Introduction

The term macro in English language has its origin in the Greek language term makros which means large.

Macroeconomics, therefore, studies economic problems from the point of view of entire economy such as aggregate consumption, aggregate employment, national income, and general price level of goods and services (Jain 2007, p. 4). It is the part of economics which studies the over all averages and aggregates of the economic system.

In macroeconomics, attention is generally focused on such problems as the level of employment, the rate of inflation, the nation’s total output, and other matters of economic wide significance (Hansen 2003, p. 83). Ordinarily, therefore, macroeconomics is concerned with the economy as a whole or large segment of it.

According to Cauvery (2007, p. 51), the scope of macroeconomics is the use of economic resources at the national level. Apparently, these are the very resources that have their effect on national income, employment, effective demand, aggregate saving, aggregate investment, price level, and the general economic development of a country.

This paper discusses two main questions that are related to the subject of macroeconomics. The first part looks at what fiscal policy is and why fiscal deficits and increases in government debt occur.

The second part then deals with why some governments have experienced sovereign debt crises and to what extent efforts to reduce government debt risk creating can double-dip recessions.

Question 1a: Understanding Fiscal Policy and Why Fiscal Deficits and Increases in Government Debt Occur

What is Fiscal Policy?

According to Dwivedi (2010, p. 601), fiscal policy can be defined in general terms as a government’s program of making discretionary changes in the pattern and level of its expenditure, taxation, and borrowings in order to achieve certain economic goals such as economic growth, employment, income equality, and stabilization of the economy on the path to growth.

Fiscal policy may also be regarded as any decision to change the level, composition, or timing of government expenditure or to vary the burden, structure or frequency of the tax payment (Shaikh 2010, p. 256).

It is also the process of shaping taxation and public expenditure to help dampen the swings of the business cycle and contribute to the maintenance of a growing high employment economy that is free from high or volatile inflation.

According to Jain (2007, p. 160), fiscal policy is the policy related to revenue and, expenditure of the government for achieving a set of definite objectives.

Apparently, fiscal policy relates to treasury or government exchequer and its significance has greatly increased in the recent past. In summary, the role of fiscal policy is confined largely to stabilization of employment and price level.

A narrow concept of fiscal policy is budgetary policy. Whilst budgetary policy refers to current revenue and expenditure of the financial year, fiscal policy refers to the budgetary operations including both current and capital receipts and expenditure. The essence of fiscal policy lies, in fact, in the budgetary operations of the government.

Typically, the two sides of the government budget are receipts and expenditure. The total receipts of the government are made up of tax and non tax revenue and borrowings, including deficit financing. The items in the budget represent the budgetary resources of the government.

The government expenditure refers to the total expenditure made by the government in any given fiscal year. Generally, the total government expenditure is constituted by payments for goods and services, wages and salaries, interest and loan repayments, subsidies, pensions and grants in aid, and so on.

From economic analysis point of view, receipt items give the measure of the flow of money from the private sector to the government sector. The government expenditure on the other hand, represents the flow of money from the government to the economy as a whole. The government’s receipts are inflows and expenditures are outflows.

Using its statutory powers, the government can change the magnitude and composition of inflows and outflows and thereby the magnitudes of macroeconomic variables which include aggregate consumption expenditure, and private savings and investments.

The magnitude and composition of inflows and outflows can be altered by making changes in taxation and government spending. The policy under which these changes are made is called the fiscal policy.

The Scope of Fiscal Policy

The scope of fiscal policy comprises the fiscal instruments and the target variables. Fiscal instruments are the variables that the government can use and maneuver at its own discretion to achieve certain economic goals.

Fiscal instruments include taxation, direct and indirect, government expenditure, transfer payments, grants and subsidies, and public investment.

The target variable on the other hand, are the macro variables including disposable income, aggregate consumption expenditure, savings and investment, imports and exports, and the level and structure of prices (Dwivedi 2010, p. 602).

