An open economy involves carrying out of economic, businesses and trade across the border. It means the opposite of closed economy in which international trade and business cannot take place.

Exporting is a term used in international trade to refer to the act of selling goods and services t across border, while importing involves buying goods and services from other nations and-the two constitute the international trade. The following model is used to explain open economy: Y = Cd + Id + Gd + EX or Y = C + I + G + (EX-IM). (EX − IM) is the net exports (Mankiw 7). This paper explores on different activities that are carried out during international trade and the financial rules that are involved.

Countries track international monetary transactions for specific periods of time using the Balance of Payment (BOP) accounts. By so doing, countries are able to know the number of trading activities conducted by both private and public sectors. This information shows how much money is being generated internally or from exports.

A country can receive or pay money in an international transaction. Credit is whereby a country has received money whereas debit is used where a country has paid money. From theoretical point of view, BOP should be zero, meaning that assets and liabilities are balanced. Nonetheless, this has not been observed practically since either deficit or surplus always prevails (Mankiw 7).

The BOP accounts are usually three, namely, the current, capital and financial account .The current account summarizes the inflows and outflows of commodities or services into a country. It also shows what the public and the private have earned in terms of investment.

The second account is capital account which records all international capital transfers. Capital items include land, non produced assets and equipments. The third division of BOP is the financial account which shows inflows from international trade activities and investment in real estate’s shares (Mankiw 7).

Open trade functions in a market called the foreign exchange market. This is the worldwide financial market for currencies. Various players of foreign exchange market include corporations, financial institutions, retail investors, governments and central banks of various countries. Relative prices for various currencies are usually determined by the market. This market is also used for conversion of different currencies. Banks trade in this market on behalf of their customers and in their own account.

Today new innovations have been implemented on this market such that more efficient electronic systems are used. (Cross 113-115). Since commercial companies have to pay for their international transactions denominated in foreign currencies, they visit the market seeking for foreign market exchange to pay for goods and services. Central bank enters the FX market to control interest rates, inflation and money supply. They also set target for their currencies to stabilize the markets (Murphy 56).

Traders use derivatives in the international markets to minimize and hedge against risks and exposures (Gregory 34). These derivatives include forward contracts, buyers and sellers agree on an exchange rate for a specified future date consequently, unless such period expires, no transactions take place.

The parties to the contract decide, set dates and negotiate the contract together. A swap is assumed to have taken place when two parties meet and exchange money. After the expiry of the agreed period in the contract, the parties reverse the transaction.

Other parties settle for currency future where they predetermine the exchange in advance. These forms of arrangements are traded in an organized market and last about 3 months. Other parties will enter into foreign exchange option. This derivative entails giving the owner a right but not an obligation to exchange money denominated in one currency into another at an exchange rate usually pre determined at a specified date (Gregory 34).

Currency Appreciation and Depreciation are used in the international trade to describe the movements of the exchange rate induced by market fluctuations. When the value of currency in respect to a particular currency increases in comparison to another country’s currency, appreciation is assumed to have occurred, while the value of the currency in comparison with another country declines, depreciation will have occurred.

Currency appreciations and depreciations are caused by changes in demand and supply for a currency in the foreign exchange market and which depends on country’s quantity of imports and exports, government involvement in the international monetary transactions, forces of demand and supply in the Forex market and economic growth of the country (Gregory 34).

Open market comprises of money market and goods market. Goods market is concerned with buying and selling of goods and services, while on the other hand, money market comprises of supply and demand for money. Even though the two markets are treated separately, they link through real income (Y) and the interest rate. This have a lot of impact on investment as it can lead to loss or gain.

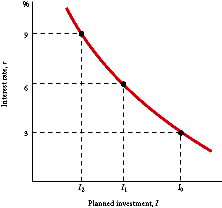

The equation in goods market is (Y=C+I+G) while that of money market is, (money demand =money supply). (Murphy 343-375). Interest rate has an inverse relationship with the level of planned investment. This means that when interest rates are high, it becomes costly to borrow funds to invest thus loans from the bank will becomes expensive. Consequently, firms will shy from obtaining additional funds to invest. This is illustrated graphically in the goods market as shown below:

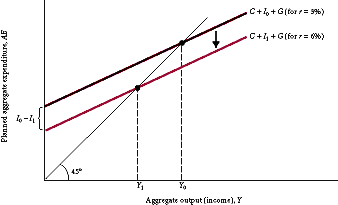

As the interest increases, investment decline, hence, aggregate expenditure decline in the money market. Expenditure is given as AE = C + I + G, the component I(investment ) will fall and force the aggregate expenditure curve to shift to the right as demonstrated in the diagram.

Open market can benefit a country technologically, especially where it lacks the key technological resources and personnel. Additionally, Open market helps countries increase sales and profits since it provides a wide customer base, reduces dependence on existing markets, and encourages global market share.

Furthermore, open market promotes domestic competitiveness, business expansions and smoothen seasonal market fluctuations. On the other hand, overreliance on international trade may restrain the local production, whilst the local industries may be overshadowed by the international competitors. In addition, rich countries may influence political matters in other countries, while ideological differences may emerge, particularly in regard to the trade procedures.

Open economy is very essential for economic growth and development of an economy because it leads to importation and exportation of goods and service hence boosting trade among countries. However, a country should not over rely on international trade as it may encourage dependency, overshadowing and political influence and ultimately end up deterring economic growth (Gregory 63).

Works Cited

Gregory, Millman. Around the World on a Trillion Dollars a Day. New York: Bantam Press, 1995. 34. Print.

Gregory has written ‘Around the World on a Trillion Dollars a Day’. He has tackled the issue the derivatives and how investors and banks can apply these financial instruments to hedge against risks associated with currency fluctuations. He describes them as financial innovations in the open economy. He demonstrates using examples how one can enter into swaps or forward contracts.

Murphy, John. Technical Analysis of the Financial Markets. New York: Institute of Finance, 1999. 343–375. Print.

The author has done research on macroeconomic theory. He has worked extensively on depreciation and appreciation in the international trade and how they influence the imports and exports. He illustrates clearly the difference between the two concepts as used in the open economy and their effect on overall economy.

Mankiw, kraph. Macroeconomics. New York: Worth, 2007. 7. Print.

The author as tackled on the open economy model by introducing the net exports in the model. He can be described as an inventor with rich knowledge in economics. He is an author who has written several books on macroeconomics.

Cross, Sam. All About the Foreign Exchange Market in the United States. New York: Bank of New York, 1998. 113–115. Print.

Cross has done research on the beauty of foreign exchange market. He illustrates the main players in the market and their main roles. He is an advocate of the open market for he appreciates the benefits associated with open markets.