Methodology and Data Collection

This chapter presents a brief overview of the methodology and data collection to achieve the research objective of the analysis of fiscal policy of China.

Methodology

The general belief of business research is often thought of as collecting data, constructing questionnaires and analysing data. However, it also includes identifying the problem and the ways of solving it (Ghauri et al., 1995). This study uses a quantitative study. Quantitative method is a research method, which depends less on subjective methods but is more focused on the collection and analysis of numerical data (Adler& Adler, 1987; Lofland &Lofland, 1984). Quantitative research involves analysis of numerical data. According to Burns and Grove, Quantitative research is: “a formal, objective, systematic process in which numerical data are utilized to obtain information about the research question” (Burns and Grove cited by Cormack 1991 p 140)

Quantitative research uses the methods, which are designed to ensure objectivity and reliability. Under quantitative approach, the person doing the research stands external to the study. Irrespective of the person doing the research, the findings are bound to be the same. The strength of the quantitative method is that, it produces quantifiable and reliable data.

Trochim (2001; 2005) defines, that ‘some methods are more quantitative (like surveys, automated counting), and other methods are more qualitative (like in-depth interviews and group discussions)’. On the other hand, ‘there can be qualitative surveys – using mostly open-ended questions’ and quantitative group discussions by using the consensus group technique.

This study adopts a longitudinal study.

The benefit of a longitudinal study is that researchers are able to detect developments or changes in the characteristics of the target population at both the group and the individual level. The key here is that longitudinal studies extend beyond a single moment in time. As a result, they can establish sequences of events (Institute for Work & Health, 1996).

Since the longitudinal study provides the cause and effect, relationship this study proposed to use the longitudinal design. The study covers the period of 29 years from 1981 to 2009. The study period becomes significant in view of the fact that this time horizon covers the period before and after the economic recession, which affected almost all the economies of the world. The study covers starting of the market economy and studies the impact of economic events during the progress of the economy. It also covers the recovery period after the economic recession, which completes a cycle. This adds value and validity to the findings of the study.

Data Collection

The required data for the analysis of the fiscal policies of China and its impact on economic growth has been collected from the World Bank Economic Data, Chinese government database and the International Monetary Fund (IMF) databases. Taking the GDP of the country for the 29 years from 1981 to 2009 as dependent variable and consumer price index, taxation ratio, government consumption and debt to GDP ratio as independent variables regression analysis have been conducted to find the impact of these independent variables on the GDP of the country. A trend line is drawn from the rate of growth of GDP for the study period.

GDP Growth

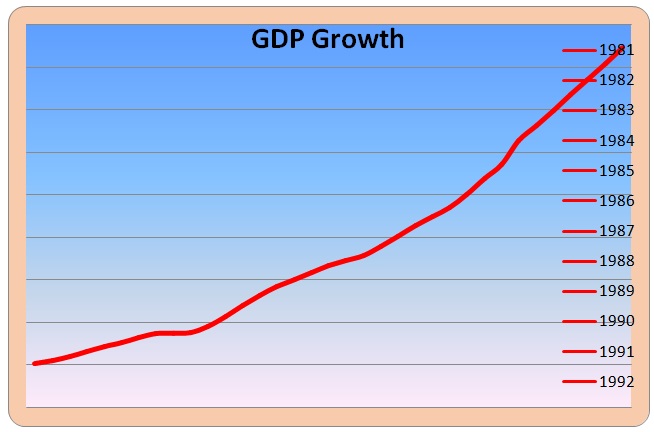

From the data collected on the GDP growth the following trend line is developed.

The figure is developed for a period of 35 years including the estimated growth rates for the year up to 2015. From the figure, a consistent growth in the GDP of China can be observed from the year 1981, which is just before the market economy in the country was opened and wide spread reform measures were introduced.

Regression Analysis

Totally four regression analysis were conducted taking GDP as the dependent variable. The results of each regression are produced in this section.

Regression 1 GDP to Consumer Price Index

The consumer price index (CPI) data was retrieved from the Chinese government database for the study period from 1981 to 2009. A linear regression was run on MS EXCEL software, which produced the following summary results.

The regression indicates a negative association between the consumer price index and the GDP of the country during the study period. The slope has a negative value indicating a negative association between the variables. The R Squared value is 0.10 indicating that the data does not explain the relationship fully. The t statistics value is also showing a negative index implying that the result is insignificant for the variables considered.

Regression 2 GDP to Government Consumption

Government consumption always has a close association with the GDP of the country. The regression run with GDP as the dependent and government consumption as the independent variable produced the following summary results.

As theory states both GDP and the government, consumption has a positive association in the case of China during the study period. This is indicated by a positive slope value for the independent variable of government consumption. Unlike CPI, government consumption has an R square value of close to one, which indicates that data used has well explained the relationship. The higher t statistics value shows a high significance of results based on the variables considered.

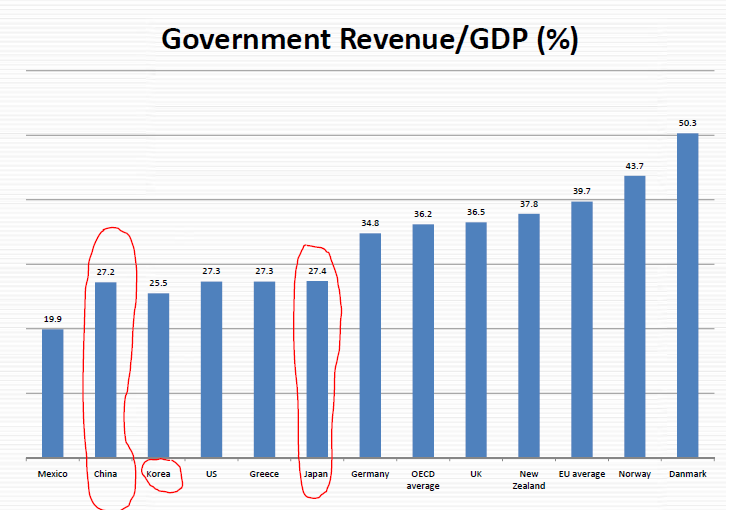

A comparative indication of proportion of government revenue to GDP is relevant to be illustrated here by the following figure.

