Executive Summary

GlaxoSmithKline (GSK) is a pharmaceutical company engaged in research, development, and sales of pharmaceutical products. This paper recommends that, GSK should not be granted a loan because it operates under conditions of extreme uncertainty and turbulent economic times. From this assertion, this paper notes that, GSK is a high risk company and the probability that it will default on its financial obligation is very high. This risk is attributed to the unpredictable nature of the pharmaceutical industry and the inconsistencies in GSK’s financial statements. Also, compared to GSK’s competitors, the company seems to be experiencing serious operational problems. Here, this paper establishes that, most of GSK’s competitors make more money, despite GSK’s earlier entry in the pharmaceutical industry. Also, from the same analysis, we see that, GSK is offering lower financial returns compared to the industry’s return. This situation poses a risky environment to grant a loan to GSK.

Though there are some aspects of the pharmaceutical industry, which are very attractive (such as threat to new entrants and supplier power), this paper proposes that, most of the industry’s dynamics are unfavorable to existing companies. This situation exposes the vulnerability of the pharmaceutical industry which is prone to extreme competition and drastic legislative changes. Here, the dominant factor (industry vulnerability) prevails, thereby informing the decision to deny GSK a loan. However, GSK stands a good chance of realizing its core business and corporate goals if it pursues the strategy of investing in foreign markets. However, this strategy poses more risks to GSK’s ability to meet its financial goals because it poses new risks of operations. The greatest risks identified in this paper, are the financial and legislative risks of operating in new markets. These risks touch on the internal and external compositions of GSK and the pharmaceutical industry. Comprehensively, a “wait and see” approach should be adopted to reduce the risks GSK poses in meeting its financial obligations.

Organizational Overview

GlaxoSmithKline (GSK) is a multinational company engaged in the manufacture and distribution of pharmaceutical products. The company’s headquarter is in London, UK, but its operations are spread in over 100 countries around the world (GSK 2011). GlaxoSmithKline is deemed to be the third largest pharmaceutical company in the world, based on its sales revenue, and the second largest in the world, based on its net income alone (GSK 2011). The company’s employee base is about 90,000 people around the world.

The company’s products are designed to treat various human diseases including viral infections, asthma, cancer and similar ailments. These products are developed within the confines of the company’s core mission, which is centered on the goal of improving people’s lives and well-being by prolonging peoples’ lives and improving their standards of living. Since 2008, the company has shifted its priorities to increasing the company’s growth, based on the pillars of a diversified business, addition of more value to products, and a simplification of its operating model (GSK 2011). However, though GSK strives to achieve its core mission and vision, it acknowledges that, the pharmaceutical industry is a very competitive market because of generic competition and loss of patents. Also, there is a strong competition of branded drugs produced by other companies such as AstraZeneca and Merck (MRK), but companies such as Novartis AG, Pfizer Inc., and Sanofi-Aventis also pose a stiff competition to GSK.

GSK has also been no stranger to controversy. Some of its products such as Paroxetine, Ribena, and Avandia have been characterized by controversies regarding their use. For instance, Paroxetine was blacklisted by the FDA because it was alleged to increase children’s’ tendencies to commit suicide. As a result of this blacklist, GSK was sued by more than 5000 people in the US alone (Jacobsen 2010). In 2007, the company made headlines after it pleaded guilty to accusations that its Ribena drink did not contain Vitamin C, even after the company marketed the product, claiming that it had significant quantities of Vitamin C. The controversy was sparked after two 14-year old school girls carried out tests on the drink and discovered that its Vitamin C contents were almost undetectable. During the same year (2007), the company was also hit with another lawsuit regarding its Avandia product, where it was alleged that, consumers who had taken the product suffered myocardial infarction (Jacobsen 2010). This controversy is still unfolding.

