Abstract

In the given paper, the threats that one is likely to encounter in the profession of an insurance agent are discussed. Because of the great responsibility that one takes when insuring something, the understanding of the liability in the given sphere is quite different from everything that one might experience in the other spheres. It cannot be doubted that only taking a specific approach to the peculiarities of the profession and the extraordinary cases when one has to take specific care of the problems in question.

Therefore, the aspect of being an insurance agent demands serious considerations. Because of the liability issues that the profession presupposes to tackle with, one can face considerable difficulties. Therefore, the aspects of insurance are to be considered carefully.

Introduction: To Start from the Scratch

Being an insurance agent involves considerable responsibility and the need to take account of every plausible effect that the given action might have on the customer and on his/her state of affairs. Considering both the profit of the client and the well-being of the company often leads to certain conflicts that must be solved, otherwise both parties are highly likely to loose. Therefore, the liability of an insurance agent is the prior thing to consider when it comes to speaking of the specifics of the profession.

Identifying the Problem: Where the Shoe Pinches

It is reasonable to mark that the profession of an insurance agent requires the skills to sell insurance and promote the services of the company for the probable clients to apply. However, historically, these were banks that owed the prerogative to sell insurance. This is where the constant struggle between the banks and the insurance agents in selling insurance stems from.

It is highly important to mark that the concern for the right to sell insurance is mainly the concern for the client and his/her further profit. Therefore, the problem has been brewing for quite long until it finally began to resolve: “Thus, for example, U.S. banks complained for decades about being prohibited from selling insurance, because agents opposed to banks selling insurance influenced legislators and regulators” (Skipper 180).

Fig. 1. Aflac.

However, it can seem rather doubtful that banks are not able to provide the clients with the same amount of safety as the insurance agencies can. Indeed, banks with their settled and long-established system of work and the well-developed infrastructure might seem reliable enough to be trusted in.

Yet it proves that the insurance agencies can provide a greater degree of safety for their clients, which means that insurance agencies have all reasons to be trusted in. Thus, the struggle between the two opponents has been long and painstaking, yet nothing has been resolved so far, which means that each time selling insurance agents have to face one and the same complicacy.

Going into Details: On the Aspects of Liability

It is beyond any possible doubt that the threat of losing the proper level of liability is rather topical for an insurance agent who is engaged in selling insurance. There is enough evidence that the banks did not cease their attempts to gain greater authority in the given sphere and are still eager to deprive insurance agencies of their business.

Thus, the struggle between the two opponents is currently growing increasingly threatening. Therefore, the problem must be tackled; otherwise, sooner or later, the opponents will suffer great losses. At present, it is quite obvious that the opponents have to stop their debates. As Gustavson marked, “Insurance agents and most insurers (to a lesser extent), however, are opposed to further bank expansion into the insurance business.

The result has been much debate and small gains by the banks.” (94) Thus, it cannot be doubted that the presented problem requires thorough considerations. It is evident that, once forgotten, this issue might drag serious consequences and even crises of the financial state of banks and insurance agencies. Like any other sphere of business, insurance requires certain allocation of responsibilities to keep in pace with the progress.

It is also worth noticing that the state acts on behalf of banks when it comes to the allocation of the responsibilities between banks and agencies. Thus, Fitch emphasizes: “In insurance sales, the law also preserves the authority of states to regulate insurance, but requires state insurance departments to treat bank-affiliated firms selling insurance on the same basis as other insurance agencies” (10).

In other words, this means that the state is not supposed to support even those insurance-selling agencies that are intertwined with the corresponding banks. Since the selling agent ahs to deal with five aspects of selling insurance, i.e. the prospect, the proposition, convictions, impulses and appeal (Strong 264), it is obvious that the system is rather well-established and any changes are highly undesirable.

Fig. 2. Managing the conflict of interests. Risk Management.

Recommendations: Solving the Puzzle

However, it must be marked that, like any other problem concerning the sphere of insurance and financing, this issue can be tackled with help of diplomatic approach and reasonable compromises. With help of these steps, one can expect positive results. Indeed, according to the calculations of the most prominent economists and political scientists, if the banks and the insurance agencies consider the aspect of selling insurance as the issue that needs solution and work out the decision that would satisfy both parties, the financial and economical profit will become possible.

However, it must be admitted that the steps that must be undertaken to solve this complicacy demand that the opponents would finally reconcile, which is important at present.