From the figure, it may be observed that the government revenue as a proportion of GDP of China is almost equal to that of Japan and can be compared to that of Korea.

Regression 3 GDP to Tax Ratios

One of the important variables that affect the GDP of the country is the tax revenue and its proportion in the total GDP of an economy (OECD, 2001). Therefore, it becomes essential that the impact of taxation on the GDP be considered as a part of the study of the effect of fiscal policy of China on the GDP of the country. The regression run with GDP and tax ratio as dependent and independent variables respectively, shows the following summary results.

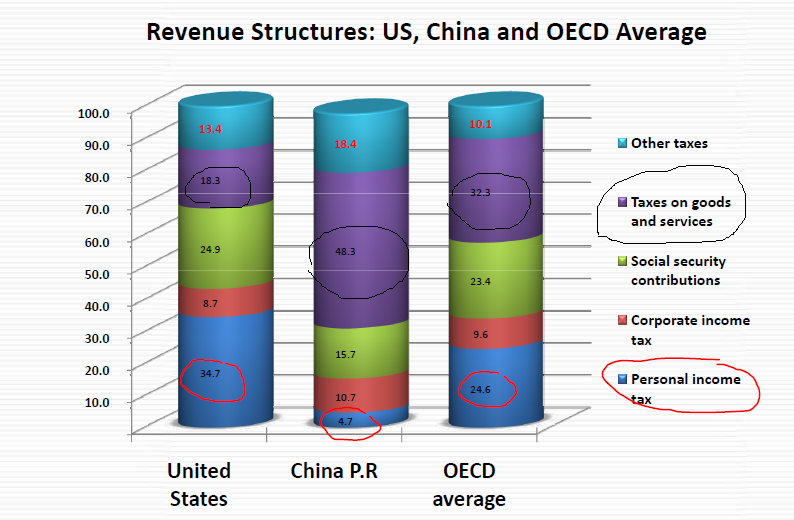

Tax ratios and GDP in the case of China is showing a very significant relationship, as the slope value is very high. With the R Square value at 0.92, the data collected have fully explained the relationship between the variables. The t statistics value of 17.72 indicates that the data are significant in respect of the results produced by the regression analysis. The tax revenues in china are an important contributor to the GDP. The following comparative figure indicates this result clearly. Tax on goods and services constitute a major portion of the GDP in China than the personal taxes.

“Tax incentives are mainly available for corporate income tax (two-year tax holiday followed by three years of 50% deduction starting from the first profit-making year), import duty and VAT (imported equipments of qualified FIEs within the range of their total investment may be exempted) and business tax (might be exempted for high-technology-related services),”Wenger & Vieli 2005).

According to a Report by KPMG (2007) large domestic enterprises and multinational companies as well as industry groups or associations were lobbying for favorable treatment of their businesses or industries during 2007

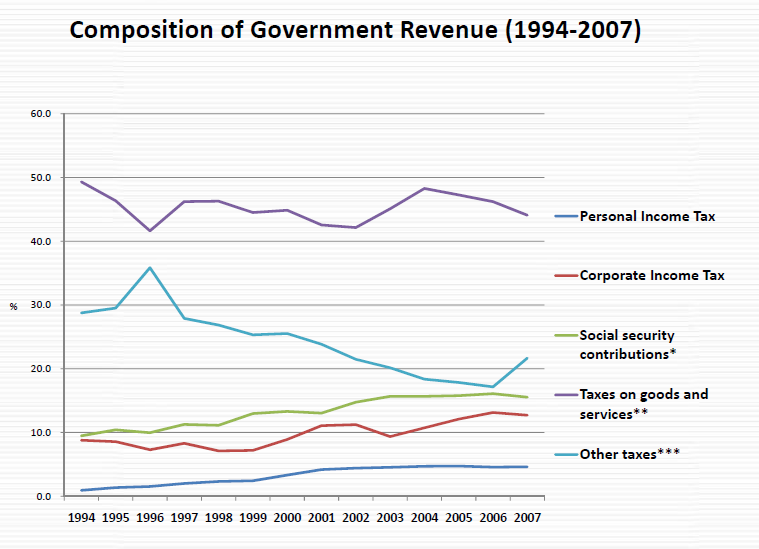

The following figure illustrates the composition of government revenue during a part of the study period.

Regression 4 GDP to Debt to GDP Ratio

The ratio of debt to GDP is another important determinant of the growth of an economy. In China, the government has maintained a consistently low percentage of debt to GDP ratio, which is obvious from the GDP growth of the country. The country was able to maintain a good economic progress even during the recent economic downturn during late 2008.

The regression run with GDP as the dependent variable and debt to GDP as the independent variable has produced the following summary results.

Although the debt to GDP shows a positive association which can be ascertained from the positive slope value, the variable considered has not produced significant results as shown by the lower R Square value. Even the t Statistics is low at 1.32, which signifies that the results are not very significantly drawn out of the data considered for predicting the relationship between the variables.

The four regression tests indicate that the government consumption and the tax ratios are the relevant variables that can contribute to the growth of the economy. The CPI is a result of GDP and therefore it may not have an effect on the GDP growth. A detailed discussion on the findings of the regression analysis and other factors connected with the fiscal policies of China, which have an impact on the GDP growth will be produced in the next chapter.

Analytical Structure

The data collected from various databases were analyzed statistically in the last chapter and this chapter presents a detailed analysis and discussion on the fiscal policies of China and its impact on the economic growth of China during the last decade.

