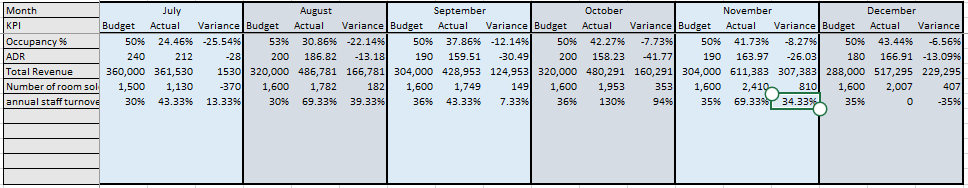

The financial performance of the e-hotel has been significantly affected by the Covid-19 Pandemic. After the resumption of operation, the e-hotel registered a low occupancy percentage for the first six months. The average daily rates were below the forecasted rates in all the months after reopening. The revenues of the hotel were above the budgeted amount. The number of rooms sold was on a steady rise for the first five months. Lastly, the rate of annual staff turnover was higher than it was anticipated. Figure 1 below gives a snapshot of the e-hotel’s financial performance.

Revenues

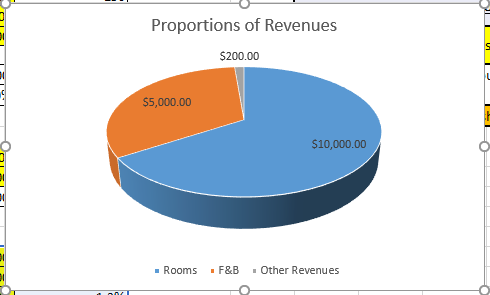

Revenues are important for organizations because they act as indicators of performance. Comparing the actual revenues to the target is important because it helps organizations understand how they are performing financially (Gerber, 2021). The hotel rooms contributed to the greatest part of the revenues for the hotel after it resumed its operations. It was followed by the food and beverages offered and lastly by the other revenues such as discounts and packages. Figure 2 below shows the proportion of revenue that was accumulated from various sources.

The hotel’s revenues have been highly affected by the global pandemic that led to the closure of most organizations in the hospitality industry. It was necessary that the hotels would quickly adjust their strategies after they reopen to manage to generate enough revenues to sustain their operations in the industry (Choi, 2020). The e-hotel considered these adjustments, and they truly had a positive impact on the hotel. Similar to the other industries, the hospitality industry was expected to maintain high standards of cleanliness. Sanitation was supposed to play a considerable role in enhancing and protecting both the employees and the customers (Choi, 2020). Maintaining high levels of overall cleanliness was one of the company’s goals that helped in attracting customers and recording the revenues that it had.

Costs

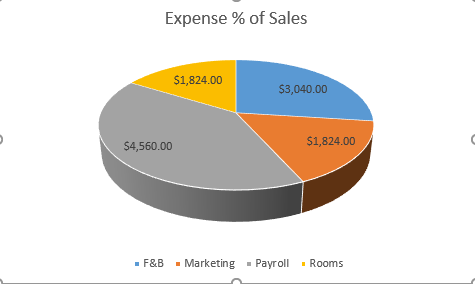

The costs that an organization incurs can also be considered an indicator of performance. When the cost incurred within some given time period is lower than that of the revenues earned, then the firm can be considered to be having a good operation (Ditkaew, 2018). The e-company had three main costs, which included advertising, payroll, and training. There were also expenses of sales, which form part of the overall costs and expenses as a value. Cost management is critical and highly fundamental for the hotel’s management because it results in accurate, timely, convenient, and reliable information needed by the firm’s decision-making body (Aničić and Aničić, 2019). The hotel’s cost of sales, for instance, has a direct impact on the revenues collected hence helping in determining the amount of profit made (Anderson, Foros, and Kind, 2018). Figure 3 below shows the sales percentage expenses realized 6 months after reopening.

Advertising costs were essential for the e-hotel because the competition was too stiff after the pandemic. Most of the other hotels were also making plans to re-open, and the number of customers was continuously decreasing. The occupancy of the hotels was expected to be low both in the third and fourth quarter. The reduction implies that competition would be necessary for the company to maintain its competitive edge.

