Introduction

HSBC Holdings plc is a multinational company with roots in Britain (London, United Kingdom). The main focus of the company is to provide banking and financial services. HBSC is ranked number five in the whole world in terms of assets base that amounts to US$2.7 trillion. It was set up in its current structure in London in 1991 by the Hong Kong and Shanghai Banking Corporation Limited to go about as another holding organization.

The beginnings of the bank rest basically in Hong Kong and to a lesser degree in Shanghai, where the first branches were started in 1865. The HSBC name is gotten from the abbreviation of the Hong Kong and Shanghai Banking Corporation. The organization was first officially consolidated in 1866. The organization keeps on seeing both the United Kingdom and Hong Kong as its domestic markets.

What is the role of commercial banks? What are the important parts of banking innovation? What figures out if banks work productively? The banks’ capacity to improve instructive asymmetries in the middle of borrowers and lenders and to oversee uncertainties is the quintessence of bank generation. The writing on monetary intermediation proposes that business banks, by screening and observing borrowers, can tackle potential risk and adverse selection issues brought on by the flawed data in the middle of borrowers and lenders. Banks are extraordinary in issuing a demandable obligation that partakes in the economy’s installments framework.

This obligation gives an enlightening point of preference to banks over different moneylenders in making advances to borrowers who do not have adequate information. Specifically, the data acquired from financial records exchanges and different sources permits banks to survey and oversee unexpected hazards, develop contracts, screen contractual execution, and, resolve non-execution issues (Lundberg 16).

The fact that the banks’ liabilities are highly demanded gives banks a motivating force over different financial institutions. The moderately abnormal state of debt in a bank’s financial structure teaches the banks’ administrators to manage risks and due diligence in order to avoid the instance of a bankruptcy. The demandable component of the debt, to the degree, that it is not completely protected, further elevates the pressure that comes with execution and security worries by expanding the risks associated with liquidity.

These motivations allow the banks to be in a pole position to observe the conduct of the borrowers. In this way, the ability of banks to offer to fund through demandable debt offers them both a motivational advantage and an educational advantage in loans to firms that are not privy to much information regarding raising capital through equity and debt. The special features of the banks’ products as opposed to the generation of different sorts of moneylenders are gotten from the exceptional attributes of banks’ financial structure (Lundberg 16).

In any case, banks’ capacity to perform proficiently – to embrace fitting investment techniques, to get precise data regarding their clients’ budgetary prospects, and to generate and authorize compelling contracts – relies partially on the property rights and lawful, administrative, and business environment in which they work. Such a domain incorporates bookkeeping conducts, contracting rules, legal regulations, and the economic situations in which banks work. Contrasts in these elements across the banking space can prompt contrasts in the effectiveness of banks across the same space. The interest of banks in the payment framework prompts their regulation and, specifically, to confinements on new entrants into the business.

The need to get a sanction to start a banking business presents a level of business sector power on banks working in littler markets and when all is said in done, licenses banks to endeavor important speculation opportunities identified with budgetary intermediation and installments. The government’s intervention in the banking sector advances their well-being and soundness keeping in mind the end goal to shield the payment framework from bank operations that debilitate macroeconomic steadiness. Ensuring the payment framework every now and again includes the protection and insurance of the deposits. To the degree that the protection or insurance is believable, the investors will have full confidence in the bank’s operations. Hence, it diminishes banks’ risks associated with liquidity (Lundberg 16).

Research objectives

On the premise of the literature review and the research gaps recognized in the literature; the accompanying objectives have been encircled:

- To examine the relationship of financial pointers with the execution of the HSBC bank.

- To quantify consumer loyalty and its association with the performance of HSBC bank.

- To gauge worker satisfaction and its association with the performance of HSBC banks.

- To study and measure the corporate social obligation and its association with the performance of HSBC banks.

- To make a comparative investigation of the general performance of the HSBC bank.

Financial ratio analysis and financial statement analysis

Financial Ratio Analysis

Financial analysis is a very significant aspect of case study analysis. In any case, the financial analysis reflects on the performance of the company in relation to its strategies and structure (Gorsky 66). Even though financial analysis is somehow complex, a great deal of the company’s financial position can be determined using ratio analysis. The financial ratios are classified into five main categories, namely: profitability tests, Liquidity tests, Activities tests, Leverage ratios, and Solvency tests (Poznanski, Sadownik and Gannitsos 1).

Profitability Ratios

These ratios show whether the company is making progress or going down. Profitability ratios include Net Profit Margin, Return on Total Assets (ROA) and Return on Stakeholders Equity (ROE). Profit margin= Net Income/Net Sales Revenue. On the other hand, Return on Total Assets (ROA) = Net Profit/ Total Assets, whereas Return of Stakeholders Equity (ROE) = Net Profit/Stakeholders Equity (Poznanski, Sadownik and Gannitsos 2).

Net Profit Margin (NPM)

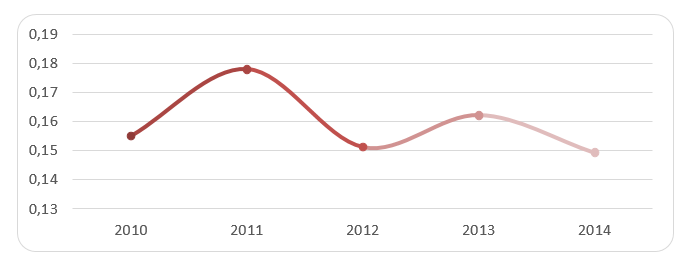

The net profit margin shows the company’s level of profitability (Poznanski, Sadownik and Gannitsos 2). The net profit margin for HSBC experienced ups and downs between 2010 and 2014 with the highest in 2013 and the lowest in 2014 of 0.179% and 0.134% respectively. The poor performance in 2014 is linked to increased equity multiplier and low net income earned by every pound of net sales.

- Profit margin= Net Income/Net Sales Revenue

Actual Calculation= Net Earnings Attributable to HSBC/ Net Sales

Table 3.1 Net profit margin.

Return on Total Assets

Return on Assets ratio of any financial institution like HSBC shows how proficient assets are used to generate returns. In most cases, constituents of bank’s Return on Assets ratio are net interest margin, net non-interest margin, and unique transaction. When these constituents are added together they result in ROA of a bank. Such a breakdown of the constituents of a bank’s ROA can be extremely useful in clarifying a number of latest changes that banks have encountered in a specific money-related position (Shams 18). Under normal circumstances, Return on Assets= Net Income/ Average Total Assets. Actual calculations= Net Earnings/ (Beginning + Closing Assets). The table below highlights HSBC’s Return on Assets ratios with its breakdown.

Table 3.2 HSBC’s ROA.

The Return on Asset ratio for HSBC also experienced ups and downs between 2010 and 2014 with the highest in 2011 and the lowest in 2014 of 0.178% and 0.149% in that order. The increase of ROA in 2011 is attributed to the growth of the net interest margin, which increased by 0.176 percent. The net non-interest margin was highest in 2010 at 0.009 percent.

