Abstract

The purpose of this report was to analyze and discus the competitiveness of Flydubai. The analysis indicated that the market in which Flydubai operates is an oligopoly. Although the market has a few airlines, competition is high because customers are price sensitive. In addition, they require high quality services.

Air Arabia is the main competitor of Flydubai at the national level. In Asia and the Middle East, the main competitors include Qatar Airways, Oman Air, and Saudia Airline. The demand for flights is price elastic at the regional level. Demand is expected to increase in the medium-term as economic growth improves.

Introduction

Flydubai is one of the leading low cost carriers (LCC) in the Middle East. The airline launched its operations in 2009 and is owned by the government of Dubai (CAPA, 2013). Despite being in the market for only five years, Flydubai has grown very fast by expanding its seat capacity and route network in the Middle East and Asia.

This paper will analyze the competitiveness of the airline. The analysis will cover the market and demand for low cost flights. It will also include the competitors, demand elasticity, and profitability of Flydubai. Moreover, the strategies that the airline can use to improve its profitability in a sustainable manner will be discussed.

Market

The market in which Flydubai operates (Asia and the Middle East) is an oligopoly. This perspective is supported by the fact that a few large firms dominate the market. Over 50% of the market in various routes in the region is controlled by only four airlines (CAPA, 2013).

For example, in the UAE-Saudi Arabia route Flydubai, Air Arabia, Saudia Airline, and Emirates Airline have a combined market share of nearly 83%. In the UAE-Qatar market, Emirates Airline, Qatar Airways, and Flydubai together control 84% of the market (CAPA, 2013).

Similarly, Oman Air, Flydubai, and Emirates Airline together control nearly 62% of the UAE-Oman market (CAPA, 2013).

Airlines are providing differentiated products to increase their competitiveness. Differentiation is promoted mainly by increased competition from international airlines that operate in the region. Low cost airlines such as Flydubai and Air Arabia differentiate their products in terms of price and service quality (Buller, 2014a).

They charge very low prices to overcome competition from full service airlines. However, Flydubai has adopted a hybrid model to offer unique services. This includes offering both business and economy class services.

Another important characteristic of the market is price interdependence among airlines. Price and output decisions of each airline are contingent on the actions taken by its main competitors.

This means that if one airline decides to increase its output and prices, its competitors will always react by changing their prices and capacity to overcome competition. For instance, the capacity of Flydubai, Qatar Airways, and Emirates Airline in the Dubai-Doha route is 12,210, 11,840, and 11,470 seats per week respectively (CAPA, 2013).

The seat capacities of the three airlines are almost identical because each of them has to take into account the output decisions of its competitors.

Several factors prevent firms from joining or quitting the market. These include high sunk costs, intensive regulation, and the market strength of the incumbents.

New entrants find it difficult to join the market due to the high cost of acquiring new aircrafts in order to compete effectively with companies such as Flydubai, which use only brand-new jets (Flydubai, 2014).

Price Elasticity

Price elasticity of demand “is a measure used to capture the sensitivity of consumer demand for a good or service in response to a change in the price of that particular good or service”.

