Company overview

HP is one of the companies that provide wide range of products that include personal computers (PC), software solutions, personal digital assistants, portable music players imaging and printing related products and services.

HP provides printers, digital cameras, servers, consulting services, IT services, computers and calculators (Hewlett Packard Company (a) 1). The company is the market leader in most of the computer hardware market has rapidly grown and it edged Dell Company in the global PC market in 2006 and was able to manage the lead in 2007.

The company is currently expanding to new markets and also venturing to manufacturing graphic recorders, medical electronics and other instruments. Due to the good market conditions, the company is able to maintain its brand image and also enjoys economies of scale.

Despite the company‘s huge success, it faces stiff competitions that could adversely affect its long term profitability and revenues.

Dominant Economic Traits

Market size and growth rate

The computer and peripherals industry has very many competing companies. As at 2011, the market had $12.01 billion dollars. The market has been experiencing fluctuations but the 10 year compounded interest is about 9% and 10% in the expected unit growth.

The computer industry is affected by the business and technology forces that control the products that are available and also the profit share that the company has. The market is quite competitive and most of the companies compete for the same market share.

Buyer needs and requirement

The market for home personal computer (PC) has attained its maximum growth in the United States as well as in other developed nations. This market is currently driven by the need for replacement. There is an increase in the need to have several PC within a given home.

This trend will however not affect the market growth by a large margin. The main market now lies with other areas of the world such as Asia and the developing nations. Corporate clients may also want specific computers that suit their needs.

Most of the needs for PC have reduced as the buyers have other products with computing functions such as the mobile phones. The buyer’s market is increasing relatively and is fully penetrated with about 111 million household owning a computer in the USA. Due to the saturation that exists in this market, it is difficult for new entrants to join the industry.

Number of rivals

The analysis indicates that there is intense rivalry in this industry. There are approximately 1500 companies that deal with PC, software’s and other computer related products.

The biggest share of the market is taken by Dell, Acer, Apple, Lenovo and HP. The remaining share is taken by the other small companies. Due to this intense rivalry, the market does not attract new competitors.

Economies of scale

The industry is greatly influenced by the experience and capacity of the firms. Large electronic companies have the necessary experience and enjoy economies of scales.

The economies of scale result to reduced production rate and this strengthens the competitive position of the company. Due to this reason, small and new market entrants have smaller chances of success.

Product innovation is also one of the most dominant factors in this industry. The continuous introduction of new products and services in the market is used by firms in attempt to take up a proportion of the market.

Most of the companies rapidly develop new products that are geared towards customer satisfaction. In this regard, the company must keep on developing new products that will solve most of the consumer’s problems.

Technological changes

Technological changes in the computer hardware and software development is also another key economic trait in this market. Most of the companies in this sector harness new technological innovations so as to gain competitive edge.

Potter Five Forces

Threat of new entrants-Normal

There is intense competition in this industry. The firms compete on the basis of fair price, product loyalty and quality of the product. Firms also compete for new customers and market share. HP competes at many levels with diverse products from different companies.

There are a large number of competitors who fight for the available market. Due to the intense rivalry, there is limited threat to the entry of new competitors. Entry into the market by competitors has little impact on HP. As such the threat of new entrants is normal(CPS 8).

The bargaining power of buyers-fierce

The market largely lacks product differentiations and this erodes the company brand. Most of the parts are standardized and have high operation capability. This makes the makes the prices nearly equal. Hence, there are a few customers who switch from one product to another due to cost. As a result, the bargaining power of the buyer is fierce.

The bargaining power of suppliers- very weak

The force from supplies is very weak and almost non- existing in this market. Most of the inputs are commodity items which have their own competitive pressures and hence no reasonable increase in price of inputs. The only pressure results when the company wants to release a new item as there is need to have preferential supplies who demand special treatment.

Shortages are also few as chip makers have adequate supplies at most times. The company can also integrate backwards so as to create parts they need for their end products.

The company spends time and money in developing new products and hence it is easy for them to integrate backwards. Also, since HP is huge, they have a tendency to buy in bulk and this reduces the force of suppliers during shortages. Therefore, in terms of the potter five forces, this is the weakest force.

The threat of substitute products and services-high

In the market, there are various products that are offered by the competitors. The customer may opt to buy the substitute due to its low price of high quality. The pressure from substitutes comes from products manufactured by the other companies.

There is also a growing tendency of computer applications being replaced by mobile phones such as blackberry and the iphone. Customers can get new smart phones if they want surf the web instead of using a computer. Laptops and notebooks have also replaced the use of PC.

In the games devices, there is the Microsoft x box and other play stations also take up a share of the company’s revenue. These devices are expected to displace PCs and lower the sales volume. Thus the threat by substitute is also at high level.

Pressure from rivals – very fierce

This is the strongest of all the five forces. The market has five large companies which are HP, Dell, Acer, IBM, and Apple. These companies launch new products and fresh market actions that attempt to take a larger portion of the market.

This fierce competition has resulted to firms lowering costs, developing new products, developing means of lowering labor and production costs and companies trying to differentiate their products. In order for HP Company to be able to cope with the intense competition that is currently found in the computer market, there is need that the company develops new innovative products that are both cheap, affordable and have high quality.