Analysis of Economic Performance during 2009

Gross Domestic Product

According to the figures released by the National Bureau of Statistics on the key economic indicators, the GDP of China rose 8.7% in the year 2009. In monetary terms, this growth represents an amount of 33.53 trillion Yuan (this is approximately equivalent to US $ 4.91 trillion). This growth has been beyond the target fixed earlier in March 2009 by the Chinese government. The growth rate was estimated to be around 8% only. The government also believed a GDP growth of around 8% is very much necessary to create enough employment opportunities in the country. The first quarter of 2009 showed a growth of only 6.1 percent. This is obviously, because the country might have been experiencing the effect of global financial crisis and this would have affected the growth rate in the first three months of 2009. This implies that the country has withstood the storm of the financial crisis and has come out of the adverse impact of the crisis.

“China’s GDP now stands very close to that of Japan, the world’s second largest economy only after the United States. The Japanese economy contracted amid the global downturn last year, but the Japanese yen has been rising against the greenback since last year. Japan has not yet released its GDP for last year” (Xiong Tong, 2010).

The Chinese economy has grown manifold during the decade. In 2003, the GDP of the country was only 13.58 trillion Yuan. It has grown by 147% to reach the GDP of 33.53 trillion Yuan in the year 2009.

The annual growth rates of China GDP from the year 2003 to 2009 are shown below:

From the table it can be observed that the global financial crisis has seriously hit the Chinese economy by lowering the GDP from 13.0% in 2007 to 9.6% in 2008. The aftermath of the financial crisis has hit the economy further in the year 2009 to reduce the growth rate to 8.7%.

Industrial Added Value

The National Bureau of Statistics has released the figures of industrial added value for the year 2009. “The industrial added value went up to 11 percent from that of the previous year. China’s industrial added value grew 5.1 percent in the first quarter of last year, 9.1 percent in the second quarter, 12.4 percent in the third quarter, and 18 percent in the fourth quarter,” (Xiong Tong, 2010). This economic indicator reveals that there has been an adverse impact on industrial production in China because of the global economic meltdown. “China uses the value-added of industry to measure business activities of some 430,000 designated large enterprises, which have an annual turnover of at least 5 million yuan ($732,064),” (Xiong Tong, 2010). The industrial added value figures for the period from 2001 to 2009 are shown in the following table.

From the table it may be observed that the industrial production was peak in the year 2007 followed by a sharp decline in the year 2008, which was further declined in the year 2009 due to aftereffects of the financial crisis. Since China is mostly a manufacturing-based economy, the industrial added value represents an important key measure to assess the economic performance of the country. The fact that the industrial output constituted 43% of the total GDP of China in the year 2008 and 42.8% of the GDP growth of the year 2008 explains the importance of this measure.

Consumer Price Index (CPI)

The consumer price is the main measure of inflationary tendencies in the country. CPI has been showing an increase from the year 2003 until 2009 when it finally fell to 0.7% for 2009 average. In the first nine months of 2009, there has a continuous decline and it started increasing from October 2009, averaging finally with a 0.7% fall for the whole year. For the period from 2002 to 2009 the changes in the consumer price index of China is shown below:

Here again the impact of the financial crisis on the Chinese economy is clearly seen from the data. In the year 2009, the CPI has shown a continuous fall indicating that consumption was less and industrial output was correspondingly less leading to a decline in the CPI for the year.

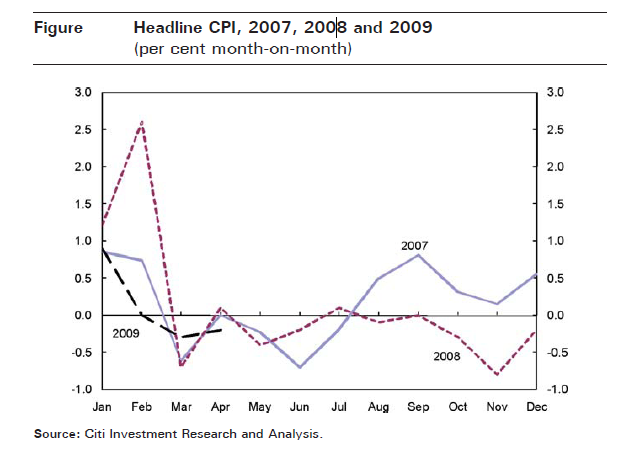

However, for the year 2010 the CPI has rebounded as shown in the following figure.

Fixed Asset Investment

Fixed asset investment has been one of the main drivers of growth for China. It accounts for the amounts invested in the purchase and building of factories, plant and equipments, property and other fixed manufacturing facilities and infrastructure. “According to NBS, China’s fixed asset investment jumped 30.1 percent in 2009 to nearly 22.5 trillion yuan,” (Xiong Tong, 2010). This accounted for 30.1% of the GDP. “Urban fixed asset investment climbed 30.5 percent in 2009 to 19.4 trillion yuan” (Xiong Tong, 2010). In the preceding four-year period, the growth in fixed assets investment has been spectacular in China, which is shown by the following table.

From the figures, it appears that the global financial crisis has not affected the fixed investment pattern in the case of China, as the percentage has increased in the year 2009.

Retail Sales

The economic growth of China is facilitated by increased exports, investments in fixed assets and increased retail sales. Therefore, retail sales in the country assume an important position in the economy of China. National Bureau of Statistics has announced the figures for retail sales for 2009. According to the statistics, inflation-adjusted retail sales in China for the year 2009 have increased by 16.9%. The last four years have witnessed tremendous growth in the retail sales of China, which is exhibited in the following table.

In monetary terms, the retails sales have increased from 6.72 trillion in 2005 to 10.85 trillion in 2008. It appears that the global financial crisis had an adverse impact on the retail sales of China as the growth percentage is showing a decline from 21.6% in 2008 to 16.9% in 2009.

