Executive Summary

This report compares and contrasts the rule and principle-based systems of accounting, as applied by two leading consumer technology companies in the world: Apple and Samsung. Although the two multinationals engage in the same type of business, they use different accounting principles. Samsung adopts the International Financial Reporting Standards (IFRS) system, while Apple uses the Generally Accepted Accounting Practices (GAAP) model.

The pieces of evidence provided in this report show that the two systems share the same objective, which is promoting accountability in the development of financial statements through shareholder value maximisation. However, the GAAP model has a higher degree of mandatory compliance compared to the IFRS. In this regard, the rule-based model presupposes a higher degree of compliance for Apple’s financial reporting compared to Samsung’s principle-based framework.

Introduction

Financial performance is an important tenet of successful business operations (Camfferman & Detzen 2018: Lavi 2016). Therefore, a well developed financial report could help managers or investors to understand their objectives and monitor the progress made in realising them (Stefanova 2015). Based on the importance of financial reporting to business performance and investor relations, researchers have recently emphasised the need to understand the methodologies used to develop sound financial reports as a basis for making good investment decisions and comparing corporate performance (Camfferman & Detzen 2018: Lavi 2016).

At the centre of these discussions is the debate surrounding the use of two accounting systems – principle and rule-based models. The rule-based framework outlines a set of procedures that companies have to follow when developing financial reports, while the principle-based framework provides a set of controls or measures that firms have to adhere to in the process of achieving their accounting objectives (Camfferman & Detzen 2018: Lavi 2016).

In practice, the application of the principle and rule-based guidelines of financial reporting has been a source of contention when determining a common basis for comparing corporate performance (Persson, Radcliffe & Stein 2018; Camfferman & Detzen 2018: Lavi 2016). Consequently, current discussions have been characterised by the need to determine the best model of financial reporting to use internationally in the evaluation of corporate performance for giant multinationals which operate across different jurisdictions (Camfferman & Detzen 2018: Lavi 2016; Persson, Radcliffe & Stein 2018).

This report contributes to this argument by comparing and contrasting the application of the principle and rule-based models of accounting in the consumer electronics market. This is one of the most vibrant tenets of the technology industry that has spurred growth in different sectors of e-commerce. At the heart of the growth has been the development of new gadgets by two leading companies: Samsung and Apple.

Samsung is a consumer electronics company based in Seoul, South Korea. Its vision is “to create a better world full of richer digital experiences, through innovative technology and products” (Samsung Inc. 2019, p. 1). Comparatively, Apple is an American company based in California. Its vision is “to bring the best user experience to customers through innovative hardware, software and services” (MSA 2019, p. 1). Samsung and Apple are traditional rivals because they operate in the same industry and have products in near similar market segments. Although Samsung has a bigger market share (24%) compared to Apple’s 27% (Mourdoukoutas 2018), the latter’s market value is greater than Samsung’s.

Both firms use different accounting systems because Apple relies on the GAAP model, while Samsung uses the IFRS system. The latter is synonymous with the principle-based system of accounting, while GAAP is linked with the rule-based accounting framework. Key sections of this report will show the similarities and differences between these two accounting frameworks and how the aforementioned two companies have been applying them to improve shareholder value and enhance investor relations. However, before delving into the details of this analysis, it is important to understand the similarities and differences between the two frameworks of financial reporting.

Analysis of Accounting Systems

As highlighted above, there are two main types of accounting guidelines adopted by different countries around the world: GAAP and IFSR. The latter is synonymous with the principle-based system of accounting, while GAAP is linked with the principle-based framework. Most US-based companies, including Apple, use the GAAP method, while Samsung employs the IFSR technique (Rampulla 2018). The two systems are similar in their objectives because they strive to promote accountability in the development of financial statements. This commonality is visible with regards to their treatment of inventory.

For example, both methods allow the use of the first in – first out technique (FIFO) for managing inventory to improve shareholder value (Camfferman & Detzen 2018: Lavi 2016). Similarly, they both allow for the weighted average cost method to minimise operational costs and reverse inventory items. In this regard, both accounting systems strive to maximise shareholder value by improving the transparency and accuracy of the information contained in financial reporting.

This similarity could be explained by the theory of incentive, which presupposes that human behaviour is motivated by people’s willingness to embrace rewarding actions and reject those that cause negative consequences. Therefore, regardless of the accounting method chosen, companies use the rule-based and principle-based accounting systems to promote shareholder value as the ultimate reward. This benefit could also be translated to reflect improved financial performance and the development of sound financial reports.

The main difference between the rule and principle-based models of accounting is the degree of regulatory compliance. While the IFRS model requires fewer details relating to a firm’s financial performance, the GAAP framework demands strict observance of the same (Camfferman & Detzen 2018: Lavi 2016). This difference stems from the degree of freedom given to companies to achieve their accounting objectives.

