Introduction

The First Citizens Bank comes available with a number of financial services to individuals, businesses, and professionals through a network of branches (Globe-Newswire 7). The main competition for the company is the BB&T Corporation. This is also a banking institution covering the Southeast regions.

Financial income statements and balance sheet

Income Statement

(First Citizens Bank Limited and Its Subsidiaries 2)

Balance Sheet

(First Citizens Bank Limited and Its Subsidiaries 2)

Financial Ratios Comparison and analysis

The following represents financial ratios used to analyze the recent performance of the First Citizens Bank in the recent years.

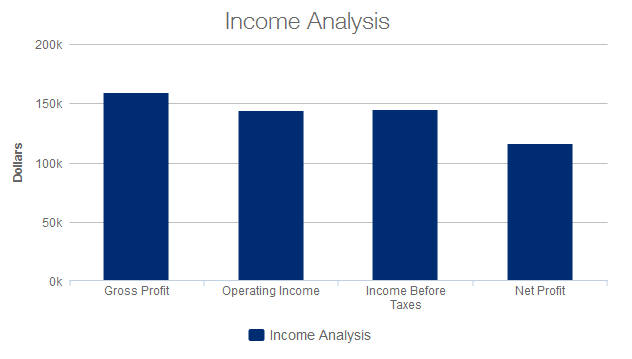

Income Analysis

The income analysis pertains to a comparison of the profit, revenue, income and profit of the institution in the recent year for analysis on the position of the company. According to the charts above, gross profit and operating profit are at similar levels. The income before taxation is the same as the operating income, but that means the surplus revenue is minimal even though we have not been provided with the taxation. There is little margin for new projects because whatever is generated is mostly reused. As for the competition, BB&T Corp shows a sharp disparity between the revenue and the resulting net income. In 2013, sharp dip of profit was experienced. The company has since recovered, but the disparity points to a lot of the money being used for operating expenses.

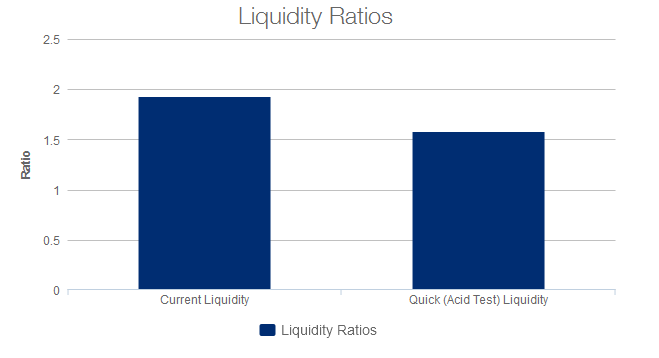

Liquidity

Some institutions may decide to balance the profit maximization activities through profit maximizing activities (First Citizens Bank 1). The current liquidity is the total cash and unaffiliated holdings which are compared to the net liabilities. This is shown as a ratio to provide the amount of insurance the assets can cover the liabilities of the company.

The same case goes for the quick or acid test liquidity. A lower ratio means the company may have to sell for long-term assets. A higher ratio means the insurer is not that dependent on premiums. From the chart above, we can see the current liquidity implies the bank does not require premiums. BB&T ‘s high current liquidity ratio implies the company is stable as concerns the short run and not dependent at all on insurance in the event of a shortfall.

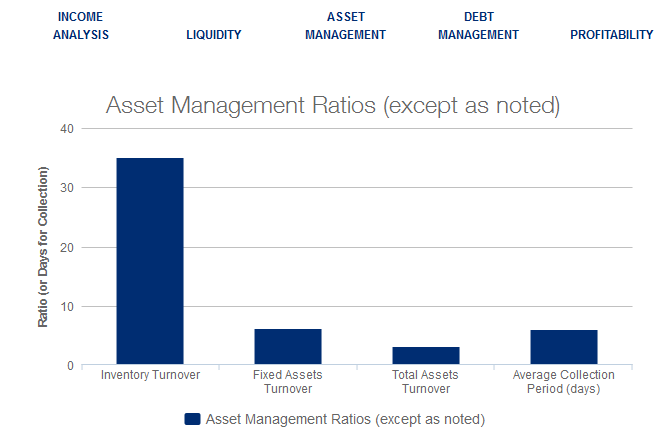

Asset Management

The above chart shows the asset management ratios of the company in the recent year. Starting with the inventory turnover, the ratio on the chart is quite high. The asset turnover is an pointer of the proficiency with which a firm is arraying assets. A bigger ratio is optimal as it implies the company is generating more revenue (First Citizens Bank 1). Chart Observation shows a problem because both the total asset and fixed asset turnover ratios are quite low, and that means it is not generating as much per asset dollar.

