Introduction

The European financial crisis, which is mostly referred to as the Euro crisis, is an economic term that depicts the economic status of most European countries. The Eurozone crisis started in the year 2009 when most countries in Europe exceeded their spending limits and embarked on borrowing mostly from the European Central Bank (ECB) and the International Monetary Fund (IMF).

The most countries affected by the Europe crisis were members of the EU including France, Germany, Italy, and Greece among others. The crisis followed after the introduction of the Euro currency to be used as a common trading currency among members of the European Union that excluded countries like the Great Britain.

The Euro crisis was instigated by reducing the bank lending rate meant to steer economic growth, but most of the countries could not repay these loans. The countries defaulted to repay back the loans. Thus, the European Central Bank was left to struggle to keep the economy of Europe in the worst case scenario since 1998 when the global crisis emerged (Arestis 2012).

The existence of the European Union was threatened by this crisis as the banking lending rates became very low. This could stall economic growth thereby instigating loss of jobs in Europe when companies are forced to limit their spending just to keep afloat. Stringent measures had to be thought out quickly as it required the intervention of economic giants like the US and Germany.

This was meant to help avert the crisis that would lead to another global financial crisis. Countries like Greece were on the verge of defaulting to repay some of the loans lend out by the ECB and IMF. Thus, the intervention of Germany to help in stimulating the economy of Greece to help it repay the loan was crucial (OECD Economic Surveys: Greece 2011, 2011).

The Solow growth model

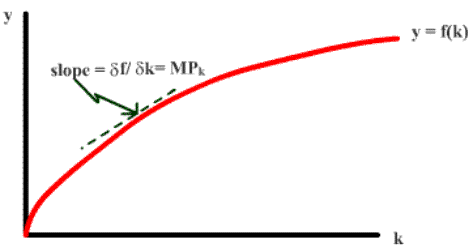

The Solow growth model is an economic graph that examines economic growth by checking how factors like production, population and capital affect the economy. Factors of production like capital and labour affect production in terms of volume and quality. Consumption of goods forms a part of the equation.

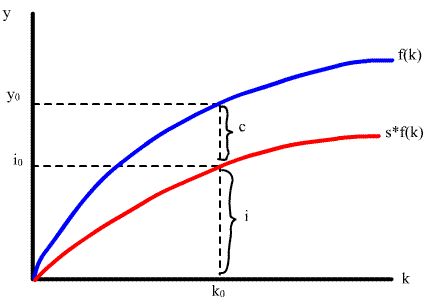

In this case, demand and supply forces determine the cost of production. The Solow model is represented by the following equation. Y = c + I, where y represents the production function in an economy, c represents consumption, whereas the I represent investments. The Solow model can be represented by the graph below.

From the graph, it is clear that the higher the economy’s output, the greater the amount of investment. In the case of Greece, the government should increase the level of national output to stabilize the economy. In turn, this will increase the level of investment and thus leading to increased production.

A country’s level of output is determined by the input factors. These are factors present in the country where capital and labour resources need to be well utilized to increase the level of output. The Solow growth model can indicate that German has put in place good production resources. Thus, the economy of the country is stabilizing while else the economy of Greece seems to stagnate.

A country’s growth is determined by its production and how the production is integrated into its input such as labour and capital. The population in a country provides manpower that helps the industries to operate efficiently. The capital is used to set up a new production line that will help the country to experience growth.

The Eurozone Crisis

German is known to have a stable economy where any decline in the lending rates could affect the economy of the country. The government of Germany has set good and solid financial policies that shield the country’s economy from major global financial crisis. However, the Eurozone crisis happened right in the middle of the country’s major trade partners and thus the value of export in the country could be reduced.

Thus, to the emergence of a single currency to be used by members of the European Union the effect of the Eurozone crisis would affect adversely on the members of this union. The Eurozone crisis would spell out a weak Euro currency, which would have a long term effect on the economy of Europe. The economy would reverse due to closure of businesses and companies as they try to cut down on the spending through employee lay off and reduced sale value (Great Britain 2012).

A strong currency would spell out economic growth where countries would experience an economic boom. Thus, the countries would increase the level of their export, and the government would collect high revenue. In the short run, the bailing out of most of the countries would spell out a relief to the economy of Europe where the central bank would be required to print more money to help in repaying some of these loans.