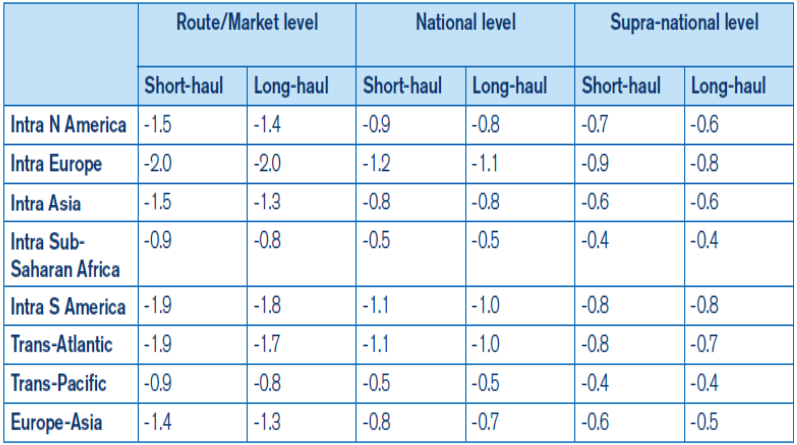

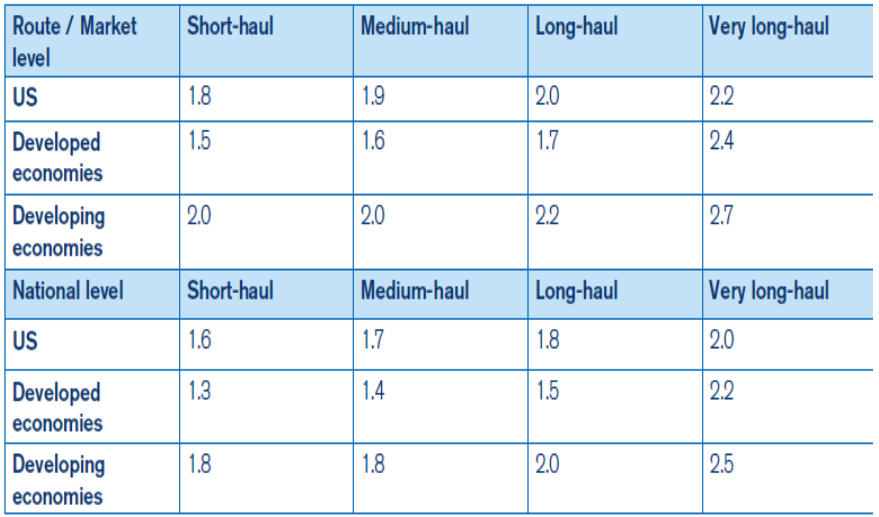

The price elasticity of demand (PED) for air travel in intra-Asia routes, which are the main markets for Flydubai are summarized in table 1. At the regional level, the PED for short-haul flights is 1.5, whereas that for long-haul flights is 1.3. This means that the demand for air travel is price elastic.

Therefore, an increase in price will result into a more than proportionate decrease in demand. At the national level (intra-country routes), demand is inelastic as indicated in table 1. Thus, an increase in price will not cause a significant decrease in demand.

One of the main factors that explain the high PED at the regional level is availability of substitutes. Most countries in Asia have national airlines, which compete with each other in various inter-country routes.

For instance, over 150 airlines operate from Dubai International Airport to various destinations in the Middle East and Asia. Thus, customers can easily switch from one airline to another in the event of a price increase.

At the national level, PED is expected to be low or inelastic because of limited availability of substitutes that can enable customers to avoid a price increase (CAPA, 2014). For instance, Flydubai, Emirates, Air Arabia, and Etihad Airways are the only airlines that provide regular flights within the UAE.

If these airlines increase their prices due to a rise in fuel cost or a tax imposed by the government of the UAE, passengers will have limited options to avoid the increase. For instance, they can avoid the price increase by using cars, which might not be appropriate for long distance journeys.

