Introduction

Generally, in active financial markets business organizations depend on financial instruments (FI) such as bonds, and equities to help them reduce potential risks they might encounter during their operations. For instance, issues such as increasing interest rates and changes in commodity prices are more likely to affect enterprises thus they rely on the various forms of securities to reduce the impacts. Apart from the aspect of reducing potential business hazards, the FIs are useful in enabling business owners to generate the required capital. In most cases, companies trade shares to raise additional funds for their operations. The approach allows investors to own a portion of the respective business organization. Therefore, the concept of FI is an essential facet of the money market hence it is necessary to have proper knowledge about it to ensure effective financial reporting by enterprises.

The Concept of FI

The term FI refers to a form of assets that can be traded in the money market. In financial institutions, FI provides an effective and efficient flow of funds from different investors across the world. In other words, FI can be defined as either a virtual or real document that represents a legal arrangement involving any form of monetary value between two or more parties (Stolowy & Ding, 2017). In general, FI is a contract for a monetary value that can be created, modified, purchased, or even settled. In terms of the agreement, FI requires a contractual obligation between the people or institutions involved in the transactions of FI. In other words, FI encompasses a two-way commitment whereby each party must comply with the agreed conditions. For instance, assuming a company is supposed to obtain cash from investors, it will be required to provide shares for the respective financier while the individual is obligated to issue the arranged funds.

Types and Categories of FI

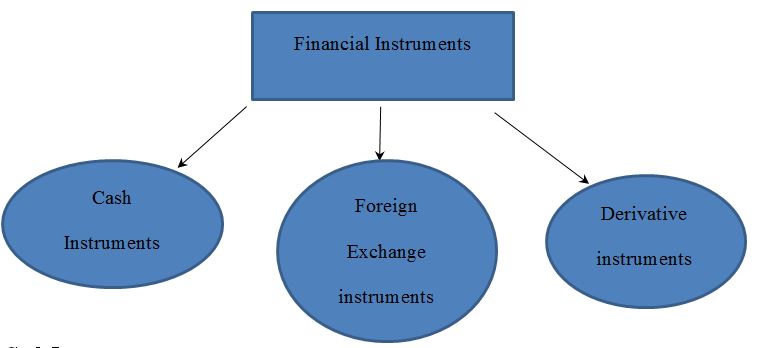

The FI are grouped into two broad types namely; derivative instruments, cash instruments, and foreign exchange instruments as shown in figure 1 below. Each of the categories functions differently making them unique from one another. Furthermore, the FI is categorized into two main asset classes which are debt-based FI and equity-based FI (Kańduła & Przybylska, 2021). The mentioned sets make the FI have wide functions that enable business organizations and potential investors to achieve their objectives in the money market.

Cash Instruments

Cash instruments are types of FI whose values are impacted directly by the prevailing condition of the general market. This type of FI further known as cash equivalents is categorized into additional two groups. The classes include securities and loans, and deposits which investors and business organizations can choose from depending on their needs in the financial market (Parameswaran, 2022). Generally, securities are FI that has monetary value and are mostly traded in the stock exchange market (SEM). There are a number of marketable securities that investors and business organizations can opt to purchase or buy in the money market. They include bonds, stocks, preferred shares, and debentures. When the given securities are purchased, they represent a significant portion of the publicly-traded enterprise in the SEM. In addition, the other category of cash instruments that are loans and deposits represent assets having monetary value. The cash equivalents require parties involved to have a well-formulated contractual agreement to which the participants must adhere to.

Derivate Instruments

Derivative instruments are FI that derive their values or performance from the underlying asset. Some of the underlying assets that can determine the values of derivatives include commodities such as oil, gold, and cotton. Other assets are stocks, interest rates, currencies, bonds, and market indices (Parameswaran, 2022). The mentioned items have the potential of influencing the creation of different financial derivatives in the market. Derivative instruments are classified into five main categories namely; options, future, interest rate swaps, and forwards. In most cases, the derivatives mentioned above are used for the precautionary purpose to enable business organizations and investors to manage possible risks and further facilitate the aspect of speculation in the market (Kang, 2019). Generally, the given types of derivatives fall into two broad classes known as option and lock.

