Introduction

Toshiba is a pioneer in the development of electric and electronic products in Japan and around the world. The company started investing in research and development in 1973. So far, it has been able to retain leadership in several innovations in its different markets. Its current trading name was initiated in 1984 to symbolize swifter decision making. At the same period, the company opted to focus more on semiconductors and its personal computer (PC) business. However, it is also innovating in general consumer electronics products, such as televisions, as well as industrial technology equipment (Toshiba, 2014b). This report reviews the Toshiba’s core business of making semiconductors, with an additional focus being on its competitiveness, the technological changes taking place in its industry, available competitive forces, as well as marketing opportunities and its other business prospects.

What market the company belongs to

As a semiconductor manufacturer, Toshiba belongs to an oligopoly market. However, the company belongs to a perfectly competitive market when considering its consumer electronic goods, including laptops. In the first case, the competitors of Toshiba are Texas Instruments, Samsung, and Intel. In the second case, there are more than ten competitors in the global market, including HP, Samsung, Sony, Apple, Lenovo, and ASUS.

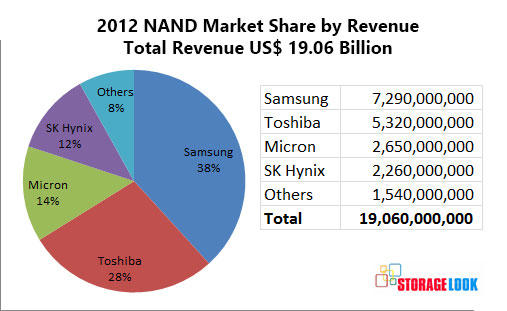

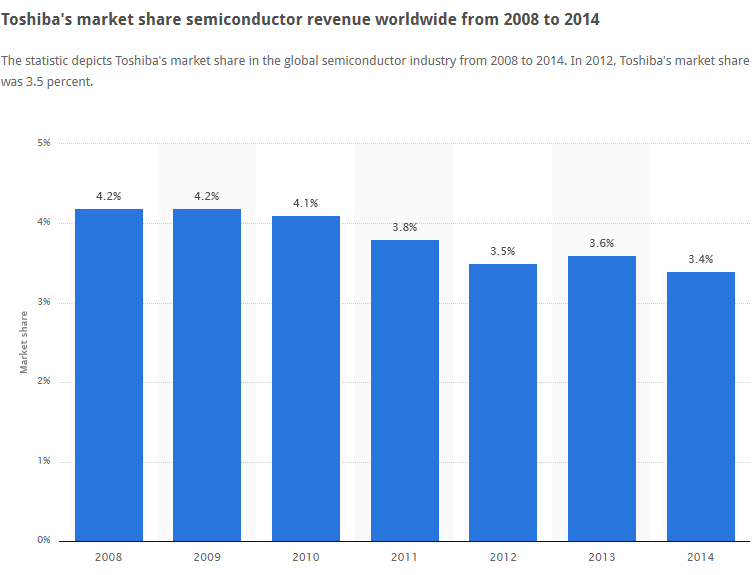

One of the characteristics of the oligopoly semiconductor market is that there are primary producers keen on mimicking the strategies employed by their rivals. Therefore, the technology advancements, which dictate product differences among manufacturers, have progressed gradually for all rivals. The following graph shows the market share of Toshiba’s semiconductor manufacturing business. Much of the analysis of the company done in this paper will be reviewing the semiconductor and storage product divisions of Toshiba, with reference to its consumer electronics division. Toshiba trails Samsung in the global production of NAND flash chips, where it acts as a primary producer. However, in its other business, the company maintains complex relationships with other suppliers by being a competitor in their consumer electronic and computing goods or it remains as a supply partner.

Toshiba SWOT analysis

Strengths

Toshiba has signed agreements with second tier manufacturing companies that rely on its semiconductors and memory chips. The companies have global presence and provide Toshiba with adequate demand to sustain profitable production throughout the year. A second positive for Toshiba is its research and development division that allows the company to come up and use the latest technologies to make cutting edge chips that differentiate the company from the rivals. In addition, Toshiba has a global presence, able to serve markets effetely without frustrating customers with delays in goods delivery or after-sale services.

Weaknesses

The company depends on subcontracts in its supply chain, where some of them are in developing countries that have less reliable political and economic conditions. The company also has to deal with a large number of legal proceedings that affect its global business, which relies on copyright and intellectual property protection laws.