Return on Equity

The ratio computes the earning from every unit of equity. It is more reliable than earnings per share when comparing the performance of different companies (Poznanski, Sadownik and Gannitsos 2). ROE is a ratio that determines a company’s success by disclosing the volume of returns it generates out of the money invested by the shareholders. The figures are given in percentages. In banking, return on equity is determined using the following components, namely: level of asset use, net profit margin, and equity multipliers. Each constituent acts as an indicator of various elements of the HSBC’s operations.

Table 3.3 HSBC’s ROE.

Table 2 shows the three components of ROE. When the three ratios decrease, ROE also decreases. ROE is the product of the level of asset use, net profit margin, and equity multiplier. The ROE for HSBC between 2010 and 2014 was at the peak in 2013 (0.125%) and at the bottom in 2014 (0. 076%). The equity multiplier was highest in 2010 and the lowest in 2014, which is sound for the business. The equity multiplier reflects on how an organization is using borrowed funds to finance assets.

This ratio shows HSBC’s overall assets per unit of shareholder’s equity. A higher equity multiplier signifies higher leverage, which implies that the company is over depending on external borrowing to finance its assets. The performance of HSBC was outstanding in 2013 when the NPM was highest at 0.179 percent and the equity multiplier was considerably small at 15.532 percent. However, in 2014, both equity multiplier and NPM went down at 14.472 percent and 0.134 percent respectively.

Earning per share

- Earnings per Share = Net Income/Average Number of Common Stock Outstanding

Table 3.4 Earnings per Share.

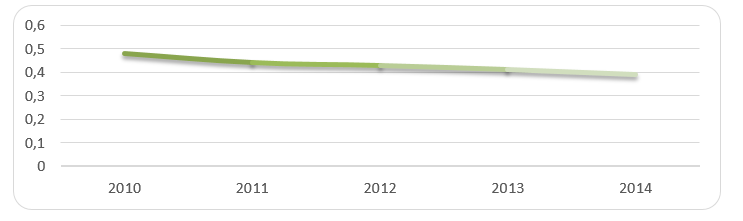

This is the monetary value of returns for every share of an organization’s common stock. Earnings per share of HSBC were at a peak in 2011 and the lowest in 2014 at £ 0.57 and £ 0.42 in that order. The overall average value for the five-year period was £ 0.54, which is economically sound. However, earnings per share of HSBC keep on fluctuating, hence not stable.

Earnings Spread

This ratio measures the company’s earning efficiency (Shams 33). It is calculated using the following formula:

- Earnings Spread= (Overall Interest Income/Overall Earning Resources)-(Overall Interest Cost/Overall Interest Liabilities).

Table 3.5 Earnings spread.

The company’s earning spread was positive for the five-year period, which is fiscally acceptable. However, earnings spread has not grown up to date. Instead, it has been decreasing since 2012.

Liquidity Test

These ratios measure the ability of the company to meet its short-term obligations. Liquidity ratios include the Current ratio and Quick ratio (Shams 34).

Current Ratio

Current ratio=Current assets/Current liabilities and it should be more than one. However, a high current ratio, particularly the current ratio larger than 2 may mean the company is using its resources unproductively.

Table 3.6 Current ratio.

The current ratios of HSBC are above 1.0 in the five-year period, which means the company is able to pay off the current debt. In other words, the company can meet short-term obligations without borrowing. This is good financially. The ratio keeps on increasing showing that the company is improving.

Quick Ratio (Acid Test)

- Quick Ratio= Quick Asset/ Current Asset

- Actual Calculations= (Cash Equivalent Investment Securities+ Account Receivable)/ Total Current Liabilities.

Table 3.7 Quick ratio.

The quick ratio confirms a solid level of HSBC liquidity. It is a more reliable ratio than the current ratio as it considers the quick asset and excludes stock, which may not be converted to cash. The low ratio shows the company is not in a good position. Still, the ratio is increasing, which means the company is increasingly growing.

Leverage Ratios

These ratios show the amounts of debt or equity used to finance the business. Businesses are highly leveraged if they use more borrowings than equity. The balance between the two is normally referred to as the capital structure. The main leverage ratios include Debt to Asset ratio and Debt to Equity ratio.

Debt-to-Equity Ratio

- Debt-to-Equity Ratio= Total Liabilities/ Stakeholders’ Equity

- Actual Calculations= Total Liabilities/ Total Shareholders’ Equity

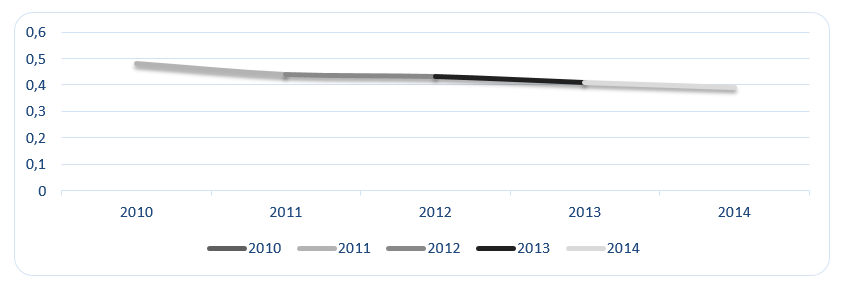

Table 3.8 Debt-to-equity ratio.

Based on the Debt-to-Equity ratio, for each dollar of stockholders’ equity, the company has a greater worth of liabilities. A high ratio suggests that HSBC depends heavily on funds provided by creditors, which puts the business at high risk. However, the company is reducing its rate of borrowing.

Debt-to-Asset Ratio

- Debt to Asset Ratio= Total Debt/Total Assets

Table 3.9 debt-to-asset ratio.

The table above shows a decreasing trend of leverage, which is good for the business. The company had high leverage in 2013. It may be due to long and short term borrowing for some new product inventions. From 2010 to 2014, the demand for debt had decreased considerably.

Capacity Ratio

Capacity ratio= Net Loan/Total Assets. Since loans and leases are usually regarded as some of the most illiquid assets banks can hold on, capacity ratio acts as a negative liquid indicator.

Table 3.9 Capacity ratio.

The company has been incredibly steady at maintaining their capacity beneath 50%. Given the size of HSBC, this is considered fiscally sound. Nevertheless, the company should invest more in instruments that can be liquidated very fast.

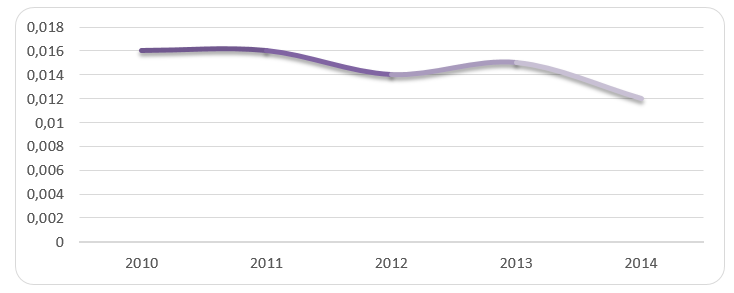

Net Interest Margin

The net interest margin is the ratio that assesses how efficient a company manages its investment decision with respect to debt condition.

