Business simulation is a process by which entrepreneurs single out the requirements needed in the business and then develop solutions that can satisfy these needs. The analysis is important since it ensures that a company’s resources are utilized in the most effective ways so as to achieve the goals of the company.

This implies that, business simulations lead to reduced cost of production and other operations while on the other hand, increasing the profit margin (Cadle, Paul & Yeates 2010, p. 3).

There are aspects considered while analyzing a company. These factors include the history and the experience of the company, its objectives, market (target market), competition, financial status, and future plans among many other factors (Blais 2012, p. 39). This paper analyzes Prestige Motors Company on these various aspects.

History and Experience of Prestige Motor Company

Prestige Motor was formed 6 years ago by a group of automobile experts it is a locally based company. From the time this company was formed, it has been dealing in a wide range of executive vehicles. These models include PR-1, PR-2, PR-S1, PR-X2 and PR-M8. The company solely conducts its markets research as well as the marketing of its products (Leeds Metropolitan University 2009, p. 1).

The company’s many years of experience make it one of the best car dealers in the entire region. It offers the best services to its customers and as a result, has been able to retain very many customers. Prestige Motor has a staff consisting of professionals of high caliber.

The company offers some of the most attractive deals in the area. It is located at a convenient point making it very easy for the customers to trace it. In addition, it offers other services such as the sales of used vehicles. It accepts various forms of payment, a factor that could be considered as an advantage to the customers (Thomas 2008, p. 281).

Objectives

The main objective of Prestige Motor is to ensure that it offers the best services to its customers. For that reason, the company strives to produce the best and most modern car models.

To support the main objective, the company has developed other objectives. They include ensuring Prestige safety, improved information processing, developing models that are energy efficient and adoption of scientific advances (Carkenord 2008, p.13).

Prestige Motor through its researchers has been able to bring to the market cars that have sensors. Sensors are devices that detect driver’s exhaustion and other factors that may interfere with the driver’s attention. This is a move geared at improving safety of the drivers while on the road.

The move has dramatically reduced the occurrence of accidents that were initially caused by Prestige cars. Currently, the research team is working on a strategy to develop other safety systems such as those that detect developing dangers such as oncoming traffic and wind around prestige vehicles (Cadle, Paul & Yeates 2010, p. 186).

The company has achieved its first dream, transiting from electrical cars with power control machines to the ones with sensors. The company plans to produce cars with GPS that are voice-activated. In addition, these new makes will have emergency communication devices together with cell phones (Cadle, Paul & Yeates 2010, p. 191).

The company has succeeded in building an energy saving car models. In fact, it is the first company to produce a hybrid car in the region. This hybrid car is a product of semi-conductor power device know-how.

At the moment, the company is looking for strategies that would enable it develop models with lower fuel consumption. There is also an ongoing research to establish cars with alternative energy sources such as solar cells (Carkenord 2008, p. 17).

The research team is working on a plan to develop more efficient engines that consume less amount of fuel and which produce less noise. These models will be developed using engine vibration and stimulated airflow technology. The company also plans to make vehicles that are more aerodynamic based on mirror vibration and wind throb technology (Carkenord 2008, p. 35).

The Market for Prestige‘s Products

The company produces vehicles that only suit the need of the customers. This implies that Prestige Motor’s vehicles are manufactured according to the specifications of its researchers. The researchers provide the details that conform to the ones they gather in the fields. As a result, these vehicles are being produced to match customers’ specific need. The company has widened its market locally and globally (Carkenord 2008, p. 39).

The company has discovered that, emerging economies purchase more cars than the economies that are already developed. For that reason, the company has been directing most of its marketing efforts to developing countries and very little, to developed ones.

As a matter of fact, these emerging economies constitute more than 60% of the entire market for Prestige products. To ensure that these emerging markets are retained, the company manufactures relatively cheaper vehicles since most of these people are just average earners (Carkenord 2008, p. 30).

The company relies on target marketing. All its marketing and adverts are directed to specific prospects, people who are likely to purchase the company’s products. The importance of target marketing is that, it saves money and time. The marketing strategy ensures that all the marketing efforts and resources are directed to the right people. The strategy is also known to yield good outcomes (Cadle, Paul & Yeates 2010, p. 35).

The company’s main challenge is the companies which offer similar products but at a lower price. Even though, their products are of lower qualities, the fact that their products are cheaper hinders Prestige products from penetrating the market of the developing regions.

Citizens of developing countries prefer to buy cheaper auto-mobiles in order to save money. They pay a lot of attention to cost thereby assuming the quality of a product (Carkenord 2008, p. 36).

The Company’s Financial Statement

Other Financial Statements of the Company

Target Promotion

Data retrieved from Leeds Metropolitan University 2009 Web

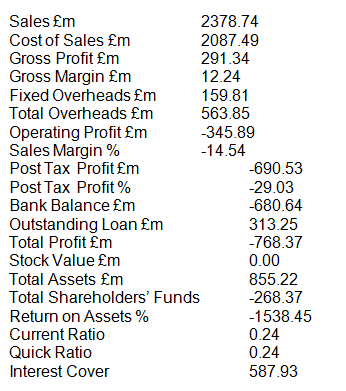

The company has made a total sale amounting to 2378.74 sterling pounds. This was possible following the effective marketing and advertisement strategies it employed during the selling processes. The cost incurred while making the sales totaled to 2084.49 sterling pounds.

The costs were far much less than the actual sales. As a result, the company recorded a pre-tax gross profit of 291.34 sterling pounds. Compared to its competitors, Prestige Company recorded relatively high gross profit. This implies that this company is competing fairly well in the motor manufacturing industry (Blais 2012, p. 109).