One of the most obvious decisions that could be undertaken would be comple3te prohibition to sell insurance for one of the parties. It must be mentioned though that the attempts to deprive one of the opponents of the right to sell insurance have already occurred, yet the experience obtained during these crusades against the banks’ expansion did not end in the most desirable way.

According to Skipper, the results of such actions ended up in an economical decay and further confusions. Based on reciprocity, which is a political, not an economical term, this would have no effect on the situation:

Outcomes from reciprocity-based liberalization are uncertain, largely because reciprocity is a negotiation, not an economic, concept. Reciprocity-based liberalization potentially requires industry-specific and country-specific analyses. Such analyses call for a substantial bureaucratic structure and a great potential for conflict with an accompanying need for dispute resolution mechanisms. (70)

This means that the solution of the conflict will involve the change in the state structure, which is quite complicated at the moment. Therefore, it would be more reasonable to resort to such means as the compromise between the opponents. With help of the reasonable steps taken, it would be possible to coordinate the actions of both the banks and the insurance agencies, thus helping both parties to benefit and not allowing them to create conflicting atmosphere.

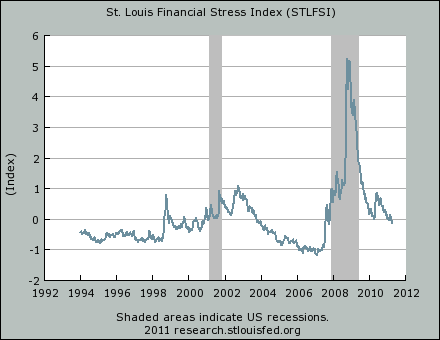

Fig. 3. Federal Reserve Bank of St. Lotus. Lotus Financial Stress Index. 2011.

Conclusion: Avoiding the Pitfalls

Thus, it can be considered that the problem of liability in the sphere of insurance takes one of the first places. It is peculiar that with several incautious steps one can destroy the impeccably working mechanism and turn the existing system of insurance liability into complete mess. Because of the constant struggle between banks and insurance selling agents, the entire system of insuring is under risk, which must be tackled.

Therefore, the idea that some economists have already come up with seems the only possible and reasonable means to save the insurance system. With help of certain compromises and careful steps made to create the system of shared responsibility for the well-being of the client and selling insurance to the probable clients, one can restore the system and help it work efficiently.

It cannot be doubted that such approach will inevitably lead to a lesser degree of competitiveness between banks and insurance agencies and decrease the strain between these opponents.

Executive Summary

One of the greatest concerns of the modern world of banking and insurance business, the aspect of selling insurance and the liability of the issue is on the agenda of the modern world. Since the problem involves both economical and political aspects, it becomes rather complicated issue to solve.

It must be mentioned that the core problem underlying the issue is the unceasing struggle between banks and insurance agencies for the right to perform the function of selling insurance to the clients.

It is essential that certain solutions have already been introduced to make the problem vanish. Yet, unfortunately, what has been suggested already does not meet the goals of each of the opponents. It can be alleged that, once the recommended ideas are out into practice, the world could face another crisis, which is rather undesirable. In addition, it is required that both opponents could benefit from the solution.

In addition, the situation has become ever more heated as the state started supporting only banks, leaving the separate agencies and even the affiliated agencies that are a part of banks, alone. Such attitude might result in considerable change for worse. At the moment, it is necessary that some ways to solve the situation could be found.

One of the most effective easy to get rid of the complicacies is to achieve a reasonable compromise between the parties. However, it must be admitted that none of the opponents wishes to retreat. Therefore, it is necessary to convince both the banks and the insurance agencies that they should come to terms in the given aspect. Once the compromise has been achieved, it would be easier to allocate the responsibilities of each of the parties and achieve peaceful coexistence of the two systems.

Reference List

Aflac. “Aflac”. 2010. JPG file. Web.

Federal Reserve Bank of St. Lotus. “Lotus Financial Stress Index”. 2011. JPG file. Web.

Fitch, T. P. Career Opportunities in Banking, Finance, and Insurance. New York, NY: Infobase Publishing, 2007. Print.

Gustavson, S. G., & Harrington, S. E. Insurance, Risk Management, and Public Policy: Essays in Memory of Robert I. Mehr. Berlin, DE: Springer, 1994. Print.

Risk Management. “Managing the Conflict of Interests.” GIF file. Web.

Skipper, H. D., & Know, J. W. Risk Management and Insurance: Perspectives in a Global Economy. Hoboken, NJ: Wiley-Blackwell, 2007. Print.

Strong, E. K. The Psychology of Selling Insurance. New York, NY: Harper. 1992. Print.