Executive summary

Forecasting allows the management of business organizations to identify their chances of making a good profit as well their stands in the market while they assure their stakeholders, including the stockholders, to have the resounding benefit that they were promised to receive upon investing and trusting in the company. The examination of the forecasting models noted that the weighted average Model has been considered a better model.

Through measuring the advantages and the disadvantages that it yields along with the considerable variables needed to calculate its results shall give a better sensible idea as to how this model defines the connection that exists between forecasting and models. The finding from this forecasting is reinforced by the value of each model between the two variables under consideration. The results of the forecasting indicate a close association between the two variables.

Introduction

The process of financial forecasting is an essential component for planning and is also seen as the basis for budgeting activities. Financial forecasting is an essential element in estimating the future financial requirements of a firm or organization. According to Delurgio, (1998), financial forecasting would essentially look at future sales as well as related expenses and then provide the firm with the necessary information to project future external financing needs.

Forecasting sales is important in figuring out future plans of a business. Various analyses are similar in the except factors help determine them. Forecasting is expanded by factor analysis and allows for simple computations of target income sales. Many different kinds of forecasting techniques are available, and no single technique works best in every situation. When selecting a technique for a given situation, the manager or analyst must take a number of factors into consideration (Delurgio, 1998).

The two most important factors are cost and accuracy. The higher the accuracy the higher the cost, so it is important to weigh cost-accuracy trade-offs carefully. The best forecast is not necessarily the most accurate or the least costly; rather, it is some combination of accuracy and cost deemed best by management.

Other factors to consider in selecting a forecasting technique include the availability of data; the availability of computer software; the ability of decision-makers to utilize certain techniques; the time needed to gather and analyze data and to prepare the forecast; and any prior experience with a technique. The forecast horizon is important because some techniques are more suited to long-range forecasts while others work best for the short-range (Chase, 1997).

Analysis

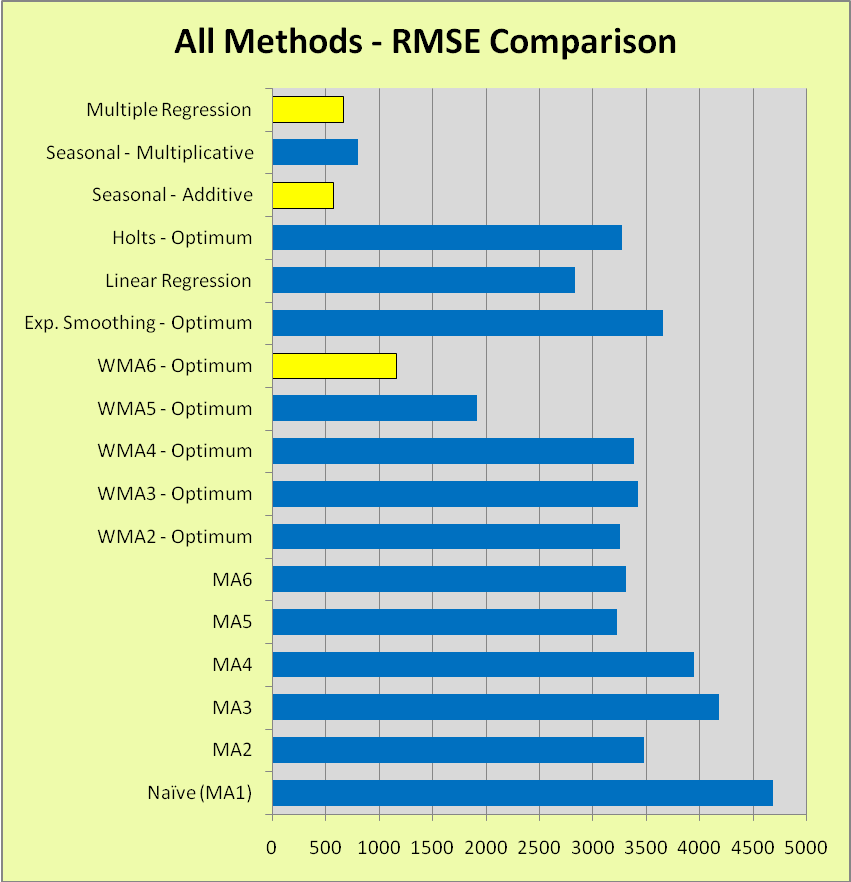

The methods evaluated were multiple regression, seasonal multiplicative, seasonal additive, holts-optimum, linear regression, exponential smoothing, Weighted Moving Average 6-optimum, Weighted Moving Average 5-optimum, Weighted Moving Average 4-optimum, Weighted Moving A3-optimum, Weighted Moving Average 2-optimum, Moving Average 6, Moving Average 5, Moving Average 4, Moving Average 3, Moving Average 2 and naïve.