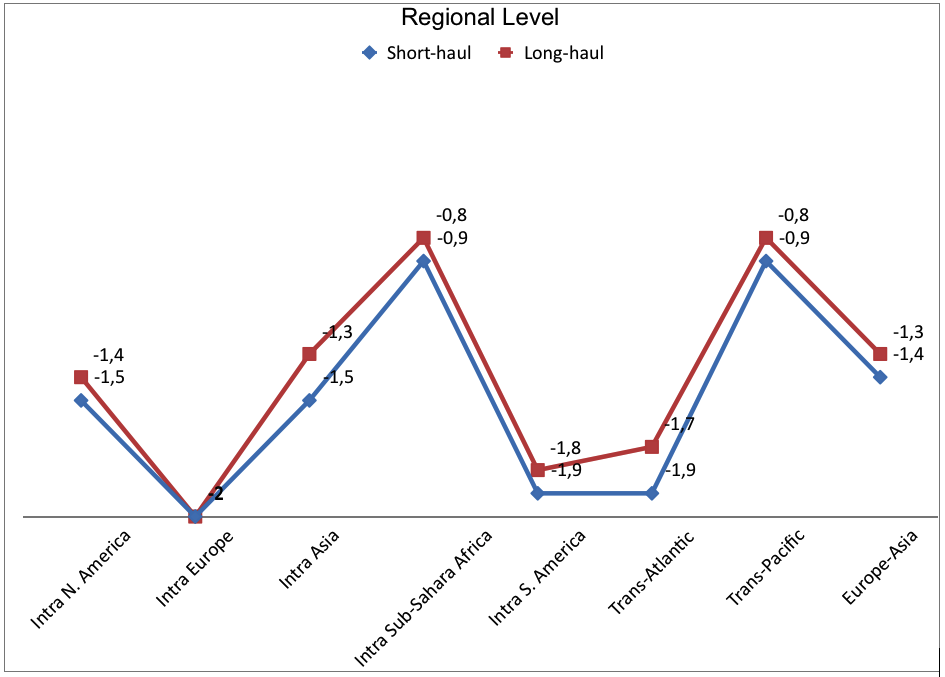

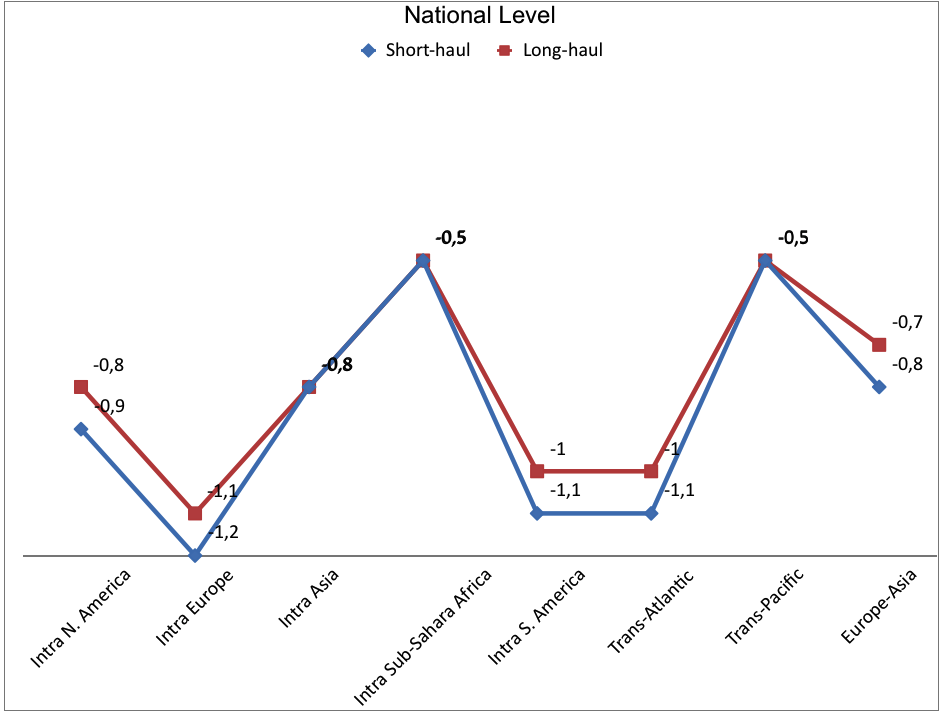

Figure 2 and 3 show the variation in price elasticity of demand in regional and national markets respectively. They show that long-haul flights have a higher PED than short-haul flights. This could be attributed to the fact that virtually all full service airlines provide long-haul flights, thereby increasing competition.

Most full service airlines operate wide body aircrafts, which allow them to achieve economies of scale. Thus, they can charge low prices to compete with LCCs. In sum, the high PED is explained by the large number of airlines that provide long-haul flights and their ability to reduce prices.

Income Elasticity

Income elasticity of demand (IED) “is a measure of the sensitivity of demand for a good or service to changes in individual or aggregate income levels”. Table 2 shows that the IED in developing countries where Flydubai operates is greater than 1 in both national and regional markets.

