Abstract

Fraud as defined by Wells (2011) is “any act, expression, omission, or concealment calculated to deceive another to his or her disadvantage” (61). Fraud is mainly depicted in financial terms with financial reports of different firms being main ways through which the vice is executed. This study will examine financial fraud in major multinational corporations.

The study will incorporate examination of major corporations that have been involved in fraud with the aim being establishment of where the responsibility lies. In order to establish the responsible parties, the study will utilize financial statements of the companies that have any signs of fraud and financial scams.

Introduction

Firms are facing many difficulties even as they undergo financial losses due to fraud cases perpetrated by some employees. Most fraud cases are financial based as they are incurred in the financial statements of the firms. According to Michelman, Gorman and Trompeter (2011, p. 65), a financial statement is a report that shows the financial position of an organization in terms of credits and debits.

Many types of financial statement are manipulated by fraudsters in order to obtain their financial and personal gains and they include balance sheets, income statements and statements showing cash flows. Fraudsters inflate or deflate figures in the financial statements for unknown reasons.

There are many cases of firms reporting false statements so that they can realize some financial benefits. Over 1200 cases have been investigated by SEC over half of this century with half of the cases being realized in consumer product firms such as the Atkins Trucking Company. The latest case is the Lehman brothers Corporation that was left bankrupt in 2010 after the global financial recession.

As noted by Michelman, Gorman and Trompeter (2011, p. 570), financial fraud is very common and has cost many firms with most of them undergoing receivership after being insolvent or bankrupt. This study will examine the existence of fraud cases in major global corporation across the globe including Lehman brothers.

Fraud Cases

According to Geiger and Smith (2010), fraud is an act that aims at financial or personal gain and involves an individual or group of individuals in an organization. It could also be defined as the act or expression, omission or concealment of financial information that aims at deceiving others. The cases of fraud can be manifested in various ways as the fraudsters continue in fraudulent acts for personal or financial gains.

Many organizations undergo financial challenges that result from fraudulent activities with fraudsters going unnoticed or being arrested. According to Daniel et al. (2012, p. 843), fraud can manifest itself in many ways beginning with being reflected in financial statements of an organization as a scam, extortion of funds, a hoax or ploy among many others.

In the cases of scams that are reflected in the financial statements, fraudsters can lure victims into purchasing shares of a company based on representations that are fraudulent. According to Hammersley, Bamber and Carpenter (2010, p. 573), proof of financial fraud requires establishment of four major elements that include establishment that the financial statement is materially false, that there exists knowledge of the false statements, that the victim relies on the statement and that the victim suffers damages after relying on the false financial reports (Chris, et al. 2008).

The common reports that are vulnerable to fraud are the balance sheet, profit and loss accounts, and cash flows. The fraudsters manipulate the figures in the reports to suit their personal interests while giving inflated or deflated information. Firms usually have competing demands for attention with much strategic thinking taking place on how the firm should present the financial data (Debreceny & Gray, 2011).

Some firms prepare concise reports that are straight forward with summaries being made for investors and other stakeholders (Carpenter, Durtschi & Gaynor 2011, p. 17). Other groups can also be provided with financial worksheets and reports that are comprehensive to meet their demands.

For instance, investors that are interested in making reasonable investment are interested financial statements so that they can track the company’s performance. Therefore, firms may provide reports that are appealing to investors yet it may not be the true picture of the corporation (Fitch & Shivdasani 2007, p. 621).

Financial fraud has many implications to an organization because they affect the long term performance of the firm. In some worst case scenarios, fraud that has occurred over a long period may lead to winding up of the firm as it is driven out of business.

However, fraud cases can be avoided through frequent auditing of financial reports of an organization using both internal and external auditors. In addition, there should be regulation of the activities of firms in the industry by the state bodies instituted by the federal government (Dorminey, Scott, Kranacher & Riley, 2012, p. 672).