Looking at the root mean squared error of each unit of each method you will find that

Most of these methods are good in forecasting sales for 2011 but moving averages uses smooth time series data. It forms a series of forecasts. The smoothed data appear smoother in the curve than the original data. The shape of the graph is the same in the three scenarios but the mean of the scenarios is different. The 3 cantered moving averages are higher than the 3 moving averages. The 3 moving averages and the 4 moving averages are not much different.

However, some of the methods such as seasonal multiplicative, seasonal additive and holts- optimum have given a figure which is very high and their Root Mean Squared Error is lower. I will eliminate this method because the amount they have given is very high. Looking at the past trends sales units have not increased drastically as these methods are proposing. That is why these methods are eliminated from those that can forecast sales from this company (Mentzer, 1999).

Moving averages and exponential smoothing are essentially short-range. Techniques, since they produce forecasts for the next period. Trend equations can be used to project over much longer time periods. When using time series data, plotting the data can be very helpful in choosing an appropriate method. Several of the qualitative techniques are selling suited to long-range forecasts because they do not require historical data. The Delphi method and executive opinion methods are often used for long-range planning (Hopp and Mark, 2001).

In some instances, a manager might use more than one forecasting technique to obtain independent forecasts. If the different techniques produced approximately the same predictions that would give increased confidence in the results; disagreement amount the forecasts would indicate that additional analysis may be needed.

The analysis of the statement of sales units is, as the previous case suggests, an important step in forecasting sales units. This case illustrates the range of useful insights drawn from this analysis. An overall analysis of sales units then corroborates or refutes the inferences from the analysis of sales (Rowe and Wright, 1999).

There are useful generalizations we can make about potential inferences from the analysis of the sales units. First, our analysis of the statement of sales units enables us to appraise the quality of management’s decisions over time and their impact on the company results operations and financial position. When our analysis covers a long time period, it can yield insights into management’s success in responding to changing business conditions and their ability to seize opportunities and overcome adversities (Georgoff and Murdick 1986).

Inferences from our analysis of sales units include where management committed its resources, where it reduced investments, where additional cash was derived from, and where claims against the company were reduced. Inferences also pertain to the disposition of earnings and the investment of discretionary sales units. The analysis also enables us to infer the size, composition, patterns, and stability of operating cash flows (Stevenson, 2005).

Sales units are used for labor, material, and overhead. They are also used for long-term assets like plants and equipment where conversion through the product-cost product-cost stream is at a slower rate. Eventually, all uses of cash enter the sales process and are converted into receivables or cash (Georgoff and Murdick, 1986).

Inferences must also include explanations for the variations in sales units’ segmentation. Most view operating sales units as an index of management’s ability to redirect funds away from unprofitable opportunities to those of greater profit potential (Wilson and Barry, 1998).

Forecasting sources and uses of sales units

Accuracy and control of forecasts is vital aspect of forecasting. The complex nature of most real-world variables makes it almost impossible to correctly predict future values of those variables on a regular basis. Consequently, it is important to include an indication of the extent to which the forecast might deviate from the value of the variable that actually occurs. This will provide the forecast used with a better perspective on how far off a forecast might be (Chase, 1997).

Some forecasting applications involve a series of forecasts, whereas others involve a single forecast that will be used for a one-time decision. When making periodic forecasts, it is important to monitor forecast errors to determine if the errors are within reasonable bounds. If they are not, it will be necessary to take corrective action.

Forecast error is the difference between the value that occurs and the value that was predicted for a given time period. Hence, Error = Actual – Forecast:

- et = At – Ft

Positive errors result when the forecast is too low, negative errors when the forecast is too high.

Conclusion

Among these methods that have been used to estimate the first quarter sales unit naïve Moving Average 2 to moving Average 6 gives an approximate which can be written upon to choose the first quarter’s sales unit. The weighted moving average of 2 to 6 is giving an increasing quote meaning that the weighted moving Average is giving different scenarios in providing the unit that would be sold next year.

The weighted moving average is giving 5 options however, looking at Root Mean Squared Error for each method. In consideration of root mean squared error and the reasonableness of the forecasting method I will choose weighted moving average 5 because the standard error is low as compared to other methods.

Reference List

Chase, C., 1997. Selecting the Appropriate Forecasting Method. Journal of Business Forecasting, 2(4).

Delurgio, S., 1998. Forecasting Principles and Applications. Boston: Irwin/McGraw-Hill.

Georgoff, D. & Murdick. R., 1986. Manager’s Guide to forecasting. Harvard Business Review; 5 (2), pp.110-120

Hopp, W. & Mark L., 2001. Factory Physics. Boston: Irwin/McGraw-Hill.

Mentzer, J., 1999. The Impact of Forecasting on Return of Shareholder Value. Journal of Business Forecasting, 3(1).

Rowe, G., & Wright. G., 1999. The Delphi Technique as a Forecasting Tool: Issues and Analysis. International Journal of Forecasting, 15(4).

Stevenson, W., 2005. Operations Management. Boston: McGraw-Hill.

Wilson, J., & Barry K., 1998. Business Forecasting. New York; McGraw-Hill.