Using appropriate theory and models identify the major external factors which have undermined Fords Strategic position as at 2007.

2007 was considered to be the year of great losses for Ford Motor Co. The losses were even bigger than it was forecasted and the experts did not reject the greater losses in the future. Ford’s leading F-series were at the bottom of sales and the company had to cope with those problems as far as it could (Isidore 2007). The company’s position was not a surprise for the Wall Street as due to some specific external factors the situation was predicted.

Globalization is one of the main external impacts on the company performance. The increase of the competitors from other countries, such as Japan, does not give Ford Motor Co. an opportunity to follow their fast change and meeting consumers’ tastes. Japan swiftly entered the US market and gained a leading position. Placing its manufacturing in low-wage and non-union regions in the USA, it was in the privileged position. Toyota and other companies also entered the international market and their manufacturing activities were greater than those of Ford Motor Co. were Thus, it may be stated that high competition was one more reason which caused the decline of the production in Ford Motor Co. (Schifferes 2007).

Financial crisis of 2007-2009 was one more reason which impacted Ford’ decline in sales. The inability to meet the coming changes and accommodate to them was one more external factor which identified the company’s position in 2007. Using ‘financialization’ strategies, Ford tried to save its position as the reduction in sales was observed even before 2007 and the financial crisis could have been devastating for the company. The government offered help and implemented a number of policies to protect automotive industry (Bailey, Ruyter, Michie & Tyler 2010). However, Ford did not want to take the governmental help, it was assured that it could cope individually, without influential assistance (Schifferes 2007).

Which changes in the automotive industries Critical Success Factors, over recent years have most impacted upon this organisation, in terms of its current level of “EVR” congruency or loss? i.e. Environment, Values and Resources, from Thompson and Martin (2005).

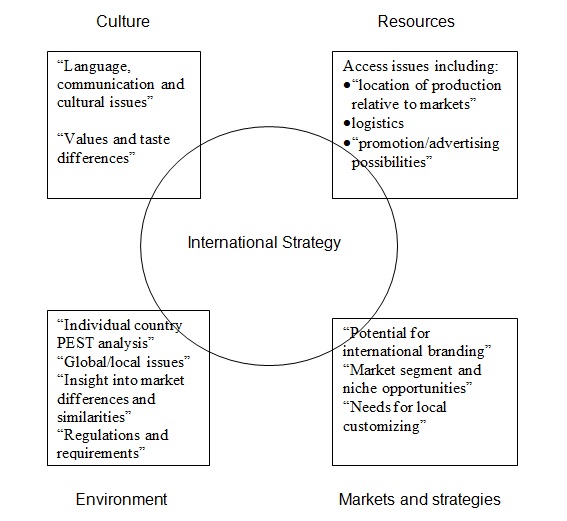

Before getting down to discussing changes in the automotive industries Critical Success Factors which influenced Ford Motor Co. over recent years, it is important to understand the nature of Environment, Values and Resources. According to Thompson and Martin (2005), E-V-R congruency is a guarantee of successful business strategy. The figure 1 helps understand the real nature of the congruency and explain the role of each factor in the model. Therefore, it may be concluded that E-V-R congruency is an essential part of international strategy which Ford Motor Co. tried to achieve.

Thompson and Martin (2005) are sure that financial success fails to be the only guarantee of leading effective business in the company. Furthermore, they even declare that the absence of E-V-R congruency is one of the reasons of business failure. Following the situation with Ford Motor Co., it should be stated that the changes in the automotive industry affected the organization under consideration in terms of E-V-R congruency.

Ford Motor Co. believes that the job cut is one of the most effective reasons. Being interested in reducing the costs on production, the company reduced 45,000 jobs in North America (‘Ford and GM see US sales decline’ 2007). Thus, it may be concluded that the increase of competition, the greater number of rival companies on the international market is one of the factors which impacted Ford. The governmental desire to affect the business in Ford organization and to offer a loan to it was ruined as the company preferred to preserve its family business, even though its share was not that great in the company (Szczesny 2008). Market segment has been changed due to the changes in the global issues. “Hybrid electric vehicles and forthcoming battery-electric and plug-in hybrids” (Hughes-Cromwick 2011, p. 167) are the changes the company has implemented in the E-V-R congruency. The nature friendly direction is one of the most positive and necessary changes which impacts company advertising strategy and the customer demand rate greatly.