Research Methods

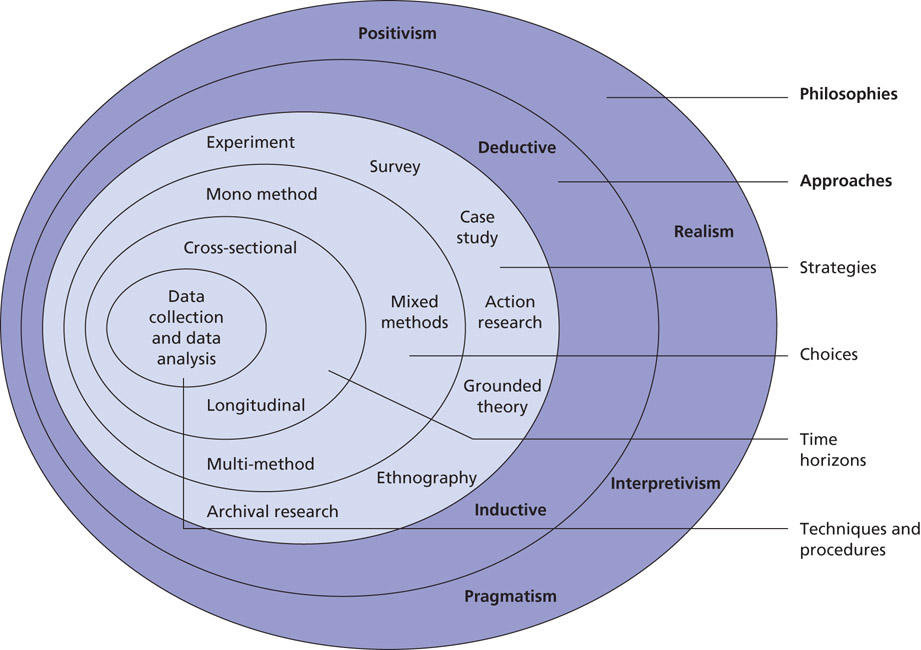

According to Myers and Avison (2003), understanding research requires that one understands the research methods, approaches, strategies and philosophies that have to be applied in a study.

Philosophy of the Research

This is shown on the outer part of the onion that indicates positivism and pragmatism among others. Positivism postulates that the researcher has to begin the study by setting the research questions with objectives and hypothesis such as established in this study. The philosophy has been applied in this research since the study aims at establishing responsibility of financial fraud cases in multinational corporations (Wells, 2011).

The study also has set objectives with research questions. Positivists believe that the collected data should be analyzed and compared with other organizations in the industry (Salkind, 2006). The limitation of the philosophy is that it generalizes the findings to represent the whole population yet the study was conducted in only one organization (Kaplan, Pope & Samuels 2010).

Research Approach

The research onion shows two approaches that could be used by this research. They are the inductive and deductive approaches. The approach that begins from known information about the research phenomena and moving toward the unknown is the inductive approach (Russell & Ryan 2009, p. 611).

The approach has been utilized in this study because the researcher will begin with the establishment of a known hypothesis that occurrence of financial fraud in organization sis common and there is not specific person to blame, although the management is to blame in some cases.

The study will then seek to fulfill the hypothesis (Quinn 2002, p. 211). On the contrary, the deductive approach that is commonly applied in the formulation of new theories begins with the general information toward establishment of the specific information (Clarke 1998, p. 1243).

Research Methods

The most common methods of conducting any research are qualitative and qualitative methods with the quantitative method involving utilization of numerical data to justify the research phenomenon. On the contrary, the qualitative research method involves examination of a social phenomenon in order to draw conclusions. Therefore, the manner in which the two methods collect, treat and analyze data is what make the difference between them (Myers & Avison, 2003).

While quantitative method utilizes numerical data, qualitative research focuses on understanding the social phenomenon. The quantitative method emphasizes on quantity wit tools used being able to measure and quantify data. The collected data has to be precise and specific so that the phenomenon at hand can be measured.

