Historical Background

South Africa is one of the developing countries that are showing some positive signs of development among other developing countries. This country is located in the Southern region of Africa Continent. The country was colonized by the Dutch and became independent in the year 1994 after a long period of unrest between the whites and Africans. The first president elect is known as Nelson Mandela who later retired paving way for the election of Thabo Mbeki, the leader of African National congress (ANC) as the president on June 2, 1999. Thabo was in power for 10 years when the third president was elected. Jacob Zuma the leader of the ruling party (ANC) became president of South Africa in April 2009. The three presidents have contributed a lot on the development of this nation.

Thesis Statement

South Africa has shown some economic growth and development. Geography and historical institutions are believed to have contributed and that is why the study intends to investigate.

Economic Growth and Development

The development of this economy lies on the formulation of good macroeconomic policies and high-level governance strategies. This country is majorly known for presence of many precious minerals, which include gold and diamond. These economic engines propel this nation to greater heights. South Africa’s agricultural sector has improved significantly. The cause of this improvement is sensitization of the locals on land ownership after the whites left the lands to them.

The research done by World Bank has proved the argument. The province of KwaZulu- Natal is known for agriculture. The main crop that is grown in this region is sugarcane. Other crops include, pineapple, citrus fruits, cotton, bananas. There is also animal husbandry in this region. The livestock kept in this area include, cattle, sheep and dairy. The area is rich in Agriculture due to fertile soils that originate from the Drakensberg and Lebombo Mountains (Fortin 126).

South Africa is known to have the highest number of learning institutions in Africa. There are also many tertiary institutions that provide technical skills to the country’s citizens. The whites started some of these institutions during the colonial period and they offer some of the best courses. For instance, there are only three universities in Africa, which offer courses in Virology, and all these are located in Africa. This means the country generates revenue from international students who seek education in this area. In general, the increased number of graduates helps the country to grow hence eliminating poverty (Bloom, Canning, and Chan 5). The line graph below shows Gross Domestic Product trends of South Africa between the year 1994 and 1995.

South Africa GDP constant 95 prices Year over Year (%YoY)

South Africa has a population of 48.7 Million comprising of colored, Asians, whites and Africans. The population provides both labor and market for the industries products. The population of each group can be shown in the table below

Financial industry also plays a great role in the development of South Africa. The financial institutions include; locally controlled banks, reserve bank of South Africa and banks that are controlled by foreigners (Maundeni 54).

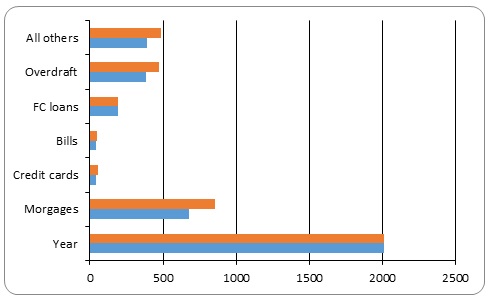

The bar graph below indicates the financial information of the banks between 2006 and 2007.

Conclusion

South Africa has shown a growth from 1994 to date. The factors discussed in the body of this study are causes of this growth. We may not have covered much as concerns the development of South Africa due to geographical and historical institutions, and we therefore recommend for future studies.

Works Cited

Bloom, David, Canning, David and Chark, Kevin. Higher Education and Economic Development in Africa: African Development Sector. 2005. Web.

Fortin, Emily. Reforming land rights: The World Bank and the globalization of agriculture. Brighton: University of Sussex, 2004. Print.

Maundeni, Zibani. et al. Consolidating Democratic Governance in Southern Africa: Botswana. 2007. Web.