How would you describe the nature of the E-V-R configuration at Ford as at 2007. Justify yourargument.

Considering the company profile of 2007, it may be completed that the company losses were devastating. The organization lost about US$5bn. The company decided to implement aggressive changes as the means for recovering from current situation. However, the actions were not positively reacted. Unfavourable economic situation in North America made the company reconsider its product markets and redirect more attention at the markets in South America (‘Company Monitor’ 2009).

Considering E-V-R congruency at Ford as at 2007, it should be stated that the Environment was positively directed at the company. Stakeholders were not depressed with the created situation, they even tried to support the company. Governmental support was also seen, even though Ford refused to get Senate’s assistance (Szczesny 2008). The national approval of the company was not ruined as well. The preference to Ford was because of the increased competition and variety, but customers did not lose trust to the car manufacture. The company resources, however, were lost. Ford Motor had to cut job places and shut down some specific plants with the purpose to remain in the business (‘Ford and GM see US sales decline’ 2007). However, public relationships were not ruined that points at the fact that the company’s actions directed at job cutting and area selling were not that negative.

Assuming that Ford’s retrenchment strategies, in terms of job cuts and selling of areas of its business portfolio, are successful in supporting a turnaround strategy generate, using appropriate concepts and models, generate four alternative possible strategic options they could now pursue.

Ford Motor Co. makes all possible to return at the market on the position it occupied. However, the job cuts and closure of several companies have negatively impacts the structure. Still, having considered the company strategy for 2011, it should be stated that the closure of some plants is planned on 2014 to make the process less painful. Nevertheless, the company has to sacrifice some manufacturing with the purpose to protect the whole company business (‘Company Profiles’ 2011, p. 30).

Having conducted a SWOT analysis for Ford Motor Co., it may be concluded that the company should choose the strategies aimed at the opportunities and company strengths. The deep consideration of the Ford’s strengths and opportunities helped to develop four following strategies the company may use:

- Increase of the production of the hybrid electric vehicles.

- Extend a production on a new Asia Pacific market.

- Increase of the strategic investment.

- Making engineering, research, and development as an outsourcing branch for other companies (‘Datamonitor’ 2010).

These four techniques may help Ford Motor Co. gain its previous positions in the world car manufacturing. These strengths and opportunities the company has should be used. Getting down to more detailed consideration of each of the strategies mentioned above, the following information should be stated.

The increase of the production of the hybrid electric vehicles should be explained by the world tendency to the increased demand on such vehicles. The environment protection movements caused great demand on nature safe vehicles. Ford should pay more attention to the development of the highly innovative hybrid with emissions reduced to minimum. The company also pays more attention to small cars as the way to help people safe on fuel (Cable 2010).

The extension of the production on a new Asia Pacific market is a guarantee of successful company development (‘Datamonitor’ 2010). Having too tight competition in North America, Ford should search for new product markets were Toyota (the main rival of Ford) has not spread its influence. Investment into innovative development is exactly what Ford needs at the moment. Offering engineering, research, and development as outsourcing for other companies is a good idea, paying attention to the fact that Ford’s engineering capability is rather strong and can satisfy the needs of the company and those who need such services.

Apply evaluative techniques to each of these strategic options.

Dwelling upon the strategies mentioned above in detail, it should be stated that “company operates over 65 engineering, research and development centers worldwide” (‘Datamonitor’ 2010, p. 5). The company has an opportunity to use these resources to satisfying the needs of other companies, get profit (which comprised about $4.9 billion in 2009) and direct that profit for company development. The working positions are going to be saved along with additional financial profit (‘Datamonitor’ 2010).