Nonetheless, this paper is a credit analysis of GSK to determine if it should be given a loan or not. Several factors will be considered in this paper. First, a strategic assessment of the company will be undertaken. This analysis encompasses several aspects of the company, including a SWOT analysis, external analysis, corporate-level strategy analysis, and a business-level strategy analysis. Secondly, this paper encompasses financial and risk assessments to investigate GSK’s financial capabilities, future corporate strategies and the risks surrounding such strategies. Finally, this paper recommends if GSK should be given a loan or not.

Strategic Assessment

External Analysis (Porter’s Five Forces)

The Porter’s five-force analysis will be used to ascertain the threat of competitors, threat of substitutes, buyer power, supplier power, and the threat of new entrants in the pharmaceutical industry. Somewhat, many experts have used this tool for an external analysis of several industries. This paper uses the porter’s five-force analysis to explain the same factors in the pharmaceutical industry.

Threat of Competitors

As mentioned in earlier sections of this study, the pharmaceutical industry is very competitive. Most of this competition emanates from branded products which are designed to serve the same purpose as GSK’s products. For example, Advair, which is produced by GSK, for the treatment of asthma, is under immense competition from AstraZeneca because the latter produces a drug, known as Symbicort, which is quickly commanding a strong market share (Jacobsen 2010). The same level of competition is also observed in the treatment of diabetes because GSK produces a diabetes drug, known as, Avandia, and several competitors (including Merck) are producing similar products (such as Januvia and Janumet) that threaten GSK’s market share in the supply of diabetes drugs. More so, this competition has been further exacerbated by FDA’s intervention in the approval and disapproval of certain drugs. For instance, FDA’s disapproval of GSK’s Avandia is likely to increase Merck’s market, at least in the supply of type-two diabetes drugs. However, GSK is deemed to be far ahead of its competition with regards to the research and development of new drugs because experts note that, in the face of stiff competition, research and development of new drugs is likely to elevate certain companies above the rest (Jacobsen 2010). Statistics report that, GSK is almost twice ahead of its closest competitor, Pfizer (PFE), in the development of new drugs. However, competition in the pharmaceutical industry is observed to concentrate on only a few markets, such as the supply of diabetes drugs, and therefore, it is important to analyze different companies from their performance on specific drug markets.

Threat of Substitutes

The pharmaceutical industry is characterized by several demands for the main stakeholders to improve the accessibility of drugs to the public. As a result, there has been increased pressure for pharmaceutical industries to lower the pricing of their products, to make them more accessible to the public, or remove patents for some of their products and allow the production of generic drugs (Jacobsen 2010). However, before the advent of the 80s period, there was an almost non-existent threat of substitute products in the pharmaceutical industry. In fact, it was established that, during the period (80s), patients were usually known to buy drugs that were prescribed by the doctor. Legislatively, there were strict patent laws that hindered the production of generic drugs by up to 17 years. However, this situation has changed over the decades and more pharmaceutical industries have entered the market. Currently, the threat of substitutes is considerably increasing (though not very strong at the moment).

Buyer power

The pharmaceutical industry is part of a wider state-funded scheme to support the provision of quality health care for various population groups. The position of pharmaceutical companies in this venture lies in the supply of drugs. Several countries have therefore contracted certain pharmaceutical industries to supply them with drugs. GSK is not new to such kind of arrangements. The company has been contracted by the US government to supply drugs in support its Medicare and Medicaid programs. The Medicare program is federally funded, while the Medicaid program is state-funded. As such, the two institutions (federal and state governments) form some of GSK’s biggest customers. However, since these institutions operate on a large scale, they have a strong purchasing power. Pharmaceutical companies that do business with them are therefore bound to reduce their prices. This factor significantly erodes their purchasing power. Moreover, governments still insist on such pharmaceutical companies to pay rebates (Jacobsen 2010). This requirement increases the companies’ sales, but it also reduces their revenue.