Profitability

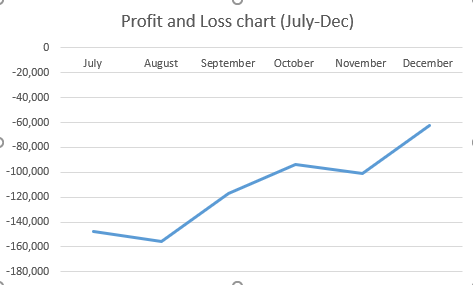

Profits are an essential consideration for any business because they are the key indicators of performance. Both employees and investors are always looking forward to working or investing in companies that are making profits (Keller and Meaney, 2017). To achieve high profitability, the management has to utilize various tools and apply a wide knowledge of profitability concepts. The use of the balanced scorecard is one of the tools that leaders can use to steer profitability (Andersson and Wachtmeister, 2016). Figure 4, below gives a graphical representation of the hotel’s profitability in the last six months.

The hotel recorded losses from the month of July up to the month of December. In the first half of the year, the profits gained were at $2252962 while in the second half the company made a loss of up to $-677,444. The profitability correlation between the first half and the second half of the year is 0; hence there is no statistical relationship between the returns of the former and latter half. The profits are critical because they help the managers and other stakeholders in the decision-making panel make decisions that can revive the performance of the company.

Cashflows

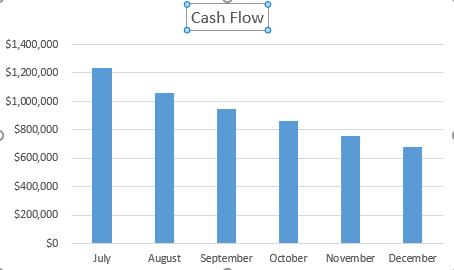

Similar to the other aspects analyzed above, the cash flow is an important variable to take into consideration because it shows how the organization is operating at any given time. The cash flows of the hotel were negatively affected by the pandemic. The company’s cash flow remained positive for the latter part of the year. This suggests that despite the fact that the cash flow has reduced the hotel can still manage to cover its expenses exclusively from sales (Ngotho, 2015). The variance of the cash flow recorded is negative from the month of July to December. Therefore, it is evident that the company made losses 6 months after re-opening. Figure 4 below shows the cash flow after the pandemic indicating the reduction with time.

Conclusion

In summary, the hotel is making significant adjustments to restore its performance after the pandemic that has had a major negative impact on the global hospitality sector. The statistics at the moment are not in favor of the organization because it has registered many backdrops. The losses that the company has made have been significant although they are reducing every month suggesting that it will start earning profits if proper strategies are in place. However, the managers have an obligation to develop better plans that will enable the company to increase the cash that they are operating on at any given time. With good management, the company will restore its profitability and enhance its sustainability. However, in all the strategies that it puts in place to revive its performance it has to ensure that the safety and health of both the employees and customers are taken into consideration.

Reference List

Anderson, S.P., Foros, Ø. and Kind, H.J. (2018) ‘Competition for advertisers and for viewers in media markets’, The Economic Journal, 128(608), pp. 34-54. Web.

Andersson, G. and Wachtmeister, A. (2016) Management strategies for profitability and growth. Uppsala: Swedish University of Agricultural Sciences.

Aničić, D. and Aničić, J. (2019) ‘Cost management concept and project evaluation methods’, Journal of Process Management, 7(2), pp. 54-59.

Choi, K. (2020) Hotels after Coronavirus: what happens after a pandemic. Web.

Ditkaew, K. (2018) ‘The effects of cost management quality on the effectiveness of internal control and reliable decision-making: evidence from Thai industrial firms’, Advances in Social Science, Education and Humanities Research, 211(1), pp. 60-69.

Gerber, B. (2021) ‘12 Key Financial Performance Indicators You Should Be Tracking’, accounting department.com. Web.

Keller, S. and Meaney, M. (2017) Attracting and retaining the right talent.Web.

Ngotho, W.A. (2015) Effect of working capital management on financial performance of three-star hotels in Nairobi county. PhD thesis. University of Nairobi.