The evolution of motor industry has progressed for decades from innovative individuals to corporate organizations witnessed today. This has contributed to the establishment of material handling industries around the world. Some of these material handling sectors are involved in manufacturing equipments and machines for use in mining, power generation, construction, and transport industry.

However, the most popular machinery within the material handling sector happens to be the forklift. Forklifts are used for different purposes and are available in all sizes and models. As a segment of material handling sector, forklift industry has over the years grown tremendously. The actual growth can be testified by the gains made by different manufacturers who have continued to dominate the global market.

For instance, the leading forklift producer for the last ten years has been Caterpillar Tractor Company. The firm was established in the wake of 1925 after Holt Caterpillar and C.L.Best Gas Tractor merged to form Caterpillar Inc. Currently this organization is one of the largest producers of material handling equipments.

As indicated by the market reports from 2001-2010 Caterpillar Inc. had sold over 4 million forklift units globally.Jungheinrich Lift Truck, Komatsu Utility Co, Anhui Forklift Group, Mitsubishi Caterpillar, TCM Corp and Kioni Group, are some of leading forklift manufacturers.

Due to structural and economic issues, forklift industry has been operating on three major business lines; provision of financial products, manufacturing, and assemblage of material handling equipments such as forklifts. From the year 2001-to-2010 the industry had generated total income amounting to $499.6 billions and earnings before interest, taxes, depreciation and amortization of $50.7billion (Thomas, et al 2005).

Strategic overview

The economic, structural, and marketing focus of forklift manufacturers for 2001-2010 was trained on operations. The purpose of this disposition was to enhance individual manufacturer operations in regard to competition and production. As testified by Caterpillar Inc. most of the forklift manufacturers have over the years employed an enterprise approach that purposely focuses on the industry’s clients, workers, and stakeholders.

The industry’s objectives are founded on the manufacturer’s tactical objectives, operating principals, in addition to corporate obligations. The industry’s primary strategic goals are: to have the best team in all of their operations, create better economic results, and be the best manufacturing industry.

The forklift industry has remained in the market due to its corporate, structural, and economic values. These values have compelled the forklift manufacturers to provide quality products, solutions and services to their clients. This includes facilitating minimal total owning as well as operating life-cycle expenses as is apparent from 2003-2010.

This approach enabled this industry to attain unequaled growth compared to other manufacturing and assemblage industries globally. Hence, Michaely claimed that the industry’s strategic objectives allowed the forklift manufacturers to experience the highest customer constancy in addition to attractive productivity (2001).

Competitive environment

Basically, from 2001-to-2010 forklift industry was involved in construction, mining, and farm machinery trade. However, the industry’s principal objectives allowed the manufacturers to offer technical solutions to other industries. Some of these solutions were given to mining, rail, agriculture, forestry, petroleum, construction, and power generation industries.

Owing to the extent of its operations within the period spanning from 2001-2010, the industry joined the competitive assemblage and manufacturing market globally. Like any other major industry it was faced with government regulations and market variations which affected its productions.

This aspect is testified by Komatsu a major forklift manufacturer who for this period witnessed mounting competition from both regional and domestic manufacturers.

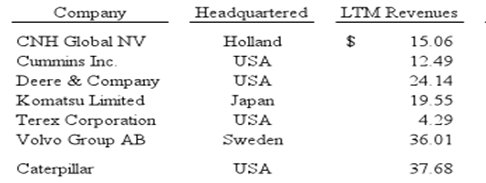

Exploring all segments associated with material handling operations, forklift manufacturers such as Caterpillar competes on the tenets of product performance, quality, price, and customer service. Hence, in regard to this industry analysis I will focus on the following global competitors: Komatsu, Cummins Inc. Deere and Company (Deere), Volvo Group AB and CNH Global NV (CNH) (See table 1).

Acquisitions

Economic prospects and changing consumer preferences saw the rate of acquisitions in this industry take a new shape. This was due to dwindling global economy, and the competition wars which transformed the once simple material handling sector into a global market.