However, in the long run, the inflation in Europe would sky rocket registering double digits. This will finally affect the global economy leading to adverse effects on the running of major governments and businesses. The economy of Greece was on the verge of collapse, and as a result of the Eurozone crisis, the country’s economy was in huge trouble.

This would affect other countries in Europe (Petrakis 2011). Thus, proper policies from countries like Italy and Spain were to be implemented to help avert the situation in Greece. Greece would have resulted to more borrowing and accumulate the international debt further and thus slow down their economic growth or even resort to the printing of money, and this would raise the rate of inflation in the country (Siebert 2005).

The Eurozone crisis would spell out a sovereign financial crisis to major economies in Europe. Here, they would lose investors, and the Euro currency would fall in value affecting most export from Europe. This will also increase the government’s spending as they try to avert the crisis. The value of the Euro would fall amid fears from major world currencies like the US dollar and the sterling pound (Lynn 2011).

Thus, the effect of the Eurozone crisis would not only affect Greece and Germany, but other countries in the world would also be affected negatively. The economy of most European countries sustains many countries, especially in Africa and Asia. These are countries that rely a lot on the trading of the Euro and the financial capability of the European Central Bank to help in money lending and foreign exchange rates to stabilize.

The effects of the Eurozone crisis are more profound on the running of the economy of countries like Germany and Greece. The value of the Euro was mostly set out to match the value of the Deutschmark, which was the most stable currency in Europe. Thus, the economy of Germany mostly depends on the value of the Euro (Raussello 2012).

The German central bank also referred to as the Bundesbank acted as preservation of the Euro. The bank sought to clear the Eurozone crisis through the economic stimulus program.

This was designed to help most European countries to steer to better economic growth and preserve the value of the Euro. The Euro is highly recognized as a strong trading currency due to its capability and power to trade in different countries around Europe. Thus, any fall in the global market would adversely affect the Euro plus other major currencies in the world (Rogers 2012).

The demand of the Euro would reduce if its value declined and this would affect the international trade in Europe that relies mostly on the export of industrial goods and services. Third party governments had to intervene and help in financing these loans. This was due to the effect that some governments could not repay or finance some of the debt they owed to the major world financial institution.

Some of the countries that were unable to finance their debts include Greece. In the case of Greece, there was the intervention from countries like German (Fiorentini & Montani 2012). The government of German was willing to bail out some of these governments. This was to be taken as a policy to address the crisis, which would have an adverse effect on the economy of many European countries in the long run.

Sluggish economic growth in many European countries would even shake stable economies like Germany and Spain. Thus, as a caution to shield their economy from the crisis, the government of these countries resolved to help avert the crisis effects. This was especially the case in other countries like Greece, which were not in a position to finance its foreign debt (Fiorentini & Montani 2012).

The Eurozone crisis has had adverse effects on the economy of Germany and Greece and not to mention the effect it has had on the economy of Europe and the world. The loss of investors as a result of weak Euro will affect the GDP of most European countries. The effect of the Eurozone crisis in Greece would be adverse and considerably profound due to its inability to finance some of its foreign debts.

In this case, the government would be forced to borrow significantly to repay a part of this loan. The financial position of the country would be on the decline as many jobs would be lost as a result of the financial meltdown. The government would resort to either print extra money or borrow from other sources.

In turn, this would increase the money supply within the economy thus raising the level of inflation. Inflation in the country would spell a low bargaining power of the goods and services in the country. International trade would be adversely affected as the country’s goods would fetch low prices on the market due to low currency value in the country (Hardach 1980). The country’s import would cost the country more money as compared to a situation with a strong currency.

The country would be spending more than its capacity for the same goods and services. The level of unemployment would increase as most companies would be involved in labour restructuring as a result of cutting costs in the country. The government should give relief to the laid off workers when the level of unemployment increases. In this case, the revenue collected from the tax would also decline resulting in low economic growth (Farnsworth & Irving 2011).

The long run effect of the Eurozone crisis on the economy of German would be a reduced economic growth. In this case, considerable funds would be directed to countries like Greece, which have defaulted in paying their foreign debt. The country’s government would resort to issuing of tax relief to some of its companies that may be affected by the low value of the Euro.

