Healthcare Systems

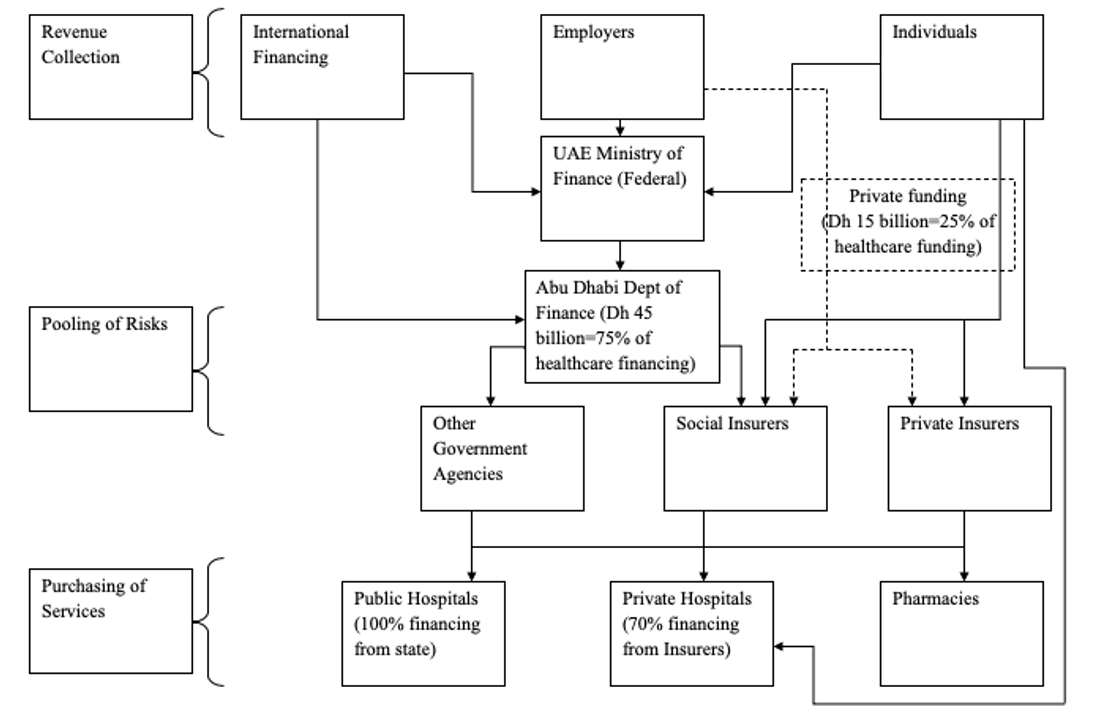

The healthcare financing flowchart in the UAE takes into account the fact that the UAE has a unique political organization. Each of the seven Emirates is autonomous. However, the emirates coordinate certain functions through a federal government to ensure that the emirates remain competitive in international trade (The Oxford Business Group, 2008). In terms of healthcare provision, there are three main functional areas. The three areas are healthcare financing, pooling of risk, and purchasing of healthcare

The healthcare financing of the emirate of Abu Dhabi comes from three sources. First, the UAE Ministry of finance provides healthcare financing from taxes collected from workers and businesses operating in the UAE. The taxes also come from employers who remit income taxes to the government. Secondly, the emirate receives financing from international organizations working in the UAE. These organizations contribute towards healthcare financing by paying healthcare fees for their employees in the UAE, and by supporting the local health systems.

The pooling of risks in the UAE takes place through social insurance and private insurance. Social healthcare insurance is a function of the Abu Dhabi government, while private health insurers provide healthcare funding as an insurance product for interested parties. The government also plays a role in the pooling of healthcare risks by supporting the provision of services to people who may not afford services any other way.

The purchase of healthcare in Abu Dhabi takes place in public hospitals, private hospitals, and in pharmacies.

Methods of Payments for Health Providers in Dubai and Abu Dhabi

Different countries use different methods of payment to finance the healthcare services provided to their citizens. The UAE is unique because of the autonomy of each of the seven emirates that make up the country. As such, each of the emirates operates different methods of payment for healthcare providers. The two main typologies of provider payment methods are fixed or variable systems, and retrospective or prospective systems.