Opportunities

A positive outlook exists in the semiconductor market, as demand for finished electronic goods increase globally. Toshiba also has a chance to fit into production agreements for new product launches with its partner companies, which would be an additional source of revenue, especially in the NAND memory market and its emerging 3-D chip subcategory (Inagaki, 2014). Emerging markets are offering cheap high quality labor that the company can tap to increase its global economies of scale in manufacturing and limit shipment costs and delays to manufacturing centers used by its various semiconductor and chip clients.

Costs

Despite the growth in the industry, competitors are also moving into the market with better innovations, as in the case of Intel and Samsung that both focus on developing chips for mobile devices. The electronics device industry relies on rapidly-changing technology that can quickly render innovations obsolete. Toshiba also faces risks of regulatory change regarding semiconductors, environment, and chip standards in different markets.

What it the price elasticity of demand for the goods that the company sells, is the demand elastic or inelastic?

The semiconductor industry, which powers the electronics industry, witnessed price drops in the last three decades due to technological improvements and economies of scale. A decrease in prices led to a significant increase in the demand for electronic products, given that semiconductors were the major components. In this regard, one can conclude that the demand for the semiconductors is very responsive to their prices. In the economic relationship, the price is said to be elastic. At the same time, irrespective of the preference status of electronic products, the cost of its components remains fixed as a factor of the eventual price of the electronic commodity (Hasentab, 2011). Thus, even though the price of semiconductors dropped in the last three decades, there could still be demand for electronic goods that does not reflect the relationship between price and demand correctly.

What kind of income elasticity does the products of the company face?

Increases in consumer income directly correspond with increases in the demand for electronic consumer goods, which also increase the demand for semiconductors. Electronic products fill both luxury and normal markets, and they respond favorably to an increase in income. In ceteris paribus, the income elasticity of Toshiba products is positive to reflect the typical quality nature of its products. However, the income elasticity will be more than one for electronic products because they are not necessities. On the other hand, it will likely be less than one in the case of semiconductors because they are essential components required by firms to make different electronic components. In fact, electronic products made by Toshiba or any other company must have semiconductors to function well (Pitzer, Maekawa, Ahmad, Paik, & Carver, 2014).

In the United States, consumer prices fell in December 2014 amid reduced inflationary pressures. As a result, consumers could afford more with the same disposable income levels (Reuters, 2015). Consumers can get higher wages and afford more goods, or they can get an equivalent in the pay rises through price decreases, which also allow them to afford more goods.

Who are their closest competitors?

The closest competitors of Toshiba vary according to the different markets that the company serves globally. In Japan, the rivals are Sony, Fujitsu, and NEC Corporation. Globally, the competitors include Samsung, Intel, Sharp, and Philips, among others.

Existence of substitutes and complementary goods

Semiconductors are virtually identical because they are raw components manufactured by different companies. Any can sell to a client to replace rival company products. However, electronic goods are highly differentiated in terms of marketing, packing, consumer preferences, design, and functionality. In either case, there are close substitutes for all the categories of semiconductors and electronic goods. The company sells NAND flash memories, just like its rivals do for smartphones and tablets. It also sells Laptops that have many substitutes in the market, as well as complementary goods, such as external storage devices (Toshiba, 2014a).

Trends in demand for Toshiba’s products and reasons

The demand for semiconductors made by Toshiba has been decreasing, as indicated by a declining market share of the company in the recent years. However, the overall demand for semiconductors has been growing due to increases in the overall electronics and consumer goods industry. Samsung, which is one of the main rivals to Toshiba, has experienced growth. Samsung concentrates on producing memory chips for computers and other smart electronic devices. It produces NAND and DRAM chips that already incorporate semiconductors. Its business grew by 24 percent in 2014 (Team, 2015).

The figures highlight the potential growth prospects of Toshiba, given that it serves the same market. The demand for Toshiba has been declining because the company is not as innovative as its rivals are. Although semiconductors are identical, rival companies have concentrated on providing value added components to increase their business performance. For example, in the case of Samsung, the rivals are still shifting to the 16nm chip from the 20nm chip. Samsung has already transitioned into producing the 14nm chip, which is better and attracts a higher demand from electronics companies (Team, 2015).