Threat of New Entrants

Investors are often put off by strong barriers to trade (Jacobsen 2010). However, if they manage to enter the industry, the same barriers work to protect their businesses. Thus, though barriers to trade act as a major deterrent to new investors, they act as a tool to wade off competitors from any given business sector. The pharmaceutical industry has a strong barrier to trade and therefore, the threat of new entrants in the industry is extremely low. The reason for this observation is the huge financial investment needed to start up a business in the sector. However, there are some other intangible factors such as stringent intellectual property restrictions that prevent new entrants from venturing into the business. Since the pharmaceutical industry greatly thrives on research and development, the cost of undertaking new research is extremely high and time consuming. This barrier to trade has been in existence for a long time. Considering the huge financial investments characterizing this sector (pharmaceutical industry), and the tremendous sense of uncertainty regarding the industry’s payoffs, there has been a very low threat of new entrants to the pharmaceutical industry (Jacobsen 2010).

Supplier Power

The pharmaceutical industry has been characterized by a strong willingness by suppliers to sell their raw materials to major stakeholders in the sector. In the 80s, there were more than 12,000 chemical companies in America alone which were willing to partner with existing pharmaceutical industries to manufacture pharmaceutical products (Jacobsen 2010). This number has significantly increased over the decades. As a result of the sheer number of suppliers in the industry, there has been a very low supplier power because it is difficult for such suppliers to have a strong control over the terms and conditions for the supply of their raw materials. Drug companies have gone on record to say that, the supplier power in the industry is almost non-existent (Jacobsen 2010).

SWOT Analysis

This SWOT analysis is mainly used to ascertain the strengths, weaknesses, opportunities and threats of the pharmaceutical industry. Somewhat, many experts have used this tool for an internal analysis of several industries. This paper however uses the SWOT analysis to explain the factors that make the pharmaceutical industry to excel; the factors that need to be improved in the pharmaceutical industry; areas that require amendment to protect the interests of various stakeholders in the pharmaceutical industry and the factors that spur growth in the sector.

Strengths

The main strength of the pharmaceutical industry is enshrined in the capability of the industry’s stakeholders to provide quality goods and services to its consumers. For instance, the pharmaceutical industry is characterized by a low staff turnover, which improves the quality and efficiency of its operations. In turn, this improves the quality of the goods produced. Also, the main players in the pharmaceutical industry have state-of-the-art laboratory facilities which are used in research and development (Jacobsen 2010). These facilities guarantee the quality of the research meant to produce new drugs. Furthermore, the pharmaceutical industry is known to have low overheads of operation and a high return on investments. The high return on investments has been a common feature of the pharmaceutical industry, for a long time. For instance, among the fortune 500 companies, the pharmaceutical industry was estimated to rake more returns than the combined median of all the existing companies within the category. For example, during the late 80s period, statistics showed that, new drugs introduced during the period raked in close to $36 million in revenue after tax deductions. That profit margin was estimated to be two to three percent more than other industries projected, even after considering the risks of researching and developing of the new drugs (Jacobsen 2010). Apart from these strengths, most pharmaceutical companies have an experienced staff which adds value to their core products. Comprehensively, these strengths add value to various product and service offing.

Weaknesses

The weaknesses of the pharmaceutical industry lie in its internal shortcomings of failing to add value to goods and services. The high-risk business modeling associated with the pharmaceutical industry is one such characteristic because, as mentioned in earlier sections of this industry, it is very difficult to predict the performance of a given product, factoring the high capital investments made in product development. Most management boards sitting in most pharmaceutical industries are also known to be highly disengaged from their companies’ core businesses and operations (Jacobsen 2010). As a result, there is some form of management discord among the key players. This reduces the efficiencies of the industry and leads to a lack of touch between the management and the reality on the ground. Partly, this fact has been attributed to the high costs of certain drugs in the pharmaceutical industry because most management boards are not in touch with reality. The pharmaceutical industry is also characterized by poor branding which significantly affects its sales and profitability (Jacobsen 2010). This poor branding has been caused by the complexities of international trade and the numerous policy regulations characterizing the industry. Diseconomies of scale is also a common characteristic of the pharmaceutical industry because, as mentioned in earlier sections of this paper, the strong buyer power among most of the key demand groups in the pharmaceutical industry, often lead to decreased profitability in the industry (Jacobsen 2010). This weakness is also compounded by instances of low staff morale among some of the key players in the pharmaceutical industry (Jacobsen 2010).