Futures

A future is a contract between two parties that is buyer and seller for the purchase of an asset at a pre-determined exchange rate in the future. In most cases, the derivate is used by traders to enable them to hedge possible risks that are likely to occur. Furthermore, a future contract allows investors to speculate the forthcoming price of the underlying asset (Dungore et al., 2022). Based on the agreement, both participants are obligated to accomplish the commitment to sell or buy the given commodity.

Options

Based on the concept of derivative instruments, an option is a FI whereby two parties agree on a given contract to undertake a transaction of an asset at an already determined price before the future date. In other words, the FI permits the owner of the asset to sell or buy the underlying asset at the specified exercise price. In this type of derivative, the buyer is limited from engaging in the buy or sell agreement. The different options include selling a call option, selling a put option, and buying a call or a put option. Generally, options are used by investors to speculate the probable prices of the underlying asset.

Swaps

Swaps are types of FI mostly used by business organizations to facilitate the altercation of one cash flow with another. The agreement is made between two parties to involve in the swapping of the interest rates (Dungore et al., 2022). For instance, an investor may opt to use an interest rate swap to switch from a fixed to a variable interest rate. The FI is essential to business organizations because it allows companies to effectively revise the conditions of the debts in order to benefit the expected or even current situations of the market.

Forwards

Forward contracts are FI involving an agreement between two parties to undertake the exchange of the given asset at a specified price during the end of the arrangement. In most cases, the forwards are traded over the counter (OTC) (Dungore et al., 2022). In the process of the transaction, both the buyer and seller may agree to customize the size, terms, and even procedures of settlements once the contract has been created. Its OTC feature makes the forward derivate bear a significant counterparty risk that has the potential of affecting any of the involved participants. For example, one of the participants may fail to adhere to the obligation stated in the contract. In such a situation, the affected party will be forced to take the risks.

Foreign Exchange Instruments

Generally, foreign exchange instruments are usually derivatives. These are FI that are fully represented in the foreign markets. The FI is mainly the spot markets, swaps, option, future, and forward markets. This type of FI is designed to facilitate the management of financial risks that involves foreign exchange. The aspect makes the FI an essential tool that business organizations can use to reduce the hazards they are likely to encounter following the fluctuations in currencies in the money market.

The Asset Classes of FI

Apart from the various types of FI discussed above, FI can be further classified on the basis of assets. The two main categories are debt-based FI and equity-based FI. Each of the groups presents business organizations with essential opportunities for instance; the former presents business organizations with the ability to increase their capital base for smooth operations (Kańduła & Przybylska, 2021). They include mortgages, credit cards, debentures, bonds, and lines of credit. In most cases, the mentioned FI is short-term and last for about 12 months. On the other hand, long-term debt-based FI usually takes more than a year and they are mainly cash equivalents and exotic derivatives. The latter provides investors with the capacity of legal ownership of the company offering securities in the market. In this group, the FI includes preferred stock, common stock, transferrable subscription rights, and convertible debentures. Even though both classes enable corporations to raise the necessary capital, equity-based FI provides funds for the firms over a long period of time than debt-based FI.

Importance of the FI Concept

The concept is useful, especially to investors and business organizations which operate in the money market. The topic equips individuals with adequate knowledge about the various types of FI thus making it easier to choose the best option when engaging in any contractual obligation. With such understanding, a person may opt to advice companies concerning the nature of FI to enable them to gain effectively from their usage.

Furthermore, the topic increases the individual’s perspective of FI and how business organizations through the use of various types of FI can limit or avoid the potential risks in the market. The FI concept further makes it easier to speculate the future changes in market prices which is important for making an effective and informed decision for the business. Having a proper understanding of the FI idea, it will be easier to conduct a thorough research about the performance of securities in the financial industry.

In addition, the FI concept is essential in enabling accountants to classify various forms of derivatives and cash equivalents in financial statements. When the entries are made accordingly, it allows investors to have a clear picture of the respective organization based on its financial performance in relation to both equity and debt (Havemann et al., 2020). Furthermore, the FI idea allows investors to hedge their assets effectively hence they face limited financial risks.