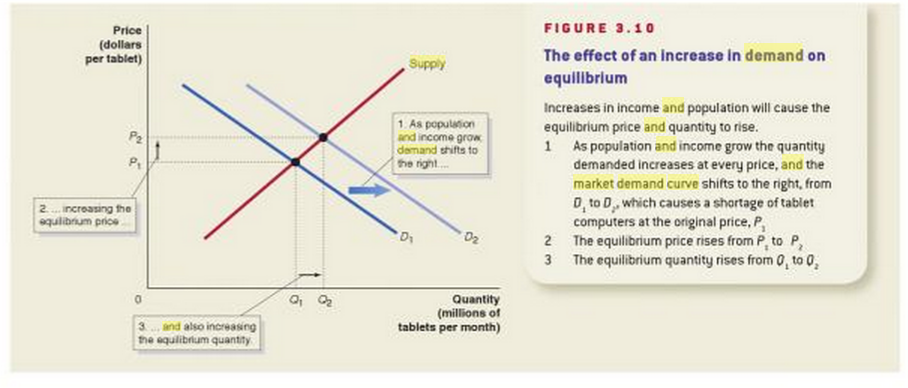

The demand for semiconductor products is caused by the rise in the global demand for smartphones and tablets. It may grow further with the increase in the manufacture of smart watches. The launch of Apple iPhone 6 increased the demand for the NAND flash chips to reflect production efficiency. However, demand does not translate to price increases. In fact, demand only increases when the NAND flash manufacturers like Toshiba can lower prices or charge the same prices for advanced chips (Rodriguez-Ardura, Meseguer-Artola, & Vilaseca-Requena, 2008). Thus, one critical driver of demand will be an increase in technology on the supply side, which will lead to lower prices and improved marketing of finished products on the consumer side, as in the case of the iPhone 6 (DRAM Exchange, 2014).

Possibilities of training labor force further to increase productivity and lower cost of production

Electronics manufacturing is a highly specialized industry that requires massive investments in capital equipment to improve productivity and precision. Nevertheless, labor remains a significant factor of production in the industry because large manufacturing plants are dedicated to product assembly after the initial design of components. Labor input in electronics manufacturing has been in the high-end positions, like engineering and design or management, on one side, and the low-end assembly of factory workers, on the other side. In the first part, an increase in the knowledge of managers, designers, and engineers leads to an increase in their output in terms of the value delivered to the firm.

However, such value depends on the interplay between the different components of the company’s success strategies. Engineers and designers can come up with faster and cheaper ways to produce the same goods and allow the company to increase its economies of scale. At the same time, they could create innovations that are not practical due to funds’ limitations and aggressive competition or lack of demand. Therefore, it is possible to train the labor force to increase production and lower the cost of production, but that is not always the case. In the low-end labor categories, additional training of labor may only increase productivity and not lower the production cost (Ong, 2006).

Profitability and sustaining it

All the market segments covered by Toshiba have room for profitability. The company serves consumer electronics, control systems, elevators, point of sale systems, and semiconductors, among many other segments relevant to its core capabilities. The market size of social infrastructure companies, home appliances, and health care vendors has increased in the last few years and should continue growing. Therefore, Toshiba has the prospects of remaining profitable in the future. As a leading chipmaker, which is its core business in the semiconductor industry, the company experienced increased profits for the last three-quarters of its financial year.

Toshiba has been quick to move to profitable market segments and away from the unprofitable ones. An increase in rivalry and decreased comparative advantages for the firm in some sectors influence its strategic decisions. For example, the company chose to quit the North American TV market because of declining sales. Instead, it chose to focus on the emerging markets as avenues for growth (Agence France-Presse, 2015). Finding markets where demand is high and costs of production allow the company to charge a competitive price is a good move that will ensure Toshiba can make its profits grow.

Ways of making the profit grow

The company expects a rise in the demand for its flash memory chips, which should translate to profitability because the company is a leading chipmaker for Apple Inc., the manufacturer of iPhones and iPads, as well as MacBook computers that are very popular mobile phone and computing devices across the world. The supplier partnership ensures that Toshiba can sell a continuous high volume of its chips to match the increasing demand for Apple’s products (Reuters, 2013). The company can sustain its profitability by entering into other similar supplier partnership agreements with renowned global brand makers in the electronics industry to provide a stable and high demand for its chip business.

Other relevant factors

The growth in the smartphone and the tablet industry globally is fueling demand in the NAND flash memory (Alpeyev, 2015). As the number of smartphone and tablet manufacturers increases, companies like Toshiba can perform favorably in the market as they find a ready demand for their innovative products. In 2014, Toshiba developed the world’s smallest class-embedded NAND flash products as a value addition to its 15nm NAND flash memory chips (Business Wire, 2014).