Consolidation of business procedures equally contributed to the high rate of mergers and acquisitions within the forklift industry. The forces of open enterprises witnessed during this period saw the forklift industry being buried in either mergers or acquisitions. The principal causes of either mergers or acquisitions in the industry were linked to the scope of seeking stable stock market, suitable regulatory environment, as well as economic and technological transformations.

In 2001 Kalmar acquired Nelcon BV; while a Canadian firm Finning International acquired a UK company Hewden Stuart. Another notable acquisition in this industry involved Detroit and Fraza which joined to form Fraza Forklifts. Also the industry witnessed Bolzoni SpA of Italy merging with Auromo of Finland. In 2010 Caterpillar Inc acquired UIT (underground imaging technologies), and Clean Air.

Marketing strategy

Forklift industry has some of the most notable brand such as Volvo, Komatsu, and CATS According to market surveys the industry had CAT as the most predominant brand. And this contributed in making CAT and Caterpillar the most popular names within the material handling and heavy industrial machinery markets.

Today, CAT label is among the most respected brand in regard to products as well as services pertaining to earth-moving sectors/industries globally. (CAT will refer to the brand, while Caterpillar Inc.will refer to the business organization in this project)

Reputation

From 2001 this industry grew to be a major global industrial player. According to Edwards, the forklift industry has persistently progressed due to its worldwide dealership network in addition to its superior quality products (2003). As witnessed in the course of 2001-2010 period the industry has established itself as a domain of excellence.

With the new entrants such as Komatsu, Cummins Inc. Deere and Company (Deere), Volvo Group AB and CNH Global NV (CNH), the industry’s manufacturing division has forged a very positive image globally.

Segmentation

The market segmentation plays a critical role in as far business success is concerned. Regarding forklift industry, Bhagwati (2009) noted that the industry was involved in various aspects of market segmentation. Some of the cited aspects entailed business-to-Business participation and business to government promotions.

Within the scope of 2001-2010 period this resulted in the industry having such clients as; Independent contractors, Industrial corporations, and Government as well as government contractors. Dividing the market in this manner allowed manufacturers to easily identify and determine their principal customers. Thus, this approach necessitated the formulation of more effective marketing strategies aimed at enhancing the industry’s brand impartiality and success.

Positioning

The fundamental aspects of forklift industry are to satisfy its clients. And this is reflected in the manner majority of the manufacturers in this industry were engaged in the success of their client. Hence, some of the industry’s labels like, Komatsu, Deere, Volvo, Cummins and CAT were positioned as brands for the hard working individuals.

Also the players in the industry implemented unique marketing strategies. This entailed effective communication objectives that recognized the importance of people. Constant with this assurance, a philosophical emphasis on relationships linking the clients and their forklift dealers was cultivated.

The industry’s objectives went far beyond the traditional transactional client-dealer relationship.And the concern wafted towards a more partnership oriented relationship. This approach facilitated the expansion of diverse products allied to forklift marketing concepts. Hence, industrial analysts assert that this boosted the industry’s position and brand equities globally.

As measured by world total production, the forklift industry presented mixed reactions in regard to the period covering 2001-to-2010. Compared to other similar industrial players, forklift manufacturers occupy 10% of global industrial ratio. This is in relation to size. Regarding its market ratings the industry has since 2001 grown progressively with over 42% annual rate positing over $566.3billions profit annually (OAS 2010, Bhagwati 2009). During this period the forklift industry has been widely described as moderately competitive.

However, global economic challenges, trade restriction, protectionism, and near monopoly trade practices affected its total production. Hence, Little, et al (2005) described the industries performance as either moderate, or subdued. This indicates that the nature and terms forklift industry considerably diversified in both designs and manufacturers preferences.

As testified by Caterpillar Inc. Komatsu, Cummins Inc.Deere and Company (Deere), Volvo Group AB and CNH Global NV (CNH) the demand for forklifts was on decline. From 2004-2007 the industry registered 1.1% growth (OAS 2010). The claim is reinforced by Komatsu group testimony that the demand for forklifts had considerably gone down by the end of 2007.

