Introduction

The paper seeks to analyze and evaluate the banking industry. In particular, the report focuses on the analysis of Banorte Bank in Mexico. It sheds more light on the bank’s financial techniques and management. The report goes ahead to analyze the current financial setting and its competitiveness in the market. The scrutiny of the bank’s fundamentals and variables of the bank form part of the report. It also evaluates the risks of Banorte in comparison to the banking industry. Financial analysis and forecast of the bank’s financial performance is the major objective of the report.

Brief background information on Banorte bank

Founded in 1898 with its headquarters in Monterrey in Mexico, Grupo Financiero Banorte developed to be the largest financial institution in Mexico. It enjoys assets worth 30 billion US dollars and has approximately 12,500 employees and over 950 branches. Banorte bank is among the branches of the group. The bank has consolidated assets of approximately $15 billion. It is the fifth-largest financial institution in Mexico. The bank has merged with other several financial and securities institutions to achieve its status. In 2006, the bank accessed entry to the US financial market by acquiring over 70 percent shares of Inter National Bank.

Global trends and competitive factors

Financial emerging trends over the recent past have become a topic attracting varied views and debates across the globe. Globalization and diversification in the financial market are the key players in these emerging trends. Banks and other financial institutions in their quest to achieve success need to adjust to cope with various emerging trends in the banking industry. The most emerging global economic trends are liquidity, commodities and protectionism. Limited interest rates result in a major upright breakout of inflation in every financial system. Liquidity as a trend comes in two major dimensions. One dimension focuses on metrics while the other focuses on implications (Basel Committee on Banking Supervision 12).

To understand how and when of a liquidity cycle, one needs to understand that its debate grounds itself in the most verifiable construct. A measurable gauge, in terms of global liquidity, however, becomes difficult to arrive at. This is because of the price and quantity dimensions involved in global liquidity. Quantity dimension at large involves aspects and combination of money and credit, foreign exchange reserves and derivatives. Price dimensions involved is a hybrid form of inflation measurement.

Price metrics are a more reliable barometer to inflation. Its application in more developed markets produces a magnificent result. Quantity metrics best fit emerging and developing markets. The most vital trick is always to bring together the two metrics to form a unit gauge in global liquidity. Most financial institutions, therefore, need to come up with the proper measures to ensure stable liquidity in their assets (Marois 865).

However, other emergent trends like E-banking, global banking, mobile money, IT-platform sharing and self-service form part of the emergent issues in the global financial industry. In the case of global banking, banks strive to infiltrate new markets by extending their services to other parts of the world, other than concentrating in their local countries. By extending their markets, banks increase their profits and general market share. For banks to ensure future success, they should use the emerging international IT sharing platform to enable them to access information speedily, as well as reduce costs. A good example is mobile operators merging with banks to ensure speedy delivery of information in the market.

Banorte bank financial analysis on Risk management

Credit risk

Credit risk denotes the risk undergone when customers, issuers or partners default on their payment commitments, making it crucial to apply suitable management to sustain the loan value in the portfolio. By March 31, 2011, the Banco Mercantile del Norte overall portfolio stood at Ps 256,805 million. The estimated losses signify 2.2% and the unexpected loss tallied at 3.8% in regards to the total portfolio. The standard projected loss stood at 2.2% in the period between January and March 2011.

In the Brokerage House, the credit disclosure of investments added up to Ps 13,068 million. Loss estimates signify 0.1252% of the exposure; the average predictable loss is 0.1277% between January and March 2011. The sum total of the operating portfolio of Arrendadora and Factor is P’s 16.648 billion. Potential losses stand for 0.7% and unexpected losses account for 2.8% of the entire working portfolio. The prospective loss estimates cater for 0.8% in the time running from January to March 2011. Credit risk is calculated by methods ratings related to the issuer, emission or scores, which compute a level of risk that can be derived from two fundamentals as follows:

- The possibility of default by the designer, emission or tallies is normally demonstrated as a percentage between 0% and 100%, where the better rating signifies a low prospect of non-payment.

- The degree of liability expected in running an operation, which may incur default, is calculated as a percentage between 0% and 100%; whereby, the more enhanced the collateral, the less the impact caused by such losses.

In moderating loan risks and trimming down the impact of losses brought about by nonpayment, partners sign ISDA agreements and pacts to net out. This is where credit lines and loan security are utilized to alleviate liability and observe risk diversification guidelines in asset and liability transactions. The bank puts up forward the following figures:

Loan transactions

In agreement with the regulations of expansion of risks in dynamic and inactive operations, the following information matches with Leasing and Factoring (Arrendadora y Factor Banorte) in millions of pesos (Fama and French 568).

