Fiscal policy refers to the “use of government expenditure and revenue collection (taxation) to influence the economy” (Krugman and Wells, 2009, p. 7). Fiscal policy is normally implemented through two instruments namely, taxation and government expenditure. A fiscal policy thus involves changing the level of government spending and or tax collection. Such changes influence the economy by impacting on the aggregate demand and the activity in the economy as well as resource allocation and income distribution.

The fiscal policy stance can be neutral, expansionary or contractionary (Barro, 2008, p. 115). A neutral stance typically occurs in an economy characterized with a balanced budget. In this case the tax revenue is adequate to fund the government budget. Thus the overall effects of the budgetary allocations have neutral effects on the economy.

This means that the fiscal policy does not result into an increase or decrease in economic activity. In the case of expansionary fiscal policy, the government expenditure normally exceeds the tax revenue. The government expenditure will be less than the tax revenue in the event of a contractionary fiscal policy.

The instruments of fiscal policy are used to correct the fluctuations associated with the business cycle. The instruments are used in a counter cyclical manner to stabilize the business cycle (Arnold, 2010, p. 123). This means that a contractionary fiscal policy is used in response to an inflationary boom while an expansionary fiscal policy is used to stimulate demand in the event of a recession.

The money used to finance a fiscal policy can be obtained through the following ways. The money can be borrowed from the public by issuing bonds or treasury bills. The money can also be obtained through taxation, sale of assets such as land and printing money.

Using Fiscal Policy to Shift Aggregate Demand

Fiscal policy can be used to influence the level of aggregate demand associated with a given economy. This helps the government to ensure price stability, full employment and optimal economic growth (Barro, 2008, p. 124). The shifts in aggregate demand as a result of a fiscal policy can be illustrated by the figures below.

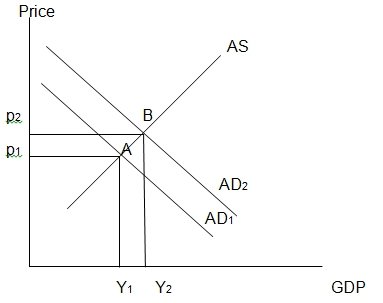

Figure 1

In figure 1, an increase in government expenditure and a reduction in tax rate results into a shift in the aggregate demand curve towards the right. A reduction in tax rate leaves consumers with a high disposable income. Hence they will have a greater purchasing power which leads to an increase in aggregate demand (Deepeshree and Agarwal, 2006, p. 98).

Increase in government expenditure also increases aggregate demand since it involves investment in capital goods and consumer goods such as relief food. The increase in aggregate demand is illustrated by the shift in aggregate demand curve from AD1 to AD2. The shift results into an increase in GDP from y1 to y2 as well as an increase in prices from p1 to p2.

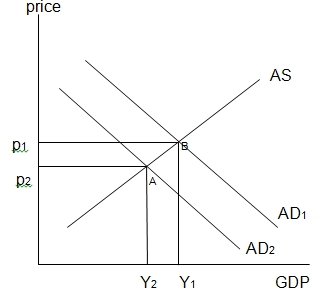

Figure 2

P: price

Y: national income

AS: aggregate supply

AD: aggregate demand

In figure 2, a reduction in government spending and an increase in tax rate will cause the aggregate demand to reduce. High tax rate reduce consumers’ disposable income hence causing a low demand for goods and services (Deepeshree and Agarwal, 2006, p. 99). Similarly a reduction in government spending reduces aggregate demand.

The reduction is illustrated by the shift in the aggregate demand curve to the left from AD1 to AD2. The shift results into a reduction in national income from y1 to y2 and a reduction in prices from p1 to p2.

Effectiveness of the Policy

Shifting the aggregate demand curve to the right as illustrated in figure 1 is achieved through an expansionary fiscal policy while shifting it to the left involves the use of a contractionary fiscal policy. An expansionary fiscal policy has two limitations namely crowding-out effect and a reduction in export levels (Mankiw, 2002, p. 156).

Crowding out is a situation whereby government borrowing from the public to finance expansionary fiscal policy results into high interest rates. The high interest rates discourage private investments thus offsetting the simulative effect of increased government spending (Mankiw, 2002, p. 176). The high interest rates attract foreign capital which leads to a high demand for the local currency. Consequently, the local currency appreciates thus making exports more expansive and reducing their demand.

Australia’s Fiscal Policy Stance

The budget priorities in the 2010/11 fiscal year include encouraging savings, developing skills and building infrastructure. Besides, the government intends to improve the healthcare system, “invest in renewable sources of energy and ease the cost of living” (Australian Government, 2011).

The government intends to achieve these objectives as follows. To ease the cost of living, the tax rate will be reduced as follows. The “low income tax offset will be raised to 1,500 dollars” (Australian Government, 2011). Australians earning a maximum of $ 30,000 will enjoy a tax free threshold amounting to $16,000.

The 30% tax rate will now be charged on incomes from $ 37,001 up from the current $ 35,001(Australian Government, 2011). The 38% tax rate will also be reduced by 1 unit to 37% for citizens whose incomes range between $ 80,000 and $ 180,000. Thus a person earning $ 50,000 per annum will save $ 450 due to these tax cuts. The essence of the tax reduction is to increase consumers’ disposable income. Company tax will also be reduced.

The other objectives will be achieved by investing $ 2.2 billion in health care, $661.2 million in developing new skills and & 1billion in infrastructure (Australian Government, 2011). Since the government currently runs a budget deficit, the budget will be funded through public borrowing. The budget priorities indicate that the government intends to increase its expenditure and to lower taxes. We can thus conclude that the government’s fiscal policy stance is expansionary.

Current Inflationary Pressures in Australia

According to the June 2011 statistics on inflation, the consumer price inflation increased by 0.9%. Increase in inflation in the course of the year was 3.6% (Australian Bureau of Statistics, 2011). The increase in inflation is attributed to increase in prices of consumer goods. The goods whose prices increased significantly include fruits (up 26.9%) and personal accessories (up 8.8%). The prices of furniture also increased by 6%.

Effectiveness of the Government’s Fiscal Policy Stance

As discussed earlier an expansionary fiscal policy is meant to increase economic activity by stimulating aggregate demand. The government’s intention to decrease the tax rate will leave consumers with more disposable income. This leads to high purchasing power and an increase in aggregate demand.

Increase in government expenditure will also increase aggregate demand. As illustrated in figure 1, the increase in aggregate demand results into an increase in GDP (economic growth). However, it also leads to high prices which may increase the overall inflation rate (Mankiw, 2002, p. 160).

Expansionary fiscal policy is also associated with the crowding-out effect. Since the economy is currently experiencing a slack, the deficit spending is likely to cause a crowding-in effect. This is because the expansionary fiscal policy will lead to quick economic growth. Hence businesses will have an economic incentive to invest rather than being crowded-out. We thus conclude that the fiscal policy stance is effective.

References

Arnold, R. 2010. Macroeconomics. New York: Cengage Learning.

Australian Bureau of Statistics, 2011. Australia Inflation Rate. [Online] Available at <https://tradingeconomics.com>.

Australian Government, 2011. Budget 2010-11. [Online] Available at <https://www.budget.gov.au/> .

Barro, R. 2008. Macroeconomics. New York: Cengage Learning.

Deepeshree, S. and Agarwal, V. 2006. Macroeconomics. New York: McGraw-Hill.

Krugman, P. 2009. Macroeconomics. New York: Worth Publishers.

Mankiw, G. 2002. Macroeconomics. Worth Publishers.