Table 3.10 Net interest margin.

HSBC enjoyed a positive interest margin from 2010 to 2014. However, the margin has been decreasing steadily. For this reason, necessary measures should be put in place to reverse the situation.

Interest-Sensitive Gap

The interest receptive liabilities have always exceeded interest receptive assets in the company for the last decade. Interest receptive liabilities were highest in 2013 and they have been on a progressive trend since 2010 (except 2014). This puts the bank at very high risk in case of considerable change in interest rate.

Relative Interest-Sensitive Gap

Relative Interest-Sensitive Gap is the ratio of the interest-sensitive gap and the size of the bank. A relative interest-sensitive gap more than zero describes an asset-sensitive bank, whereas a relative interest-sensitive gap means the bank is liability-sensitive.

Table 3.11 Relative Interest-Sensitive Gap.

Since the figures above are below zero, it means that the bank is liability sensitive. Nonetheless, the figures have never slumped beyond -0.05 and it has been stable since 2012.

Interest Sensitivity Ratio (ISR)

An interest-sensitive ration is a difference between interest-sensitive assets and interest-sensitive liability. An interest-sensitive ratio of less than 1 describes a liability sensitive bank, whereas an interest-sensitive ratio of more than one describes an asset-sensitive bank. Given the fact that all the ISR values from 2010 to 2014 are below one, it means that HSBC is a liability-sensitive bank.

Table 3.11 Interest-sensitive ratio.

Cash Position Indicator

This ratio measures the bank’s efficiency in handling immediate cash needs. It is measured by dividing cash and deposits from depository institutions. A higher cash position indicator means the bank is in a stronger position to take care of immediate cash needs.

Table 3.11 Cash Position Indicator.

HSBC maintained an average of 75% cash position from 2010 to 2014, which is decent for a bank. This means the bank is very capable of handling immediate cash needs. Though in 2012, the bank had the lowest cash position in the five-year period.

Liquid Security Indicator

This ratio measures the capability of a bank to hold on to marketable securities given its asset portfolio. When the ratio is higher, it means the bank is in a more liquid position. It is calculated using the following formula:

- Liquid Securities Indicator=state securities/total assets

Table 3.12 Liquid Security Indicator.

The company’s liquid security indicator is very small. It is almost nonexistent. This implies that HSBC does not depend on marketable securities for immediate cash needs.

Tier 1 Core Capital

A company’s capital base is normally categorized into three for a regulatory purpose, namely: tier 1, tier 2 and tier. This form of classification depends on the level of perpetuity and loss of absorbency. The core tier 1 category constitutes of stockholder’s equity and non-controlling interest. For the purpose of capital sufficiency, the book values of immaterial assets are subtracted from this category and additional amendments are made for items that are included in stockholder’s equity.

Table 3.13 Tier 1 Core Capital.

The tier 1 core capital entails common stock and excesses, plowed-back earnings, aggregate stock, marginal interest and immaterial assets. This ratio basically describes the company’s financial strength. From 2010 to 2014, the ratio has increased by £1636562.million. This makes HSBC be ranked among the leading financial institutions globally.

Tier 2 Supplementary Capital

Tier 2 Capital constitutes secondary loans, associated non-controlling interest, permitted combined risk allowances and unrealized returns originating from a fair appraisal of stocks. It also comprises of reserves arising from the re-evaluation of assets.

Table 3.14 Tier 2 Supplementary Capital.

The company’s tier 2 capital has been decreasing since 2010. However, it is still strong at £20135 million. The decline is attributed to the company’s emphasis on tier 1 capital.

Internal Capital Growth Rate

This measures the rate at which the bank allows assets in order to avert the decline in capital to asset ratio. The internal capital growth rate is calculated by the following formula:

- Internal Capital Growth Rate= Retained Earnings/ Net Income after Taxes

Table 3.15 Internal Capital Growth Rate.

Internal Capital Growth Rate is the highest rate of growth feasible for a company devoid of external borrowing. The company’s Internal Capital Growth Rate went down by 0.02 percent from 2010. However, the rate has been steady since 2010. Nonetheless, the bank is still vulnerable at 0.62 percent.

Activity Ratios

These ratios show how their company is overseeing the use of its assets.

Return on Assets

- Return on Assets= Net Profit/ Total Assets

From 2010 to 2014, the return on assets was on a rising trend. It may be due to several reasons. Firstly, the sales increased and expenses reduced. Secondly, the asset turnover increased. This may also be attributed to efficiency in revenue collection and inventory management. However, in 2013 in slumped a little bit.

Literature review

The elements that determine the performance of a bank can be divided into two, for instance, internal elements and external elements. The internal elements of the bank’s performance can be characterized as those elements that are affected by the bank’s administration choices and strategic targets. Administration impacts are the aftereffects of contrasts in bank administration goals, strategies, choices, and activities mirrored in contrasts in bank working results, including the level of profitability. Administration choices, particularly with respect to credit portfolio, are an essential contributing component in bank execution.

Specialists often credit great bank execution to quality administration. Administration quality is surveyed as far as senior officers’ mindfulness and control of the bank’s approaches and execution. The majority of the financial ratios in the balance sheet and income statement are fundamentally identified with productivity, especially capital ratios, interest payable and receivables, compensations, and wages.

An aide for enhanced administration ought to first accentuate cost administration, administration of fund source, administration of reserves. A bank’s resource and risk administration, financing administration and the non-premium cost controls all significantly affect the performance record. Various studies have inferred that cost control is the essential determinant of bank productivity. Cost administration offers a noteworthy and steady open door for performance change. With the expansive size and the substantial contrasts in pay rates and wages, the proficient utilization of work is a key determinant of relative benefit.

Staff costs, as tried and true way of thinking proposes, are relied upon to be contrarily identified with productivity on the grounds that these expenses diminish the bottom line or the aggregate performance of the bank. The level of staff costs seems to negatively affect banks’ return on assets. In any case, there exists a positive relationship between staff costs and aggregate benefits.

High benefits earned by firms in a controlled industry might be appropriated as higher finance consumptions. The external elements that determine the bank’s performance deal with those components which are not impacted by a particular bank’s choices and approaches, but rather by occasions outside the impact of the bank. A few outside elements are incorporated independently in the analysis of the performance to confine their impact from that of the structure of the bank.

This makes the effect on profitability be all the more unmistakably recognized. A generous measure of exertion has been dedicated to the determination of the relationship between the financial structure of the bank and performance. Numerous studies in the financial market and in the more broad financial industry locate a positive relationship in the middle of performance and measures of business sector structure in terms of market concentration and market share.

