The current economic recession has harmed various sectors of the global economy (Recession, 2009, p.1). One of the sectors that have been greatly impacted is the United States housing industry. The housing industry consists of various sectors which consist of construction, sale, resale, and residential properties. According to the economic impact of the housing sector (Anon., n.d), the US housing industry contributes a significant proportion to the country’s Gross Domestic Product (GDP). This is because it provides millions of citizens with jobs. Over the past few decades, the US construction industry has witnessed rampant growth. However, this trend of growth was reverted in 2007 upon the occurrence of the financial crisis. According to Betsy (2009, para.3), this is the first drop in the housing industry since which is the first drop since the 1990s. In 2008, the spending on construction averaged $713.5 billion which represents a 5.9% spending. This is a 1.9% drop in spending compared to the 2007 construction spending.

The economic recession has resulted in the loss of employment. This has had affected the housing industry due to an increase in mortgage default rates. This is because the individuals who had purchased houses using a mortgage are not able to service their mortgages. As a result, there has been an increase in the number of foreclosures (Tom, 2009, para.1). According to research by Realty Trac, approximately 1.2% of the housing units in the US faced foreclosure filing. This translates into 1 out of every 84 housing units (‘Market watch’, 2009, Para. 5). Despite the drop, it is expected that the housing industry will recover from 2009 onwards.

To achieve, this it is important for the US government to formulate and implement an economic stimulus program about the industry (‘Alternative Insight’, 2009, Para. 3). This paper entails a report analyzing the impact of a national economic stimulus program on the housing industry.

Aim

The objective of the report is to illustrate the implications of the national economic stimulus program about the globalization of the US housing industry. The report is also aimed at determining whether the economic stimulus plan can result in an increase in homeownership in the US.

Scope

The paper entails a literature review where the various national economic stimulus programs are considered by the US government. The introduction considers the nature of the US housing industry and the problem that is facing the industry. The various tax programs considered include tax policies such as tax credit and tax relief, weatherization of homes, Neighborhood Stabilization Program (NSP), and Market Home Affordable Program (MHAP). The tax credit will be issued to individuals who purchase homes for the first time and apply for three years. The tax policies result in the creation of a good housing environment and an increase in demand for homes. The weatherization program will enable a large number of individuals to increase their savings on energy. Through the NSP, the government will be able to stabilize the communities affected by the foreclosures. Through the MHAP, the government will be able to assist individuals to refinance their mortgages. This will increase the confidence in investing in the housing industry. The paper also involves an analysis of the various ways in which the economic stimulus program will result in economic recovery and globalization. Finally, the report considers the general findings and a conclusion.

However, the report does not consider the approximate duration that the economic stimulus program will take to ensure that there is total economic recovery.

Literature review

The current financial crises have resulted in a reduction in the level of investment within the housing industry. This is due to the increase in the prices of homes which has culminated in a reduction in demand for homes amongst the consumers. According to housing as a lever for economic recovery (2009, p.1), the US government has conducted several sessions to determine whether investing in the housing industry would stimulate national economic growth thus contributing to the country’s economic recovery.

Economic stimulus refers to an investment that is specifically designed to improve the economic performance of a particular sector (Richard, 2009, para.3). This results in an increase in confidence in investing in that sector creating more jobs. According to Richard (2009, Para. 1), there has been an increase in the rate of unemployment in the US over the past few years. An economic stimulus program that is effectively designed can benefit the US economy during the current tough economic environment.

According to a study conducted by Minnesota Housing Finance Agency (MHFA), investing in housing is an effective way to create revenue and stimulate spending. The analysis indicated that investing $1million in the housing industry generates approximately 1$1.75 million – $ 2.1million within the entire economy. The study also indicated that the potential of job creation within the industry is numerous. The result of the analysis indicated that a $1 million investment in the housing industry through public funding that is leveraged with a certain amount of private capital can result in a creation of 14 to 21 jobs (‘Housing as a lever to economic recovery’, 20009, p. 4).

Tax relief and tax benefit

The US National Association of Home Builders (NAHB) is committed to ensuring that the government considers the housing industry as a priority in its public policies (‘Federal economics stimulus and tax credit’, 2009, Para. 1). In addition, the NAHB has called for the US government to include key recovery provisions to the housing industry (Keat, 2008, para.4). Through this, the government will be able to create a conducive housing environment. In addition, the US National Leased Housing Association (NLHA) has also advised lawmakers to consider including certain provisions in the economic stimulus package such as tax reliefs as a strategy to eliminate the current disincentives to homeowners. The current disincentives are causing the homeowners not to sell their affordable homes to individuals who can effectively recapitalize these assets (Keat, 2008, Para. 7). In addition, the NLHA is also pressuring the US government to consider provisions aimed at stimulating the country’s economy through the Section 8 Program. This will ensure that there is an annual production of 100,000 housing units per year. The NLHA estimated that the government could incur an average annual cost of $600 million.

