Overstock.com Inc. is one of the first companies operating in the e-commerce environment.

Since it is a public company, it is obliged to submit its financial statements to the authorities after being reviewed by independent auditing firms.

In 2009, a dispute between Overstock.com Inc. and its auditor Grant Thornton emerged that resulted in the auditor’s dismissal.

The disputed evolved around the improperly disclosed overpayment to one of the company’s partners and an un-reviewed Form 10-Q that followed.

The company’s failure to follow the rules and guidelines provided by the authorities caused a disruption in the perception of the entity’s ability to comply with the regulations and maintain its status as an SEC registrant.

Disclosure’s impact on investors’ confidence

- The disclosure of financial information that was not reviewed by an independent auditor was a violation of SEC’s rules.

- SEC and other authoritative entities must obtain independently reviewed data as proof of a public company’s financial information credibility.

- The credibility of these data is important to investors since it helps assess the risks and benefits of investments.

- Due to the inconsistencies between press-release statements of Overstock.com Inc. and Grant Thornton regarding its invalid financial statement for 2008, stakeholders’ decision-making is negatively impacted.

- The disclosures impaired the reliability of independent audit functions.

- The interactions between the companies were unprofessional due to their public presentation of the uncertainties that must have been resolved in a working process.

- The dispute emerged as a result of under-discussed perspectives on the company’s vision of the overpayment.

- The formal reporting of the overpaid amount of $785,000 was improperly presented as a gain contingency entry.

- It consequently led to interpreting the return of this sum as a reduction in costs of goods sold.

- The accounting would have been performed without a dispute if Grant Thornton added an adjusting entry for the sum the company expected to return from the overpaid partner.

$785,000 Amount Materiality

The dispute between the company and its auditor was centered around a sum of $785,000 that has been overpaid to one of the partners of Overstock.com Inc.

This amount might be considered material due to the qualitative and quantitative considerations.

It is commonly agreed that materiality is determined against the percentage of the amount in relation to the company’s net income.

Research on Overstock.com Inc.’s net revenue shows that this number equals to approximately $7,500,000, making $785,000 more than 10 percent. This percentage is considered material.

In addition to these quantitative considerations, there are such qualitative factors that play a role in determining materiality as profit loss, conflict of interests of the involved parties, compensation, and stakeholders’ reaction to the misconduct.

Since there was an adverse impact on the company’s consecutive performance following the dispute, the consideration of these qualitative factors allows for identifying the amount material.

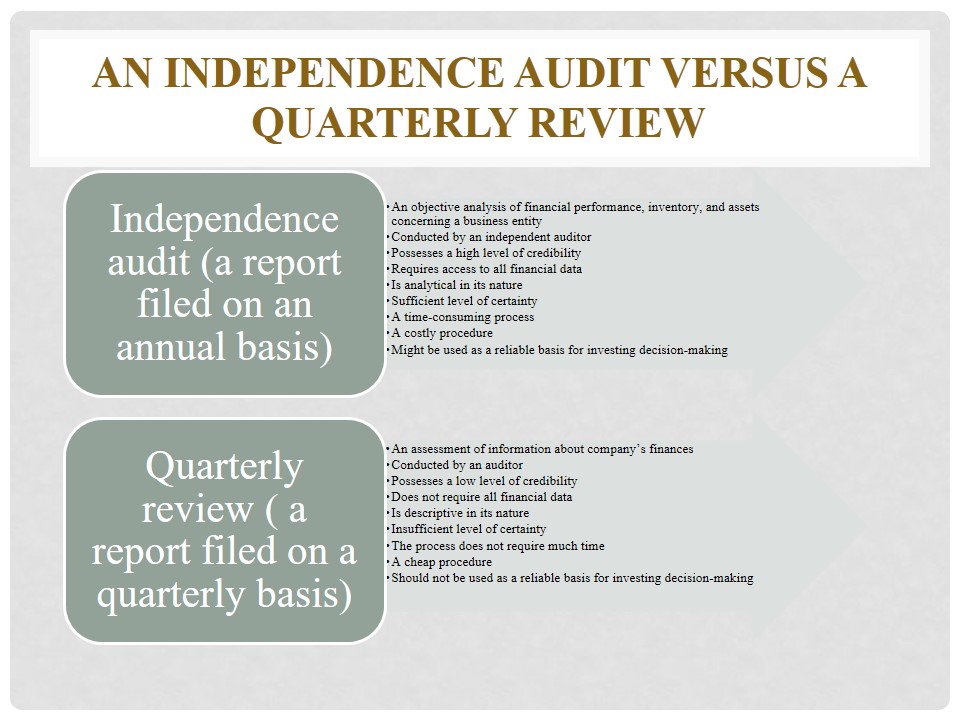

An Independence Audit versus a quarterly review

- Independence audit (a report filed on an annual basis):

- An objective analysis of financial performance, inventory, and assets concerning a business entity;

- Conducted by an independent auditor;

- Possesses a high level of credibility;

- Requires access to all financial data;

- Is analytical in its nature;

- Sufficient level of certainty;

- A time-consuming process;

- A costly procedure;

- Might be used as a reliable basis for investing decision-making.

- Quarterly review ( a report filed on a quarterly basis):

- An assessment of information about company’s finances;

- Conducted by an auditor;

- Possesses a low level of credibility;

- Does not require all financial data;

- Is descriptive in its nature;

- Insufficient level of certainty;

- The process does not require much time;

- A cheap procedure;

- Should not be used as a reliable basis for investing decision-making.

Form 10-q and review reports

Form 10-Q is required to be provided to SEC on a regular basis to ensure public companies’ compliance with auditing rules.

No review is required on a regular basis; it is only necessary under specific circumstances, which are defined by the authorities and are valid for all SEC registrants.

Such circumstances include the cases when company’s financial performance deviates from the SEC’s generally accepted accounting principles.

The registrants must submit a quarterly financial statement with a review if they have filed irrelevant disclosure.

SEC does not routinely require public companies to include their review reports in their 10-Q filling due to the short-term financial obligations that are present in 10-Q reports, which are not obligatory for every reporting period.

Form 8-k for SEC registrants

Form 8-K is a document that is required to be obtained from public companies in the USA in exclusive conditions.

This filing is needed to ensure company’s credible interpretation of the alterations in its financial performance that might potentially have a significant impact on shareholder decision-making.

The form is expected to be filed to the respective authorities within the SEC by its registrants if a company experiences events that are of crucial importance for its investors.

For example, as the case of Overstoc.com Inc. shows, form 8-K is needed when a company hires a new accounting firm.

Also, it is commonly filed when a public company fails to meet standards, experiences stock changes, asset securities, and internal controls.

The following specific items of information must be included in an 8-K that announces a change in audit firms: auditor changes, managerial changes, bankruptcy, the explanation of the reasons why prior auditing information is inaccurate, and the changes in the financial statements for the fiscal year.

Overstock’s accounting treatment of partner revenues

A company that operates under the guidance of a partnership is financially interested in tracking the capital account.

As for Overstock.com Inc.’s accounting treatment that it typically applied to the revenues generated by its “Partner” line of business, I think it is a reasonable and appropriate company policy.

The company applies specific accounting treatment to its partners due to the importance of the stock costs.

In particular, Overstock.com Inc. pays particular attention to its stocks with an aim to validate their objective cost.

Each stock is allocated a cost that is relevant to the revenue it might provide in the future.

Therefore, I agree with the company’s accounting treatment as per the matter under discussion.