Opportunities

Present opportunities in the pharmaceutical industry border on the external competencies of the industry which enable it to grow or give it a competitive advantage. These factors are not normally within the control of the industry because they are external to the industry’s operations, but at the same time, they represent the authentic business environment. Several factors have affected the opportunities that the pharmaceutical industry poses. Critical point among them is the increased sense of health consciousness among pharmaceutical consumers (Jacobsen 2010). The increased sense of health consciousness provides a good opportunity for the pharmaceutical industry to grow because its main stakeholders may produce products that complement new consumer tastes and preferences. Complementarily, this change in consumer preference has significantly increased the demand for high quality pharmaceutical products. Players in the pharmaceutical industry stand a better chance of improving their profitability and revenues by improving the quality of their products. The pharmaceutical industry has also been subject to a change in food and drug administration (FDA) standards to improve the quality of products supplied to the market (Jacobsen 2010). Though this provision is perceived to be a destabilizing factor for the industry, some experts note that, it is an opportunity for the pharmaceutical industry to develop new products and services that appeal more to its consumers. Comprehensively, these factors define the opportunities existing in the pharmaceutical industry.

Threats

Existing threats in the pharmaceutical industry stand to dent a blow to the future sustainability of the industry because they are bound to decrease the opportunities for growth in the market. Often, these factors are external to the industry, but yet, they correctly represent the pharmaceutical industry market. Key among the main threats characterizing the pharmaceutical industry is the increased change in government policy and increased restrictions on the sector (Jacobsen 2010). This threat stands to destabilize the pharmaceutical industry by reducing the freedom to undertake operations as pharmaceutical companies please. Moreover, increased government legislation goes against the laws of a free market or market liberalization policies. This is a big problem for existing pharmaceutical players. Also, a declining economy, especially in the western world, seeks to reduce consumers’ purchasing power, thereby endangering the future growth and profitability of the pharmaceutical companies (Jacobsen 2010). Alongside the decline in economic growth, there seems to be an increased cost of doing business (the world over) and the pharmaceutical industry is feeling this pinch. More so, the pain is felt in the increased costs of undertaking research and development of new products. Comprehensively, these factors define the threats characterizing the pharmaceutical industry.

Corporate-Level Strategy Assessment

GSK’s corporate level strategy is informed by the need to diversify its core business portfolios to include growing markets in the developing world. For instance, the company is focusing its resources on growing the pharmaceutical market of India (Oomman 2010). This strategy aims to increase the volume of products sold in these markets. To achieve this objective, GSK aims to adopt a flexible pricing strategy aimed at making its products more affordable, and ultimately realizing increased profitability for the company. The company’s executive directors were recently quoted as saying that they intend to adopt a flexible pricing strategy that is aimed at increasing the accessibility of their products to ordinary consumers (Oomman 2010). They hope that this strategy will be profitable for the company because they want to capitalize on increased volumes of trade. Through this strategy, GSK also intends to be a market leader in making its products more accessible to the wider public by being more proactive as opposed to reactive.

Also, to reduce the increased risk of operation that the company experiences today, it aims to increase its core business portfolios and investments into products that show more potential for growth (Oomman 2010). These strategies are motivated by several factors, including a promising growth of the pharmaceutical market; an increased accuracy in vaccine drug sales forecast; a promising emerging market segment and the increased appreciation for quality products by pharmaceutical consumers (Oomman 2010).