Thus, demand for air travel increases more than proportionate to a rise in disposable income. This means that customers consider air travel a luxury service.

The high IED can be attributed in part to customers’ low income. Air travel in developing countries is a luxury that can only be consumed in the event of an increase in income. Customers will always explore alternative modes of transportation in order to save on travelling costs.

In countries such as the UAE, Qatar, Oman, and Kuwait, the uptake of air travel services is less than the level in developed countries such as the US where household income is very high.

The implication of the high IED is that travelers are likely to use full service airlines that offer luxury services during periods of economic boom. However, they are likely to use low cost airlines that focus on reducing travelling expenses rather than providing luxury flights during economic downturn.

Therefore, low cost airlines must provide service packages that allow travelers to enjoy high quality flights at affordable prices. This will enable them to avoid losing customers to full service airlines such as Emirates Airline, which are able to provide luxury flights at low prices.

Figure 4 and 5 show the variation in IED in regional and national markets respectively. Clearly, IED is higher in developing than developed economies. This means that a change in income is more likely to cause a significant increase in demand in developing than developed countries.

In this respect, LCCs should focus on serving developing economies that are experiencing rapid economic growth to increase revenue and profits. The low IED in developed countries is a sign of high competition and slow market growth.

In developed countries, airlines must focus on aggressive marketing techniques to attract existing customers. LCCs with limited capital can hardly survive intense competition.

Competitors

Flydubai competes with several airlines within the UAE and other destinations in Asia, the Middle East, and Europe. In the UAE, Air Arabia is the main competitor of Flydubai (CAPA, 2014). The main strength of Air Arabia is that “it has a larger and more diversified route network than Flydubai” (CAPA, 2014, p. 3).

It operates from three different hubs, which enable it to connect to various destinations in the Middle East at a low cost. By contrast, Flydubai operates from only one hub in Dubai. As a result, Air Arabia is able to serve 91 routes, whereas Flydubai serves only 66 (CAPA, 2014).

Air Arabia also has a strong brand image and adequate knowledge of the market because it has been in operation since 2003. This helps it to develop products that allow it to retain customers.

Despite its strengths, Flydubai has already overtaken Air Arabia in terms of passenger traffic. For instance, in 2013 Flydubai transported 6.82 million passengers, whereas Air Arabia handled only 6.1 million travelers (CAPA, 2014). Flydubai also has a larger market share than Air Arabia in most routes in the Middle East.

For instance, in the UAE-Qatar route Flydubai has a market share 23%, whereas Air Arabia has only 5% (CAPA, 2013). In the UAE-Saudi Arabia route, Flydubai has a market share of 22%, whereas Air Arabia has only 12%. The success of Flydubai is explained in part by its hybrid business model.

The airline combines the features of a LCC with those of full service airlines, thereby delivering superior value to customers.

In the GCC, Asia, and Europe, Flydubai competes with large airlines such as Qatar Airways, Etihad Airways, Saudia Airline, and Oman Air. Flydubai counters competition from these airlines by cooperating with Emirates Airline (CAPA, 2013).

The cooperation “allows Flydubai to serve Emirates Airline’s passengers in routes that are not served by the latter” (CAPA, 2013, p. 4). Flydubai also cooperates with international airlines in Dubai to attract passengers in underserved markets.

These strategies have helped the airline to increase its market share at the expense of its competitors.

Substitutes and Complements

The main substitute for air travel is road transportation using cars or trains. In markets such as the UAE, passengers can substitute flights with road transportation to avoid high costs or inconvenience. However, cars can only be used for short distance journeys. Using cars to travel for long distances is very expensive and time consuming.

Moreover, travelling across the border in the Middle East and Asian countries by road is not easy due to lack of infrastructure and insecurity. Therefore, there are no close substitutes for medium and long haul flights. Lack of close substitutes is an advantage to airlines since they face little or no competition from other industries.

Nonetheless, brand substitution is a major challenge in the industry due to high competition and sensitivity to prices. Customers often substitute one airline for another to enjoy favorable prices and excellent services.