In 2009, the US government advanced a significant package that averaged $ 787 billion to the local and state government through tax reliefs. This economic stimulus is intended to stimulate investment in various sectors such as infrastructure, health, energy, and science. The economic stimulus package advanced to the housing industry averaged $75 million. The economic stimulus package to the housing industry is intended to persuade them to purchase new homes. According to Nickel (2009, para.1), the stimulus package also constitutes a tax credit of $8,000 to individuals purchasing homes for the first time. The tax credit applies to individuals who purchased a home during the period ranging from 1st January 2009 to 30th November 2009. In addition, this tax credit is refundable. According to Erica (2009, para.4), the buyers are obliged to repay their tax credit upon selling their home within three years.

Weatherization of homes

In addition, the national economic stimulus program to the housing industry will also entail the weatherization of homes through the Weatherization Assistance Program (WAP) under the Department of Energy. Weatherization of homes entails ensuring that the home is secure from cold or storm through insulation. In this national economic stimulus program, the government has set apart $50 billion to ensure that homes builders incorporate clean energy (Joseph, 2009, Para. 8). This package also entails advancing tax incentives in form of tax credit to the homeowners through to the year 2010 (Keat, 2009, Para. 5). This will enable them to purchase the necessary furnaces, energy-efficient doors and windows, and other insulations to effectively weatherize their homes. It is estimated that the weatherization of homes will boost the country’s economic growth (Sue, 2009, Para. 6). Through weatherization, the households will be able to save approximately $350 annually on their air conditioning and heating bills (Keat, 2009, Para. 5).

Neighborhood Stabilization Program (NSP) and Market Home Affordable Program (MHAP).

The US government has also formulated a Neighborhood Stabilization Program and Market Home Affordable Program in its national economic stimulus program. According to Kathleen and Rosemary (2009, p.4), the NSP, the government will be able to stabilize the communities that were affected by foreclosures by purchasing and developing the homes that were foreclosed. This will increase the chances of securing a home by a large number of citizens. On the other hand, MHAP will enable individuals to refinance underwater mortgages. The underwater mortgages consist of mortgages whose current market value is below its balance (Malcolm, 2009, Para. 1).

Analysis

Through an economic stimulus towards the US housing industry, the government will be able to stimulate the country’s economic growth. This is because the economic stimulus will increase the number of investors venturing into the industry. The economic stimulus through tax credit will increase demand for homes. This is because more individuals will be able to purchase homes. The result will be an increase in the number of home sales culminating in a stimulation of the price of homes. As a result, more investors will be enticed to venture into the industry since it will be possible to maximize their returns (James, 2005, Para. 6).

Through the tax credit, a large number of individuals will be able to secure their own homes. An increase in demand for homes within the US economy will attract a large number of domestic investors. In addition, an increase in demand for homes will also result in the globalization of the industry. This is because more foreign investors will be willing to venture into the industry through foreign direct investment. According to Tony (2009, p.1), an increase in globalization within the housing industry will result in an increment in the volume of capital inflow into the US economy. According to the economic impacts of the housing industry (Anon., Para. 4), residential fixed investment significantly contributes to the country’s GDP.

This will reverse the drop in the number of housing units that are privately owned. From the graph below, it is evident that the US experienced a drastic reduction in private home ownership from 2006 and it is at its lowest in 2009.

An increase in the number of investors venturing into the construction industry will impact the economy both directly and indirectly. For instance, there will be stimulation in economic activities through an increase in the number of construction projects. This will result in the creation of more jobs for individuals who work within the industry. This is in line with the multiplier effect that was advanced by Keynes. The purchase of homes will result in further spending within other economic sectors.

In addition, more jobs will be created in other economic sectors that support the construction industry. These include the various production and manufacturing industries such as concrete, wood products producing firms, flooring, and trimming companies, heating and cooling equipment manufacturing companies amongst others.

The creation of more jobs will increase consumers spending. This is because there will be an increase in the consumer’s disposable income. In addition, through the incorporation of tax credit concerning weatherization, the consumers will be able to save a significant amount of money. This means that there will be an improvement in the consumers’ consumption pattern since they will be able to allocate their income to other consumer items. An increase in consumer spending will stimulate the country’s economic growth. This is because personal consumption forms a significant part of a country’s GDP.