The move to focus the company’s resources on less developed countries is complemented by a commitment by the company to offer its products at a lower cost. The low costs are expected to increase the accessibility of such drugs to ordinary people who need them (more). This focus is especially informed by the fact that, there are several tropical diseases which have been ignored by conventional drug companies for a long time and GSK intends to focus its energy in developing drugs to treat these diseases (Oomman 2010). To achieve the best results, GSK intends to adopt several strategies. For instance, the company intends to adopt a flexible pricing strategy in different countries. The company also intends to be more flexible in handling intellectual property because it wants to embrace knowledge sharing technologies more openly than it did before. The second strategy that the company intends to adopt is to forge new partnerships in research and development so that new and better products can be developed (Oomman 2010). New partnerships provide access to new facilities; equipments; knowledge platforms and other resources needed to develop new and quality products. The last strategy GSK intends to adopt is to improve the access of GSK’s new compounds so that, researchers can accelerate the development of new products for the provision of quality products and services in conventional and non-conventional markets.

Business-level Strategy Assessment

GSK’s business level strategy is informed by its intention to build high quality and strong brands in the pharmaceutical industry. The company intends to accomplish this goal by investing more money in research and development, not only to come up with high quality drugs, but also to continually produce new products in the market. The company’s management team intends to produce large volumes of mid-sized products for specific population groups which would appreciate the products more (as opposed to a universal population groups) (Oomman 2010). They hope that this strategy would increase their sales volume and create a low-risk portfolio because the dependency on a few high performing products will seize to exist. To accomplish this objective, GSK has externalized most of its research and development processes to focus on disease areas where more revenues are expected (Oomman 2010). This strategy will sustain the company’s long-term business growth.

Financial Assessment

Company Assessment

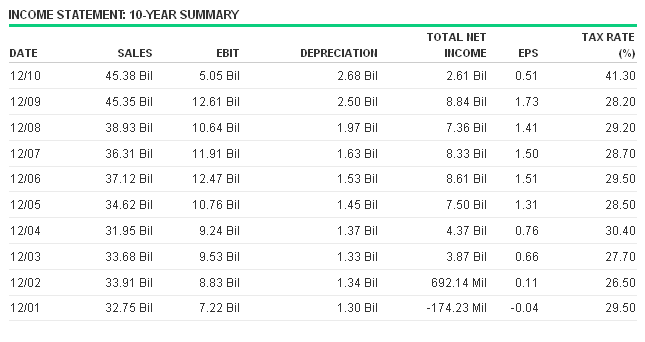

GSK has steadily witnessed its net income decline over the past three years. The pharmaceutical industry has also changed over the years and key among this change is the huge toll that competition and an increase in operating costs have taken. These factors are attributed to cause the decrease in net income from $8 billion (in 2007) to slightly over $2 billion in 2010 (Microsoft 2011). This drop in income has been witnessed despite unchanged revenues over the same period. Over the years, GSK has witnessed a slow progression of its sales revenues from an average of about $35 billion in 2001 to an average of about $40 in 2010 (Bloomberg 2011). In the second quarter of 2011, GSK reported that its sales revenue growth was -2% (GlaxoSmithKline Plc 2011). In the first quarter of 2011, the company reported a sales growth of -10%. However, in the same quarter (first quarter of 2011), the company reported an underlying sales growth of 4% and in the second quarter, GSK reported an underlying sales growth of 5%.