Two contending speculations concerning market structure and execution are the customary structure-conduct-performance (SCP) theory and the efficiency-structure (EFS) speculation. The two hypotheses have been utilized by universal investigations of bank execution. The SCP theory affirms that banks can remove monopolistic rents in saturated markets by their capacity to offer lower interest rates for deposits and charge higher interest rates for credit. Another hypothesis which is the relative-market-power theory (RMP) declares that firms with a vast share of the market and a variety of distinct products can practice market power in valuing these items and procure supernormal benefits.

Simpson discovers backing for the SCP theory on account of European banks for the period 1986-1988. Simpson found that the connection between financial structure and performance in banking might be best described by a dichotomous relationship (Simpson 4).

On the off chance that this happens, banks that work in a highly saturated market realize bigger profits while the others procure just competitive benefits. Market focus is not an irregular occasion but instead the outcome in businesses where a few firms have prevalent proficiency. This theory expresses that effective firms grow in size and share of the overall industry as a result of their capacity to produce higher benefits, which as a rule prompts higher market saturation. A vital condition for the EFS theory to be genuine is that proficiency must be decidedly identified with market concentration or market share. The positive relationship in the middle of performance and concentration is clarified by lower expenses accomplished through either prevalent administration or forms of production (Simpson 4).

Another variable utilized in a few studies is the size of regulation in a few banking divisions. The changes taking after expanding deregulation seem to happen in light of the fact that better banks develop to the detriment of their less productive opponents. Different studies have found that the qualities of the bank owners might impact bank performance. This depends on the perspective that the administration’s impetuses vary under various types of bank ownerships. The utilization of GDP development as a variable does not highlight widely in the writing. In any case, the conduct of real GDP neglects to clarify the variability of the bank profits in the UK than in Germany. However, he does not say that GDP variability did not have an impact on profits, just that he could not utilize it to clarify distinctive UK/German bank’s execution. On the off chance that this variable is not critical in clarifying profitability, then the inferences of the scholar are strengthened.

The impacts of inflation can be considerable and affect the soundness of the banking framework and the capacity of the regulator to administer the dissolvability of monetary intermediaries. Fluctuations in the profitability of the bank can be unequivocally clarified by the level of inflation. An imperative aberrant impact on business banks is tied with the effect of inflation on their clients and the ensuing changes in the interest for various types of money related administrations. Unforeseen ascents of inflation cause income challenges for borrowers which can prompt untimely end of the credit process and encourage bad debts.

Besides, inflation is one of the fundamental courses through which it is conceivable to influence the operations and returns of banks through loan costs. High and fluctuating inflation majorly affects bank income.

Firstly, it makes incredible trouble for the evaluation of credit choices, since a credit arrangement which performs at the expected rate of inflation might end up being significantly more negligible if inflation is low and acknowledged loan costs along these lines surprisingly high. Instability about future inflation might bring about issues in arranging and in the transaction of credits. At last, high and fluctuating inflation leads the banks to participate in real estate financing, a speculation strategy that might prompt commercial misfortunes or incredible profitability as per the actualized financial arrangement.

The bank’s performance is likewise affected by various strengths that are much of the time portrayed as “interest” variables. While all interest elements cannot be recognized or measured, the degree and changes in populace and wages might sensibly be thought to be among the most imperative. GDP per capita in the US applies a solid positive measurable impact on state bank profit while wage development clarifies a moderately little measure of the fluctuations in bank income. Then again, GDP per capita does not influence the profitability of the bank. Regardless, we think that GDP per capita may not be a decent intermediary for monetary setbacks that most specifically influence bank income. A sharp fall in a sector, for example, land, could drastically influence bank profit without largely affecting the GDP per capita.

The territorial employment situation is a critical contributing element for both group bank resource quality and returns on assets. The impacts of the area on productivity are not vital (these impacts are essential just to bank chiefs and others). The local heterogeneity of US banking and its worldly elements are vital determinants of bank performance. Then again, location is an essential component in deciding the bank’s productivity. In the environment of retail banking characterized by rivalry, neither IT capital not IT work ventures ought to have huge effects on the bank’s productivity.

Performance of the bank

The banking sector has risen as one of the most important drivers of any country’s economic growth and development. HSBC Bank is among the best banks in the world when contrasted with the top banks in regards to assets and return on assets. The various scopes of studies have been directed by the researchers for measuring the performance of the banks, which give an alternate point of view with respect to the performance of the banks in various nations.

Customary frameworks of assessing the performance of banks, for the most part, utilize the variables like return on assets and return on investment for evaluating the financial performance of the banks. In any case, these days’ specialists and organization administrators find that customary frameworks of assessing the bank’s performance have been commonly in light of money related perspectives which are inadequate in assessing the general performance of the bank and providing accurate feedback (Gorsky 66).

Constant evaluation of the financial performance of the bank can lead to an upward shift in the level of the profits of the bank in the short term. In the long run, the bank will risk losing its competitive identity and eventually compromises the level of the bank’s profits. Non-monetary criteria like consumer loyalty, employee fulfillment and corporate social obligation can be vital for the key accomplishment of any bank.

Consumer loyalty is a necessary condition for the bank’s profitability, and it has an extended impact on the bank’s operational life cycle. Another point to note is that the performance of the bank is directly related to the proficiency and level of fulfillment of its employees. When the state of the human capital is effective and employees are fulfilled, the performance of the banks will go up. It has likewise been found by the analysts that the banks which hold fast to be socially mindful in their standard exercises, surpass their financial performance.

There is a direct relationship between the corporate social obligation and the budgetary execution of the bank both in the short and long run. Therefore, there are two principal angles from which one can quantify the general performance of the banks to be specific, money related perspectives and human viewpoints. The measurements of the performance of a bank under the human viewpoint are, in particular, consumer loyalty, worker fulfillment, and CSR. The accompanying theoretical model (Figure 5.1) clarifies the execution and its measurements.

Consumer contentment

Consumer loyalty is the judgment accepted out of the correlation of pre-buy desires with the post-buy assessment of the service or item, as characterized by scholarly writing. Consumer loyalty has turned into a critical measurement for performance estimation, especially in the financial sector. Due to the fact that many banks and other financial institutions offer comparative items and administrations, enhancing consumer loyalty and devotion is the most imperative variable in keeping up and also expanding the share of the industry for these institutions.

Worker productivity and comfort

The banking sector heavily relies on the human capital employed as it is the principal resource of the banks. The costs acquired on workers are the major working cost in the banking industry. The human resource is the main intellectual and strategic resource which expands the effectiveness of banks. The performance of the banks relies on the effectiveness of its human capital. When the state of efficiency is high, it means that the performance of the bank will as well be high due to the fact that the level of efficiency is positively correlated with the level of performance. Proficient employees are not an adequate model to gauge the performance of the banks.