Exports and Imports

General Administration of Customs (GAC) has released the exports and imports figures in respect of China’s foreign trade in 2009. In the year 2009, the exports of China were US $ 1.2 trillion, which was a decline of 16% from the year 2008. The imports for the same period were US SSSSS$ 1.01 trillion which showed a decline of 11.2% as compared to the year 2008. “In total, China’s foreign trade in 2009 dropped 13.9 percent from a year earlier to 2.21 trillion U.S. dollars and its trade surplus last year slid 34.2 percent year on year to 196.1 billion U.S. dollars,” (Tong, 2010)

Foreign Direct Investments

Foreign Direct Investment (FDI) measures foreign ownership of productive assets. These investments are made in manufacturing facilities, and plant and equipments, which increase the productive capacity of the company (OECD Paper, 2002, 2003; Padma & Sauvant, 1999). FDI shows the ability of the country to attract the foreign capital. China has attracted US $ 90.03 billion in FDI during the year 2009, which shows a decline of 2.6% from the figure of 2008. There were 23,435 overseas-funded ventures in 2009 approved by the Chinese government during the year 2009, which accounts for a decline of 14.8% from the amount of FDI for the year 2008. The following table shows the FDI received during the years from 2006 to 2009.

The figures of FDI received and the number of new establishments approved for FDI clearly shows the impact of global financial crisis on the economy of China, with a reduction of 27.35% in the new foreign companies approved by the government during 2009. Similarly, the FDI amount also has come down by US $ 2.37 billion during 2009 as compared to the year 2008.

According to the Report from Economic and Commercial Counselor’s Office of the Embassy of China (2005); from 1990 to the end of June 2003, there are actually 216.2 thousand foreign-invested enterprises across China, with a total investment of 1048.899 billion US dollars. The registered capital amounting to 577.83 billion US dollars and the investment amount paid by the foreign partners reaching 427.096 billion US dollars were also reported. During the one-year and a half from China’s entry into WTO till June 30, 2003, the number of newly-registered foreign-invested enterprises amounted to 47.3 thousand, with a total investment of 184.087 billion US dollars and the registered capital reaching 100.005 billion US dollars and the investment amount paid by the foreign parties being 79.848 billion US dollars. In comparison with the same period prior to China’s entry into WTO, all showed a momentum of rapid growth and development unseen for years.

Total amount of FDI actually utilized by China has been increasing year by year. From 1979 to 2004, the total amount of FDI actually utilized by China is $ 562.105 Billion. From 2000 to 2004, the average increase rate of the amount of FDI actually utilized by China is 10.60 percent.

Total Amount of FDI Actually Utilized by China

Unit: USD 100 million. Source: China Statistical Year Book 2004-2005.

In order to attract the inflow of FDI the following measures have been taken by the Chinese government:

- Income tax reductions and exemptions for the enterprises with foreign investments

- Income tax reductions that will be enjoyed by the export-oriented enterprises or the advanced technology enterprises

- Income tax reductions and exemptions will be enjoyed by the enterprises located in Special Economic Zones, Economic and Technological Development Zones, Coastal Economic Open Zones, State New High-tech Industry Development Zones and/or Bonded Zones

- Income tax reductions and exemptions will be enjoyed by the enterprises established in middle and west of China

- Income tax exemptions and reductions for additional investment made by the enterprises with foreign investment

- Income tax reductions and exemptions may be enjoyed by foreign investors and foreign enterprises

- Foreign investors would get tax rebate for their re-investment in China

At present, most areas grant tax reduction or exemption to the enterprises with foreign investment. In some areas, the preferential treatments are only limited to production enterprises and in others there is no limitation. In some areas, a time limit is specified for the preferential treatment, and in some others, there is no such time limit. (Jin Dongsheng Chen Li)Analysis of China’s Economic Growth

Even though China was able to register a record growth rate of 9.3% on an annual average ever since the year 1990 the results of the last decade appear to be different from what was achieved by the country during the 1980s. Economic growth during 1980s worked out to eliminate poverty from 13.5 million households annually and created a number of employment opportunities for the benefit of rural migrants. The consequence of this rising household income enabled a sustained growth by accelerating domestic consumption. Because of this position, the economic growth was consumption-led and domestic consumption constituted 70% of China’s total GDP in that period. This also caused frequent incidences of trade deficits rather than surplus during this period of growth.

The economic growth of China in the mid 1990s was different and was accompanied by increasing imbalances of payment, which were sudden. This situation was created by the large amount of FDI received by the country during this period and increased pile-up of trade surplus. In the year 1985, the proportion of exports to GDP was 10%, whereas it increased to 40% during 2007. “Large amount of surplus in the balance of payment and accumulation of foreign exchange reserves of over US $ 2 trillion have exerted growing pressure on its fixed exchange rate regime and increasing trade friction with the US and EU.

In the domestic front, since the 1990s there has been an increasing trend in the growth of investments in fixed assets. The investments in fixed assets to GDP ratio was 20 percent in the early 1990s. This increased to 45% in the year 2005. In the 1980s, the economy was driven by the concept of regional convergence. This concept changed to regional divergence from the mid 1990s. The investment-led growth led to increased regional imbalances by enlarging the gap between the rich and poor provinces. From the mid 1990s, the job creation has been showing a declining trend. There was no trickle-down effect in the economic growth

There are strong reasons for the difference in the economic progress of China during 1980s and after mid 1990s.

“With respect to successful transition and growth, China has been regarded as a noteworthy case in the world of centrally planned economies, but much of the success in its performance is based on the experience of dissolved institutions, emergence of the non-state sector, and improved efficiency of existing sectors in the 1980s.” (Zhang 2008).

Analysis of Fiscal Policies of China

One of the important objectives of fiscal policy is to have an effective control on the macroeconomic conditions of the economy, and the objectives of having effective control on macroeconomic situations is to achieve higher levels of social stability, economic growth, stability in prices and a full employment situation in the country. However, it is observed that over the period, the implementation of fiscal policy by the government was not able to produce a major effect on the different economic objectives envisaged by the government.

Since the beginning of the twentieth century, the many countries have started visualizing the Keynesian demand management and fiscal policy to contribute to an increased domestic aggregate demand to stimulate the economic growth in the respective countries and increasing aggregate demand has become an active policy tool in the hands of the policymakers of these countries. Learning from the experience of Western countries, China adopted the fiscal policy to support the change the economy from a planned one to a market economy. This change was brought at a time when the country was passing through an extraordinary time and needed a strong driving force for stimulating economic growth, increasing the employment opportunities and for stimulating domestic consumption.