Therefore, although its rivals like Samsung may be ahead in other parts of the NAND flash technology, Toshiba still has room for growth and profitability if it concentrates on value addition to make its products relevant to the market demand presented by smartphone and tablet manufacturers across the world. Electronic goods are going to mature with time and cause an increase in supply and the lower prices. The only way for Toshiba to continue with its profitability momentum will be to continue divesting into other industries in the long term.

Conclusion

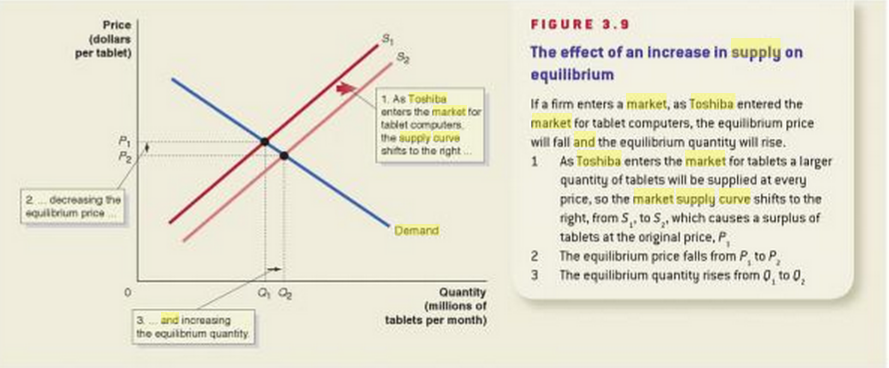

Toshiba can grow its profits and its market share of the global semiconductor industry by focusing on manufacturing agreements with the world’s largest chip buyers. They include companies like Apple and HTC, which manufacture smartphones and tablets to meet a growing global demand for consumer electronic products. Moreover, Toshiba can increase its innovations in other consumer electronics areas, such as home appliances, where being innovative pays off in terms of increased demand for a company’s products. Working closely with its clients ensures that the company understands market demand and end-user consumer preferences. Furthermore, Toshiba must keep costs of manufacturing low, because it operates in an oligopoly market. In this case, changes in one manufacturer’s price can easily upset the market equilibrium to cause gains or losses for other companies. Keeping manufacturing and R&D costs low will ensure that Toshiba remains afloat and capable of funding its innovations for long-term competitive capabilities.

References

Agence France-Presse. (2015). Toshiba profits soar, exits North American TV business. Industry Week. Web.

Alpeyev, P. (2015). Google challenge to iPhone reign opens platform door for Toshiba. LiveMint. Web.

Business Wire. (2014). Toshiba launches world’s smallest-class embedded NAND flash memory products. Business Wire. Web.

DRAM Exchange. (2014). Trend force: iPhone 6 increases demand for NAND flash in smartphones. DRAM Exchange. Web.

Hasentab, B. (Ed.). (2011). McKinsey on semiconductors. New York, NY: McKinsey. Web.

Hubbard, R. G., Garnett, A. M., Lewis, P., & O’Brien, A. P. (2015). Macroeconomics 3. Frenchs Forest, NSW: Pearson Australia. Web.

Inagaki, K. (2014). Toshiba, SanDisk joins 3-D chip race: Move looks to capitalize on smartphone growth. Web.

Ong, A. (2006). Neoliberalism as exception: Mutants in citizenship and sovereignty. Berkeley, CA: Duke University Press. Web.

Pitzer, J. W., Maekawa, H., Ahmad, F., Paik, A., & Carver, R. (2014). Apple nudging smartphone makers to boost NAND. Barrons. Web.

Reuters. (2013). Japan’s Toshiba sees 34 percent jump in profit in FY 2013/14. Reuters. Web.

Reuters. (2015). U.S. inflation drops the most in six years – and it’s not all oil. Financial Post. Web.

Rodriguez-Ardura, I., Meseguer-Artola, A., & Vilaseca-Requena, J. (2008). Factors influencing the evolution of electronic commerce: An empirical analysis in a developed market economy. Journal of Theoretical and Applied Electronic Commerce Research, 3(2), 18-29. Web.

Team, T. (2015). Trends that will drive Samsung’s semiconductor business in 2015. Forbes. Web.

Toshiba. (2014a). Annual report 2014. Web.

Toshiba. (2014b). Corporate Information. Web.