Introduction

Cosmetics is defined by Mills (2002, p. 36) as a product meant for external application or a process of applying a substance on the body with intentions of making it look more attractive. Cosmetics are always make-ups applied on the body in order to make an individual more appealing. Cosmetics industry is one of the developing industries in Australia. A report by KPMG shows that this industry experienced a growth of 3.1 per cent in 2009.

It was then estimated to be worth 3.6 billion US Dollars. From this report, it is evident that although the growth has been positive over the recent past, this sector still falls under the least developed industries in the country. However, the industry is very robust and promising. The report by KPMG indicated that this industry is projected to grow at a rate of 6 per cent this year. This is an indication of how the size will grow in the subsequent years.

Firms in this country have a very huge market locally. However, this market may not satisfy all the production needs. For this reason, some of the large firms in this industry have resorted to exportation of their products to ensure that they expand their market share. The volume of sales can be analyzed by examining the units making up the entire industry. In this industry, the largest sector is the Hair Care. It accounts for about 28 percent of the total sales volume.

This was estimated to stand at about 864 million US dollars. In the same year, the industry’s growth was estimated to be around eight percent. Other sectors such as the body lotions, the toiletry, among other units have also witnessed some growth. There has been great growth in this industry since then.

The level of production of cosmetics within Australia is relatively high. The cosmetics from this country find their way to UK and other European nations. Although stiff competition comes from the French’s cosmetics, the local production has found its way to markets outside the borders of this nation.

Some of the countries where these products are exported to include USA, UK, New Zealand, Hong Kong, Japan, Singapore, Taiwan, India, Malaysia and South Korea. Some of the emerging markets for the Australian cosmetics include Denmark, China, Thailand and Norway.

The rate of turnover has equally been good. The local market is large enough to absorb most of the cosmetics produced by this industry. Although not a huge employer, this sector employs a substantial number of people, most of whom are nationals of this country. These people are directly employed in this industry, especially in the manufacturing firms, marketing firms and in the beauty therapy firms (Wittner 2003, p. 12).

Major Competitors

The Australian cosmetic firms are very successful. They have witnessed a substantial growth over the recent past, managing to increase their market share to regions outside their borders. Currently, cosmetic products from Australia are very popular in the American market. Mills (2002, p. 45) says that the ability of the Australian firms to penetrate the American markets was one of the successful story. The American market is one of the most attractive in the world.

Other regions such as the United Kingdom, China and Hong Kong also consist of the attractive markets. However, penetrating such markets and remaining relevant in them is not as easy as one may think. The whole process has been characterized by many challenges, top of which is competition.

The level of competition in this industry is great. This competition comes both from the industry players within Australia in form of internal competition, and external competition from companies from other countries. The Australian Departmental Information Management and Deregulation agency reports that Australian cosmetics industry has grown in size, and currently includes over 300 firms. Some two hundred Australian firms are known worldwide for exporting their products outside the country.

Some of these companies that have dominance in this industry include The Natural Source, Jurlique, The Ward Group, Laderma, Cat Media, Lifeforce Pty Ltd, Bloom, L’Oreal Australia, Procter & Gamble, Olay Regenerist, Becca, Aesop and Perdis. Some of the products that these firms deliver to the market include aromatherapy, men grooming products, dermatological products, baby products, sun care and natural products.

Australia has a good proportion of population as the aging group. For this reason, the anti-aging products are very popular. Scholars report that since 2010, anti-aging products have continuously gained popularity. Due to the increasing number of the aging population in this country, products that maintain youthfulness have gained popularity.

This has seen a serious competition between firms in this sector. There has been a deliberate attempt by various firms to remain firmly in the market as regards to producing these types of products.

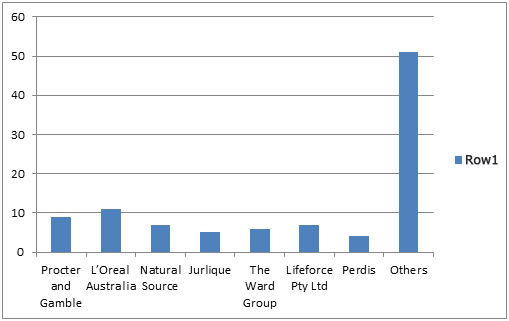

Some of the firms that have managed to maintain the market share in this industry include L’Oreal Australia Pty Ltd and Procter & Gamble Pty Ltd. In this production sector, the market leader is L’Oreal Australia Pty Ltd. Scholars concede that that it had a market share of 11% by close of 2011. It has continued to be attractive in the first quarter of 2012.

It is also the leading exporter of skin care products in Australia. Its anti-aging products have gained popularity both at home and abroad. Its main brand in the skin care industry is L’Oreal Dermo-Expertise. Closely behind it were Procter and Gamble Australia Pty Ltd. Experts report that this firm occupied about 9% of the industry by the close of 2011. Its main brand in the market is Olay.

This company has been the major competitor of L’Oreal Australia Pty Ltd. Although L’Oreal Australia Pty Ltd has proven its prowess in securing the home and most of the European markets, Procter and Gamble Pty Ltd has mastered the American markets and those in Asia, as well as other markets in the third world countries such as those in Africa. The two firms offer high quality products that meet the world standards, with variations coming in the color fragrance.

The other sector of this industry that is also developed with strong competition is the Hair Care sector. The world recession of 2009/10 affected Australia to an extent. This saw many of firms cut down expenditure on beauty products. The Hair Care industry had to respond to this and provide products that would be cost effective in the market.

This saw many industry players introduce mass production of saloon products to the supermarket outlets in the country. Procter and Gamble commands a huge market lead of about 26%. It has managed to maintain this lead by creating internal competition in the market.

