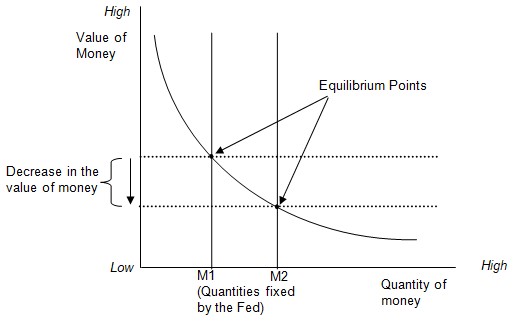

Ever since the US economy started feeling the effects of the recent economic crisis, the Federal Reserve (Fed) has been using stimulus packages to try and rectify the money demand and supply associated with inflation. The most ambitious stimulus was the 2009 two trillion worth of bonds at the height of inflation. Most recently, the Fed is again planning to buy long-term US Treasury bonds to the tune of hundreds of billions of dollars. The rationale for this controversial decision is to stimulate public spending. The effect of this is that inflation will be slightly adjusted upwards from the current 1% to 2%. The fed officials believe that this will have long-term positive effects on the economy. When people anticipate higher future prices, it is expected that they will increase expenditure today to avoid the extra expenses of the future (Hilsenrath and Cheng 1). This relationship can be shown in a demand-supply curve as illustrated below.

The equilibrium point is a point where the value of is money adjusted thereby creating an equilibrium in the quantity of money supplied and that of the quantity of money demanded. When the Fed adjusts the quantity upwards, it results in the increment of price levels consequently pushing down the value of money. The process of regulation of the money supply as explained above is made possible by one of the Fed’s tools of monetary policy which is known as the Fed fund markets. This is a policy that is carried out by the central bank (Brannstrom 26).

The QE policy is aimed at regulating long-term interest rates rather than short-term interest rates. The main reason for this is that they believe if they can set a threshold of an increasing interest rate in the long run, it will encourage people to make money from their savings and use it to spend. for example, if the inflation rate is to be fixed at 2% per annum from the current 1% and one was planning to take a bank loan the following year, chances are that he would prefer to take the loan today as the loan repayment of the same loan in the next year will be higher. This will increase investment and it will therefore spur economic growth.

Hilsenrath (1) underscores the importance of pushing down inflation rates as well as the interest rates. This is a concept widely taught by economists. But the experiment conducted reveals that the fed is doing exactly the reverse of this; they are taking the risk of pushing the inflation up. While the inflation has been on a steady 1%, they argue that it is not a good enough percentage to spur growth and so they suggest pushing it up to 2%. The Fed to cause a good panic in the market that will cause people to spend more and save less. This, they believe will increase the investment thereby helping in checking on the inflation.

One notable effect of inflation is the redistributive impacts associated with inflation. As explained by Hilsenrath (1) as well as by Brannstrom (26), a high rate of inflation drives up the wage levels thereby making it easier and cheaper for the borrower to pay back his loan. For instance, if a student took a loan today to pay his fees, and the loan was due ten years later within an economy that had undergone hyperinflation, the student will have a lot of money as the wage level will have also gone higher and he will easily pay back the loan. The only problem is that the value of money will have gone down and so the bank may not make a profit out of this scenario.

Works Cited

Brannstrom, Tomas. Money Growth and Inflation. Stockholm: Economic Research Institute, 2005.

Hilsenrath, Jon and Cheng, Jonathan. fed gears up for stimulus. Wall Street Journal. 2010. Web.

Hilsenrath, Jon. Why the fed wants a tad more inflation. Wall Street Journal. 2010. Web.