The main complementary good in the airline industry is jet fuel. Every airline needs adequate supply of cheap fuel to operate its aircrafts profitably. Since fuel accounts for nearly 40% of airlines’ operating costs, an increase in its price causes a reduction in profits, especially, if the increase cannot be passed to customers (Flydubai, 2014).

Ground handling services are also very important in the industry. LCCs need efficient ground handling services to transfer passengers and luggage from other airlines to their terminus. Lack of high quality ground handling services can result into customer dissatisfaction and lose of market share.

Demand

The demand for low cost flights is growing rapidly in the Middle East and Asia. Demand is expected to grow at an annual rate of 6.6% in the next 10 years. The factors that account for the expected growth include the following. First, emerging markets in Asia and the Middle East are characterized by rapid economic growth.

Specifically, economies in Asia and the Middle East are expected to grow at an annual average rate of 6% and 4% respectively in the next three years. The growth will be characterized by increased business activities that will necessitate cross-border transactions.

For instance, the UAE and Saudi Arabia are expected to become major commercial hubs in the Middle East due to increased foreign direct investment (FDI) from developed countries. The resulting increase in travelling among business executives will increase demand for flights in the region.

High economic growth will also increase disposable income. Thus, more people will be able to afford flights.

Second, emerging markets in Asia are experiencing rapid population growth, which will increase demand for cheap flights in future. For instance, Flydubai serves a market with nearly 3 billion people (CAPA, 2013). The market is underserved due to lack of airlines that focus on serving short distance routes.

Finally, the penetration of low cost airlines in the Middle East and Asia is still less than 20%. This means that the market is still at its growth stage and will take several years to mature. Thus, the demand for flights is expected to increase as the popularity of LCCs increases in Asia and the Middle East.

Training Labor Force

The employees of Flydubai can be trained further to increase productivity and reduce costs in several ways. To begin with, the company is in the process of acquiring 75 new aircrafts (Flydubai, 2013). Several pilots with advanced skills and knowledge in flying commercial aircrafts will be required after the acquisition.

Given the short supply of qualified pilots in the UAE, Flydubai can reduce staff costs by training its own pilots. Currently, the company incurs high labor costs since it hires pilots from developed countries in Europe and North America where wage rates are very high (Flydubai, 2014).

Flydubai can also train its cabin crew to increase productivity. Undoubtedly, every airline needs employees with excellent customer care skills to provide excellent services to passengers. Excellent services lead to customer loyalty. It also enables a company to attract customers from its competitors.

The resulting increase in market share leads to an increase in profits. Therefore, Flydubai should continuously provide customer service training programs to employees to improve its competitiveness.

Managers can also contribute to profit maximization and cost reduction if they are trained on leadership. Managers with effective leadership skills are likely to stimulate innovation among employees. An innovative workforce will help Flydubai to develop superior products that will increase sales and profits.

In addition, employees will be able to develop a more efficient business model to reduce operating costs without compromising service quality.

Profitability

Flydubai has maintained a consistent growth in profits since 2012 (CAPA, 2013). The growth in profits and revenue is illustrated in table 3. Net profits increased from AED 151.9 million to AED 222.8 million in 2013 (Buller, 2014b). It further increased to AED 250 million in 2014 (Flydubai, 2015).

Overall, these statistics show that the airline realized a 64.58% growth in net profits in the last three years.

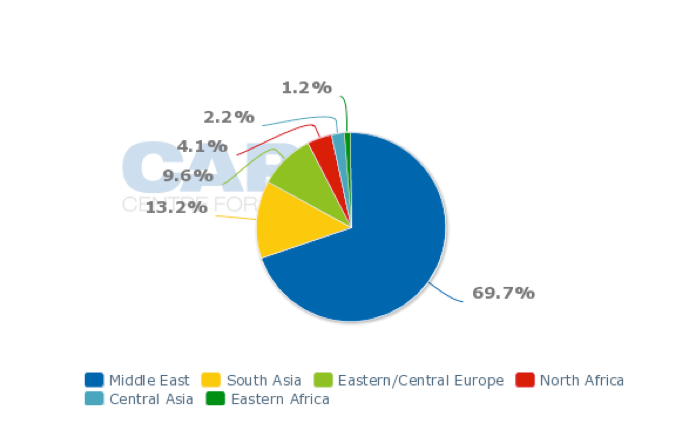

The increase in profitability can be attributed to the fact that Flydubai has the largest market share among low cost carriers in most routes in the Middle East as shown in figure 1. This allows the firm to earn high revenue, which translates into huge profits.