It ought to additionally be guaranteed that workers are both proficient and fulfilled, on the grounds that the disappointment of workers might transform their effectiveness into wastefulness whenever. Worker fulfillment is critical in accomplishing quality and productivity in the service business. The fulfillment of the employees prompts higher service quality and it impacts consumer loyalty positively. The service quality and consumer loyalty, in the long run, trigger higher profits (Gorsky 66).

CSR

CSR is the proceeding with duty by business to carry on ethically and adds to economic development while enhancing the personal satisfaction of the workforce and their families and of the general surrounding community and society. Banks make a substantial commitment to the nation’s GDP development, take care of the demand of the developing white collar class, add to infrastructure spending, and connect with the semi-urban and the countryside.

Financial execution

On the premise of the writing survey, the performance pointers of the banks can be isolated into two principal classes, in particular, the financial statement and non-financial statement pointers. The financial statement pointers are identified with the choices which specifically influence the entries in a balance sheet and the profit and loss accounts. Then again, the non-financial statement pointers include those elements which affect the financial statements indirectly.

Research gaps

- There are not very many such studies where countless variables have been combined to measure the performance of the banks.

- Performance has for the most part been evaluated in line with financial performance. The human parts of the execution, for example, worker fulfillment and consumer loyalty have been overlooked.

- There are very few studies that have measured the corporate social obligation (CSR) of the banks vis-a-vis the financial performance.

- There is no accessible model which takes both the financial and human angle at the same time for measuring the general performance of banks.

- Few analysts have attempted endeavors to give a near investigation of private, open and remote area banks at the same time.

Research analysis

Liquidity management

Banks have two focal issues with respect to liquidity. Banks are in charge of overseeing liquidity creation and the risks associated with liquidity. Liquidity creation assists the investors and organizations to stay fluid, particularly when different types of financing get to be troublesome. Overseeing the risks associated with liquidity is to guarantee the banks’ own liquidity so for it to keep on serving its capacity. There has been a lot of examination on this issue because of the global credit crunch that started in 2007 is as yet influencing the economy today. Liquidity is a term that is regularly utilized as a part of different connections. The liquidity of an asset can be utilized to portray how rapidly, effectively and expensive it is to change over that asset into money.

Liquidity can likewise be utilized to portray a bank by the measure of cash or near cash resources an organization has; the more fluid resources, the higher an organization’s liquidity. The bank utilizes liquidity ratios as the financial ratios that measure the liquidity of the bank. An example of liquidity ratio is the current ratio, which decides an organization’s capacity to meet the short-term obligations.

Liquidity risk, therefore, refers to the chances that the bank will be incapable of meeting the short-term monetary obligations. This powerlessness can lead a bank to face genuine budgetary issues. Notwithstanding this, liquidity risk can likewise be characterized as far as the counterparty to an exchange. In this manner, the term implies the danger intrinsic to the way that the counterparty will most likely be unable to meet or repay the exchange regardless of the fact that they are in great monetary position, as a result of an absence of liquidity (Lundberg 20).

Liquidity risk for a bank is particularly pervasive as it is simple for a bank to fail its liquidity since investors can pull back assets when they want. Notwithstanding investors, banks tackle another channel in which their money stores can be strained by satisfying commitments to organizations. These organizations have beforehand settled loan responsibilities, referred to as credit lines, which can be acquired from the bank when required.

Generally, research on banks has demonstrated certain bank’s inclination to liquidity hazards and the seriousness of effect this danger can have on the economy. This danger is complicatedly attached to the way of managing the banks. This is the reason why banks, legislative entities, and private industry have attempted to comprehend liquidity hazards and execute open arrangements, regulations, and danger evaluation strategies to alleviate this danger.

Besides dealing with their own particular liquidity, banks assume another part as to liquidity by making liquidity for the business sector. Because of the development of the commercial paper, equity, and securities markets in the late decades, the part of banks as the sole supplier of funding to expansive organizations has reduced. This means that many organizations are now searching for the sort of financing that best suits their particular needs. Banks still assume a to a great extent compelling part in the financing. They are an essential guarantor of funding to organizations that look for credits to satisfy a segment of their financing needs. Ordinarily they go about as the fallback bolster on which organizations bolster themselves in times of troublesome financing (Miller 8).

Organizations can do as such by building up credit lines for banks to secure financing that guarantees liquidity when it is required most. In synopsis, banks tackle two focal issues with respect to liquidity. Banks are in charge of overseeing liquidity creation and liquidity hazards. Liquidity creation helps contributors and organizations stay fluid for organizations particularly when different types of financing get to be troublesome. Overseeing liquidity danger is to guarantee the bank’s own liquidity so that the bank can keep on serving its capacity.

The liquidity of a bank and its part as a liquidity supplier are complicatedly associated. The fundamental relationship is that when banks need more liquidity, they can give less liquidity to the business sector. Clearly this is a streamlined relationship. By holding more fluid resources, banks diminish their liquidity hazard. The holding of fluid resources in overabundance is viewed as a liquidity cushion that offers banks assistance with overcoming the pressure that comes with the need for liquidity.

Having a liquidity cushion, in this manner, brings down the measure of liquidity a bank can make for the business sector in ordinary times. Notwithstanding, in times of turmoil or emergency this liquidity support can really build a bank’s liquidity creation because it gives the bank a chance to capitalize on the other banks’ failure to loan.

By making liquidity in the business sector, banks serve a vital monetary part. In the event that business sectors go illiquid, this can prompt a decrease in business development and in addition put troublesome strains on purchasers. This is why the relationship between the two affects the economy and along these lines has justified a lot of scholastic consideration. There are numerous variables that influence the liquidity of a bank and thusly influence the measure of liquidity they can make. These components impact the harmony between liquidity danger and liquidity creation, or a bank’s liquidity administration.

A bank’s resources and liabilities assume a focal part in their adjusting to liquidity danger and creation. A bank’s liabilities incorporate every one of the bank’s creditors. Banks have three primary forms of creditors: deposit accounts, obtained funds, and long haul reserves (Miller 8).

The value and sources of finance plainly influence the amount of liquidity hazard a bank has and the amount of liquidity it can make. The less demanding a bank can get to finances the fewer hazards it has and the higher measure of funds it holds the more liquidity it can make, if willing to do as such. Deposit records are comprised of transaction records; otherwise called demand accounts deposits, savings account deposits, time deposits, and currency market accounts. The obtained funds of a bank originate from advances from different banks by means of the Federal Funds market, credits from the Federal Reserve Bank, repurchase agreements, and Eurodollar/Eurobond borrowings. The bank can issue bonds to generate capital. Normally, it is considered to be a long term source of finance.

In the past years, the liquidity management of banks has been explored by concentrating on the liabilities that have been recorded on the balance sheet. The liability side normally records the demand deposit accounts and also the credit lines that are undrawn. These two liabilities are the main considerations of a bank’s liquidity hazard. Demand account deposits provide the bank with a bigger money base and in this manner is a type of liquidity.

