Budget

In most general terms, the government budget is a financial status of the government, covering its proposed income and spending for a particular financial period (usually a financial year); it includes all the money, of which the country can currently dispose. The budget (also called the Annual Financial Statement of the country) is usually passed by the legislature and needs the approval of either the chief executive or the president. The document has to anticipate government expenditures and revenues (including all taxes that will be collected). It is the task of the Finance Minister to present the budget to the nation.

The budget of the country can have an economic, political, and technical basis, which implies that the government distributes money not only to obtain the maximum economic profit but also to pursue other interests of the nation, including avoidance of political dependence on other states. The government budget is usually subdivided into three major categories:

- balanced budget: the ‘non-gain’ situation, in which the government spends exactly as much as it receives and manages to avoid national debts;

- surplus budget: the ideal situation, in which the government satisfies all the needs of the nation but still has more money than it is required for everything that has been planned.

- deficit budget: the situation, in which the expenditure exceeds the revenue, usually indicating that the nation’s position is critical.

A continuous budget deficit for a country is connected with several consequences, not all of which are negative. The point is that, unlike private organizations that run bankrupt if their expenditure exceeds the revenue for a considerable period, governments receive money from taxes–this means that they need to spend as much as possible on the nation’s need if they want to win a good reputation. However, when the deficit becomes continuous, the government has to face the following problems:

- increased borrowing: The government is forced to borrow money from the private sector if such an opportunity exists;

- higher debt interest payments: If the national debt increases, future generations will have to pay higher taxes to be able to cover increased interest payments;

- increased AD: generally, a deficit presupposes higher AD; in the long run, this may lead to inflation, the consequences of which are unpredictable;

- higher taxes and spending cuts: To deal with the deficit, the government may increase taxes or introduce new ones while cutting spending on certain areas that are considered to be of secondary importance; this may reduce incentives to work and bring about public unrest;

- increased interest rates: Selling more bonds may result in increased interest rates that are supposed to attract investors;

- decreased size of the private sector: This consequence may be caused by the increased borrowing;

- inflation: To obtain the money to pay debts, the government can decide to increase the money supply and create inflation.

If the national debt remains high for a considerable period, it can result in:

- money being drawn away from private investment in productive capital, which will bring about a smaller stock of capital, lower output, and income;

- reduced spending on benefits and services as all the money will be spent to cover the deficit;

- restricted policy-making ability and incapability to respond to some unpredicted challenges;

- undermined security of the nation because of constraint defense spending;

- financial crisis.

Economists typically use macroeconomic variables to assess the performance of an economy. The major ones include the gross domestic product (GDP), the rate of unemployment in the country, and the rate of inflation.

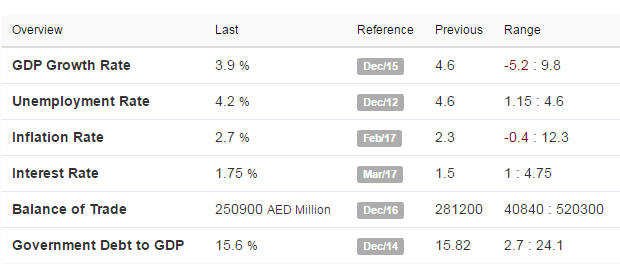

The two countries I have chosen for comparative analysis are the UAE (Dubai in particular) and Singapore. The key economic variables for the first one are summarized as:

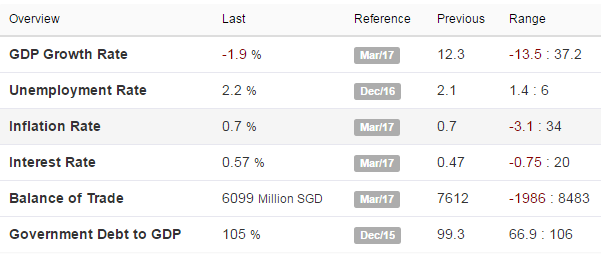

As far as Singapore is concerned, the picture is the following:

In general, the UAE still depends on oil in its revenue. However, Dubai is the only exception to the rule. Over several decades, the city has been looking for additional sources of income to diversify the economy and ensure high revenue that would not rely on petroleum. For this purpose, tourism and international finance are developed; furthermore, the Dubai International Financial Center was established by the government to offer 55,5% foreign ownership, no withholding tax, freehold land, and other benefits–the entire practice is regulated by laws borrowed from the major financial centers (such as London and New York). Dubai announced a new stock market for local companies, developed Internet and Media zones (free of charge), offering no tax office space for companies, and is currently developing other initiatives to boost the economy. As a result of the measures taken, the city has become an attraction for a lot of investors. Some companies decided to open their branches there while others even moved their headquarters to Dubai. Liberalization in the property market allowed people without the UAE citizenship to purchase freehold land, which led to a considerable advance in construction and real estate sectors, bringing additional income to the country. Moreover, airlines also make a substantial contribution.

As far as expenditures are concerned, Dubai is currently investing large amounts of money in infrastructure and the construction market, which is growing by 2-5% each year. The major projects are the Route 2020 Metro extension on the Red Line and Jebel Ali Port and Al Maktoum Airport growth. Moreover, the introduction of rail service is also planned.

Although the country has serious budgetary problems (mostly connected with its military bills), its position is much better than that of its neighbors as it has abundant natural resources.

As for Singapore, the country has a highly developed trade-oriented market economy that has won the position of the most open and pro-business one in the world. The economy is mostly sustained by government-linked companies. The country also benefits from global investors and institutions for the reason that it offers favorable investment conditions coupled with a good political situation.

The major source of revenue for the country is its export, especially in electronic goods, chemicals, and services, for which Singapore is famous. However, despite its general success in the trade sector, the government has to deal with considerable expenditures since its natural resources, raw goods and even water (which is defined as a precious resource) are scarce. This can create a budgetary problem that is now prevented by increasing water prices and introducing taxed on emissions.

As we can see, both countries successfully manage to deal with their economic challenges. Their national debts do not exceed dangerous limits and are likely to be paid without bringing considerable damages to their government budget. Moreover, both countries are developing rapidly in several directions simultaneously, which means that they have good chances to solidify their positions as well-established economies.