The company should also produce devices with high functionality and this is only possible if there is continuous innovation (Hewlett Packard (a) 20).

To counter the increase in devices from the competitors, the company should continually diverse their products and also innovate continuously. This will enable HP to actively compete with other competitor in this field.

Driving Forces

There are a number of factors that drive the change in this industry. One of these forces is the rapid development and the increasing capabilities of smart phones to be used for computing purposes.

Cloud computing is also affecting the need for faster computers and this negatively affects the sale of PC and software’s (Hewlett-Packard(c) 30). This shows that the need for PC is reducing while the price is increasing.

Product innovations

Product innovations are a force to reckon with in the PC and other products that HP develops. Customers are always looking for new innovative products in the PC market and their peripherals.

Products such as wireless keyboards and mouse, flash disks are some of the products that improve the ease of mobility among the computer users. These are in high demand. Improvement in the processing speeds and size of the products also increases the demand for new product.

Changes in customer

The market of the product also keeps of changing. Competitors mostly venture into new market and this increases their sales volume and profit margins. Due to the high competiveness of this market, most of the companies are venturing into other global markets in Africa and other continents so as to increase their sales volume.

Changes in cost and efficiency

Cost and efficiency is also an imperative factor controlling the production rates and the profits that company gain. Most of the firms have currently shifted their operations to areas with lower labor rates such as China.

With reduced production rates, most of the companies are able to lower the products prices and this enables them gain price leadership. The reduction in cost is also important especially during economic hard times. Most customers look for economically priced products and this means that reduction in price would increase the sale of HP products (Bernd 33).

Competitor’s Analysis

The HP companies have a wide range of competitors in most of the products that they produce and market. HP has four principle competitors, that is Dell, Acer, Apple and IBM. These competitors can be grouped into three main groups based on their strategic approach.

The first group comprise of Dell and IBM. This group has high returns; high market share and the operating margins are moderate. All these companies are strategizing on methods of increasing their market share and also diversifying in the related industry so as to gain high profit margins.

To improve the cost, these companies plan to move to china and outsource their productions. The HP holds the highest market share worldwide due to its diversified nature and it is closely followed by Dell. Dell however is not very diversified as compared to HP but offers relatively lower prices and high quality product as compared to HP.

HP and Dell rely on the sale of many products so as to increase their sales. Another competitor is the IBM which solely deals with servers and don’t have a lot of diversifications. IBM has high quality products and services but slightly higher prices.

The second group of competitors is Acer. This company is deeply involved in the commoditized industry. There financial performance is low as compared to HP and the other competitors. Though Acer is small company, it is expected to merge with Lenovo and take up the Chinese PC manufacturing industry.

The other group of competitor is Apple Inc. The company products are highly priced and most of the customers believe that they offer high quality products. Apples Inc produces devices that edge out the use of PC.

The company has for years maintained a market niche for luxury computing and has also ventured to manufacture of the iPod and the iphone. The long term growth prospects of this company are high and the company has a strong balance sheet and financial ratios.

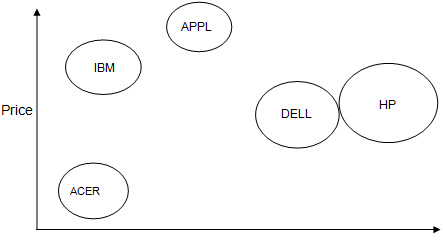

Strategic group map

The HP strategic map is shown below.

Diversification

From the strategic map, it can be seen that the companies either try to lower the prices and also diversify their operations. Acer has lower prices and reduced diversification. Apple leads in terms of high prices and has also diversified into the ipod market and iphone.

HP is the largest of all these companies with the greatest product diversifications and reasonable prices. Dell follows HP but with a little diversification and relatively the same price for PC and other products.

Key success factors

The key factors that contribute to the HP company success are

- Establishing a brand: HP must struggle to maintain its brand name. Even though the cost and product differentiation are virtually impossible, the company should market their products as being of high quality so as to maintain their brand.

- Diversification: currently HP leads in diversification. As competition increases, the company must diversify into new markets such as production of iphones as well as diversify to other computer accessories(Bennett 5)

- Economies of scale: due to the large size of this company, it is able to enjoy large economies of scale. These would be necessary so as to reduce production costs and subsequently the price of the final product. Using economies of scale, the company is able to offer competitive prices. In a competitive market, low prices are crucial in establishing and maintaining of a brand.

Overall in industry attractiveness

The market can be regarded as being very unattractive. Most of the successful business such as apple, Dell and HP and others are diversifying to other areas so as to increase their profit margins. There is high competition and the product differentiation is limited as the speeds and performance of most of the components are standardized.

Most of the companies are trying to establish a brand in this market but this problematic due to pricing and product differentiation limitations.

Works Cited

Bennett, Jon. Attractiveness of the Personal Computer Manufacturing Industry in the United States, Ohio: Ohio university press, 2009. Print.

Bernd, Panzer 2005, Technology, Market and Cost Trends 2012. Web.

CPS 2009, IT Industry Trends, Research and Developments. Web.

Hewlett Packard (a). Hewlett Packard 2012 Annual Report. 2012. Web.

Hewlett Packard (b). Company products and services. 2008. Web.

Hewlett-Packard (c) 2008, Hewlett Packard 2008 Annual report. Web.