Fixed and Variable Systems

The fundamental feature that distinguishes fixed systems from variable systems is the relationship between activities and payments (Jegers, Kesteloot, De Graeve, & Gilles, 2002). Activities refer to the health services offered by the healthcare provider, while payments refer to the remittances made to the provider by the healthcare funder. In fixed systems, the funds remitted to the provider do not depend on the services offered. This amount is fixed, and the provider knows from the onset what the funder will pay for the services. This makes planning more effective on the part of the provider. However, the quality of care may suffer because of the need to keep costs within certain limits.

On the other hand, variable systems are sensitive to changes in demand for healthcare services. If there is an increase in the activities of the healthcare provider, then the funder adjusts remittances accordingly (Jegers, Kesteloot, De Graeve, & Gilles, 2002). These systems introduce unpredictability in the provision of healthcare. The funder cannot tell in advance the amount of money needed to meet healthcare financing costs. Providers also do not spend sufficient time planning for healthcare services since there is no penalty for failure to plan.

Retrospective and Prospective Systems

The fundamental feature that distinguishes retrospective systems from prospective ones is the relationship between healthcare costs and financing (Jegers, Kesteloot, De Graeve, & Gilles, 2002). In retrospective systems, the healthcare funder provides the money after the providers offer health services. Prospective systems, on the other hand, ensure that the provider receives the money needed to provide services before the provision of the services. Retrospective systems force providers to plan and offer services in ways that conform to laid down guidelines to protect their income. It gives the funder the power to audit services and to query any discrepancies.

On the other hand, it can compromise the quality of care if a healthcare provider cannot meet the costs of providing services. Prospective systems tend to discourage planning because the income from the service comes early. In this sense, the providers may fail to follow laid down guidelines relating to the use of funds because the funder does not have any means of punishing disobedience within a financing cycle.

In Dubai, the Dubai Health Authority regulates the provision of public and private healthcare (Deloitte, 2011). Public hospitals use the retrospective system because they need to have the capacity to handle any unforeseen epidemiological issues. On the other hand, private hospitals use prospective systems whenever they rely on insurance funding. This helps to introduce predictability in healthcare.

In Abu Dhabi, the Health Authority Abu Dhabi (HAAD) regulates the provision of healthcare (Deloitte, 2011). However, the health services in Abu Dhabi, including the Emirates of Ajman and Sharjah are under the control of the UAE Ministry of Health. This demonstrates the interplay between the federal and the emirate governments. The public health centres use the prospective system while the private ones use the retrospective system.

Table 2: Funding Methods in Abu Dhabi and Dubai

Methods of Payments for Health Providers in Germany, UK, and Abu Dhabi

Germany uses social insurance to raise funds to provide medical services for its citizens. The country’s demographic characteristics are such that it is not possible to fund the healthcare system entirely from payroll taxes (WHO, 2007). Different sectors of the German healthcare system rely on different financing models. In public hospitals, the country prefers to use prospective methods to increase the degree of predictability in the provision of healthcare. It is easy for the country to implement these systems because of the availability of long-range data relating to the medical history of the country.

In the UK, the main method of provider payment is capitation, which is a derivative of prospective funding models. Capitation involves providing a fixed amount of money to a health service provider for every member of the society it projects to serve (WHO, 2007). The money reaches the healthcare provider before providing the services. Capitation may reduce the quality of care if the providers feel that the money provided for certain types of care is not sufficient. The UK adjusts the funding provided to take care of criteria like age and income levels. For instance, treating heart disease in a baby is not the same as treating heart disease in an octogenarian. Therefore, capitation for heart disease needs to factor in age and other social and demographic disparities (Ulmer, 2010).

Table 2: Funding Methods in the UK, Germany and the UAE

References

Deloitte. (2011). 2011 Survey of the UAE Healthcare Sector Opportunities and Challenges for Private Providers. London: Deloitte.

Jegers, M., Kesteloot, K., De Graeve, D., & Gilles, W. (2002). A Typology for Provider Payment Systems in Healthcare. Health Policy, vol 60, pp. 255 – 273.

The Oxford Business Group. (2008). The Report: Dubai 2008. Dubai: Oxford Business Group.

Ulmer, C. (2010). Future Directions for the National Healthcare Quality and Disparities Reports. Washington, DC: National Academies Press.

WHO. (2007). Provider Payments and Cost-Containment Lessons from OECD Countries. Technical Briefs for Policy Makers, vol 2, pp. 1-7.