About fiscal policies

Fiscal policies are tools used by the state to stimulate the economy. The government can implement fiscal policies that can lead to growth or shrinkage of the economy. Contractionary fiscal policies are often instituted by the government when the amount of spending is greater than the amount of tax revenue earned by the government. In such instances, the government used fiscal policies to reduce the amount of public debt.

On the other hand, the government uses expansionary fiscal policies to stimulate the level of economic activity in the country. Such measures are often taken by the government after periods of severe economic conditions such as the recession that occurred from 2009. Expansionary fiscal policies often create inflationary pressure in the economy (Mankiw 2011).

Government spending and taxation are the main fiscal policy tools (Mankiw 2011). The state can stimulate the economy by increasing the amount of the spending allocation per annum. It results in the creation of job opportunities thus increasing consumer spending. Also, the government can reduce taxes.

Increasing government spending is more effective than reduction of taxes. Besides, the effectiveness of fiscal policy is achieved when the economy is operating below full capacity of the economy.

Fiscal policies in Australia

The government of Australia came up with fiscal policies that comprised of reduction of taxes and increase in the amount of government spending to stimulate the economy after the recession. The government came up with a number of stimulus plans. For instance, the government came up with a stimulus plan that focused on implementing a number of fiscal policies.

The goal of the stimulus plan was to enhance economic growth and job creation. The plan also focused on protecting the existing jobs so that more people do no lose their jobs and also create jobs. Job creation leads to an increase in the amount of disposal income and increase consumption expenditure.

The government also increased spending on major investments such as infrastructure within the country. This initiative was put in place so as to replace lost jobs during the period of recession. Further, the government increased spending in learning institutions. The government improved infrastructure in higher learning institutions with an aim of promoting technology and research in the institutions.

Further, the government also supported communities and some of the industries that most affected by the recession. Finally, the government collaborated with financial institutions so as to make funds available to the citizens cheaply.

The stimulus plan was implemented successfully in partnership and cooperation of various agencies in Australia. The stimulus plan was temporary and was supposed to be implemented in phases (International Monetary Fund 2012).

The implementation of the stimulus plan has been successful in Australia. The country is considered as one of the countries that successfully recovered from recession. The implementation of the stimulus plan has led to significant improvement in the economy. For instance, in the year 2012, the government of Australia reported a decline in the amount of the budget deficit.

The value declined from $63.584 billion that was reported in the 2010 – 2011 fiscal year to $42.119 billion in the fiscal year that ended in March, 2012. The amount of a budget deficit that was reported in 2009 during the recession was $64.51 billion (International Monetary Fund 2012).

Further, the amount of government revenue increased from $1,335.87 billion that was reported in the 2010 – 2011 fiscal year to $1,380.02 billion in the fiscal year that ended in March, 2012. This shows an increase in the level of economic activity in Australia. Further, the amount of government expenditure increased from $523.827 in 2011 to $542.038 in 2012.

The inflation rate (measured by the consumer price index) increased from 178.45 in 2011 to 182.1 in 2012. This is an indication of an increase in the rate of inflation in the country. Expansionary fiscal policies in a country often create inflationary pressure. Despite creating more job opportunities, the unemployment rate continued to rise. The unemployment rate declined from 5.592% in 2009 to 5.225% in 2010.

The value further declined to 5.083% in 2011. However, in 2012, the unemployment rate increased to 5.217%. The current account deficit increased from $33.522 billion in 2011 to $62.969 in 2012. It is an indication that the amount of import in the country exceeds the amount of exports. However, the economy grew by 3.304% short of the expected 6.2% that was expected in 2012 (International Monetary Fund 2012).

This led to weak economic projections and the loss of confidence in the full recovery of the economy for the recent inflation. Expansionary fiscal policies often create inflationary pressure in the economy.

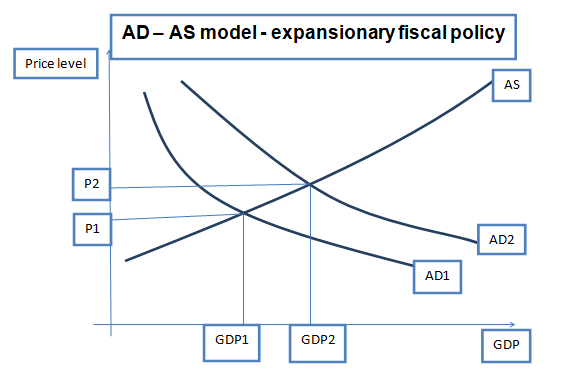

The fiscal policies implemented will increase the aggregate demand in the economy. In the AD – AS model, the aggregate demand curve will shift outwards as presented in the graph below. The aggregate supply curve will not be affected. The impact on the AD – AS model is illustrated below.

Expansionary fiscal policies shift the AD curve from AD1 to AD2. This results in an increase in price level from P1 to P2. The GDP also increases from GDP1 to GDP2.

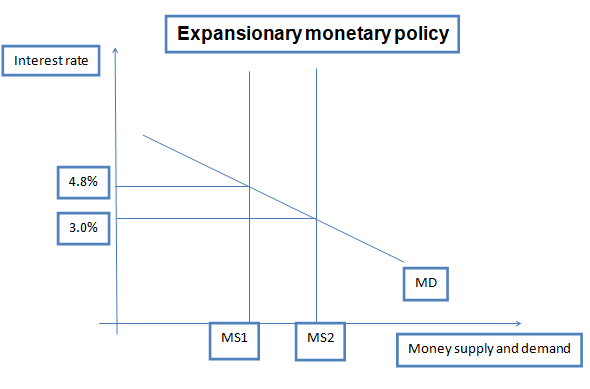

Apart from the expansionary fiscal policies, the Reserve Bank of Australia also instituted monetary policy to aid the economy recovery. The bank lowered interest rate from 4.8% in 2011 to 3.0% in 2011. The expansionary monetary policy is illustrated below.

When interest rates are lowered (from 4.8% to 3.0%), there will be an increase in borrowing and a decline in investment. This causes an increase in the amount of money in circulation that is, from MS1 to MS2. This will result in an increase in the amount of economic activities in the country thus leading to GDP growth.

References

Arnold, R. 2008, Economics, Cengage learning, USA.

International Monetary Fund, 2012, Data and statistics. Web.

Mankiw, G. 2011, Principles of economics, Cengage Learning, USA.

Reserve Bank of Australia, 2013, Monetary policy. Web.