The structure of China’s secondary industry changed fundamentally during the 1980s. Following the reforms of the 1980s, manufacturing output boomed as “collective” enterprises were established under the aegis of local governments—particularly the township and village enterprises. Since the mid-1990s, however, the driving forces behind growth have been foreign investors (either in wholly owned enterprises or in joint ventures with Chinese interests).

Comparative Economic Indicators, 2006. Source: Economic Intelligence Unit Estimates, 2006.

The effect of fiscal policy on the economic growth is a controversial and long-standing topic in economic theory, empirical research and economic policymaking. Fiscal policy can foster growth and human development through a number of different channels. These channels include the macroeconomic-as though the influence of the budget deficit on growth- as well as the micro economic through its influence on the efficiency of resource use. “Prudent fiscal policy in the form of low budget deficits and low levels of public debt is a key ingredient for economic growth,” (Benedict Clements et al. 2004).

According to Easterly and Rebelo (1994), first, there is a strong association between the development level and the fiscal structure: poor countries rely heavily on international trade taxes, while income taxes are only important in developed economies; second, fiscal policy is influenced by the scale of the economy, measured by its population; and third, investment in transport and communication is consistently correlated with growth while the effects of taxation are difficult to isolate empirically (Easterly and Rebelo 1994).

However, where the level of public debt is high and unsustainable the activated fiscal policy may not have its intended salutary effects on the economic activity.

Chinese Fiscal Policies and Economic Development

The pro-active fiscal policy adopted by the Chinese Government in recent years has played a crucial role in boosting the country’s economy.

Since the second half of 1998, the Chinese government has issued 310 billion yuan worth of additional treasury bonds to fund infrastructure construction, fixed asset investment and technological upgrading. At the same time, it has introduced tax incentives for exports and investment, increased welfare payments to poor city residents and raised salaries of government employees. These measures began to show effect in the first half of the year 2000 when the economic growth increased to 8.2 percent (People’s Daily Article).

Certain sectors of the macro economy showed abnormal growth during 2003 with the growth rate at 9.1%. In order to have a cooling down on these overhead sectors, the government implemented some control measures. Despite the efforts of the Chinese government, there were still some issues like redundancy in investments, excessive reliance on government consumption and regional imbalances, which the government had to address for achieving a uniform growth of the economy.

The Process of Economic Development in China

The pace of economic growth in change has been extremely rapid since the start of economic reforms just over 25 years ago.

Economic growth has averaged 9 per cent over the past two decades and seems likely to continue at that pace for some time. It has delivered higher incomes and a substantial reduction of those living in absolute poverty. Many industries have become completely integrated into the world supply chain and, on current trends, China could become the largest exporter in the world by the beginning of the next decade. Underlying this growth there has been a profound evolution of economic policies that has transformed the efficiency of enterprises (OECD, 2005).

The process of Chinese economic growth was steered by shift in the government’s policy, which had changed its course to give more power to market forces acting on the economy. “While price controls were being abolished, the government introduced a pioneering company law that for the first time permitted private individuals to own limited liability corporations” (OECD Policy Brief, 2005).

“The government also rigorously enforced a number of competition laws in order to unify the internal market, while sharpening the business environment by allowing foreign direct investment in the country, reducing tariffs, abolishing the state export trading monopoly and ending multiple exchange rates” (OECD Observer, 2005).

In fact, these important measures had triggered the upward swing of the Chinese economy.

With China joining the World Trade Organization, the momentum towards a freer economy had continued.

“In 2005, regulations that prevented privately-owned companies from entering a number of sectors of the economy, such as infrastructure, public utilities and financial services were abolished. Overall, these changes have permitted the emergence of a powerful private sector in the economy,” (OECD Observer, 2005).

Reforms in the State Owned Sector

Wide-ranging reforms were also introduced in the state owned sector, which was playing a dominant role in the early 1990s. “State-owned enterprises have been transformed into corporations with a formal legal business structure and many have been listed on stock exchanges that were created in the early 1990s,” (OECD, 2005). Stock exchanges were created in the early 1990s. Most of the corporations, which were earlier state owned enterprises, have been registered in these stock exchanges. Since 1998, the policy of promoting large corporations and reduction of the smaller companies was followed. This resulted in the reduction of state owned enterprises to more than half in the next five years.

“Employment contracts were made more flexible, leading to job reductions in the industrial sector of over 14 million in the five years to 2003. This process was aided by the creation of unemployment and welfare programmes that transferred the burden of compensating redundant workers from enterprises to the state,” (OECD, 2005).

All these reforms have increased the gross saving rate reaching to the half level of the GDP generating a rapid increase in the capital stock.

Indeed, the changes in government policies have created a largely market-oriented economy in which the private sector plays a key role. Overall, between 1998 and 2003, the progressive evolution in government policies allowed a fivefold rise in the output of domestically-owned private companies and a threefold rise in the output of non-mainland controlled companies; by contrast, the output of the state sector rose by just over 70% in this period. The growth in private output has also been the result of the higher productivity of most companies in the sector (OECD, 2005).

It has been the case with China, that it used active fiscal policy for stimulating the economy immediately after the Asian crisis in 1998, (Jia, 2002; Hodrick & prescot, 1997). However, the analysis of the traditional measures of fiscal policy implementation such as the general government deficit may not reveal the actual impulse. Similarly, the yearly changes are only minimal and these changes did not have much effect on business cycles. Considering the official budget deficit as presented by the International Monetary Fund or the national statistical office, fiscal policy does not appear to have actively been used during the past two decades except for two occasions around 1989 and 2000. The national statistics indicate that the budget deficit was moving around one percent of GDP, while IMF figures show that the budget deficit was around 2 percent of GDP.

There were two instances where the deficit widened sharply. They were:

- 1989/1990 recession, and

- the global boom caused by the development of the New Economy during late 1990s.