The group notes that from 2004 the demand for forklifts went down by 1.9 % but in the second half of 2008 the demand rose to 4.4 % (Bhagwati 2009). The growth was expected to boost the anticipated sales in the coming financial years. Most forklift manufacturers have different sets of allied products which go beyond industrial machines.

As is testified by Caterpillar a leading forklift manufacturer, the organizations sells, services and also rents equipments linked to engines, electronic as well as turbines. Examining the extent of product pricing in the industry, Caterpillar had one of the best pricing policies when compared to Komatsu, Cummins Inc.Deere and Company (Deere), Volvo Group AB and CNH Global NV (CNH).

According to Bhagwati, the company had sold over 2million units, while the nearest rival Komatsu had sold 0.8million units globally within 2001 to 2009 periods (2009).

The success of this company was linked to its well formulated legacy of rental scheme. The arrangement allowed its clients to use the company’s machinery without financial commitment of purchasing the rented unit. Also the company had a program allied to rent-to-own preference.

Looking at the current financial trend the forklift industry has over the last one year shown concentrated growth in comparison to 2009. The Machinery and Engine analysts noted that the forklift industry generated an approximate of 407.7 billion as EBIDTA (earnings before interest, taxes, depreciation and amortization) in 2001-2009. This was a 63% increment compared to 2001-2007 financial period. However, as shown by Caterpillars Inc and Volvo Group the industry growth level was considerably low by 2008, the growth rate was progressing at 0.21% annually (Bhagwati 2009).

Determining Changes in globalization

Forklift industry over the period of ten years witnessed a number of changes that compactly influenced unit productions. It ought to be noted that each manufacturer had dynamic procedures of determining market positioning. This is also reflected on the manner manufacturers approached and treated the anticipated consumers.

And this was demonstrated by the growing rivalry between Caterpillar, Komatsu, Cummins Inc. Deere and Company (Deere), Volvo Group AB and CNH Global NV (CNH). The emerging global changes witnessed during this period present a candid view. The consumption of heavy machinery such as forklift was heading towards uncertain future particularly for those companies and brands without a strong market base.

World trade volume

According the projections provided by National Association for Business Economics, 70% of forklift manufacturers were facing stiff market restrictions. While 10% were under threat of involuntary acquisition. Too, 20% of the expected consumers are had cut their spending heavily affecting the industry’s net income globally (Bhagwati 2009). This is as shown by the association survey conducted from 2002-2009.

The observation is also reinforced by Material Handling Industry in Africa which asserts that globalization was slowing the growth and expansion of forklift industry considerably (Krueger 2004). The scope of globalization influenced market segmentation, product promotion, and capital distribution within the industry. As witnessed in the leading forklift producers, globalization tilted the marketing and production strategies considerably.

The shift in production was necessitated by market demands. For instance Caterpillar Inc. was compelled to develop electric powered forklifts within a span of five years (McMillan 2001). The move from IC powered equipment was necessitated by competition from rival forklift manufacturers.

Hence, the changes in globalization as seen in forklift industry were correlated to bargaining power of material suppliers, threat posed by new entrants, extreme rivalry among manufacturers, and threat of alternative products.

These factors played a central role in determining the world trade volume in regard to forklift production. The onset of 2001 saw the demand for material handling equipments soar. This contributed to the increase in the global demand for forklifts which was accountable for 2.0% of world trade volume as per 2004.

The strong demand for IC counter balanced the need for forklifts with dynamic load bearing capacity. Hence, in 2001 Komatsu group produced over 3000 units, while Deere manufactured 10,000 units. However, Caterpillar Inc. in the same year produced over 55000 units.

These figures show the impacts of globalization in the industry (OAS 2010). The extent of globalization forced many countries to embrace SAPs (structural adjustment programs), in which industrial liberalization was slapped with increased tariffs. These features contributed to immense competition which displaced some of the producers from the market.