Market Risk

Value at Risk

The disclosure to market risk is realized by computing the Value at Risk (“VaR”). Under this context, the VaR value denotes the probable loss, which could be a result of the valuation of the portfolios at a particular date. This technique is used, both for the estimation of market risk and the development and regulation of in-house limits. To calculate Value at Risk (VaR), the organization has to utilize a nonparametric historical simulation technique, whereby, a 99% confidence point, using the 500 recent historical settings. The outcome is multiplied by a security factor, changing between 3 and 4 and relying on yearly Back Testing outcomes from preceding quarters considering 10 days to disintegrate the risk portfolio under scrutiny. These interventions make it realistic to ensure impulsive aspects within the risk factors influence such portfolios. The standard VaR during January-March 2011 quarter for the portfolio is P’s 1,533 million.

The VaR for all the risk factors illustrated is determined by replicating the effects of 500 historical scenarios within the variables constituting particular factors; retaining at a constant value, the variables that impact on associated factors identified. The combined Value at Risk for the Bank and Brokerage House accounts for the association of all risk dynamics that affects the portfolio valuation. This explains that the disparity between the sum total Value at Risk in each Risk Factor does not indicate equivalent values (Marois 45).

Operational risk

GFNorte has a strict Operational risks department related to the “Executive Management of Credit and Operational Risk Administration”, which is accountable to rgw General Management of Risk Administration. The organization identifies Operational Risk as the possible loss occasioned by shortfalls and scarcity in internal command errors in functional processing and storage and/or data transmittal, not forgetting profound managerial and legal rulings, and financial scandals as referred to by the technological and legal department.

Although operational risks may not have a greater impact on a bank’s risk profile, some unexpected events accruing from operations may jeopardize the activities of a bank and lead to an eventual collapse. At the strategic level of every bank, the calculation of exposure to capital risks leads to the proper mechanism of management. In this case, the extreme capital allocation system of calculation provides a clear viewpoint of assessing and calculating a bank’s exposure to capital and operational risks. Operational risks may result in the loss of billions of moneys and at some points render a bank bankrupt hence collapsing. Therefore, operations banking will need a clear framework to ensure holistic operations. External operational risks may occur due to the involvement of a rogue customer while internal operational risks result from internal processes and systems.

Income statement and balance sheet analysis

Income statement and balance sheet Highlights for Banking Sector

Net Interest Income

In regard to net income, 13% and 10% growth in performing loans and deposits respectively, led to an increase of 6% YoY and Ps 5.67 billion net interest income growths. However, due to seasonal effects, net interest income remains the same as 4Q10, on a quarterly basis.

Non-Interest Income

The presence of a more complex market environment decreased intermediation revenues. This made a noninterest income for 1Q11 to decline by (6%) YoY. Unexpected recovery of Commercial Mexicana loan, which was previously written-off in 4Q10 made Non-Interest Income decline by 23%, on a quarterly basis. Seasonal and regulation changes effected from January 2011 led to a 4% QoQ contraction of services fees.

Non-Interest Expenses

There were three main reasons that led to an increase in Non-Interest Income for 1Q11 by 9% YoY. The first reason was the large volume of real payments in 1Q11, which increased Other Taxes. The second reason was the increased sales in life insurance, and advertising and administration expenses linked to increased use of credit cards. Last was the more Professional Fees Payment for various business-related advisories. Reduced Promotion expenses and Personnel administration made Non-Interest Expenses decline by 6% QoQ on a quarterly basis.

Loan Loss Reserves

The low requirement in consumer portfolio led to Ps 1.34 billion Loan Loss Reserves in 1Q11 equivalent reduction of (23%) YoY. The most important reductions in reserves were for Commercial portfolios and credit cards. Nevertheless, on a quarterly basis, there was a 27% QoQ Loan Loss Reserves decline. This was because of decreased credit card requirement, corporate portfolio as Mexicana loan was fully reserved in 4Q10, and payroll portfolios.

Net Income

1Q11 accumulated net income of the banking sector was Ps 1.62 billion, 13% higher than 1Q10. This was because of the reduction in Loan Loss Reserves and increase in net interest income and noninterest income. Nonetheless, due to the reduction in operating expenses and Loan Loss Reserves, there was a 9% QoQ quarter accumulated net income increase.

Ratio analysis

The banking ratio is an analysis involving the evaluation of financial conditions in the present, past and future. The aim of ratio analysis is to consider the strengths and weaknesses of the bank in question. The tools used in ratio analysis include financial statements and a comparison of the past and industry firms. Its main objective is for the purposes of ratio analysis is to evaluate current bank operations, compare its present performance to past performances, analyze the effectiveness and efficiency of operations, evaluate risk operations and standardize most financial information for the purposes of comparison. A clear ratio analysis, therefore, becomes useful in the evaluation of customer creditworthiness, evaluation of loan applications, analysis of investment opportunities and evaluating potential merger candidates. It also helps in analyzing internal management control.

Past due Loan Ratio

Inclusive of NPLs of INB, the NPL ratio of the banking sector was 2.4%. This was a favorable comparison against 2.5% and 2.6% in 4Q10 and 1Q10 respectively.

- NIM = Annualized Net Interest Margin / Average Earnings Assets

- NIM = Annualized Net Interest Margin adjusted by Credit Risks / Average Earnings Assets

- Annualized earnings as a percentage of the average quarterly equity over the period.

- Annualized earnings as a percentage of the average quarterly assets over the period.