Credit lines that are not yet drawn are a liquidity hazard that is from the accounting report. Banks with set up credit lines can obtain from other banks when they require it and subsequently diminish the bank’s liquidity. These two restricting liquidity components can be investigated in times of monetary misery, for instance by exploring the default of the Russian and the consequences in 1998 (Miller 8).

After the Russian default, a noteworthy pattern developed: the gap between Treasury bill paper and commercial paper broadened. This flagged investor vulnerability and influenced the demand deposit accounts and credit lines. With speculators no more needing to put resources into commercial paper, numerous depended on their cash to the banks. In particular, the investors put this cash into demand accounts deposits trusting the business sector trouble would not last for long. This caused an expansion in real money saves at banks, and those with more demand accounts deposits delighted in a huge increment in liquidity.

Notwithstanding, with many organizations being not able to renegotiate their commercial paper, or compelled to renegotiate at a much higher cost, these organizations swung into their pre-set up credit lines for financing. The banks with many credit lines that are undrawn tackle many challenges regarding liquidity pressures than their counterparts that do not have as many undrawn credit lines.

The 1998 crisis gives confirmation to two imperative focuses. The first is that when speculators are indeterminate they tend to rush to banks as a place of refuge. This, therefore, diminishes a bank’s liquidity hazard by expanding their money in cash. The other is that in times of vulnerability, organizations likewise swing to banks but for the inverse reason: they require financing. This expands a bank’s liquidity hazard however it is likewise how banks go about as liquidity makers. Scholarly articles demonstrate that banks adjust their liquidity hazard and their part as a liquidity maker by adjusting their demand accounts deposits and their measure of undrawn credit lines. The banks that did as such succeeded monetarily (Miller 8).

Profitability

The elements that affect the profitability of a bank can be grouped into internal and external elements. The internal elements of the profitability can be characterized as those elements that are impacted by the bank’s administration approach goals and choices. Administration impacts are the consequences of contrasts in bank administration policies, choices, goals, and activities reflected in contrasts in bank working results, including productivity. The administration choices, especially with respect to credit portfolio focus, were a critical variable contributing to bank execution. Analysts every now and again ascribe great bank performance to quality administration. Administration quality is evaluated as far as senior officers’ mindfulness and control of the bank’s arrangements and execution.

A large portion of the computed balance sheet report and income statement ratios were fundamentally identified with productivity specifically capital ratios, compensations, premium receivable and payable. The data used for the two-year study was for all the banks of the US Federal Reserve System. He likewise expressed that a guide for enhanced administration ought to first stress cost administration, capital source administration and, in conclusion, capital use administration. There are so many studies reasoning that one of the essential elements affecting the profitability of a bank is the control over the costs. The profitability can be enhanced through the cost administration making this an open door for the banks to control it.

The external elements of the profitability of a bank are confronted with those components which are not affected by a particular bank’s choices and arrangements, but rather by occasions outside the impact of the bank. A few external elements are incorporated independently in the performance evaluation to separate their impact from that of the bank’s structure. This allows for the effect on productivity to be all the more plainly observed.

The utilization of GDP development as a variable does not highlight broadly in the writing. Be that as it may, the conduct of real GDP neglects to clarify the most noteworthy variability of the bank’s profitability in some countries. In any case, the scholar does not say that GDP variability did not influence the level of profitability. In the event that this variable is not statistically significant in clarifying the level of profitability, and then the recommendations of the scholars are fortified (Miller 8).

Profitability is used to evaluate the financial performance of the business banks. Financial execution will focus on the summary of account statements that indicate the incomes, revenues, and expenses of an organization. The summary of the accounts statements can be prepared by any organization on a monthly basis, quarterly basis, half-yearly basis or annually. The profitability and the interest margins of a bank are pointers that determine the proficiency or inefficiency of the banking business, as they draw the line between the financing cost got by savers on their deposits and the premium paid by moneylenders on their advances. The measure of profitability is essential to all investors in the banking industry. This measure of productivity is the most vital for the bank’s shareholders since it reflects what the bank is procuring on their ventures.

Banks normally use the return on assets to measure the level of profitability performance. The investigations of bank’s effectiveness depend on bookkeeping measures of costs, yields, inputs, incomes, benefits, and so on to describe proficiency in respect to the best practice inside of the accessible banking stratum. In this exploration paper, the benefits execution will be measured utilizing the return on asset (ROA) of HSBC Bank.

Other than that, there are numerous approaches to quantify the benefits execution. Productivity can be evaluated in various ways including return on resources, return on value or net revenues. Apart from that, ascending to the monetary measures of bank execution is a vital piece of maintaining a developing business, particularly in the current financial atmosphere. Moreover, return on assets and return on equity are the pointers of measuring administrative effectiveness (Lundberg 21).

In utilizing return on assets, the bank will know the proficiency and ability to change over the assets into net income. Return on assets is got by dividing the operating profit and the average total assets. On a fundamental level, return on assets mirrors the capacity of a bank’s administration to create benefits from the bank’s resources; however, it might be one-sided because of shaky balance sheet exercises.

Both return on assets and return on equity can be utilized to see the bank’s execution in regards to profitability. In examining how efficient any given bank is functioning, it is frequently helpful to mull over on the return on assets and the return on equity. Return on assets is favored over return on equity as the key indicator of the bank’s profitability in light of the fact that an examination of the return on equity dismisses money related influence and the dangers connected with it. Additionally, the performance of the bank is normally measured by profitability, which might itself be intermediaries by utilizing the ratio of the return on assets. Furthermore, as indicated by the scholars, return on assets likewise can be characterized as the remainder of net benefit after taxes to aggregate assets.

The upside of utilizing the profitability ratios is that they do not vary with inflation; that is they are not influenced by variations in the level of prices. Other than that, the return on assets is a useful estimation when contrasting the productivity of one organization with another, either for that inside of the same business or those from an alternate industry. In this way, the return on assets is a significant measure when contrasting the productivity of one bank and another or with the business banking framework all in all.

Management Capacity

The quality of management has a direct effect on the performance of the bank. The high profits that are gained by an organization are attributed to well-executed managerial planning. Therefore, formal planning in business is associated with progressive financial results. There are two aspects of planning, for instance, the quality of the planning and the extent of the planning. Various scholars have argued that it is the quality of planning that impacts the organization more than the extent of planning impacts it. Planning in an organization can be affected by external factors like government regulations. These regulations have an effect of suppressing the influence of planning to the performance of the business.

Various scholars have identified two elements of planning, for instance, the goals or objectives of the organization, and the plan of the organization. The goals of an organization refer to the outcome statement that indicates clearly what the organization is to achieve. The goals can either be in line with the programs of the organization or the structure of the organization. The objectives of the organization on the other hand refer to the activities within the organization that support the attainment of the goal.