However both occurrences can be described as odd ones. For instance, during 1989/1990 the Chinese government had been slowing down the economy intentionally more sharply after the events of June 1989 (Lin & Schramm, 2003; Van der Noord (2000). The New Economy boom enabled the Chinese economy to experience a demand surplus so that there was no need for an additional fiscal policy stimulus to boost the growth. “The 1994 slowdown when the government managed to cool the overwhelming economy without raising interest rates much at the same time does not turn up in overall deficit figures,” (Dullien, 2004).

Empirical Support and Application

For the empirical support, this study made use of the trend line on the GDP growth of China. The data on the GDP during the study period was derived from the database of Chinese National Statistical Database and the world economic indicators database. The trend has cleared shown a consistent growth in the GDP of the country during the study period. The historical data also revealed that China was able to manage the financial crisis of 2008 very well without much of an impact on the economy. By adopting suitable policies both on fiscal and monetary front, the Chinese government was able to control the macroeconomic conditions very well, so that there is no adverse impact on the economic growth. However, due to the adverse impact on the economies of industrially advanced countries including United States, the financial crisis has affected the exports out o China largely due to reduced consumption.

As a part of the empirical support to the research, the study conducted regression analysis for assessing the effect of different variables on the economic growth. The first regression considered the effect of consumer price index on the GDP over the study period. This regression analysis has produced a result showing a negative association of the CPI with the GDP of the country.

With the general outlook of the economy, there is every chance that the likely risks of deflation and inflation may be adjusted and become balanced during the near future. The base effect has kept the year-on-year CPI headline negative for the remainder of 2009 and the early months of 2010. However, the seasonal patterns in the CPI index appear to have taken place in the monthly changes as reflected in the following figure.

There can be no instances of sharper deflationary tendencies as it happened during 2008 with de-stocking and the decline in the house prices.

The second regression considered the impact of government consumption on the GDP of the country over the study period. The regression indicated a positive association of government consumption with the GDP of the country during the study period. As far as the government consumption is concerned, the country was able to control its monetary policies effectively so that the public expenditure is maintained at a controlled level. This has helped the economy to control its budgetary balances in a comfortable situation. The increased domestic savings, caused by the increased FDI inflow, has enabled the economy to have favorable national funds position over the period.

The taxation ratios have an important implication on improving the GDP of an economy. Therefore, the next regression was conducted to analyze the effect of taxation ratios on the GDP of the Chinese economy during the study period. Taxation is a major policy tool in the hands of the policymakers to control the direction of the economy. The empirical analysis in the form of regression on this element shows a significant and positive relationship of taxation ratios with GDP of the country. The research extended to the analysis of the proportion of taxation revenue to the total GDP.

The last regression was run taking the debt to GDP ratio as the independent variable to find its impact on the dependent variable of Chinese GDP by taking the data for the study period. Although the regression showed a positive association, the results could not be considered significant due to other poor statistical measures.

Other Empirical Support

As shown by the figures of various economic indicators in section 4.1 the Chinese economy has taken another drastic turn in the year 2009 at the beginning of the year. The survey by the China Center for Economic Research shows that the average forecast of GDP growth during the second quarter of 2009 as computed from 20 domestic and foreign-owned institutions went up to 7% from the real performance of 6.1 percent during the first quarter. This supports the fact that the Chinese economy has already crossed the storm of economic crisis of 2008.

Only during the year 2008, the Chinese authorities were focusing on containing the inflation. In February 2008, the CPI increased to a high of 8.7 percent, which was caused by 20 percent inflation in the food prices. The People’s Bank of China (PBOC) undertook various measures to tighten the monetary policy. The bank was keen on raising policy rates, increasing the requirements of reserves and appreciating the currency value. From the mid 2008 there was a complete change in the macroeconomic conditions of China took a downward turn. GDP growth declined from 9 percent in the first quarter of 2008 to 6.7 percent in the year to the fourth quarter. The slowdown of the economy was due to tightening monetary policies implemented by the PBOC earlier. However, the weakening of the global economy because of the subprime prices was also instrumental for the downward trend of the Chinese economy in the latter half of 2008.

The 2008 US financial crisis affected the Chinese economy mainly in three ways. They are: (i) weakening of exports due to reduced consumption worldwide, (ii) reversal of capital flows and (iii) loss of investor confidence. In response to the changing macroeconomic conditions, PBOC quickly loosened the monetary policies. The Bank announced the first rate cut in September 2008. During the second half of 2008, there was a sudden stoppage in the appreciation of the currency value. The most important change was in the credit policy of PBOC. The bank made a complete shift in its credit policy from strict control of loans in early 2008 to the promotion of loan extension in early 2009.

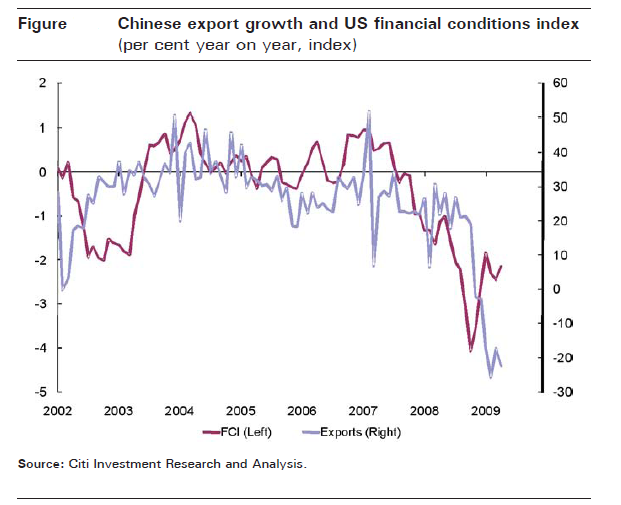

Export growth collapsed from 20 to 30 percent on a year-on-year basis. However, the customer confidence increased later towards end of 2009 along with the financial conditions in the US. During the year 2009, both the exports and financial conditions in the US remained weak and it is expected that it would take some more time before the Chinese exports could grow significantly. The following graph illustrates the position of Chinese exports growth and the financial conditions in the US during the period 2002 to 2009.