Finally, there is a ratio of the average collection period which is the time it takes for the industry to receive payments owed. This is in the favor of the company because the charts show a lower ratio. Less time is better, in this case. It means the company does not take long when turning receivables into usable money. The capital ratio is similar to the asset turnover, and the percentages can be related to rates. A lower percentage in the case of the BB&T Corp means the company is generating enough revenue per unit asset

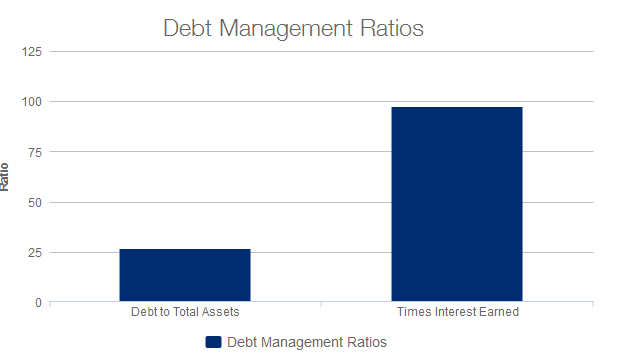

Debt Management

The debt to total assets is a leverage ratio, and it shows the amount of debt relative to the assets. The charts show a lower ratio and that meaning lesser financial risks at least for the short term. The debt ratios for BB&T Corp are similarly lower meaning better borrowing capacities.

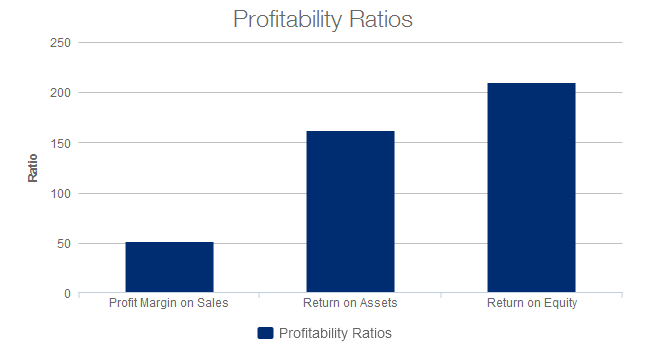

Profitability ratios

The low profitability ratio above means the company is not that profitable. Nevertheless, the return on assets themes to the effectiveness of administration of utilizing assets in revenue generation. The return on equity utilizes the company’s investing capital to generate revenue. The ratios of both systems above depict an efficient system even though it is not translating to revenue. The return on equity for the BB&T Corp rises in the chart for 2010, 2011 and 2012, but drops steeply in 2013 before rising again in 2014. By all accounts and financial ratios provided, 2013 represented one of the worst fiscal periods for BB&T Corp.

First Citizen Bank strengths and weaknesses

The First Citizens Bank is one of the top institutions within the country and has a number of advantages that come with banking with them. For one, they have experienced business units. This comes with the more a century of banking experience they have had within the state of Carolina and the 17 states they have expanded to. Reduced labor costs also occurred, meaning good wages for the employees (Advisorgate 1).

Weaknesses

They do not have a very substantial tax structure as it is liable to provide costing issues. They face a lot of competition from upcoming online financial platforms, and they operate using small business units. The other thing is they do not put a lot of investment in research and development for new projects.

The ratio here is the gross profitability margin and as stated before has a direct relationship ratio with the profit, whereby the higher the margin, the higher the profitability and this ratio has increased in the recent 5 years as viewed from the above chart courtesy of Y charts analyses.

Annual report analysis

According to the CEO, Frank Holding, the primary mission of the company relates to the expansion and the community. As such, he claims the company looks for various opportunities to expand on a regular basis. This being said, they also want to deliver an exceptional experience to every client across all channels every day. Considering the profitability which seems to be rising through the years, I think the operating procedures are taking up most of the revenue. The company needs time to stabilize before opening up any more branches.

Forecast

The constant interest of 0.08, if it were to stay in the same position would undoubtedly not have much of an effect on the profitability of the firm. As seen in the chart above, the profitability of the First Citizens Bank has been steadily rising and if they do not undertake any taxing projects like opening a branch, this could maintain the same for the next three years to reach a ratio of 12 or 13 by the next few years.

Works Cited

Advisorgate. First Citizens Bank – SWOT analysis. Strength, Weaknesses, Opportunities, Threats 2015. Web.

First Citizens Bank. Financial Ratio Analysis. Insight & Tools. 2015. Web.

First Citizens Bank Limited and Its Subsidiaries. Consolidated Financial Statements. 2014. Web.

GlobeNewswire. 1st Financial Services Corporation Shareholders Approve Merger With First Citizens Bank. The Street. 2015. Web.