Target Corporation a significant increase in revenue growth in 2020 from 2019 by 19.8%, which exceeded the previous year’s revenue growth at just 3.7% (Target Corporation, 2020). This is attributed to the strategy implemented by the company offering a mix of retail and online during the pandemic lockdowns and having the designation as an essential retailer which boosted it over many competitors (Repko, 2020).

Operational Expenses

There was a marginal growth of approximately 1.02% in operational expenses in 2020, reduced from the 1.05% in 2019. Target is committed to optimizing operational costs through supply chain and maintaining appropriate inventory. At the same time, these operational expenses are high because Target’s fulfillment network has to operate smoothly to meet consumer demands to avoid out-of-stock options or delivery delays (Target Corporation, 2020).

Profit Margin

Despite Target increasing its net earnings year over year, especially by over $1 billion in fiscal year 2020, its net profit and gross profit margins are remaining similar, with decimal of percentage points in changes. Retail typically has lower profit margins than other sectors and 4% is on the upper side for this industry (Ross, 2020). It is also important to consider that Target is achieving growth, and operating costs are on the rise annually. The fact that Target is able to increase net earnings by such a significant amount and even slightly raise its net profit margin indicates much efficiency in the company. Meanwhile, the gross profit margin is also remaining stable, slightly decreasing. It is not critical and still indicates stable financial health for Target which invests heavily in costs of goods due to its retail industry. It also could not actively increase prices even if inventory pricing was going up because of the pandemic and economic situation in the country. Therefore, in conclusion because its net profits have gone up so significantly while net and gross profit margins have remained relatively the same, it demonstrates efficiency and healthy earnings for the company.

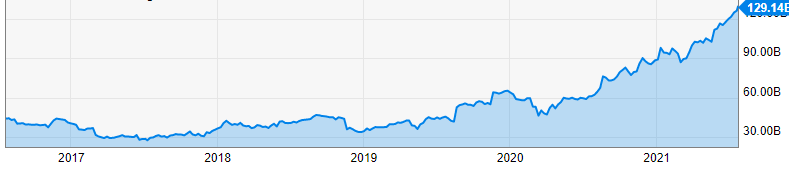

Stock Performance

The stock price has been gradually on the rise over the last 3 years, generally with few dips but a stable upwards trajectory. Its increase of 219% in the last year alone is likely based on extraordinary sales and revenue projections that Target has been demonstrating with each quarter. Target is one of the strongest leading stocks in wholesale-retail over the last year. The stock TGT has made a 42.27% return on investment over the last year, while retail stocks on average are –1.20% (Zacks Equity Research, 2021). The company’s high earnings and recommendations for investors as a strong purchase has been contributing to the growing stock price.

Latest Market Value

Target’s market value has been increasingly growing, largely matching the trajectory of the stock price which obviously contributes. In addition to its high net positive profits also contributes to the market value. Investors are very satisfied with the performance of the company and there is a stronger call to invest further. Target’s market value is a big factor of the company’s growing market share in the sector. Depending on product segment in wholesale retail, Target holds between 20 and 26% market share (Statista Research Department, 2021).

Debt

Target notes that it relies on debt for operations, suggesting that access to financial markets is critical, and it is necessary to maintain strong credit ratings. As can be seen total debt has been increasing, but so has total assets and shareholder equity at a much faster rate. The debt-to-equity ratio indicates that Target finances a significant portion of its debt through shareholder equity and is in good financial health. Meanwhile, the debt-to-asset ratio indicates that just a quarter of its assets are financed by creditors and easily meet all debt obligations. Target is in excellent financial health in terms of debt and can preserve high trust among creditors.

Cash Position

Target has seen a 326% increase of its cash position with period-end cash and cash equivalents balance climbing to $8.5 billion. It is a significant cash position and corresponds to the company’s strategy of maintaining liquidity to be enough for maintaining operations, finance any expansions and strategic initiatives, and fund debt maturities. The company also maintains an operating cash flow of $10.5 billion, increased by 3 billion from previous years, and $10.7 billion in inventory (Target Corporation, 2020). Target’s cash position is stable and along with other liquid assets far exceeds its total debt and potential liabilities, which signifies the financial strength of the company.

Liquidity Measurement Ratios

(Source: WSJ, 2021).

Liquidity measurement ratios evaluate the ability of a company to meet its short-term debt obligations. Current ratio is based of balance sheet financial performance, measuring liquidity in the estimate to pay off debts over the next 12 months. Here the ratio is over 1 indicating high possibility of it. Quick ratio is short-term liquidity measures, once again coming at much higher than 1, indicating significant health. The only element where Target is below the ration of 1 is in cash ratio, indicating that its immediate cash is unable to pay off its liabilities. However, given that the majority of the company’s total liabilities are long-term debt, this does not indicate that the company is facing any issues, but should strive to build up its cash position in the future.