Exports from China are not expected to recover significantly in the near future, as the exports are determined by the conditions prevailing in the industrially advanced economies, which account for more than 60 percent of the Chinese exports. With a dim economic outlook, prevailing in these economies the chances of early recovery of exports out of China appears bleak.

However, China has done better in the area of investment in fixed assets. This area provides an encouraging picture about the economy especially with respect to the imports into China. The imports of capital goods show an increase.

“The faster recovery of imports than of exports suggests that the trade surplus and the current account surplus could shrink further. This would present a greater drag on GDP growth in the coming quarters. During the first quarter, the nominal trade surplus was greater than a year ago; but removing price changes that penalized imports much more than exports, the surplus was really $7 billion short. This produced a 0.2 percentage point drag on GDP growth in that quarter,” (Huang et al, 2009)

The burden on the fiscal expansion to encourage economic growth is likely to increase with the extended weakness in exports and the surplus. This situation could lead to structural imbalances in the economy. Under the prevailing economic conditions, China would not adopt any major changes in its foreign exchange policy until such time the exports return to growth and there is stabilization of surplus.

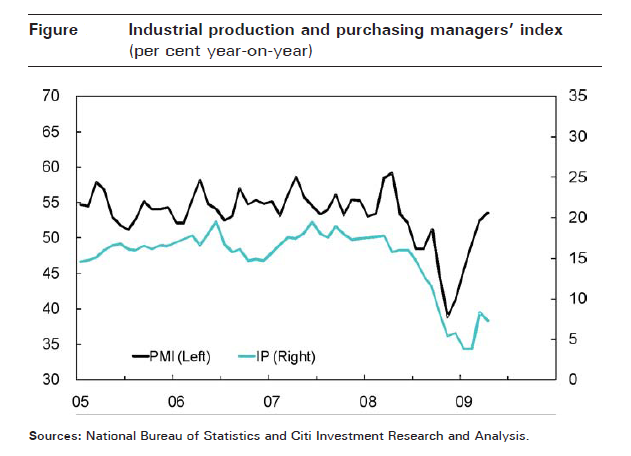

With subdued growth in exports, there can be no support for production to grow in the near future. The following figure illustrates this position.

The return of the Purchasing Managers’ Index (PMI) can be seen as in line with the growth in production in the coming periods. The below – 40 figure prevailed in November 2008, which was similar to the PMI levels in the US and other European Countries during the same period is to be regarded as an overshooting which was abnormal. The production is expected to bounce back with the stimulus policies of the government; however, the firms are still waiting to expand, even though the worst of the economic scenario has passed. “Stimulus projects are still in their early stages, which could be helping digest inventories but is yielding little boost to new production,” (Huang et al, 2009).

It is expected going forward there would be a decline in the investment growth than what was achieved during the first few months of the year 2009. In the fixed asset investment figure the value of land and used facilities have been included and these values constitute a significant share in the total amount of investments as reported. Since these values are accounted at the beginning of the project, the investment quantum might be vitiated to that extent. For instance, during January to April 2009, there were 86,000 new projects valued at RMB 3.7 trillion and this constituted 45% of the investment for the year and 91% of the investments on a year-on-year basis. All these projects have longer gestation periods, and they would take several years to reach the stage of completion. However, the land value involved in the projects has been already taken in the figure for investments as also the front loads growth. Therefore, there is the likelihood that the fixed assets investments will deteriorate in the future.

Major Findings, Implications and Recommendations

Major Findings

The country’s economic policies adopted in the periods after Mao are designed in such a way that they act as the motivating factors for the inflow of foreign direct investments. These economic policies, being industry oriented have resulted in a fast growth of the country’s economy in all sectors. The investors from the foreign nations are attracted by the availability of infrastructural facilities in the form of roads, large power stations and other basic infrastructural facilities like airports, seaports and other transport equipments. Besides the provision of basic and other infrastructural facilities, the government has also made changes in the various tax structures. The government was keen in making these changes applicable especially to the foreign owned companies.

Thus, the revised developmental economic policies and the faster market growth in the Chinese economy has helped not only the Chinese economy but also encouraged the other countries of the world to invest their funds in various industries of and thereby increase their profitability. The Chinese government encouraged its state-owned enterprises to make use of the investments from the foreign countries for forming joint ventures with various foreign companies (Zhai, 1999;Yan & Warner, 2001). The state owned enterprises also obeyed the government policies and formed joint ventures in the manufacturing sector making it the largest and most important sector receiving foreign direct investments. With this, the joint venture organizations became the most popular way of utilizing the foreign direct investments that came into China. Because of this China has become the second largest recipient of FDI in the world and the single largest recipient nation among the developing nations (Subramanian, 2002).

Due to the restrictive joint venture investment policies of the Chinese government in the early stages, the process of forming joint ventures with the foreign funds was difficult and the foreign firms found it difficult to make their investments in the country. However, realizing this difficulty the government had brought lot of changes in various legislations governing the foreign investments. The most important of them are being the concessions granted by the government for the foreign investment companies. Because of these changes, number of international companies had started investing their funds in the companies within China especially in the manufacturing sector. Thus, the joint venture arrangements also started increasing in their numbers and it made a big success in the country.

Another major finding of the study is that China adopted a provocative fiscal policy to promote the economic growth. In the market mechanism of mature economies, the fiscal policy effects would take longer time to effect improvements, because of lesser impacts. However, in the Chinese economy the institutional arrangements were significantly different from the mature economies with the result that, the economy got stimulated. According to Western economic theory, provocative fiscal policy by the issue of large volume of government bonds would lead to increase in the interest rates to generate crowding effect. On the contrary, the provocative fiscal policy adopted by China contributed to declining interest rates and at the same time, the policies had the effect of expanding the demand for social investments and acted as guidance for the enterprise investment.

