The organization in the focus of this research is Ford Motor Company. Founded in 1903, the company has been a pioneer in global industry (“Our company,” 2018). The company is concerned about making their “cars better, our employees happier and our planet a better place to be” (“Our company,” 2018, para. 2). Since high-quality vehicles are needed all over the world, Ford is actively expanding to the word’s markets. The company builds its work to follow the vision, which is “People working together as a lean, global enterprise to make people’s lives better through automotive and mobility leadership” (“Our company,” 2018, para. 4).

Ford is a company that demonstrates a steady increase in revenue throughout the majority of the last ten years. There was a dramatic drop from $143,584 million in 2008 to $115,125 in 2009, but the company overcame the crisis and finished 2011 with $128,122 million revenue (“Ford’s revenue from FY 2008 to FY 2017 (in million U.S. dollars),” 2018). As of 2017, the revenue of the Ford Motor Company was $156,776 million. Still, the company’s focus is not only making profit. Ford Motor Company is demonstrates climate commitment by taking responsibility for reducing greenhouse gas emissions through developing hybrid and electric vehicles (“Sustainability report 2017-2018,” 2018).

The company is highly concerned by constructing smart vehicles and conduct research about self-driving vehicles, which are important for building a city of tomorrow. The company provides responsible and transparent governance through clear policies and strategies. The most significant aspects for the company are ethical business practices, reduction of carbon footprint and fuel economy, product quality and safety and the resulting customer satisfaction, effective supply chain management, and government regulation and policy. This paper analyses the major aspects of the Ford Motor Company’s performance based on its financial statement, provides pro forma financial statement, conducts a ratio analysis, and evaluates the soundness of the company’s financial policies.

Financial Statement Review

Financial statement of the Ford Motor Company are presented in its annual report. The company closed 2017 financial year with 2,566 thousand of units sold to retailers in the United States and 4,041 thousand sold in other markets throughout the world (Ford Motor Company, 2018). Total revenues for year 2017 are $156,776 million, which indicates an increase in revenues compared to $151,800 million in 2016. Net income of the company increased significantly from $4,607 million in 2016 to $7,628 million in 2017 (Ford Motor Company, 2018).

The major share of income comes from the company’s automotive segment while the financial services segment makes up about one quarter of the company’s net income. Costs and expenses of the company also increased. Thus, cost of sales in 2017 was $131,332 million while in 2016 this indicator was $126,193 million (Ford Motor Company, 2018). At the same time, interest expense on automotive debt grew up as well and was $1.133 million in 2017. An increase was observed in basic income per share, which changed from $1.16 million in 2016 to $1.91 million in 2017.

An increase was recorded in the company’s assets, liabilities, and equity. For example, total assets of the Ford Motor Company grew up by almost $200 million in 2017 compared to 2016 from $237,951 million to $257,808 million respectively (Ford Motor Company, 2018). Company’s total liabilities boosted from $208,668 million in 2016 to $222,792 million in 2017, mainly due to the growth of financial services long-term debt. Total equity increases as well. While capital in excess of par value of stock did not change much, retained earnings grew up, thus leading to total equity growth from $29,170 million in 2016 to $34,890 million in 2017 (Ford Motor Company, 2018). Moreover, the company observed a slight increase in net property value.

Pro Forma Financial Statements

Pro forma financial statements are the tools that allow forecasting the impact that change in the company’s policy can have on its financial situation (Byrd, Hickman, & McPherson, 2013). In this paper, the Ford Motor Company 2017 Annual Report will be used to construct a pro forma income statement for 2018 and 2019. It will be grounded on some assumptions about how the business performed during 2016 and 2017. The historical income statements for the company can be found in Table 1 and Table 2.

Table 1. Ford Motor Company and Subsidiaries Consolidated Income Statement (in millions, except per share amounts).

Table 2. Consolidated Statement of Comprehensive Income (in millions).

Based on the data found in the report, the assumptions for 2018 and 2019 are as follows.

- Sales will increase by 10% in 2018 and 2019 compared to 2017 levels.

- COGS and SG&A will preserve the average percent from sales similar to what they were for the last two years.

- The tax rate is expected to be 25%.

- Dividend payout will remain at the average level of years 2016 and 2017.

According to the assumptions mentioned above, sales are expected to increase by 10% in 2018. Therefore, they will make 1.10 × $156,776 = $172,454 in 2018. The same growth is likely to be observed in 2019. Considering a 10% increase, sales will make 1.10 × $172,454 = $189,699 in 2019.