Furthermore, the concept of FI is important because it gives people an opportunity to understand different ways of generating capital for business operations. Since there are various options in the market, with efficient knowledge it becomes easier to choose the best alternative to raise the necessary funds.

The concept of FI enables people to understand the importance of transferring risks to the other party. For instance, an investor may opt to buy instruments such as interest-rate swaps to give them the ability to protect their businesses against losses. Based on the FI idea, it becomes easier to remain effective in the market despite the challenges a firm may encounter. The FI topic is fundamental, especially in speculating sectors that are more likely to face frequent fluctuations leading to high risks in the market.

New Areas Learned in the FI Topic

In the process of exploring the FI concept, several new pieces of information I encountered. For instance, I learned about floating rate bonds which are essential financial securities that provide various interest influenced by the coupon rate that changes based on the market interest rates. In the US, the floating rate bond is preferred by most business organizations because of its feature that allows it to increase in value depending on the current status of the market. In other words, floaters make it possible for investors to continue receiving benefits following changes in the rates. Furthermore, the securities are less affected by market volatility hence they are effective and productive. However, despite the benefits associated with investing in a floating-rate bond, the FI experiences significant limitations. For example, in terms of rates, the security offers lower rates than their counterparts the fixed-rate bonds. The aspect makes them less attractive to business organizations that are attracted to higher rates.

Relationship between the FI and Financial Reporting and Analysis

Generally, the aspect of financial reporting and analysis encompasses the recording of the monetary details in the books of account. The practice is aimed at making a comprehensive financial statement that captures all the facets of a company’s financial information. Most sources of funds for the business organization include loans and equities which are major parts of the FI. The concept of FI makes it easier for accountants to effectively classify the various FI as financial assets, liabilities, or equities. The relationship between the reporting and FI makes it easier to analyze core aspects such as bank loans, amortized cost accounting, fair value, and balance sheets. After a proper examination of the FI, the analysts are then able to provide an accurate and reliable financial statement containing the necessary details that can be used by potential investors. Furthermore, the correlation ensures the reporting provides details of possible risks that are associated with different types of FI in the market.

Conclusion

To sum up, the concept of FI is essential, especially for business organizations that depend on the performance of the financial market. The FI are classified into three broad categories namely; cash instruments, foreign exchange instruments, and derivatives. The various types of FI play a vital role in enabling companies to have access to adequate sources of capital. In addition, the equity-based FI allows investors to own a portion of companies that are publicly traded in the SEM. By using the FI, business organizations have the ability to reduce potential risks through hedging practices. Similarly, the companies enhance their chances of benefiting future operations following effective speculations accompanied by either sell or purchase of the underlying asset. Based on the financial details in the FI concept, it is important for people especially accountants to have adequate knowledge about the FI topic. The aspect will enable them to develop effective financial reports that capture the key types of FI and classify them accordingly.

References

Dungore, P. P., Singh, K., & Pai, R. (2022). An analytical study of equity derivatives traded on the NSE of India. Cogent Business & Management, 9(1). Web.

Havemann, T., Negra, C., & Werneck, F. (2020). Blended finance for agriculture: Exploring the constraints and possibilities of combining financial instruments for sustainable transitions. Agriculture and Human Values, 37(4), 1281-1292. Web.

Kańduła, S., & Przybylska, J. (2021). Financial instruments used by Polish municipalities in response to the first wave of COVID-19. Public Organization Review, 21(4), 665-686. Web.

Kang, B. J. (2019). Economic benefits of derivatives for long term investments-equity linked securities. Journal of Derivatives and Quantitative Studies. Web.

Parameswaran, S. K. (2022). Fundamentals of financial instruments: An introduction to stocks, bonds, foreign exchange, and derivatives. John Wiley & Sons.

Stolowy, H., & Ding, Y. (2017). Financial accounting and reporting: A global perspective, (5th ed.). London: South-Western Cengage Learning.