Product Offerings

Target is a large retailer which purchases goods from manufacturers and wholesalers and allows consumers to browse and buy a wide variety of goods in one location. Target operates in five product categories of food and beverage, apparel and accessories, home furnishings and décor, beauty and household essentials, and hardlines (Vault, 2019). Most general merchandise can be found under one of these categories, with assortments changing depending on location and consumer demands. Similar to other large retailers, Target offers online ordering for pick-up or delivery as well as a loyalty program for consumers.

Core Products

As a large retailer, Target does not necessarily have core products. Instead, its core offering is location and service, attempting to become a premier shopping location offline and online. The company’s mission statement focuses making Target “the preferred shopping destination” by offering value, innovation, and guest experience. As one of the ways the company does so is selecting a few exceptional brands in each category of products, known as owned brands, that Target supports to being in line with their core strategy and meeting the best quality expectations for consumers. These are sold exclusively through Target and consist of 1/3 of total sales (Target Corporation, n.d.a). Otherwise, Target’s core is ensuring the consumer experience in its retail space is flawless from entry to checkout.

Distribution Method/Strategy

Target is a retailer, which means that it purchases a wide range of products from wholesalers and manufacturers directly. The goods are shipped and kept in one of the 44 large warehouse distribution centers that Target has around the country. The company then uses a pick-and-pack strategy for the majority of products. Rather than shipping full cases of product, it receives a ‘mixed bag’ of items ordered, which helps to reduce inventory management and labor costs with the most optimal utilization of space in store. Consumers then enter one of Target’s 1,900 stores nationwide and purchase products available on display or in inventory. There is also a digital fulfillment option where consumers can order online and then get it delivered or pick-up from its brick-and-mortar stores (Britt, 2020). Overall, Target’s distribution strategy is aimed at the most efficient movement of inventory from its source and distribution centers to the retail stores and to consumers, while minimizing costs and optimizing delivery times.

Target Audience

Since Target carries general merchandise, it seeks to appeal to virtually any demographic and customer segments. It carries products for households and singles, males and females, all age groups. However, approximately 60% of base shoppers are female. Although Target does not necessarily position itself as such, it is often viewed as more upscale in comparison to other large retailers such as Wal-Mart or Costco, attracting affluent consumers. Therefore, moderate to upper-median income customers are often seen at Target. Target shoppers are also generally younger, with the age bracket 18-44 being the most relevant. The majority of Target shoppers are also white, consisting of 65% of the customer base, while more than 20% are Hispanic. While appealing to all lifestyles, Target selections and merchandise tend to favor active lifestyle customers (PYMNTS, 2016).

Main Competitors

- Walmart – one of the largest companies and retailers in the world. Walmart is known for its expansive size and hold on wholesale retail industry and is synonymous with this type of shopping experience. Similar to Target, Walmart offers a range of products in all categories, both under its own and from outside brands. It also has its own pharmacy and other customer services in-store. Walmart is known for their highly versatile inventory management and distribution system, able to have a digital e-commerce presence that is 2nd only to Amazon. Walmart is associated with low-cost, discount goods being appealing to the majority of low-income and lower-median income populations.

- Costco – similarly one of the largest retailers that operates under the model known as warehouse/wholesale clubs, essentially selling many of its merchandise offerings in bulk quantities, allowing customers to receive value. Costco is a membership-based retailer where consumers purchase an annual membership and then enjoy the discounts that Costco has to offer as well as other services such as their in-store food court, pharmacy, and gas-station outside. Costco’s unique selling point is the bulk products, especially for non-reusable goods for which the company is better known for, having several its own sub brands. It does offer a range of other products in multiple categories, although the selection is typically lesser in comparison to competitors. With the cost of membership being a barrier, Costco is most popular with the middle-class demographic who see it as a good balance between value and quality.

- Amazon – Although Amazon does not have a strong brick-and-mortar presence (outside of a few experimental stores), it is the absolute dominant giant of online retail and serves as a direct competitor to Target and the others. Given contemporary trends, with each year, more people shop and order online, including goods that would be traditionally bought in-store such as foods, household goods, clothing and accessories, beauty and self-care products. Amazon has grown to fulfill these consumer needs, with perishable food being the only category where it is the weakest (but is growing with its Amazon Fresh sub brand in metropolitan areas). Target and the other retailers realizing the consumer trends of ordering online are attempting to capture as much of the market as well, but Amazon remains synonymous with online retail and offers features such as rapid next-day delivery to the doorstep, usually a much wider choice in most consumer categories, and other online services where Amazon has expanded, and customers can draw benefits from.

All of these competitors are similar in that they are large retailers, both in-store and online, offering a broad range of products with complex inventory management systems which seek to get the goods from producers to consumers in an optimal manner. Each simply has its own approach to the concept and maintains a unique selling point that appeal to different types of consumers or situations.