The company has a gross margin of 12.24 sterling pounds. Gross margin is the difference between the cost of production and the sales revenue. The company’s margin is positive indicating that the company’s revenues surpassed the cost it incurred in producing these cars.

In essence, this shows that Prestige Company is faring well in the industry. This is also reflected in the company’s fixed overheads and total overheads. The company’s total overheads amount to 159.81 sterling pounds and fixed overheads sum up to 563.85 pounds (Cadle, Paul & Yeates 2010, p. 99).

Since the company is still new in the motor manufacturing industry, there are some hidden expenses that it has to meet. These expenses have great impact on the operating profits. As a result, the company has recorded a bad operating profit of -345.86 sterling pounds.

It is obvious that ones the operating profit is affected, post tax profit and sales margin will be affected as well. The company’s sales margin is -14.54% while the post tax profit is -690.53. If the company was an old one, these hidden expenses, which drastically reduce the gross profits, would be minimized. Still, the company’s trend shows that, it will be able to avoid such expenses in due course (Blais 2012, p. 112).

The company still depends mostly on financial institutions in order to finance its operations. The revenues obtained from sales of the cars are not sufficient to cover all the expenses. For that reason, the company has been forced to dig deeper to its bank savings, to finance some of the operations.

The company’s overall bank balance is -680.64 and 313.25 as the outstanding loan. In turn, this has affected the total profit, reducing it to -768.37. Still, the company’s management has been effective enough to prevent the effect from spreading to value of stock. The value of stock is maintained at zero (Carkenord 2008, p. 42).

Even though the company has been able to maintain the value of stock at 0.00, it is evident that the company is in dire need of other sources to help it finance its operations.

The management is currently working on a plan that will see the company finance most of its operations from its own revenues. This strategy will assist in ensuring that the company avoids unnecessary debts that negatively affect its profits (Cadle, Paul & Yeates 2010, p. 102).

The company does not have many assets. Its assets in monetary value amount to 855.22 sterling pounds. These assets are sufficient enough to run the company. However, the company plans to add more assets under its expansion program.

Probably, the small amount of the assets and reduced bank reserve has resulted in the company not being able to return value to the share holders and the assets. The total funds for share holders are recorded as -268.37 sterling pounds whereas the percentage of return on assets is -1538.45 (Blais 2012, p. 114)

The company’s current ratio of 0.24 indicates that the company is still incapable of meeting all its short term liabilities using the short term assets. It is a common knowledge that the ratio determines a company’s ability to offset its short term liabilities.

The lower the current ratio the more incapable the company is of meeting majority of its short term obligations. This also applies to the quick ratio. The company’s quick ratio is less than one. This implies that it still requires some interventions in order to be able to meet its short-term obligations (Blais 2012, p. 115).

The company has recorded an interest cover of 587.93. Unlike the quick and the current ration, the interest cover is a bit encouraging. This cover determines the company’s profits adequacy in comparison to the interests it incurs on its debts. The cover is large enough and this shows that Prestige Company is able to pay all its interests using the profits it obtains from the sales (Cadle, Paul & Yeates 2010, p. 107).

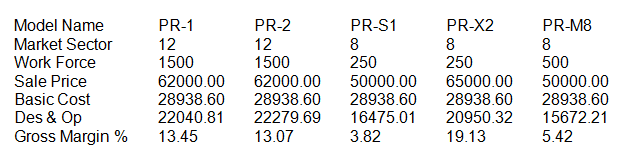

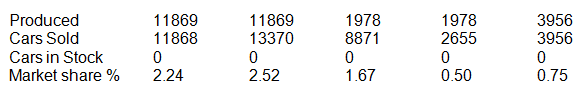

There are five models of cars manufactured in Prestige Company. These models include PR-1, PR-2, PR-S1, PR-X2 and PR-M8 having workforce of 1500, 1500, 250, 250, 500 respectively. These models sell at 62000, 62000, 50000, 65000 and 50000 respectively.

The fourth model has the highest gross margin of, 19.13%. For that reason, the company plans to increase its labor force and the number of units produced, this move will increase the company’s sales. The move will also include increasing its market share from 0.50% to more than 2.60% (Leeds Metropolitan University 2009, p. 1).

Recommendations

Firstly, Prestige Company needs to increase the number of the shareholders. The current investors that the company currently has do not contribute enough money that can finance all the operations of the company. As a result, the company operates at a very low quick and current ratio.

This is particularly dangerous since the company cannot fully finance its current liabilities using the current assets such as sales. Therefore, increasing the number of shareholders will automatically increase the amount of money that the company will reserve for any uncertainty (Thomas 2008, p. 272).

The management of Prestige Company needs to re-examine the total number of employees that serve at the manufacturing level. The number of units of a model needs to reflect the market share of that model. For instance, the model PR-M8 has been accorded smaller workforce whereas it has a bigger market share.

Therefore, it is recommendable that the models, which sell most be accorded bigger workforce. This will increase the number of units produced thereby increasing the sales of that particular model (Thomas 2008, p. 274).

Lastly, the current prices of Prestige models are slightly higher given that the company is new in the industry. People rarely purchase expensive cars which they have very little knowledge about. Therefore, it is only proper if the prices are slightly cut and the promotional activities for the models should be increased. This will have the effect of attracting more customers, which in turn will increase the sales volume (Thomas 2008, p. 275).

References

Blais, S 2012, Business analysis: best practices for success, Wiley, Hoboken, NJ.

Cadle, J, Paul, D & Yeates, D 2010, Business analysis, British informatics Society, Swindon.

Carkenord, BA 2008, Seven steps to mustering business analysis, J. Ross Ft Publisher, Lauderdale, FL.

Leeds Metropolitan University 2009, Business analysis and practice: x-stream. Web.

Thomas, SJ 2008, The journey to improved business performance, Industrial Press, New York, NY.