The principle-based model gives companies the freedom to achieve their accounting objectives, but the GAAP framework is strict in doing so. For example, the rule-based system demands that firms provide a statement of comprehensive income, but this requirement is not necessarily true for the IFRS because its proponents do not perceive this index as an important indicator of financial performance (Lavi 2016).

The lengthy rule-based disclosures of the GAAP framework explain why Apple is often required to provide lengthy financial disclosures for investors to make sound financial decisions. For example, the firm is required to abide by the rules of the US Securities Exchange Commission (SEC) in addition to following the guidelines of the rule-based GAAP model (Camfferman & Detzen 2018: Lavi 2016). This is because this system of accounting has three key areas of focus: revenue-based financial statements, balance sheet and item classification (Camfferman & Detzen 2018: Lavi 2016).

Comparatively, Samsung uses the IFSR standard, which strives to promote transparency and stability in the development of financial statements. Its procedures were developed to understand a company’s financial performance and to enable investors to make sound financial decisions based on an accurate data review (Lavi 2016). Therefore, Samsung’s IFRS system differs from Apple’s GAAP model because it is principle-based, as opposed to rule-based (Camfferman & Detzen 2018: Lavi 2016).

Critical Evaluation of Rules-based vs Principle-based Frameworks, Including the Degree of Mandatory Compliance

The use of different accounting systems for Apple and Samsung highlights variations in financial reporting standards that are premised on how both companies have consolidated their financial statements. For example, Samsung’s IFRS accounting framework has been based on a control model, while Apple’s GAAP advocates for a risk-reward system (Camfferman & Detzen 2018: Lavi 2016). This is why some entities that have been highlighted in Apple’s income statement have been consolidated separately from Samsung’s statement. For example, there is no segregation of extraordinary items for Samsung’s income statement, but this item is highlighted below the net income in Apple’s income statement (Market Watch 2019a; Market Watch 2019b).

Inventory management and reporting standards between Samsung and Apple’s accountings statements also highlight the above-mentioned differences in accounting standards because it is not possible to use the Last In First Out (LIFO) model of inventory reporting for Samsung because the IFRS model does not support such a practice (Camfferman & Detzen 2018). However, Samsung has the liberty to choose which inventory system to use between the LIFO and First in First Out (FIFO) models.

This difference is also observed in the manner Apple and Samsung report their earnings per share because the latter’s reporting practices do not average the calculations made for each period in review. Comparatively, Apple’s computation for earnings per share is an average of the incremental shares made within each individual period under evaluation. Lastly, differences in financial reporting between the GAAP and IFRS systems were observed in their treatment of development costs for research and development. Samsung’s IFRS guidelines created the need to capitalise this expense on the company’s financial statements, but Apple’s GAAP framework reports this item as an “expense” (Market Watch 2019a; Market Watch 2019b).

An overview of the development of Apple and Samsung’s income statements highlights the major point of assessment for the principle and rule-based accounting systems adopted by both companies. The major difference is how Apple and Samsung label their income statements. Under Samsung’s IFRS’s guidelines, this statement is presented as the” statement of profit or loss”, and it captures most items comprising its revenues, income and expenses (Market Watch 2019a; Market Watch 2019b).

However, Apple’s income statement covers most, but not all, items relating to the above-mentioned areas of income reporting. Furthermore, not all items of the income statement follow through with the conventional understanding of profit and loss reporting. For example, the fair value re-measurement of equity instruments did not follow this example (Market Watch 2019a; Market Watch 2019b). This observation stems from the freedom accorded to Samsung by the IFRS framework to classify their expenses based on their nature or function. Comparatively, Apple’s IFRS model has stringent requirements for this area of financial reporting.

Therefore, it is easy to identify expenses of an unusual nature in its financial statements. However, it was difficult to do the same for Samsung because of the lack of standardised accounting practices. Broadly, these insights highlight differences and similarities between the principle and rule-based accounting systems because they emphasise the need for shareholder value maximisation by exercising different degrees of regulatory compliance (Camfferman & Detzen 2018: Lavi 2016).

Summary

Based on the findings highlighted in this report, Apple and Samsung adopt different accounting systems, which accord them varying levels of regulatory compliance and independence in financial reporting. The GAAP framework gives Apple less room to tweak its financial reporting standards, but Samsung enjoys more freedom to do so, provided it adheres to the principles espoused in the IFRS framework.

However, the bigger question that emerges from this report is whether both systems provide investors with reliable and credible data for making financial decisions, and the answer is that both systems do because they strive to promote shareholder value. Therefore, their differences are limited to methodological adoption. Nonetheless, there is a need to constantly review the financial performance of companies that use both systems to understand the quality of investment decisions made.