The restricted exports and low priority on forklift industry contributed to the industry decimal world trade attained in the year 2004 and 2007. Basically, this shows that between 2001 and 2010 this industry incurred less gains points. This is testified by world gross product in regard to world trade volume revolving around 8 and 28% witnessed in 2008 and 2009 (Bhagwati 2009). This resulted in a sharp drop in sales which reached 40% in 2009 (Bhagwati 2009). Also the sales of forklift in Africa, Asia, Europe, and America plummeted.

Intra-industry trade

The sharp increase in IIT from the early 2004 to 2010 was linked to the outward oriented agenda in this industry. Industry level examination shows that forklift was experiencing a lethal fall in protection due to its higher degree of IIT. More so, an increment in IIT suggested that adjustment expenses linked to industry liberalization were technically low. As the forklift industry indicates product differentiation as well as scale economies were influenced by intra-industry variations including IIT.

However, R&D had no direct impact on IIT in relation to forklift industry. For instance, simultaneous imports and exports within this industry were found to be instances of IIT. As exposed by both patterns and market determinants IIT affected the industry’s productivity globally.

Hence, Forklift industry has over the years witnessed a number of changes due to the influence of IIT and globalization. Some of these changes are a result of either seamless exports or imports. As witnessed in the case of Caterpillar, most global nations are importing more of this group product that is its flagship brand CAT. Other than exploring the degree of determining transformations due to globalization, the range of intra-industry trade developed to be a global economic issue.

Consider the fact that from the wake of 2001 to the year 2010 the global market in regard to material handling equipment had gone up. The prominence of Caterpillar Inc and Komatsu explains the scope of IIT globally. This affected the extent of trade in terms of both exports and imports. What this testified is that IIT had transformed to be a fundamental pillar in as far forklift industry was concerned.

According to the industry analysts intra-industry trade helped to sustain strong economic ties between the major forklift producers from the mid 2002.

This was fueled by rapid dismantling of trade and investment barriers around the world. More so, seamless structural changes necessitated the need for these policy changes. The impacts of intra-industry trade were felt in mid 2009 after it emerged that majority of the industry players were manufacturing dissimilar varieties of the analogous product. This resulted in low demand levels due to consumer preferences.

World Industry Trade Barriers as measured by the MFN (Most Favored Nation)

From 2001to 2010 the forklift industry encountered numerous challenges. These challenges involved market division and stiff regulatory measures. As was noted from Africa, India, China, and Australia the instances of trade barriers, tariff quotas and export restrictions compelled principal forklift industry stakeholders to operate on losses.

However, some of the leading industry players like Caterpillar Inc opted to sustain the scope of open trading scheme which is employed by most countries today. Though, the tariffs in regard to this industry were at all times high. What this shows is that tariffs were employed as instruments exploited to guard domestic industries. This scope was evident in forklift manufacturing countries as china, USA, Korea, Japan and UK.

From a global perspective this approach was employed as parameter of guarding this industry as a principal source of income in some quarters. Globally, tariff structures have since 2002 encountered seamless simplification. Applied MFN tariff ratios have persistently moved upwards, from a global unweighted standard of 7.5 % in 2001 to approximate 10% in 2008 and was expected to soar up to 11.5% in 2009 (OAS 2010; Bhagwati 2009).

This is allied to the industrial tariffs which stood at 12.3% and 11.00% in 2008 (OAS 2010). Comparing this industry with other competitive sector, the escalating tariffs were seen to be incoherent with the stated objectives of most governments allied to the gradual reductions on tariffs linked to forklift industry. This scope affected the forklift manufacturers who were manufacturing other equipments unrelated to material handling sector.

This saw such forklift manufacturers as Komatsu, Cummins Inc.Deere and Company (Deere), Volvo Group AB and CNH Global NV (CNH) cutting their production. These cuts were as a result of import licensing, trade quotas, export subsidies as well as voluntary export limitations. Typically, tariffs are taxes that increase the cost of any imported product.hence, the extent of tariffs, trade barriers, and trade restrictions were against the scope of MFN.

As indicated by industry’s market trends WITB worked against the growth of forklift industry. For instance, EU member states trading in forklifts enjoyed lower customs duties while discriminating against third world countries such as Ghana, Kenya, and India. As demonstrated by WTO and GATT from 2001 to 2010 there were no specific rates tied to forklift industry. However, different countries had their own approach to this issue.