Geographic Reach

Target is present in all 50 U.S. states and Washington D.C., with 75% of the population located within 10 miles of a Target store. It has 1909 stores in the U.S. with 44 distribution centers (Target Corporation, n.d.b). It has no international retail locations, but offices worldwide, likely for sourcing products. Similar to many other retailers, Target is closing stores in 2021, largely in less-affluent communities. Overall, the company’s reach across the U.S. is significant and it is recognized in all states.

Advertising & Promotion Strategy (IMC)

Target uses a highly developed and complex marketing mix on all platforms to reach its consumers. It has television, radio, print, and online advertising. Target’s logo with its bright red colors is universally recognizable, making it easily stand out which the company uses to its advantage in marketing design and planning. Target’s slogan is “Expect more. Pay less.” It positions itself as a company which offers high quality of products, stylish, even elegant to an extent, while maintaining accessible pricing. Target’s advertisements are often youth and family-oriented, making it appeal to the middle-class household demographic of a wholesome family shopping. Similar to other retailers, Target aims marketing at high-volume purchasing periods such as Christmas, back-to-school, and others, with discounts in appropriate categories. Target utilizes its own brands and a mix of trusted outside brands to also drive forward its message in marketing value. The key promotion strategy is offering exclusivity of products and brands at very attractive pricing (Talbot, 2020).

Pricing Method & Strategy

Target uses an economy pricing model, aimed at keeping overhead low. Instead of having a wide assortment compared to Walmart, Target limits its assortment and combines it with its company owned brands or private label brands to achieve sales. Target also has a policy of price matching on a significant portion of its inventory to match lower prices than that of competitors for the same exact version of a product. Target does seek to provide value so it will have regular discounts for consumers on essential and non-essential goods.

Positioning Strategy

As described earlier, Target is driven by its slogan of “Expect More, Pay Less” positioning itself as an accessible retailer of high quality and elegant goods in all categories. It positions itself as widely appealing and inclusive, having something for everyone. The brand has an association of design, slickness, even a level prestige, combined with excellent service and very clean and well-setup stores. Over the years, it has positioned itself to a narrow market focus which are its core consumers, young adults, particularly young couples and families, offering assortments most tailored to their needs (Mourdoukoutas, 2019). This strategy is allowing to compete healthy with Walmart and Amazon in a market when they should theoretically be falling.

Value Proposition

Target’s mission is to “fulfill the needs and fuel the potential of our guests” by making Target the preferrable shopping experience on all channels. The value proposition for Target is that it will provide a pleasant shopping experience via the customer service it provides, value delivered on its products, and innovation through available features both in-store and online. Therefore, Target seeks to deliver value through a range of elements such as accessible pricing on more upper-end products, as well as accessibility and convenience of online ordering and pick-up/delivery.

Differentiation Strategy

Target is achieving differentiation through once again, its pricing strategy of offering discounts on higher quality items. It also seeks to differentiate itself through its brand, being highly recognizable and associated with certain types of consumers which are its core base (young families). However, as part of the marketing around the universally recognized Target logo, the company promotes brands that it owns or have chosen. The strategy is based on achieving relevance through differentiation, and the company’s in-house media agency actively promotes the relevant factors that make Target stand out.

Customer Relationship Management (CRM)

Target values consumer service, which serves as one of its differentiators, so it invests heavily into CRM. The company attempts to maintain a positive image in the community and be the brand that is liked by everyone. Target communicates both in marketing and company-related announcements clearly and transparently, so customers are aware of any changes. Target takes the needs and safety of consumers into consideration, for example, offering curbside pick-up since the pandemic hit. Target provides key consumer services in-person and online, combining technology and innovation with optimal consumer choice and satisfaction. Target has a dedicated CRM system which utilizes consumer data to enhance the shopping or customer service experience so that there are seamless transitions. Finally, the company provides various resources to communicate with the customer base and receive its feedback as part of an essential dialogue for improvement.

References

Britt, H. (2020). How Target ensures its supply chain never misses the mark. Web.

Mourdoukoutas, P. (2019). Target’s three-step strategy for fighting Amazon And Walmart paying off. Forbes. Web.

PYMNTS. (2016). Meeting the average Target shopper. Web.

Repko, M. (2020). Target reports a monster quarter — profits jump 80%, same-store sales set record. CNBC. Web.

Ross, S. (2020). What is a good profit margin for retailers? Web.

Statista Research Department. (2021). Target: Sales share in the U.S. 2020, by product segment. Web.

Talbot, P. (2020). Inside Target’s marketing strategy. Forbes. Web.

Target Corporation. (2020). Target brands. Web.

Target Corporation. (n.d.a). 2020 annual report. Web.

Target Corporation. (n.d.b). All about Target. Web.

Vault. (2019). Target corporation. Web.

WSJ. (2021). Target Corp. Web.

Zacks Equity Research. (2021). Has Target (TGT) outpaced other retail-wholesale stocks this year? Yahoo Finance. Web.