- Non-Interest Expense / (Total Operating Income + Loan Loss Provisions)

- Annualized Administrative and Promotion Expenses / Average Total Assets.

- Liquid Assets / Liquid Liabilities (Liquid Assets = Cash and due from Banks + Negotiable Instruments + Securities held for sale, Liquid Liabilities = Demand Deposits + Loans from banks and other institutions with option to redeem any moment + short term loans from banks.

- Growth versus the previous period.

- Does not include Fobaproa / IPAB and loans managed by Recovery Banking.

Liquidity ratios

Banorte bank liquidity ratios assess the bank’s ability to meet its current obligations. The liquidity ratio has other sub ratios such as current ratio, quick ratio, and cash ratio. The current ratio involves the assessment of current assets and liabilities. Current assets include cash, accounts receivable and inventory, and marketable securities. Current liabilities on the other hand include the bank’s accounts payable and debt due within one year. The current ratio is the ratio of current assets to current liabilities. The quick ratio is the ratio of current assets less inventory to current liabilities. It is hard to convert this ratio to cash.

Leverage Ratios

This ratio measures the extent to which the bank has enjoyed financing by debt. A high ratio makes the acquisition of a loan quite difficult. The total debt ratio is the ratio of total debt to net assets of the bank. The debt-equity ratio on the other hand seeks to measure the bank’s extent to rely on debts.

Bank analysis and forecast

The following table shows the balance sheet of the bank for the financial years 2009, 2010 and 2011.

When planning a balance sheet, one needs to take into account the concept of fully integrated cash flows. This is because most balance sheet items arise from profit and loss accounts such as fixed assets resulting from capital expenditures, accounts receivable from sales, and accounts payable from spending. Considering figures from the bank’s balance sheet, it is evident that the bank experience upward growth in its asset growth. This positive indicator helps in the analysis of the bank’s forecast in relation to the financial statements for next year. With reduced risks such as operational, capital, liquidity and risks of interest rates, the bank experiences evident growth and increase in its valuation in the next financial year. Banorte bank enjoys such tremendous growth due to its application of an efficient framework for dealing with the risks it faces. With this framework, we can be sure the economy of the bank will grow so fast. Increased domestic demand coupled with private investment is another major factor facilitating the growth of the bank increased growth.

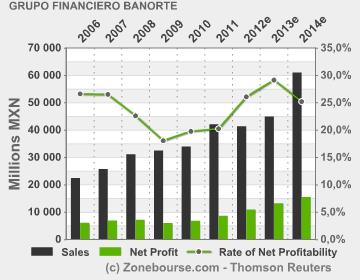

The bank’s financial results have highly benefitted from the inclusion of the Ixe financial group, which was purchased in April 2011. For the last quarter of 2011, a profit of $191 million was realized. The banking unit contributed 68% of the profit for the quarter. Although the bank continues to run in a difficult environment, the country’s economy offers enormous opportunities for growth in the financial sector. This is because the level of banking service is quite low; and also, because, compared with other countries, the leverage level is relatively low. From the graph above, the sales and the net profitability are projected to grow considerably up to 2013. Thereafter, more competitors are expected to take root, which will affect the bank’s profitability (Bernanke and Gertler 156).

Framework for measuring liquidity risk

Banorte bank relies on various methods of approaches to measure its exposure to liquidity risks. The stock approach method is one of the famous methods applied by the bank. In this approach, the bank considers liquidity as stock. In that case, comparison of balance sheet items and bringing together most financial metrics, one can determine the bank’s ability to reimburse its short-term debt obligations to measure the value of the bank’s liquid assets. While that is achieved, one now determines the number of assets that can be liquefied by the bank or be used to attain secured loans.

Conclusion

From the above aforementioned, banks face a lot of challenging situations in their quest to attain success. However, with a descriptive practical framework on how operations of a certain bank are run, success is not a nightmare. Management of operational risk remains the first priority of every bank. This is because the risks mostly accrue from within the bank itself, therefore, are easy to control. Banks also need to remain competitive in order to maintain their market share. Banks remain competitive by adjusting and coping with the emerging trends of the market for better results. In doing so, they maintain their market viability and relevance.

Works Cited

Basel Committee on Banking Supervision. A Framework for Measuring and Managing Liquidity. New York: BSBS, 1992. Print.

Bernanke, Ben, and Mark Gertler. “Agency Costs, Net Worth, and Business Fluctuations”, American Economic Review, March 79. 1(1989): 14-31.Print.

Fama, Eugene, and Kenneth French. “Dividend yields and expected stock returns”, Journal of Financial Economics 22.1(1998): 3-25. Print.

Marois, Thomas. “Emerging Market Bank Rescues in an Era of Finance-led Neoliberalism: A Comparison of Mexico and Turkey”, Review of International Political Economy 5.1 (2010): 5-89. Print.

Marois, Thomas. “The 1982 Mexican Bank Statization and Unintended Consequences for the Emergence of Neoliberalism”, Canadian Journal of Political Science 41. 1 (1998): 143-67. Print.