This is due to the fact that the tariff issues have played a central role in causing division among diverse trading partners. For instance, the product requirements for Africa were less diversified than those intended for Asian, European or American markets. Also the product specification for either China or India differed considerably with what exported in either Kenya or Ethiopia.

Thus, in as far as this industry is concerned product variation was determined by the market. And this was against the principal tenets of WITB as defined under MFN and GATT. Consider the table below in regard to scope of tariffs as established from 2001 to 2010.

(These %s are not correlated to trade density or value, they are major global tariff lines: source: OAS 2010)

Factors affecting Forklift industry

Both internal and external factors play a central role in determining the scope or destiny of any given industry. The extent of forklift industry in general and in particular in Africa has been considerably affected by political factors. It ought to be noted that Africa is one of the richest continent in terms of natural resources.

However, political instability has played a critical role in destabilizing the manufacturing industry. Democratic republic of Congo, for instance, is one of the major consumers of Komatsu products a leading forklift manufacturer. In the wake of 2003 the group anticipated opening an assemblage branch in this region so as to serve their clients effectively.

However, their plans were aborted after the country exploded in a range of civil war. It is apparent that almost all industries do in one way or the other experiences seamless cycles of economic instability. Some of these factors have played a principal in regard to development of forklift industry.

For instance, global news, war, consumer preferences, even such unrelated circumstances as earthquakes, epidemics, and overall health of the market tilts the industry position globally. Thus, economic events also revolve within the scope of inflation which is commonly related to political instability. What should be noted is that some of the core markets for forklifts are in developing countries like Kenya, South Africa, Ghana, Pakistan and India (Little, et al 2005).

However, the happenings which have engulfed some of these regions propelled most of the industry players to relocate. Some of these events are like 2007 post election violence in Kenya. The said events affected forklift sales in east Africa. While in South Africa Komatsu group had a massive profit margin in due to the world cup.

However, the scope of political instability in some of the regions such as Zimbabwe, Somalia, Iraq and Afghanistan saw the forklift industry leaning towards the development of military and commercial oriented products. These observations indicate that political events do compel the industry players to seek venues which are less prone to risk.

Thus, from 2001 to 2010 the forklift industry in all its spheres had experienced harsh economic events. As is evidenced by high tax rates in some of the regions such as the Caribbean’s and in particular Venezuela. This has compactly impacted on the growth of this industry. However, these challenges have contributed to the creation of economy class forklifts which are marketed in those areas which are hostile and interest rates are either high or falling. When the interest rates are high the markets are typically crippled (IDB 1996).

Concerning technological events that have shaped or affected this industry it can be argued that diverse players have injected new life into forklift industry. This can be allied to the manner and nature of different models being released into the market. The entry of new companies has over the years since 2001 reshaped the industry and making the competition even stiffer.

This resulted in the manufacture of user friendly machines with diverse attributes which made these products to be all time attractive. Also governmental involvement or intervention can be attributed to the manner the forklift industry behaves in some regions. It ought to be noted that almost all major industries are controlled or regulated by the government.

This is testified by the role of government agencies such as Environmental Protection Agency in US. And due to the nature of forklift industry it is heavily regulated in such countries as china, South Korea and UK and this for the last ten years have weakened this sector.

Other events affecting the historical development of forklift industry relates to stability including predictability. Note that political institutions are mandated with generating what is perceived to be dynamic stability as well as separation of diverse powers among them being checks and balances of all executive authorities. Thus, from such observation, the wake of 2001-2010 saw the unsteady progression of this industry amid instable global economics.

The top 5 global firms

Market dominance as well as global sales is some of the principal pointers that determine the position of any industry on the global scale. It is from such observation we note that the forklift industry has a number of key players who have stayed in the market for years while others are recent entrants.