The occupation of a new market is a great opportunity. A compound annual growth rate increased on 3.8 % ($285.5 billion) in 2009 in comparison with the previous period in Asia Pacific market. Indian and Chinese markets are opened for a new manufacture and are ready to consume its product (‘Datamonitor’ 2010). Ford should do all possible and invest more in improving its capacity at a new market. A new plant in China is a great step on the way to occupying Asia Pacific new car market.

Ford is interested in investing into new products. Working on such options for several years, the company has reached much success (‘Ford Motor Company 2011’ n.d.). One of the most successful affairs the company invested into is the support of research, design and development of hybrid vehicles. The company plans to put into production new next-generation hybrids in 2012. Moreover, the investment f the company in “powertrain engineering and facility upgrades in North America to $1.8 billion to support its 2011 vehicle launches” (‘Datamonitor’ 2010, p. 9).

The development of research and using this facility as outsourcing is a great opportunity for making some companies depend on Ford. This strategy may be used for developing business and economic connections with other companies and help Ford safe its brands. To the word, Ford had to sell some brands in 2007-2010 to remain a competitive company (Cable 2010).

From your evaluation which strategic option would you recommend to Ford?

Having considered a number of specific strategies Ford Motor Co. may use, it should be stated that strategic investment is considered to be one of the best strategies. The innovative technologies have become a guarantee of company success. The possibility to meet customers’ demand (environment safe vehicles) and their desires (small cars), Ford can become one of the leading companies again. Having experienced downsizing in 2007, Ford cannot recover from crisis up to now. The investment into new products may be helpful in increasing company segment, and attracting more loyal customers.

Moreover, investing into new development and technologies resulted into creation new vehicles may help the company return its leading positions in North American market. Many customers have refused from Ford products because the company is unable to meet their requirements. The tendency to ecologically safe vehicles is a good business and Ford should do all possible to satisfy customers’ needs. Thus, Ford Motor Company should direct more attention at strategic investment into development of innovative vehicles aimed at consuming fewer natural resources. Such strategy is winning, as the society needs ecologically neutral cars.

Moreover, according to the research in a couple of years, the USA is going to be the largest market for hybrid electric and plug-in hybrid electric vehicles with rough sales of 640,000 cars (‘Datamonitor’ 2010). If Ford Motor Co. wants to return its previous magnificence and leadership, it should make all possible to occupy this market.

Reference List

Bailey, D, Ruyter, A, Michie, J & Tyler, P 2010, ‘Global restructuring and the auto industry’, Cambridge Journal of Regions, Economy and Society, vol. 3, no. 3, pp. 311-318.

Cable, J 2010, ‘Fighting Through the Worst of Times’, Industry Week/IW, vol. 259, no. 6, p. 24-28.

‘Company Monitor: Ford Motor South America Regional Overview’ 2009, Brazil Autos Report, pp. 50-55

‘Company Profiles’ 2011, Canada Autos Report, vol. 5, no. 2, pp. 28-31

‘Datamonitor: Ford Motor Company’ 2010, Ford Motor Company SWOT Analysis, pp. 1-11.

‘Ford and GM see US sales decline’ 2007, BBC News.

‘Ford Motor Company 2011 Investor Day – Final’ n.d., Fair Disclosure Wire (Quarterly Earnings Reports), International Security & Counter Terrorism Reference Center, EBSCOhost, 2011.

Hughes-Cromwick, E 2011, ‘Ford Motor Company’s Global Electrification Strategy’, Business Economics, vol. 46, no. 3, p. 167-170.

Isidore, C 2007, ‘Ford: Biggest loss ever’, CNNMoney, Web.

Schifferes, S 2007, ‘The Decline of Detroit’, BBC News.

Szczesny, JR 2008, ‘Ford family values: Why the automaker wants to go it alone’, Time Business, Web.

Thompson, JL & Martin, F 2005, Strategic management: awareness and change, Cengage Learning EMEA, London.