The low value of the Euro would affect local industries that produce goods and services for export. Here, their sales would decline due to low currency value thus leading to the lay off some of the workers as a cost cutting mechanism in order to remain in business (Habermas & Cronin 2012). The country’s lending rate would go down. This will adversely affect the economic growth in the long run as the government tries to revive some of the companies to enhance borrowing in order to stay in business.

The government would resort to privatization of some of its assets as it tries to offset some of the deficits it may incur in the process. The country had to budget for over 110 billion Euros to bail out Greece and other countries that had a problem in meeting up the loan repayment. Such financial budgets can affect both the country that is bailing out, and the beneficiary as more stringent measures could be issued to avert the whole situation (Arestis & Sawyer 2012).

There were various solutions to the Eurozone crisis where major economies in Europe like German, Spain and Italy resolved to help countries like Greece that had problems in repaying their foreign debts in time. The country had to privatize most of its assets as a means of payment for the bail out.

This would also help restore the country’s economy, which was on the verge of collapse (Lipschitz & McDonald 1990). This will also stimulate economic growth within the next few years. The country had to implement a complete restructuring of its financial reforms so as to stimulate competitiveness and economic growth. The reforms would help in steering the economy to greater heights and project government initiated investment into the economy.

The economy could be improved by issuing government bonds to raise more funds and service the loan without having much effect on the value of the Euro. The bail out would help Greece to reduce a part of its foreign debt by over a half. This would help the country to increase its GDP through increased investment and strengthening of the country’s economic growth rate to a great extent (Baldwin, Gros & Laeven, 2010).

Conclusion

The Euro crisis is said to have emanated from various countries in Europe. These are countries that had defaulted in paying their public debt. This led to a fall in value of the Euro currency. Countries like German, which have had strong and stable economic growth characterized by strong, financial capability, resolved to bail out some of these countries that had un-serviced foreign debt accumulating to millions of dollars.

These defaulting countries included Greece that had a foreign debt amounting to more than 110 billion Euros. Most industries in the country were on the verge of collapse and thus required an economic stimulus package to help revive the economy back again. The long term effects of the crisis are still being experienced in these countries as they try to revive the value of the Euro for competitive trading.

Reference List

Arestis, P & Sawyer, MC 2012, The Euro crisis, Palgrave Macmillan, Houndmills, Basingstoke Hampshire.

Arestis, P 2012. The Euro crisis, Palgrave Macmillan, Basingstoke.

Baldwin, RE, Gros, D & Laeven, L 2010, Completing the Eurozone rescue: what more needs to be done? Centre for Economic Policy Research, London,

Farnsworth, K & Irving, Z 2011, Social policy in challenging times: economic crisis and welfare systems, Policy, Bristol.

Fiorentini, R & Montani, G 2012. The new global political economy: from crisis to supranational integration, Edward Elgar, Cheltenham, Glos, UK.

Great Britain 2012, Treaty on Stability, Coordination and Governance: impact on the eurozone and the rule of law: sixty-second report of session 2010-12. Vol. 1, Report, together with formal minutes, oral and written evidence, Stationery Office, London.

Habermas, J & Cronin, C 2012. The crisis of the European Union: a response, Polity, Cambridge, UK.

Hardach, K 1980, The political economy of Germany in the twentieth century, Univ. of California Press, Berkeley.

Lipschitz, L & McDonald, D 1990, German unification: economic issues, International Monetary Fund, Washington, D.C.

Lynn, M 2011. Bust: Greece, the Euro, and the Sovereign Debt Crisis, Hoboken, Bloomberg Press, N.J.

OECD Economic Surveys: Greece 2011 2011, OECD, Paris.

Petrakis, P 2011. The Greek Economy After the Crisis: Challenges and Responses, Springer Berlin, Berlin.

Raussello, F 2012, The Eurozone experience: monetary integration in the absence of a European government, F. Angeli, Milano.

Rogers, C 2012, The IMF and European economies: crisis and conditionality, Palgrave Macmillan, Houndmills Basingstoke.

Siebert, H 2005, The German economy beyond the social market. Princeton Univ. Press, Princeton.