Why Fiscal Deficits and Increases in Government Debt Occur

There are various reasons why fiscal deficits and increases in government debt occur. In the United States, for example, the government’s budget deficit is attributed to the country’s poor saving habits.

Apparently, most American families save a smaller fraction of their incomes than their counterparts in many other countries such as Japan and Germany.

Although the reasons for these international differences are not clear, many policy makers in the United States view the low level of saving as a major problem that drives the government into heavy borrowing in order to meet its obligations to its citizens (Mankiw 2008, p. 282).

In most cases, a country’s standard of living depends on its ability to produce goods and services. However, this productivity gets affected when citizens do not save as much as they should since saving is regarded as an important long run determinant of a nation’s level of productivity.

If, for instance, the United States could somehow raise its saving level, the growth rate of the Gross Domestic Product (GDP) would increase, and over time, the citizens of the United States of America would enjoy a higher standard of living.

Despite the fact that the a country may be driven into budget deficits and subsequent debt as a result of poor saving habits among its citizens, the government also has a major part to play in encouraging its people to save more.

Many economists have used this argument to suggest that the low saving rate in the United States is at least partly attributable to unfriendly tax laws that discourage saving. In general, many state governments collect revenue by taxing all forms of income received by individuals or corporations.

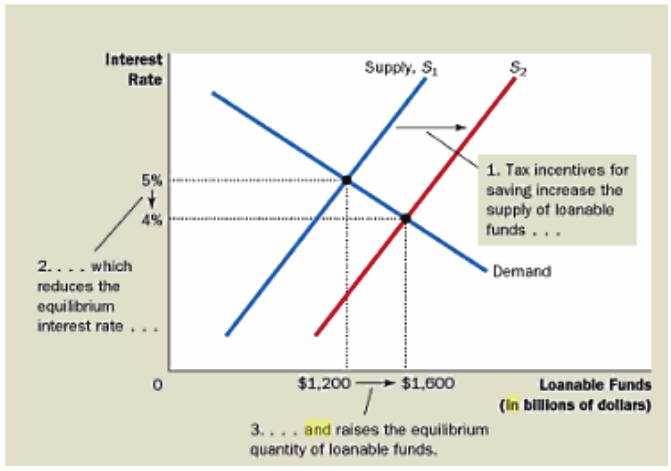

In response to this problem, many economist and law makers have proposed reforming the tax code so as to encourage greater saving. The effect of such a saving incentive on the market for loanable funds is illustrated by figure 1 (Mankiw 2008, p. 283).

As can be seen from the figure, a change in the tax laws to encourage individuals and corporations to save more would shift the supply of loanable funds to the right from S1 to S2. As a result, the equilibrium interest rate would fall, and the lower interest rate would stimulate investment.

Whilst the equilibrium interest rate declines from 5 per cent to 4 percent the total amount that may be given out in form of loans increases from $ 1,200 billions to $ 1,600 billions.

Although this analysis of the effects of increased saving is widely accepted among economists, there is little consensus about what kinds of tax changes should be enacted. Many economists endorse tax reforms aimed at increasing saving to stimulate investment and growth.

Others, however, are skeptical that such tax changes would have much effect on national saving. These skeptics also doubt the equity of the proposed reforms. They argue that, in many cases, the benefits of tax changes would accrue primarily to wealthy people, who are least in the need of tax relief (Gupta 2004, p.124).

Fiscal budget deficits and increased borrowing are also attributed to less attractive investment incentives. Tax reforms aimed at making investment more attractive will definitely bring many investors on board and the final result would be an improved economy.