In regard to concentration ratio we are examining five top most firms. This would entail examining the proposition of the total output in the forklift industry generated by the five principal players in the industry. The scope of this approach is to determine the degree of the given firm in regard to market control to which a company may be classified as monopolistic or oligopolistic. This method would thus entail calculating the concentration ratio based on the market shares of the leading firm in the industry

The concentration ratio can be articulated as:

CRm = s1 + s2 + s3 +…… + sm

where si = market share of the ith firm.

The table 1 presents the 10 years sales of the top five forklift manufacturers globally

Forklift industry

The above table demonstrates that the forklift industry sales were over $ 16,000million for the period of 2001-to-2010.

The concentration ratio in this case can be either calculated using one of the principal identical procedures. The first procedure is to add up total sales of the top firms in the industry, then dividing the sum with the total. On the other hand, the market shares of the top companies can calculated separately or individually, then summed. According to the above calculations the measures indicates that the forklift industry falls within the premise of medium concentration. What this demonstrates is that concentration ratio doesn’t give details pertaining to market competition rather it provide an indication in relation to industry market nature.

The Herfindahl index is employed to measure or determine any given industry concentration ratio. The standard formula for calculating Herfindahl index is:

HI= (Share 1)^2 + (Share 2)^2 + (Share 3)^2 +… + (Share n)^2

This method is commonly employed to measure any industry concentration. in addition, by inference, the level of market control. While there are no Supremes (absolutes) when one attempts to evaluate the concentration, common degrees as well as the corresponding HI values are typically presented

Concentration levels

Herfindahl index for the top 5 firms

The above observations (See table 2) illustrates that the industry concentration has not changed much. However, as is testified by the topmost company the industry concentration has not trickled down to be defined as monopoly. Thus, in the course of 2001-to-2010 the industry has grown gradually with the market control being evenly distributed among the competitors.

What this indicates is that companies with greater market values and shares maintained a greater market share. In regard to the industry concentration the anticipated changes can only be determined by exploring each individual firm market involvement and this cannot be determined through industry concentration (Krueger 2004).

However, it is evident that even those companies with minimal market shares can have a profound impact on the market. Thus what this implies is that the instances of monopolistic rivalry within the forklift industry cannot take root despite the differences apparent within the industry concentration.

More so, over the period of 10 years it has emerged that each company had a significant percentage no matter how decimal it was that influenced the market. However, it is apparent that product differentiation as well as other variations of non-price competition gave the individual company’s some features leveled against monopolistic supremacy that highly competitive corporations didn’t have.

Thus, the scope of industry concentration was also etched within the scope of having a brand name as well as a packaging that was identifiable and was a symbol of authority in the market. As shown below by some of the key competitors (See table 3)

It is evident that the greater the company market dominance so as its concentration and profitability. What this demonstrates is that the competing organizations can in one way or the other join the growing market and equally make a credible monetary profit. However, as the above key competitors shows the industry concentration diminishes as more firms join the industry and more so this decreases the demand as consumers opts to shift their allegiance to other firms.

Geographic concentration

As presented by the above information concerning both concentration ratio as well as Herfindahl index, it is apparent that geographic concentration played a central role in determining the nature and level of industry concentration. Diverse regions had different preferences in as far as material handling equipments were concerned.

It ought to be noted that geographic concentration in specific regions evolved to be near monopoly. This trend was necessitated by the market values and product presentation. Caterpillar Inc, for instance, had become the global standard for almost all forklift manufacturers.

Be it in Africa, Asia, and china, America or the Caribbean’s, geographic concentration as presented by the firms examined offers candid insight into the industry requirements. It is evident that geographic concentration provided the opposite platform for the involved firms to examine their strengths, weakness, opportunities as well as threats (Bhagwati 2009).

This concept as presented from 2001 to 2010 illustrates that each and every company having a profound impact on the market regional exploited the scope of geographic concentration to capitalize on the weaknesses of the competing company. This is testified by the way Caterpillar enjoyed massive popularity in African market and this was made possible by its product awareness which was anchored within its geographic concentrations across the globe.

According to the data gathered it is evident that forklift industry has unique and dynamic industry structure. The structure of the industry provides a considerable insight into the manner this industry runs or is operated by diverse global players. The structure of the forklift industry is essential in that it has over the years affected the both industry sellers and buyers.

