by PWC. Web.

Rezaee, Z, & Riley, R 2011, Financial statement fraud defined, John Wiley & Sons, Hoboken, New Jersey.

Rich, J, Jones, J, Mowen, M, &Hansen, D 2011, Cornerstones of financial accounting, Cengage Learning, Boston, MA.

Singleton, T & Singleton, A 2010, Fraud auditing and forensic accounting, John Wiley & Sons, Hoboken, New Jersey.

Skalak, S, Golden, T, Clayton, M, & Pill, J 2011, A guide to forensic accounting investigation, John Wiley & Sons, Hoboken, New Jersey.

The fraud files blog 2009, More financial statement fraud at Overstock.com. Web.

Wells, J 2007, Corporate fraud handbook: prevention and detection, John Wiley & Sons, Hoboken, New Jersey.

Weygandt, J, Kimmel, P, & Kieso, D 2009, Managerial accounting: tools for business decision-making, John Wiley & Sons, Hoboken, New Jersey.

Zack, G 2012, Financial statement fraud: strategies for detection and investigation, John Wiley & Sons, Hoboken, New Jersey.