This company has developed a number of brands in this line of products, which have engaged in a very healthy market competition. Some of the brands include Pantene Pro-V, Clairol Herbal Essences, Wella Balsam, Clairol Nice ‘n’ Easy and Head and Shoulder. Other minor competitors in this market have come out strongly against the above array of brands of Procter and Gamble.

Another segment in this industry is the Color Cosmetics. Technology has brought with it several changes in the market. Consumers are becoming more sensitive about the products that are availed to them in the market. In the cosmetics industry, the market is currently giving a rare attention to the color cosmetics.

The market wants value for what it pays. Brand has become an issue as customers identify specific brands in the market. Mills (2002, p. 47) notes that the market has become so sensitive and very discerning towards the products availed to it. Consumers seek for professional guidance before making such purchases.

Revlon Australia Pty Ltd has maintained the leading position in this industry. According to a report by KPMG, this company has acquired a market share of 19%. It has managed to position itself in the market as a firm keen to offer quality products. This has seen its products grow popular in the market.

To ensure that it captures all market segments, it has developed an array of brands targeted at different market segments. Mills (2002, p. 23) reports that this firm has successfully managed to identify itself with different segments of the market. Each segment feels satisfied with the products offered by this company. One of its popular brands in the market is ColorStay.

Factors that Affect this Industry

Legal Factors

In any given country, there are always rules and regulations that govern the business environment. Mills (2002, p. 42) posits that without the rules, the business environment could be a jungle that is very difficult to navigate. The legal factors are put in place to govern the way business units relate with their customers, how they relate amongst themselves, their relationship with the government and the public. Australia has liberalized the business environment.

There are no restrictions to the cosmetic firms operating within the country borders. However, there are some laws that they must observe. The government, through various organs, has been keen to ensure that products that are availed to the market are of good standards in terms of health and quality.

Australian Organization for Quality has been keen on monitoring the quality of products that are made available to the market. Other bodies have also been put in place, both at national and industry levels to ensure that products availed to the market are of the right standard both in quality and in quantity.

Environmental concerns have become an issue in the recent past. The raw materials and the by-products from cosmetics industry have been noted to contribute greatly to pollution of the environment. Some have come strongly against such industry operation, leading to regulatory procedures regarding the emission of poisonous gases in the air and industrial effluent into the rivers. Such industries must adhere to these laws.

There are other regulations as regards to pricing and the general competitive environment within the country. Inasmuch as the firms are free to operate with a lot of freedom in this market, they are not permitted to engage in such acts that would result to interference of other firms.

Political Factors

Australia is one of the countries with the most stable political environment in the world. Since it gained its independence from United Kingdom in 1901, the country’s political environment has remained relatively stable. It is currently regarded as one of the most developed democracies in the world.

The political class has not influenced the business sector negatively (Hollingsworth 2000, p. 600). With such a business environment, business units have grown to capture both local and international markets. The country’s leadership has also ensured that job creation is maintained.

This has seen business units prosper locally, making them financially stable enough to capture other international markets. The government has also keenly protected the cosmetic firms in the international market. This goodwill from the political class has ensured growth and development of the Australian cosmetics industry. For those firms that export their products to other countries outside Australia, political environment is given a broader picture. Uncertainties in external markets can greatly affect the prosperity of a firm.

If the firm’s destination market faces political turmoil, it would be a challenge to navigate such markets and make substantial sales. This was witnessed in China when activists, human rights bodies and a number of nationals engaged the police in battles over what they termed as human rights violation by the government. In such occasions, the market becomes impenetrable leading to loses and possible destruction of goods.

Economic Factors

Australia is a developed country. Its economy is one of the strongest in the world. The majority of Australians are employed, with decent salaries. The entrepreneurial culture of this society has made it cut down the rate of unemployment. Because of this, the populace has enough disposable income to spend on such items as cosmetics. Mills (2002, p. 61) notes that the cosmetics industry can only flourish if there is a stable economic condition within the country.

A case in point was in the 2008/9 economic recession that hit the world. It had a strong negative effect to this industry. Cosmetic products may be considered goods of ostentation. Their sales strongly depend on the economic strength of the customers. During the recession period, they completely avoided expensive products while preferring cheaper cosmetics. This saw a reduction on sale of products targeted at the higher market segment as many of this segment moved to lower ones, which were comparatively cheaper.

Technological Factors

In the contemporary world, technology dictates most of the activities done by humankind. It is not easily predetermine what tomorrow will carry. One is left wondering what the next inventions and innovation will bring. The changes in technology are so radical that failure to adapt to it within the right time may lead to a complete phase out of a firm in the market (Porter1990, p. 79).

Cosmetics industry in Australian is faced with the challenge of adapting to the new technologies. Technology brings with it prosperity. Technology makes work easier. It always provide quicker and more efficient ways of doing things. Technology is the only answer to the twenty-first century problems. However, with it come numerous challenges and costs. It is therefore important that firms within this industry develop strategic approaches to managing emerging technologies.

List of References

Hollingsworth, RJ 2000, “Doing Institutional Analysis: Implications for the Study of Innovations”, Review of International Political Economy, Vol. 7, no. 1, pp 595–644.

Mills, G 2002, Retail-pricing strategies and market power, Melbourne University Publishing, Melbourne.

Porter, ME 1990, The Competitive Advantage of Nations, MacMillan Press, London.

Wittner, P 2003, The European Generics Outlook: A Country-by-Country Analysis of Developing Market Opportunities and Revenue Defense Strategies, Datamonitor, London.

Appendix

A Table Showing Market Share of Different Companies in Skincare Sector

A Graph Showing Market Share of Different Companies in Skincare Sector