From 2001 to 2010 the industry structure has touched and influenced the profitability of such key industry players as Caterpillar, Volvo, and Komatsu. What this asserts is that forklift companies have over this period evolved to be more consolidated as manufacturing industries.

Thus, the concept of industry structure proved to be essential for both trade policy as well as public policy. And this helped in nurturing healthy competition within the forklift industry and more so making certain companies look more attractive while affecting the performances of others.

By exploring the forklift industry structure from 2001-to-2010 it is evident that the scope and extent of this industry has provided an essential window by which to understand the global attributes in regard to entry barriers, competition, rivalry as well as dynamics of competitive aspects in the industry.

Another instrumental feature is that over this duration forklift industry has proved to be a more attractive sector, despite its competition extent which is commonly found within either fragmented or consolidated industries (Bhagwati 2009).

The key driving forces in this industry and how conditions may change in the future

The major driving forces in this industry are allied to the concept of having the opposite tools and strong financial base. This can be allied to the fact that unlike any other general industry, forklift industry is classified under heavy industries which are closely monitored and this calls for apposite planning as well as production of high standard products.

This concept can be testified by the manner Caterpillar Inc has over the years managed to package and market itself globally. Thus the expansion of resources and investment in research, market orientation as well as motivation among the industry players can be said to be among the major driving forces in the industry.

Having credible product development procedures is another notable feature which has over the period been employed to boost performance and economic gains in the industry. Equally, maintaining balanced research as well as development spending has been a core driving factor that has helped this industry to maintain a stable profit margin and more so enhance its supplier and consumers collaboration.

Another significant feature is exhibited by Volvo Group AB which over the years have developed and progressed profound presences locally as well as in foreign markets by employing the indigenous staff so as to strengthen its ties with the locals as well as with the government and equally restricting the risk of severe government strategies (Rodrik 2002).

Other major factors driving this industry includes mergers and acquisitions, the scope of this approach is to ascertain of a market niche in both existing and emerging markets both locally and internationally. And this is being achieved organically via expansions.

However, due to the emerging market challenges being fueled by e-commerce the industry is facing diverse challenges which are either as a result of political influence or as the market dictates. As from 2001 to 2010, the industry has in some instances been faced with antitrust challenges especially in EU markets (OAU 2010).

To overcome competition laws which are being implemented by diverse economic blocks the players or the stakeholders in this industry have to change marketing and packaging strategies.

In essence, the scope of pricing distribution and promotion must be considered. As the world is moving towards formation of greater economic blocks as is being witnessed in Africa, Asia, the Caribbean’s and the entry of china in the forklift industry, only the best policies and effective implementation will make the industry to remain relevant and competitive.

References

Bhagwati,J., 2009. FTR and Economic developments. Cambridge: NBER.

Bhagwati,J., 2009. Import Competition and Response. Chicago: University of Chicago.

Edwards, S., 2003. Crisis and Reforms. Washington: WB.

IDB., 1996., Economic and Social Progress. Baltimore: Johns Hopkins.

Krueger, A., 2004. Foreign Trade Regimes. Cambridge: NBER.

Little, I.and Scott,M.,2005.Industry and Trade. London: OUP.

McCulloch, R and Petri, P., 2006.Capital Flow. Cornell: Cornell University.

McMillan, J., 2001 Regional Integration. NY: St.Martins.

Michaely, M.and Choksi, A.,2001 Liberalizing Foreign Trade. Cabridge: Basil.

Organization of American States.,2010.Trade and Integration. Washington: OAU

Rodrik, D., 2002. Has globalization gone too far. Washington: IIE.

Thomas, V.and Nash, J., 2005. Best Practices. Oxford: OUP.

Tables

Table 1: source: (OAS 2010; Bhagwati 2009; McCulloch, et al 2006; Thomas,et al 2005.)

Table 2: source: (OAS 2010; Bhagwati 2009; McCulloch, et al 2006.)

Table 3: source: (OAS 2010; Thomas, et al 2005.)