Another indicator of interest is the cost of goods sold (COGS). It is the accumulated total of all costs used to create a product or service, which has been sold. A manufacturer is more likely to use the term COGS while retailers operate a term “cost of sales” more frequently. In the report of the Ford Motor Company for 2017, the term cost of sales is mentioned. Thus, in 2016 and 2017, cost of sales were 83,1% and 83,8% respectively. Assume that cost of sales will be the average of 83,1 and 83,8, which is 83,5%, in 2018 and in 2019.

Gross margin can be obtained subtracting cost of sales from revenue. SG&A expense was 7,2% of sales in 2016 and 7,4% in 2017, so the average of 7,3% percent of sales can be used in 2018 and 2019. Depreciation expense can be found in Table 3.

Table 3. Depreciation Expense.

EBIT = Gross margin – SG&A expense – Depreciation expense.

Interest expense can be found in Table 1.

Taxable income = EBIT – Interest expense.

Net income can be found in Table 1. Other results can be obtained by computing taxes at 25% and subtracting them from taxable income to get net income. Thus, it can be assumed that the percent was probably not 25%.

It is necessary to subtract dividends from net income to identify how much money will be reinvested in the firm by adding it to retained earnings on the balance sheet. The pro forma income statement for Ford Motor Company can be found in Table 4.

Table 4. Pro Forma Income Statement.

Table 5. Ford Motor Company and Subsidiaries Consolidated Balance Sheet (in millions).

The assumptions for 2018 and 2019 are that common stock will not change. To complete the pro forma balance sheet, it is necessary to count the Cash per cent of sales (Revenue for 2016 and 2017) from Table 1 (Income statement). It was 10,5% in 2016 and 11,8% in 2017, so it can be assumed that the average for 2018 and 2019 will be 11,2%.

Since in the balance sheet present in the Ford Motor Company 2017 Annual Report does not follow the scheme of a classical balance sheet, there are some different positions. Therefore, there are no rows that correspond to traditional item of “Plant, Properties & Equipment (PP&E)”. The data that reflect “Net PP&E” are in the table 6.

Table 6. Net property of The Ford Motor Company (in millions).

Since the concept of “Net PP&E” is different from “Plant, Properties & Equipment (PP&E)” and “Accumulated depreciation” (which are found in table 3), it is possible to solve an inverse problem and calculate the value of “Plant, Properties & Equipment (PP&E)”:

PP&E = Net PP&E + Accumulated depreciation.

“Total assets” for years 2016 and 2017 are given in Table 5. Based on these data, pro forma total assets can be provided for years 2018 and 2019. Analogously, the Ford Motor Company 2017 Annual Report has no data for “Bank loan” and “Other CL”, but there are “Total current liabilities”, which is a similar concept. Consequently, it is possible to predict liabilities for years 2018 and 2019. Retained earnings are the values of retained earnings in 2017 plus retained earnings from Pro forma income statement (table 4) for 2018. Similarly, the respective value for 2019 is calculated. All of the mentioned data are included in pro forma balance sheet, which can be found in Table 7.

Table 7. Pro Forma Balance Sheet.

A Ratio Analysis for the Last Fiscal Year

Ratio analysis is an integral component of the company’s financial management. It is grounded on data included in financial statements of an organization and allows evaluating diverse aspects of operation and performance of a company. Ratio analysis comprises such aspects as liquidity ratios, financial leverage, asset management, profitability ratios, market value, and return on equity.

Analyzing the Liquidity Ratios

The current ratio

The current ratio measures how many times the company can cover its own current liabilities. The quick ratio measures how many times the company can cover current liabilities without selling any inventory and so is a more exact measure of liquidity. The current ratio for the Ford Motor Company for 2018 will be calculated in the following way. First of all, the Total Current Assets are taken which make 125,719 (see Table 7) and divided by the Total Current Liabilities (according to Table 7, Total Current Liabilities = 103,312).

Current Ratio = 125,719/103,312 = 1.22X

It means that the company can pay for its current liabilities 1.22 times over. Analogously, the current ratio for 2019 is calculated:

Current Ratio = 138,291/113,630 = 1.22X

It means that in 2019, the company can also pay for its current liabilities 1.22 times over. A quick analysis of the current ratio shows that the company’s liquidity will be the same in at least two subsequent years.

The quick ratio

In order to calculate the quick ratio, the Total Current Ratio for 2018 is taken and Inventory point is subtracted out. After that, the results divided by Total Current Liabilities. In the Ford Motor Company 2017 Annual Report, there is no information containing proper data on inventory or property, plant, and equipment. Therefore, the “PP&E” was calculated and can be used for defining quick ratio. Thus, quick ratio for 2018 is as follows:

Quick Ratio = 125,719-42,768/103,312 = 0.803X.