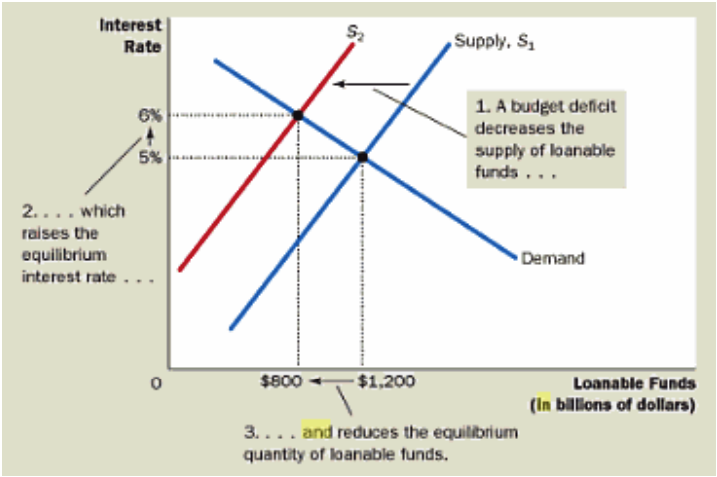

An investment tax credit, for example, gives a tax advantage to any firm building a new factory or buying new equipment, and this encourages many to invest. Figure 2 shows the effect of a government budget deficit.

When the government spends more than it receives in tax revenue, the resulting budget deficit lowers national saving. The supply of loanable funds decreases and the equilibrium interest rate rises.

As depicted by the figure, when the supply shifts from S1 to S2, the equilibrium interest rate rises from 5 per cent to 6 per cent, and the equilibrium quantity of loanable funds saved and invested falls from $ 1,200 billions to $ 800 billions.

Question 1b: Why some Governments have Experienced Sovereign Debt Crises and to what Extent Efforts to Reduce Government Debt Risk Creating can Double-Dip Recessions

As explained previously, some countries have ended up in deficits and heavy spending as a result of having unfriendly tax policies that, to a large extent, lead to low saving by citizens and discourage investments. According to Giles (2012, p. 1), fiscal policy can not provide a lasting solution to all economic problems.

There are other factors that also affect the economy. In the United Kingdom, the idea of cutting down government expenditure and the rapid increase in the rate of taxation have failed to yield the desired results. On the contrary, they have are blamed for slow economic growth and high unemployment.

This in turn, has forced the government to borrow more in order to offset its budget deficit. Summers (2012, p. 1) suggests that a better way to deal with Britain’s economic challenges is to first realize that lack of demand is the main factor that is preventing its economy to progress.

According to Krugman and Layard (2012, p. 1), the present economic woes are can be attributed to the fact that many countries are operating based on ideas that worked so many decades ago. There is, therefore, a need to create policies that are suitable for the present economic environment.

Among others, most economic problems are caused by irresponsible public borrowing behavior and the high levels of poverty and unemployment which leave many individuals economically powerless. It will, therefore, be beneficial for the government to work hard to empower citizens economically.

With friendly economic policies in place, many individuals will be encouraged to participate more actively in growing the economy.

Reference List

Cauvery, R 2007, Public Finance: Fiscal Policy, S. Chand & Company Limited, New Delhi.

Dwivedi, DN 2010, Macroeconomics: Theory and Policy, 3E, Tata McGraw-Hill Education Private Limited, New Delhi, India.

Giles, C 2012, Fiscal Policy can’t Cure all Britain’s Ills. Web.

Gupta, GS 2004, Macroeconomics; Theory and Applications, Tata McGraw-Hill Publishing Company Limited, New Delhi.

Hansen, B 2003, The Economic Theory of Fiscal Policy, Volume 3, Routledge, London, UK.

Jain, TR 2007, Macroeconomics Management, FK Publications, New Delhi, India.

Krugman, P & Layard, R 2012, A Manifesto for Economic Sense. Web.

Mankiw, NG 2008, Principles of Macroeconomics, Cengage Learning, Mason, OH.

Shaikh, S 2010, Business Environment, 2/E, Pearson Education India, New Delhi, India.

Summers, L 2012, Britain Risks a Lost Decade unless it Changes Course. Web.