Comprehensively, over the past ten years, GSK has witnessed varied returns of income. In 2001, the company was operating at -174.32 million (in net revenue) and in 2010; this figure was reported to be $2.61 billion (Microsoft 2011). Though there has been a significant increase in operating profit, considering the two figures, there is also a significant shift in net income. For instance, in 2009, the company posted a net income of $8.83 billion, and in 2010; the company posted a net income of 2.61 billion. The following table shows these statistics

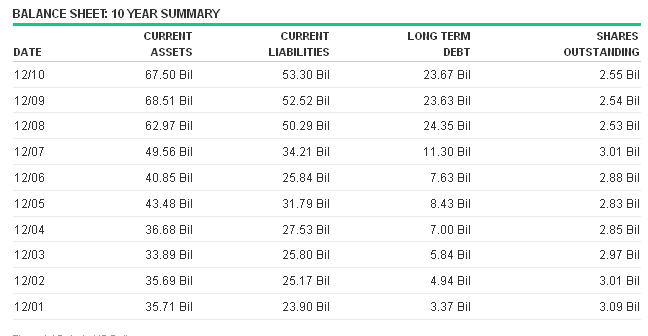

Also, within the last decade, GSK has witnessed a significant shift in its balance sheet because most of its financial fundamentals have changed. For instance, the company’s long-term debt has increased from a mere $3.37 billion in 2001 to $23.68 billion in 2010 (Microsoft 2011). The same trend has however been witnessed in the growth of its current assets and current liabilities. The company’s current assets have increased from a mere $35.73 billion to $67.54 billion. The company’s current liabilities have also increased from $23.91 billion to $53.32 billion. Comparing the two financial categories, we can see that, the company’s current assets have grown by $31.81 billion and its current liabilities have increased by $29.41 billion (Microsoft 2011). The company’s total long-term debt has increased by $20.31 billion. These increases have happened over the past decade. The following table shows these statistics

In the last ten years, the company’s net profit margin has increased from -1.1% to 9.2%. However, just like the trend exhibited in the net income postings, the net profit margin has also been very irregular. For instance, in 2009, the company posted its net profit margin at 31.2% but in 2010, this figure decreased to 9.2%. The company’s debt to equity ratio has however been somewhat steady, but increasing. In 2001, the company’s debt to equity ratio was 0.57 and in 2010, the same figure was posted at 1.70. The highest figure was reported in 2008, where the company posted a debt to equity ratio of 2.04. Over the last ten years, GSK’s return to equity has increased from a mere -1.5% in 2001 to 18.4% in 2010. The highest figure was recorded in 2004, where the company posted its return on equity ratio at 64.1% (Microsoft 2011). Similar to other financial figures reported above, GSK return on equity has not been steady. For instance, in 2010, the company’s return on equity decreased from 55.3% to 18.4%. Also, between the years of 2002 to 2003, the company witnessed an increase of return on equity from 6.6% to 47.8% (Microsoft 2011). The company’s return on assets has witnessed a gradual shift over the first five years of the decade, but it has significantly reduced from 21.1% in 2006 to 3.9% in 2010. From 2001 to 2006, the company’s return on assets has increased from -0.5% to 21.1% (Microsoft 2011). These statistics show an irregular projection of financial ratios.

Comparison with Competitors

Most of GSK’s competitors are performing better than GSK. This has been observed despite the fact that, GSK has been in the pharmaceutical industry, longer than some of its competitors. In terms of market capitalization, GSK trails Novartis AG (NVS) and Pfizer Inc. (PFE). NVS has a market capitalization of $141.97 billion while PFE posts a market capitalization figure of 148.47 billion (Microsoft 2011). GSK comes third with a market capitalization figure of 113.70 billion. Sanofi-Aventis (SNY) trails GSK with a market capitalization of 94.52 billion. Of GSK’s three main competitors, GSK has the least number of employees. Compared to its main competitors, GSK has a quarterly revenue growth of -4.3%, while its main competitor, NVS, has a quarterly revenue growth of 26.90%. NVS also surpasses GSK’s revenues by $13.05 billion (Microsoft 2011). PFE also posts more revenue receipts than GSK because in 2010, the company posted its revenue at $67.59 billion and GSK posted its revenue at $43.58 billion. SNY also surpassed GSK’s revenue by about $900 million. GSK’s net income is also relatively lower than its competitors because its main competitor NVS posted a net income of $9.92 billion and GSK only posted a net income of $5.15 billion (Microsoft 2011). PFE posted a net income of $8.61 billion and SNY posted a net income of $5.93 billion. Comprehensively, from this analysis, we see that, GSK is not performing as good as its competitors. In fact, of the four main companies in the pharmaceutical industry, GSK seems to be trailing the lot.