For 2019, the calculation is the same and quick ration is also 0.803X. Similarly to the current ratio, the quick ratio does not change. Thus, the company’s liquidity will remain at the same level. Usually, a company has two sources of current liabilities such as accounts payable and notes payable. Also, companies have bills that they owe to their suppliers (these are accounts payable). Moreover, nearly every company has a bank loan or an alternative source of financing. Since there is no information about the frequency of payments on the note, there is no opportunity to include them in the analysis.

Financial Leverage

Financial leverage is an indicator which presents the degree of fixed-income securities application by a company. These securities include debt and preferred equity. Financial leverage increases in case a company is using more debt financing. A high degree of financial leverage results in high interest payments, which, in turn, have a negative effect on the company’s bottom-line earnings per share.

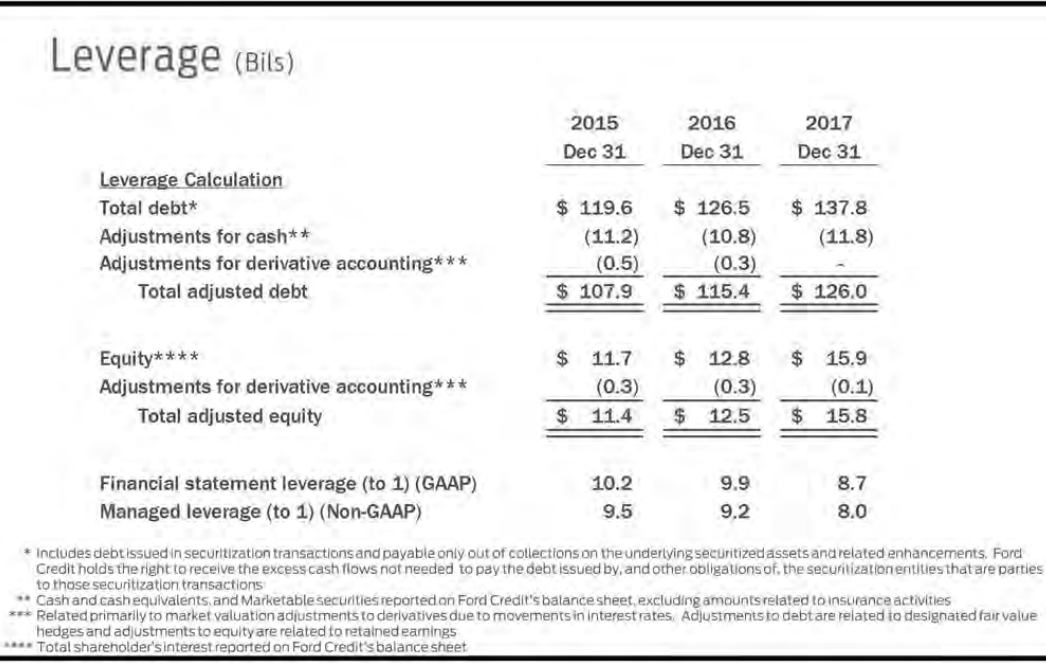

Ford Credit plans its managed leverage grounded on prevailing market conditions and with the consideration of the risk characteristics of its business. As of December 31, 2017, Ford Credit’s financial statement leverage was 8.7:1, and managed leverage was 8.0:1. Ford Credit targets managed leverage in the range of 8:1 to 9:1 (See Figure 1).

Analyzing the Asset Management Ratios (Accounts Receivable)

Asset management ratios make another group of financial ratios that should be considered for analysis. They provide the business owner with information about the efficiency of their assets utilization to generate sales. In other words, these ratios indicate how successfully a company is using its assets to generate revenues.

The receivable turnover ratio

This ratio is also called debtors turnover ratio or accounts receivable turnover ratio and illustrates the velocity of an organization’s debt collection and the number of times average receivables are turned over during a year. This ratio influences the tempo with which a company achieves outstanding cash balances collected from its customers within an accounting period. This indicator is crucial for company’s financial and operational performance. Moreover, it can be used to determine any complications with collecting sales made on credit that a company has.

Receivables Turnover = Credit Sales/Accounts Receivable

For years 2018 and 2019, the result is 3,135. It means that all accounts receivable are cleaned up (paid off) 3,135 times.

Analyzing the Profitability Ratios

The last group of financial ratios that is in focus of business owners is the profitability ratios. In fact, it summarizes the ratios of 13 ratio groups. They indicate success in such aspects of a company’s performance as cost control, efficient use of assets, and debt management, which are three vital areas of any business.