Yet another finding of the study indicates a difference in the approach to the economic growth and devising of the policies according to this differentiation. Prior to mid 1990s, China was focusing on increasing domestic consumption, which worked out well for the uplifting the poorer section of the society. After this period, there was a drift in the approach where the government concentrated on expanding the economy through exports, which resulted in regional imbalances.

This approach has affected the economy, when the exports went down due to lower consumption in the Western countries including United States.

Implications

This study has serious implications for the policymakers and the government. While adopting the fiscal policies the policymakers have to take into account the environmental protection, over-exploitation of resources to achieve short-term economic targets, and investment costs. These are some of the major factors, which would add to the cost of economic growth. The policymakers in their desire to maintain the consistency of economic growth must not neglect the impact of these factors on the economy, while revising the fiscal policies of the government.

On the personal front, the study has helped the researcher to gain a firsthand knowledge on the factors, which have a major impact on the growth of an economy and the role of fiscal policy on promoting the growth. Having gone through a large volume of literature, the researcher is able to acquire the skill of quickly grasping the important themes and elements conveyed by the research reports.

The study suffered from one major limitation that there was abundance of resources, which the researcher could access. It was a cumbersome task to analyze each resource as to its applicability and relevance to the current research. Next is the limitation on the use of secondary data for the research. Since there was, no use of primary data to that extent the reliability of the research can be questioned. However, the secondary data have been retrieved from authentic sources, which take care of this limitation. Therefore, this limitation does not affect the reliability of the study largely. Apart from the limitations mentioned there were no other serious limitations, which impeded the progress of the research.

Recommendations

This study has identified certain areas of interest, where it is possible to do further research to augment the existing knowledge on the topic. A comparative analysis of the fiscal policy of China and its impact on economic growth with that of one of the Western countries like the United States or the UK will shed light on the character of the fiscal policies of China. An empirical study on the impact of monetary policies of China for the period after the Asian crisis will produce an interesting piece of research work.

References

Adler, P. A. & Adler, P. 1987 Membership roles in field research. Newbury Park, CA: Sage Publications.

Benedict Clements, Sanjeev Gupta and Gabriela Inchauste, 2004. Fiscal Policy for Economic Development: An Overview. Web.

Burns and Grove cited by Cormack (1991), p.140, taken form ‘Ways of Approaching Research: Quantitative Design’.

Dullien, Sebastian 2004. Measuring China’s Fiscal Policy Stance. Web.

Easterly, William and Rebelo, Sergio, 1994. Fiscal Policy and Economic Growth: An Empirical Investigation, Centre for Economic Policy Research London. Web.

Economic and Commercial Counselor’s Office of the Embassy of the People’s Republic of China in the Islamic Republic of Iran, Foreign Investment. Web.

Ghauri, P., Gronhaug K and Kristianslund I., 1995 “Research methods in business studies – a practical guide.” Hempstead, Prentice Hall.

Hodrick, R. J. and E. C. Prescott, 1997, Postwar U.S. Business Cycles: An Empirical Investigation, Journal of Money, Credit, and Banking, 29 (1), 1-16.

Huang Yiping, Ken Peng & Minggao Shen, 2009. Macroeconomic Performance amid Global. Crisis. Web.

Jia, K. 2002, Pro-active fiscal policy in China since 1998: backgrounds and its emphases in practice, Journal of Asian Economics 13, 615-622.

Jin Dongsheng and Chen Li China’s Tax System on FDI. Web.

KPMG, 2007. China Alert: Tax and Regulatory Development, Issue 4. Web.

Lin, G. and R. M. Schramm 2003, China’s Foreign Exchange Policies since 1979: A review of Developments and an Assessment, China Economic Review, 14, 246-280.

Lofland, John and Lyn H. Lofland. 1984 Analyzing Social Settings: A Guide to Qualitative Observation and Analysis Belmont, CA: Wadsworth.

OECD, 2001. Corporate Tax Incentives for Foreign Direct Investment. OECD Tax Policy Studies No 4. Web.

OECD, 2005. Economic Survey of China 2005: Key challenges for the Chinese economy. Web.

OECD Observer, 2005. China’s economy: A remarkable transformation. Web.

OECD Paper, 2002. Foreign Direct Investment in China’s Regional Development: Prospects and Policy Changes. Web.

OECD Paper, 2003. Reforms Could Boost China’s Ability Foreign Investment. Web.

OECD, Policy Brief 2005 Economic Survey of China, 2005. Web.

Padma Mallampally, and Sauvant Karl P. 1999. Foreign Direct Investment in Developing Countries. Finance & Development Magazine. International Monetary Fund Vol. 36 No. 1. Web.

People’s Daily Article, Active Fiscal Policy Boosts Economic Growth. Web.

Subramanian, 2002. FDI: Any lessons from China? Article on FDI Business; The Hindu Newspaper. Web.

The Wall Street Journal, 2010. Economists Think Inflation Picked Up in July. Web.

Trochim, William, 2001. The Research Methods Knowledge Base, Second Edition USA: Atomic Dog Publishing.

Trochim William, 2005. Research Methods: The Concise Knowledge Base, First Edition USA: Atomic Dog Publishing.

Van den Noord, P. 2000, The Size and Role of Automatic Fiscal Stabilizers in the 1990s and Beyond, OECD Economics Department Working Papers No. 230.

Wenger & Vieli. 2005. China Legal Framework. Web.

Xiong Tong, 2010. Facts and figures: Key indicators of China’s economic performance in 2009 and previous years. Web.

Yan, Daniel and Warner Malcolm, 2001. Sino-foreign Joint Ventures Versus Wholly Foreign Owned Enterprises in the People Republic of China. Working Paper 11 of 2001 The Judge Institute of Management Studies Cambridge. Web.

Zhai Pu, 1999. Strategy for Sino-Foreign Joint Venture Formation: A Resource-Based Process View. Web.

Zhang Jun, 2008. China’s Economic Growth: Trajectories and Evolving Institutions. Web.