The findings of this report could be useful to academicians and industry observers when identifying issues that affect the financial performance of an industry. Based on a broad understanding of the impact of the rule and principle-based accounting systems on different industry segments, it would also be possible for experts to find a “common ground” in the application of different accounting systems across the world to allow for a review of the financial performance of multinational companies.

Nonetheless, the evidence provided in this report shows that the principle and rule-based systems are similar in their objectives because they strive to promote accountability in the development of financial statements. However, the GAAP model has a higher degree of mandatory compliance compared to the IFRS.

Appendix

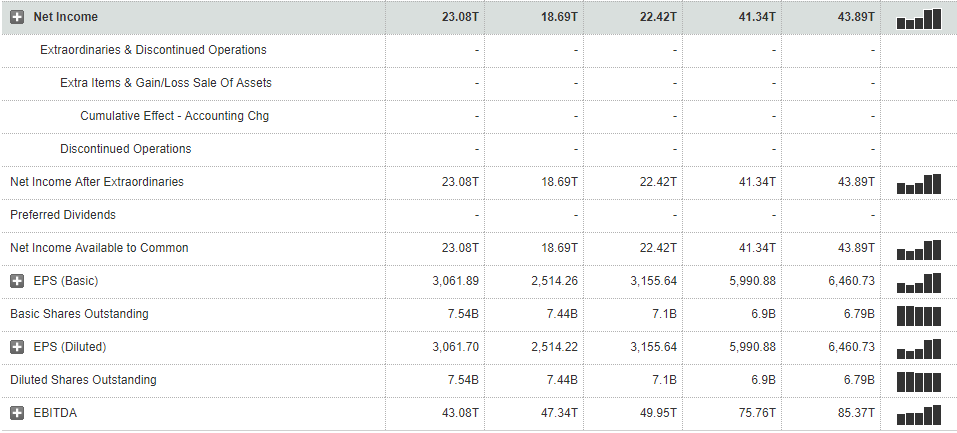

Appendix 1: Samsung’s Income Statement (2014-2018)

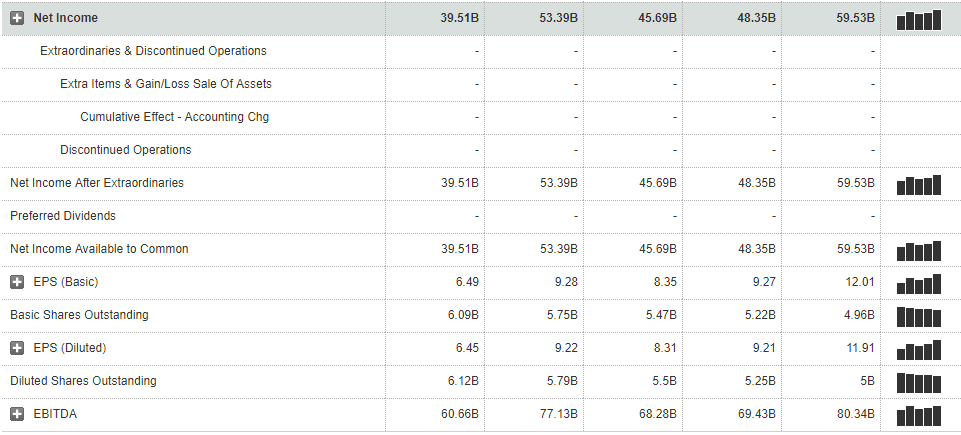

Appendix 2: Apple’s Income Statement (2014-2018)

Reference List

Camfferman, K & Detzen, D 2018, ‘Forging accounting principles in France, Germany, Japan, and China: a comparative review’, Accounting History, vol. 23, no. 4, pp. 448-486.

Lavi, M 2016, The impact of IFRS on industry, John Wiley & Sons, London.

Market Watch 2019a, Apple Inc. Web.

Market Watch 2019b, Samsung Electronics Co. Ltd. Web.

Mourdoukoutas, P 2018, Samsung beats Apple in the global smartphone market as Chinese brands close in. Web.

MSA 2019, Apple mission and vision statement. Web.

Persson, ME, Radcliffe, VS & Stein, M 2018, ‘Elmer G Beamer and the American Institute of Certified Public Accountants: the pursuit of a cognitive standard for the accounting profession’, Accounting History, vol. 23, no. 1, pp. 71-92.

Rampulla, R 2018, Common U.S. GAAP issues facing CPAS, John Wiley & Sons, London.

Samsung Inc. 2019, Vision 2020. Web.

Stefanova, M 2015, Private equity accounting, investor reporting, and beyond: advanced guide for private equity managers, institutional investors, investment professionals, and students, 2nd edn, FT Press, New York.