Net profit margin

The net profit margin is a measurement of contribution that every dollar of sales makes to profit and how much of this amount is used to cover expenses. For example, in a company with a net profit margin of 5%, 5 cents of every dollar made on sales go to profit and 95 cents go to expenses. For the Ford Motor Company, the net profit margin in 2018 is as follows:

Net Profit Margin = Net Income/Sales Revenue = 6,855/172,454 = 4%

For 2019, the net profit margin value is the same. In 2016, the net profit margin was 4.5%, and in 2017 it was 3,7%. Therefore, the company observed a decrease after 2016, and an increase in their net profit margin is expected after 2017. It is evident that their sales increased while their cost of goods sold fell before 2018, which led to the growth of net profit margin.

Return on assets

The return on assets ratio, which is also called return on investment, represents the company’s asset base as well as the type of return it receives on the investment in its assets. It is better to consider the total asset turnover ratio and the return on asset ratio together. In case total asset turnover is low, the return on assets is expected to be low as well due to low efficiency of assets’ utilization by a company.

Another approach to study the return on assets is in the context of the Dupont method of financial analysis. This approach to analysis reveals the picture of return on assets in the context of both the net profit margin and the total asset turnover ratio. To calculate the Return on Assets (ROA) ratio for The Ford Motor Company for 2018, the formula is as follows:

Return on Assets = Net Income/Total Assets = 6,855/276,957 = 2.5%

For year 2019, the return on assets is the same. For two previous years, ROA2016 = 2,9% and ROA2017 = 2,3%. Since for 2018 (and 2019), the ROA is 2,5%, it is possible to state that the decreased (after 2016) and then increased return on assets in 2018 reflect the growth of sales, reduction of costs, and significantly higher net income for that year.

Return on Equity Calculation

Return on Equity

The return on equity ratio (ROE) is of high interest to shareholders or investors of a company. This ratio informs the business owner as well as the investors about the amount of income per dollar of their investment the business under analysis is earning. This ratio can be also discovered by applying the Dupont method of financial ratio analysis. For the Ford Motor Company, return on equity for 2017 was as follows:

Return on Equity = Net Income/Shareholder’s Equity,

Shareholders’ equity = Total assets – Total liabilities.

The data and results are in the table 8.

Table 7. ROE for the Ford Motor Company.

In year 2016, ROE was 4,6% while in 2017 ROE = 3,6%. According to the calculations, ROE is 3,9% for 2018. One reason for the increased return on equity was an increase in net income. In case of applying the return on equity ratio analysis, the business owner should also consider the volume of financing by means of debt and how much of the company is financed using equity.

Management Performance Assessment

One of the approaches to assess management performance is to calculate Economic Value Added (EVA). EVA, or economic profit, is the difference between revenues and costs, where costs include not only expenses, but also the cost of capital.

- EVA = NOPAT – WACC*(Total assets – Current liability)

or

- Economic profit = NOPAT – Cost of capital × Invested capital

The data for 2016 and 2017 can be found in the 2017 Annual Report (Ford Motor Company, 2018). Using additional information about the company’s EVA, the data are expanded to cover years 2018 and 2019 (“Ford Motor Co. (F),” 2018). The results are provided in Table 8.

Table 8. EVA for the Ford Motor Company.

Evaluation of the Soundness of the Company’s Financial Policies

The sustainable development of the Ford Motor Company is a result of its sound financial policies. Thus, the company provided active investment policy to expand to distant markets such as South American and Asian Pacific. As for the capital structure, the company has a substantial debt, but still remains a leader in the industry and manages to increase the revenue every year. The analysis of financial leverage of the company proves that Ford manages maintaining its leverage within the determined limits. The company’s dividend policy is also sustainable with preserved levels of dividends paid throughout the year.

Synopsis of Findings

Summarizing, it should be mentioned that the Ford Motor Company is a firm that demonstrates steady growth and spreads to international markets. Its annual report and pro forma calculations prove that the company is on the right way to achieving sustainability and increasing profit. Thus, it is expected that sales will grow by 10% during two subsequent years and the company will preserve the same rate of dividend payout.

The cost of sales is also likely to increase in 2018 and 2019. Depreciation and amortization expenses are also the indicators that grow, which can demand more investment in equipment and innovation. Still, the increasing revenue of the company allows investing in its own development and proves that Ford is developing. On the whole, the analysis of the Ford Motor Company financial statements provides evidence for its success and it can be recommended to purchase stock from this company.

References

Byrd, J., Hickman, K., & McPherson, M. (2013). Managerial finance. San Diego, CA: Bridgepont Education.

Ford Motor Co. (F). (2018). Web.

Ford’s revenue from FY 2008 to FY 2017 (in million U.S. dollars). (2018). Web.

Ford Motor Company. (2018). 2017 annual report. Web.

Key performance data. (2018). Web.

Our company. (2018). Web.

Sustainability report 2017-2018. (2018). Web.