Through the economic stimulus, the country’s economy will be stimulated in two main ways, these include an increase in housing service and residential fixed investment. Residential fixed investment entails the value that results from new housing units, commission to brokers during the sale of residential properties, expenditure incurred in the process of improving the existing housing units, and purchase of used housing units from the government agencies. On the other hand, housing services consist of all the personal expenditures incurred in the process of acquiring residential homes. This can either be through rents by the tenants or the rental equivalent for the homeowners.

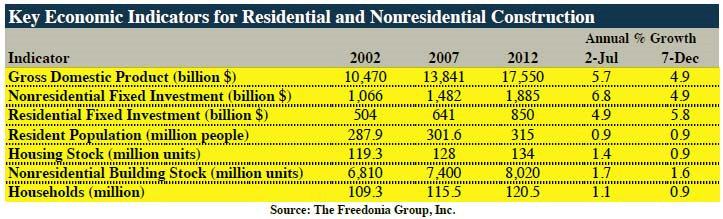

From the table below, it is projected that the economic stimulus program to the housing industry will result in an increment in the country’s GDP from a low of $13,841 billion in 2007 to $17,550 billion by 2012 (Betsy, 2009, Para. 6). The non-residential fixed investment will increase from $1,066 billion to $1,885 billion by 2012. In addition, the residential fixed investment will increase from $ 641 billion to $850 billion.

Through the NSP and MHAP, there will be increased homeownership amongst US citizens. This will result in increased satisfaction amongst the citizens culminating in increased labor productivity in the various economic sectors.

Findings and Conclusion

From the above research, it is evident that the housing industry can result in increased economic growth in the US. The government should consider designing, implementing, and controlling an effective economic stimulus program for the housing industry. The national economic stimulus program will enable the US economy to increase its economic recovery rate. The various economic stimulus programs will increase the economic activity within the industry. For instance, the tax credit and tax relief policies advanced to initial homeowners will increase demand for homes. Increased demand for houses will increase the number of domestic and foreign investors venturing into the industry. This is because there will be the creation of an effective housing environment culminating in an increase in foreign direct investment within the industry. This means that there is a high possibility of the industry becoming globalized in the future. This will increase the volume of capital inflow into the US economy.

Through the tax policies, NSP, and MHAP programs, it will be possible for the government to increase the chances of homeownership amongst US households. This will result in increased satisfaction among the citizens and hence their productivity. Through the weatherization program, individual households will be able to increase their annual savings on energy. This will enable them to allocate their spending to other economic sectors.

In addition, the economic stimulus program will result in direct and indirect job creation. This means that there will be an increase in the country’s employment rate (‘National employment matrix, 2009, p.1). Direct jobs will be created in the construction industry while indirect jobs will be created in other sectors that support the housing industry. This will culminate into an increase in personal disposable income and hence consumer spending. This means that other economic sectors will also be stimulated increasing the rate of economic growth (Sustainability prospects in the US real industry, 2009, p. 3).

Reference list

Alternative Insight. 2009. Can the Obama plan revive the US economy? Web.

Betsy, D. 2009. Construction: state of the industry. Web.

Donjek Incorporation.2009. Housing as a lever to economic recovery. Minnesota: Minnesota Housing Fund. Web.

Data 360. 2009. Housing starts. Web.

Economic impacts of the housing sector.2009. Web.

Housingstimuluspackage.com. 2009. Expand the tax credit. Web.

Improvement and Development Agency. 2009. Recession: local impact. Web.

James, R. 2005. The 10 hottest trends in the US housing market: WSJ real estate archives. New York: The Wall Street Journal. Web.

Joseph, R. 2009.What is green about new stimulus deal? Tax incentives to spur energy savings and green jobs. Web.

Keat, F.2009.Housing group for economic stimulus package to bring back section 8 production program. Industry News. Web.

Kathleen, R. & Rosemary, C.2009. Multifamily rental housing in the US: can we take a lesson from Germany.(On-line) Virginia, USA: Virginia Tech. Web.

Malcom, T.2009. What is an underwater mortgage? Wise Geek. Web.

Market Watch. 2009. Foreclosures up despite moratorium and legislative efforts. Web.

National Association of Home Builders.2009. Federal economic stimulus and tax credit. Web.

National Employment Matrix. 2006. Employment by industry occupation and

percentage distribution 2006 and projected 2016. Web.

Nickel. 2009. Taxpayers benefit from economic stimulus package. Web.

RREEF Research. 2009. How a green recession? Sustainability prospects in the US real industry. Web.

Richard, W.2009. What is economic stimulus? (On-line). CATO Institute. Web.

Sue, K.2009. How will the $ 787 billion stimulation package affect you? Web.

Tony, G.2009. Americas: real estate globalization; establishing international standards. Web.