It is mandatory that the objectives of the organization be linked to the goal. In addition, the objectives should also be precise and easy to comprehend. The objectives should also give a timeline for the attainment of the goals and also be measurable. Therefore, this implies that the goals of the organization cannot be attained if there are no clearly defined objectives.

Other scholars argue that a goal is an anticipated result that is wished-for by an organization. Many organizations set deadlines for the attainment of their goals. Many organizations have the goal of providing the best quality services or goods to the final consumers by using the minimum cost of production and in the process earning greater revenue. The goals of the organization, therefore, reflect the anticipated results of the organization. With this, the organization will be provided with a clear direction towards the attainment of the objectives. It is therefore important for organizations to identify the targeted results before devising plans to meet them.

An organizational plan is a framework that outlines the various preferred ways of attaining the goals of the organization. The organizational plan involves setting up the objectives of the organization (both long term and short term) and then advances an approach for meeting the goals. An organizational plan is an element of planning which provides direction for the organization to adhere to (source). The plan also stipulates on how to share the organization’s resources or allocate them to realize an optimum production, thus, achieving the set goals within the set time frame. Managerial planning, therefore, entails setting up organizational goals and devising the organization’s plans to act as a roadmap to give direction on how to meet the goals. The figure below outlines the various types of plans that can be adopted by an organization.

Various scholars have explored the trait theory of management, whereby they have argued that the personalities of the managers are directly related to their management styles. The manager of an organization plays the role of inspiring trust from the people. The manager also has the privilege to transform the entire organization in line with his vision and passion for the organization. The actions of the manager empower the rest of the people, hence, making it possible to learn new ideas and concepts. The manager is the first person to start any change process in an organization as the rest follow.

The original definition of the management associated it with the personality while the most recent definition of the management associated it with the ability of the person to influence. Management is a wide concept that is respected across the globe, and that is the reason why the definition of management changes from one organization to the other. There has been a limitation associated with the studies on management that have been done since the early 1990s. This limitation has been attributed to the fact that the scholars who study management and the individuals who are the managers have been unable to accurately give a universal definition of management.

Management has a broad depth because it is considered to be universal. Management and management are very close, but it should be noted that they are not similar. Every manager should demonstrate strong and articulate management skills. There are numerous variables that characterize viable management. These variables include the culture in the organization, the behavior of the members of the organization, and the personality of the person entrusted to lead the organization. Many managers who are considered to be successful have so many positive traits. Successful managers are flexible, thoughtful to others, commanding, concerned, enigmatic, powerful, and confident. All these traits are possessed by a transformational manager.

Giving vision is insufficient to the firm to live up to the customers, workers and different partners. The dreams must be sufficiently solid for everybody in the space of the firm to have confidence in. The thought is discriminating for worldwide firms that are topographically scattered for workers down the chain of importance to partake in the same vision. Conciseness, stability, investigative and future introduction are discriminating qualities needed in the visionary management. The presentations are nearly trailed by the high performing organizations crosswise over different commercial enterprises. Studies also demonstrate that such traits have basic ramifications for managers working with high performing organizations crosswise over fluctuated commercial ventures and in differing societies.

Capital structure

There are two broad categories of capital, for instance, debt capital and equity capital. Through debt capital, organizations can get funds from many different avenues. The avenues are divided according to different orders. These include both private sources and public sources. The private sources of debt capital incorporate banks, credit unions, insurance agencies, factor organizations, renting organizations, and so forth.

The public sources of debt capital include numerous advanced ventures gained by the help of the government to support the businesses. There are several categories of debt capital available to HSBC Bank. These include placement of bonds, using debentures that are convertible, and using development bonds. The capital can be used by co-underwriters and can also be safeguarded by the management. In addition, security is needed to obtain the loan. The security can be in the form of a land title, stock or a guarantee.

Equity fund for the banking business is additionally available from a varied range of sources. Mature businesses have two routines to acquire equity funds. The first routine is through the floating stock. This is also appropriate for businesses that are still developing or are already established. The second routine is through venture capital. The private placement is much direct and regular for developing businesses or mature companies. The placement of shares should be in line with a few governments or state regulations. The principle prerequisites for floating shares are that the business should not support the funding and need to have a direct exchange with the client.

Bonds and debentures

Financing is the essential necessity of each of the banks. The banks can raise funds through debts or equity instruments. Bonds and debentures are outstanding examples of the debt instruments. In numerous nations, they should be one yet the two terms contrast in numerous respects. Bonds are for the most part issued by government organizations and enormous enterprises, yet debentures are issued by organizations. HSBS Bank used the debt instruments of bonds and debentures to raise money for capital. Mr. Douglas Flint, the group chairman of HSBS Bank has attributed the financial strengths of the company as a product of bonds and debentures.

A bond is a money related instrument that demonstrates the commitment of the borrower towards the lender. They are made to raise reserves for the organization. It is a testament connoting an agreement of obligation of the issuing organization, for the sum loaned by the bondholders. By and large, bonds are secured by guarantee, i.e. a benefit is promised as security that if the organization neglects to pay the loan inside the stipulated time, the holders can release their obligations by acquiring and offering the assets secured. The period for issuing a bond is fixed, during which the bond earns an interest called a ‘coupon’. The interest should be paid at consistent interim or else it will accumulate after some time. The principal has to be paid on the maturity date, which could be after 6 months, 1 year, and so on (Lundberg 18).

A debenture is an obligation instrument utilized for supplementing finance for the organization. It is a consent involving the holder of the debenture and the company issuing the debenture. The instrument demonstrates the sum owed by the organization towards the debenture holders. The finance raised is the obtained capital, which is the reason the status of debenture holders is similar to the lenders of the organization. Debentures convey interest, which is to be paid at intermittent interims. The sum acquired is to be reimbursed toward the end of the agreed term, according to the terms of reclamation. The issue of debentures openly requires FICO scores.

Bonds and Debentures are considered to be obtained in finance. The significant contrast between these two obligation instruments is that bonds require additional security when contrasted with debentures. The financial soundness of the issuing organization is checked in both cases. These are the obligation of the organization that is the reason they have a preference for reimbursement on the occasion of liquidating the organization. HSBC Bank has the dominant part of issued obligation capital consisting of bonds and debentures. Despite the fact that the term bonds and debentures are frequently utilized conversely the two are unmistakably diverse. A bond is commonly a credit that is secured by a particular tangible resource. A debenture is secured just by the guarantor’s guarantee to pay the premium and the principal. A bond is similar to an advance.

The company issuing the bond is the borrower and the holder or financial investor. The borrower guarantees to pay an agreed yearly loan fee, or the security’s coupon rate, in equivalent general installments for whatever length of time that the holder keeps on holding the security or debenture. The bond issuer additionally consents to reimburse the principal of the bond’s, or standard worth, on the date it matures.