The airline will be able to sustain high profitability because of its ability to reduce operating costs through strategies such as fuel hedging (Flydubai 2014). Cooperation with other airlines and using online distribution channels will also help Flydubai to reduce costs. Low operating costs will allow the airline to increase its profit margins.

Rapid expansion of route network and fleet size will also support growth in profitability (Flydubai, 2015). Flydubai will double the number of its aircrafts and triple the number of routes that it serves in the next five years. The expansion will be accompanied by an increase in passenger traffic, which in turn will increase revenue and profits.

Increasing Profits

Flydubai can increase profits by considering the following strategies. First, the “airline should explore new markets in Africa and Asia”. Currently, the penetration of LCCs in Africa is only 9.9%. This means that the market has great growth opportunities that have not been exploited.

In addition, most short-haul routes are not served by full service airlines because they cannot support their business model. This reduces competition in short-haul routes. Serving new routes that lack competition will increase revenue and profits.

Second, the airline must focus on innovation to increase its profits. As a hybrid airline, Flydubai has embarked on introducing the services of full service airlines such as meals, long haul flights, and business class (Jones, 2014). These services will increase operating costs significantly.

Therefore, innovative ways of reducing costs such as retiring aircrafts after five years to improve fuel efficiency must be adopted to ensure growth in profitability.

Finally, Flydubai should launch operations in new hubs in Asia and Africa to allow it to serve more routes at a low cost. For instance, operating from Morocco will enable the airline to serve parts of Europe and Africa by providing flights that take less than four hours. This will reduce operating costs, thereby increasing profitability.

Conclusion

Flydubai operates in an oligopoly market where competition is high among the leading firms. Air Arabia is the main competitor of Flydubai in the UAE. However, Flydubai has already outperformed it in terms of passenger traffic. Other competitors in Asia and the Middle East include Qatar Airways, Oman Air, and Saudia Airline.

The demand for air travel in the market is price elastic at the regional level. In addition, the income elasticity of demand indicates that customers consider air travel a luxury service. Despite the high competition, the demand for air travel is expected to increase in future due to robust economic growth.

Flydubai should focus on training its employees and reducing operating costs to improve its long-term competitiveness.

Appendix

Table 3: Flydubai’s profits and revenue.

References

Airbus. (2012). Global market forecast. Herndon, VA: Airbus.

Buller, A. (2014a). Exclusive: Flydubai CEO on the low cost airline’s meteoric rise. Gulf Business. Web.

Buller, A. (2014b). The low-cost airline announced full-year 2014 net profit of Dhs 222.8 million. Gulf Business. Web.

CAPA. (2014). Air Arabia lags Flydubai in the battle for Middle East LCC supremacy but opportunities abound. Web.

CAPA. (2013). Flydubai has bright outlook after recording first profit and emerging as close partner of Emirates. Web.

Flydubai. (2015). 2014 sees Flydubai achieve increased revenues of AED 4.4 billion up 19.1% and profits of AED 250 million. Web.

Flydubai. (2014). Flydubai announces 47 percent profit increase over 2012 results. Web.

Flydubai. (2013). Flydubai soars to new heights in 2013. Web.

IMF. (2015). World economic outlook. Washington, DC: International Monetary Fund.

Jones, R. (2014). Flydubai putting the squeeze on Air Arabia, says NBK Capital. Wall Street Journal. Web.

Nazar, T., & Al-Jubran, J. (2013). Flying Low: The evolution of low cost carrier in Middle East. Jeddah, Saudi Arabia: Aljazira Capital Ltd.

Smyth, M., & Pearce, B. (2014). Air travel demand. Geneva, Switzerland: IATA