Comparison with Industry

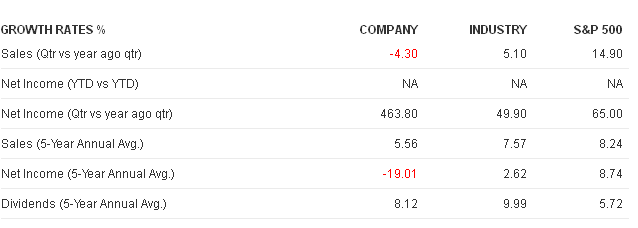

GSK has not grown the same rate as the pharmaceutical industry. Most of its parameters are below the industry’s return. For instance, as mentioned in previous sections of this paper, the company’s second quarter result for 2011 was 4.35% while the industry’s sales growth was 5.1% (Microsoft 2011). The company’s five year annual sales growth is 5.56 while the industry’s annual five-year sales growth is 7.57%. GSK’s five-year net income average was -19.01 while the industry’s figure was 2.62 (Microsoft 2011). The five-year annual dividends issued by the company also fell below the industry’s average of 9.99 because GSK posted a figure of 8.12. The following table shows these comparisons

Corporate Focus

In the coming years, GSK is expected to still make huge profits but its sustainability is expected to be secured by its market diversification strategy (GlaxoSmithKline Plc 2011). Though the company has enjoyed continued periods of profitability, it has also endured endless periods of financial shocks, owed to the unpredictable nature of the pharmaceutical industry. Based on these fundamentals, experts agree that, diversifying GSK’s market from its traditional markets to emerging markets will act as a reliable cushion to safeguard it from market shocks (Microsoft 2011). Therefore, in the coming years, GSK is expected to spread its operations to emerging markets such as India and Japan. Current statistics show that, such markets provide better returns to investors, when compared to more traditional markets such as Europe and America (Microsoft 2011). Moreover, the cost of doing business in such countries is expected to be small and therefore, this low cost is expected to slow down the cost pressures in GSK’s financial books.

Risk Assessments

Considering the above financial assessment, it is inevitable to note that, GSK stands a high risk of not completely realizing its corporate and business level goals. This is because the company’s financial books show an irregular financial performance. Considering the financial shocks the company experiences, it is almost impossible to guarantee GSK’s ability to meet its short-term and long-term goals. Also, considering GSK’s business-level and corporate-level strategies, it is crucial to note that, these investments are capital-intensive and possibly, their returns may take a long time to materialize (Bloomberg 2011). It is therefore more likely that, GSK may invest a lot of money in financing its corporate and business-level strategies, but fail to realize its returns, at least in the short-term. This kind of situation calls for a careful analysis of GSK’s options of investing.

Apart from the company’s shortcomings, GSK also operates in an environment of uncertainties because returns in the pharmaceutical industry may take an equally long time to materialize. The biggest uncertainty is the change in regulatory policies required of pharmaceutical companies (Bloomberg 2011). Over the years, there has been an increased oversight on pharmaceutical companies because of increased consumer awareness, and companies are slowly suffering under these unpredictable legislative changes. This factor directly affects GSK’s future capacity to grow because it intends to concentrate on emerging markets. Most of these markets are in third world countries and it poses a new legislative challenge because such markets have carried legislative requirements that may impede GSK’s ability to succeed. These financial and legislative risks therefore directly affect GSK’s ability to finance its future company obligations (Bloomberg 2011).