The yearly premium can be paid in installments that range from a month to month, semi-yearly and yearly, with semi-yearly installments the most widely recognized. Both bonds and debentures furnish the issuing company with external capital. The external finance is useful in funding the long haul capital ventures and the current expenses. Notwithstanding corporate guarantors, legislatures of all levels likewise issue obligation capital as securities and debentures. Ordinarily, the debt securities issued by governments are not secured by tangible resources; therefore, they are in fact named debentures.

Equity finance

For the mature companies, equity finance come in three ways, for instance, new issue, right issue and preference shares. A new issue implies that stock or bond is issued for the first time to people in general. It can be in the form of an IPO or a security issued by a mature company which may have skimmed a few such issues before. A new issue is a reference to a security that is being sold on the business sector to the people in general. Normally, security has to be registered before being issued or sold. The term does not inexorably allude to recently issued stocks, albeit IPOs are the most ordinarily known new issues. HSBC Bank raised capital through the issue of new shares to the public.

Numerous financial specialists purchase new issues on the grounds that they regularly encounter colossal interest and, subsequently, fast cost increments. Different financial specialists don’t trust that new issues warrant the build-up that they get and just observe from a distance. A financial specialist who buys a new issue ought to know about each one of the dangers connected with putting resources into an item that has just been accessible to the people for a brief span; new issues frequently end up being somewhat unstable and unpredictable.

The right issue refers to an allotment of rights to the shareholders of the firm. The right issue enables the shareholders to acquire additional shares directly from the company. The offer price for the shares is normally at a discounted rate for the existing shareholders. There is a possibility for the shareholders to transfer their rights to somebody else. The existing shareholders of the company have an upper hand than outsiders. The bank is simply enabling the shareholders to expand the volume of their shares at a lower price. It is possible for the shareholders to trade the rights in a similar way that shares can be traded.

The shareholders may exchange the rights available in a similar way they would exchange standard shares before the new shares are obtained. The shareholders obtain rights with a value attached to them. This helps to insure them for the future weakening of their current offers’ worth. Pained organizations ordinarily utilize rights issues to pay down obligation, particularly when they cannot obtain more cash. In any case, not all organizations that seek after rights offerings are unstable. HSBC Bank used the right issue for expansion and acquisition of assets. An investment bank normally acts as an underwriter during the right issue process.

Preference shares can be defined as the firm’s stock that can generate profits and are issued to the investors earlier than the basic stock. When a company is going broke, the preferred stock shareholders have the privilege to be issued the organization’s resources first. The preference shares normally pay a settled profit in contrast with the basic stocks. Furthermore, not at all like regular shareholders, the holders of preference shares do not have the privilege to vote. The preference shares come in four types. The first type is cumulative preferred, whereby the profits have to be paid. The profits must include skipped profits. The second type is non-cumulative favored, whereby the skipped profits are excluded. The third type is participating preferred, whereby the holders have the profits on top of the additional income taking into account various conditions. The fourth is convertible, whereby the holder can trade the shares with normal stock.

Share performance

As far as the macroeconomic atmosphere, the scholars utilize the external elements which cannot be handled by the administration of the bank. The external elements are determinants that are not identified with the bank’s administration but rather mirror the monetary and lawful environment that influences the operation and execution of money related institutions. There are such a large number of external elements, including, loan fees and cash supply which will have an effect on the bank productivity.

Business banks will plan for working arrangements to respond to changes in the macroeconomic elements, for instance, the banks will raise or lower the loan fee as indicated by the monetary condition in that year. Bank earnings are influenced by macroeconomic variables, proposing that macroeconomic arrangements that reduce the rate of inflation and increase stable output development do help credit extension. The external elements are those components that cannot be handled by the administration of the banks. Among the broadly talked about external elements are regulation, market saturation, industry share, shortage of capital, inflation, cash supply and size.

The share performance procedure depicts the different channels in which money is exchanged between individuals who spare cash to organizations that need the cash. The exchanges can occur straightforwardly, indicating that a venture offers its shares or securities specifically for investors who give the venture money in return. Exchanges of money can likewise happen in an indirect way through a financial institution or through a monetary middleman, for example, a bank or insurance agency. On account of an indirect exchange utilizing an investment bank, the venture offers shares to the bank that then offers the shares to the potential investors.

At the end of the day, the capital just revolves around the investment bank. On account of an indirect exchange utilizing a financial middleman, there is another type of capital that is made. The mediator bank gets finance from investors and issues its securities in return. At that point, the mediator bank utilizes the money to buy stocks or securities from organizations.

Conclusion

From the above analysis, it is evident that HSBC bank is performing well and, therefore, it is rational to invest in the company. The analysis shows that HSBC is stable and healthy financially. The profit margin shows that the profitability of HSBC keeps on growing. The Earnings per Share and Return on Equity are also increasing. The current ratio further suggests the company is able to pay off current liabilities. The quality of cash is good, which means that there is enough cash for running the business, especially when money is needed for emergency purposes. The debt-to-equity ratio also shows that the company mainly relies on creditors, which is not a healthy condition for any business. Nonetheless, the bank is still recovering from the effects of the 2007/2008 financial crisis.

The 2007 financial crisis was the most profound and extensive financial slump ever experienced in recent times. The crisis was mainly attributed to the US subprime market. Even though reports on the sub-prime crisis became public as early as 2007, its impact was not felt immediately. The impact of the recession was very devastating, especially in the property market. It caused the asset-backed-securities attached to the US housing sector to devalue at a higher rate.

The drop in the value of residential property took away the incentive to pay back the mortgage, thus increasing the rate of defaulters. Subsequently, a number of banks and other financial institutions collapsed. This prompted the Troubled Assets Recovery Plan and the Economic Stabilization act of 2008. These were aimed at minimizing the losses made by financial institutions and thaw out the credit market.

Simpson explains that decade before the crisis the US monetary policy was awfully loose leading to interest rates that were extremely lower than the conventional standard, which is based on Taylor’s principle on interest rates (3). Taylor’s principle is a monetary rule that regulates the level of interest rates bearing in mind the prevailing economic conditions. As a matter of fact, it represented the biggest deviation in the last four decades. Indeed, the real funds were negative from 2002 to 2005 (Simpson 4).

Works cited

Gorsky, Alex. Company Analysis, Cincinnati, Ohio Print: J & J Inc., 2014. Print.

Lundberg, Curt. “Toward Theory More Relevant for Practice.” Current Topics in Management 6.1 (2001): 15-24. Print.

Miller, Roger. “How Culture Affects Mergers and Acquisitions.” Industrial Management 2.1 (2000): 8-8. Print.

Poznanski, Julie, Bryn Sadownik and Irene Gannitsos. Financial Ratio Analysis. 2013. Web.

Shams, Ishtiaque. Financial Analysis of HSBC, Mohakhali, Dhaka: BRAC University, 2013. Print.

Simpson, David. Recession: Causes and Cures, London, UK: Adam Smith Institute, 2009. Print.