Unlike the quantitative research, the qualitative research has its goal as completely describing the phenomenon through application f reasoning. Interviews and questionnaires are applied in the collection of data (Jankowicz 2005, p. 301).

While taking the two research methods in question above, it is important to note that this study would utilize a quantitative approach with numerical data being collected using a likert scale questionnaire (Zand, 1997, p. 79). In order to gain an understanding of the phenomenon, a detailed explanation will be undertaken regarding financial fraud and the liable parties (Yin, K 2003, p. 206).

List of References

Carpenter, T., Durtschi, C., & Gaynor, L. 2011, ‘The Incremental Benefits of a Forensic Accounting Course on Skepticism and Fraud-Related Judgments’, Issues in Accounting Education, vol. 26, no. 1, pp. 1-21.

Chris, E. et al. 2008, ‘Financial Statement Fraud: Insights from the Academic Literature’, A Journal of Practice & Theory, vol. 27, no. 2, pp. 231-252.

Clarke, A. 1998, ‘The qualitative-quantitative debate: moving from positivism and confrontation to post-positivism and reconciliation’, Journal of Advanced Nursing, vol. 27, no. 6, pp. 1242-1249.

Daniel, A. et al. 2012, ‘Does Investment-Related Pressure Lead to Misreporting? An Analysis of Reporting Following M&A Transactions’, The Accounting Review, vol. 87, no. 3, pp. 839-865

Debreceny, R. & Gray, G. 2011, ‘Data Mining of Electronic Mail and Auditing: A Research Agenda’, Journal of Information Systems, vol. 25, no. 2, pp. 195-226.

Dorminey, J. A., Scott, F., Kranacher, M., & Riley, R. 2012, ‘The Evolution of Fraud Theory’, Issues in Accounting Education, vol. 27, no. 2, pp. 555-579.

Fitch, E. & Shivdasani, A. 2007, ‘Financial fraud, director reputation, and shareholder wealth’, Journal of Financial Economics, vol. 86, no. 2, pp. 606-336.

Geiger, M. & Smith, J. 2010, ‘The Effect of Institutional and Cultural Factors on the Perceptions of Earnings Management’, Journal of International Accounting Research, vol. 9, no. 2, pp. 21-43.

Hammersley, J., Bamber, M., & Carpenter, T. 2010, ‘The Influence of Documentation Specificity and Priming on Auditors’ Fraud Risk Assessments and Evidence Evaluation Decisions’, The Accounting Review, vol. 85, no. 2, pp. 547-571.

Jankowicz, A. 2005, Business research projects, 4 ed. Cengage Learning EMEA, New Jersey.

Kaplan, S., Pope, K., & Samuels, J. 2010, ‘The Effect of Social Confrontation on Individuals’ Intentions to Internally Report Fraud’, Behavioral Research in Accounting, vol. 22, no. 2, pp. 51-67.

Michelman, J., Gorman, V. & Trompeter, G. 2011, ‘Accounting Fraud at CIT Computer Leasing Group, Inc.’, Issues in Accounting Education, vol. 26, no. 3, pp. 569-591.

Myers, D. & Avison, D. 2003, Qualitative Research in Information Systems, Athenaeum Press Ltd, London.

Quinn, M. 2002, Qualitative Research & Evaluation Methods, 3 ed., Sage Publications, New York.

Russell, B. & Ryan, G. 2009, Analyzing Qualitative Data: Systematic Approaches, Sage, London.

Salkind, N. 2006, Exploring Research, 7 ed., Pearson-Prentice Hall, Upper Saddle River.

Saunders, M., Lewis, P., & Thornhill, A. 2007, Research Methods for Business Studies, 4 ed., Pearson Education, Boston, MA.

Wells, J. 2011, Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the Books, John Wiley & Sons, Hoboken.

Yin, K. 2003, Applications of Case Study Research, 2 ed. Sage, New York.

Zand, D. 1997, The leadership Triad: Knowledge, Trust, and Power, Oxford University Press, New York.