Recommendations

This paper shows that, GSK’s earlier entry to the pharmaceutical industry has made it a strong player in the pharmaceutical market. Also, this paper exposes the huge potential and willingness that the company has in developing new drugs for conventional and non-conventional markets. These areas of key competencies have created a strong economic moat for GSK, despite the strengthening competition in the pharmaceutical industry. Also, from this study, we have established that, the future of the pharmaceutical industry lies in the development of new drugs. As a result, we have seen that, GSK has taken up this challenge and is already in the business of developing new products through new partnerships. Furthermore, GSK’s size elevates it to be a top-tier company in the pharmaceutical industry, and therefore, it has been able to enjoy strong economies of scale. Its strength in the manufacture of new drugs has also been seen to spur across various disease segments, including treatment drugs, vaccination drugs and the likes. This diversity has gone a long way in minimizing the risks of operation. Similarly, certain sections of this report point out that, the main companies in the pharmaceutical industry perform well in certain product categories as opposed to others. However, these areas of key competencies are overshadowed by some of GSK’s main areas of weakness.

Considering GSK’s financial performance and market environment, there seems to be a lot of uncertainty shrouding GSK’s ability to meet its financial obligations. Though we have confirmed that the company intends to build the quality of its brands as a core component of its business-level strategy, there is still a lot of doubt regarding the company’s ability to implement its corporate-level strategy, which is expected to spur growth into the future. Furthermore, from the porter’s five force analysis described above, we can see that, there is a strong threat of competitor intrusion in GSK’s future sustainability. These competitors are likely to reduce the company’s profitability, or minimize its chances of realizing its growth projections. Already, the influence of the competitors can be seen in the competitor comparison segment described in earlier sections of this study. Unfortunately, the company lags behind the three main competitors in the market (according to the financial information posted above) and it is clear that, the company is not making much headway in terms of financial progress.

From the SWOT analysis, we can establish that, there are various factors that also limit GSK’s ability to grow or implement its strategies for future growth. From these factors, the main challenge described in earlier sections of this paper is the legislative hurdle of operating in the pharmaceutical industry (especially in emerging markets). These legislative challenges, coupled with the uncertainty of the pharmaceutical industry, pose a great challenge to GSK’s future prospects of growth. It is very difficult to plan under such uncertainties because the market pressures are tough and there is a strong sense of socio-political uncertainty of operating in new markets. Under such conditions, GSK is faced with the grim need to utilize its limited resources for the optimum development of new products, and for the maximization of company revenues.

Morning Star credit committee (cited in Bloomberg 2011) conquers with this paper’s assertion by noting that, GSK is at the bottom of its peers, and subsequently, it has decreased its credit rating to AA. This credit rating is perceived to be lower than most of GSK’s competitors, hence, the downgrade of GSK’s credit rating. It is also estimated that, GSK holds 7.2 billion pounds in cash, as compared to 16 billion pounds in debt. Here, we can see that, GSK operates on a deficit because its cash flow does not support the servicing of its debts. It would therefore be difficult to lend more debt to such a company which is already having trouble servicing its current debts. Also, there have been reports indicating that, GSK is unable to pay dividends to its debt holders, based on its substantial dividend payment program. From these observations, it is vital to refrain from granting GSK a loan because it is a high risk company.

References

Bloomberg. “Financial Statements for GLAXOSMITHKLINE PLC (GSK).” Glaxosmithkline Plc, 2011. Web.

GlaxoSmithKline Plc. “GSK announces Q2 2011 results.” Quarterly Results, 2011. Web.

GSK. “Our mission and strategy.” GlaxoSmithkline, 2011. Web.

Jacobsen, Thomas. 2010. Modern Pharmaceutical Industry: A Primer. London: Jones & Bartlett Learning.

Microsoft. “Fundamentals.” GSK, July, 2011. Web.

Oomman, Nandini. “GlaxoSmithKline’s Evolving Business Model: For Profit and for Greater Good?” Global Health Policy, 2011. Web.