Introduction

The purpose of this report is to assess men’s salon experience for the new product range of L’Oréal Professionnel Homme to prepare a marketing strategy. However, the proposed products, “Hair regeneration cream” and “Aftershave lotion,” have various unique properties. This product range will be introduced to the Dubai market. The report will focus on the beauty conscious male attributes of Dubai, including their increasing spending for grooming. This paper will argue that the new product range of L’Oréal has a prospective market in Dubai, in the United Arab Emirates and the neighboring GCC counties.

Pre-Case Study

The Market

Dubai city is a very prosperous market to the investors from all over the world; the global market economy has been suffering from long-term recessionary impact following the global financial crisis, but the UAE economy has dramatically gained momentum recovery and indicated significant growth in the non-oil sector, especially in the service sectors. The Bank Audit (2014, p.18) reported that the economy has successfully gained consumer confidence with real GDP growth of 4% in the last fiscal year, although it was 4.4% in the presiding year; such growth followed the acceleration of non-oil sector and reduction in the oil exports in the global market.

According to the IMF analysis, the trade surplus of UAE evidenced large deficits, while the service level income, along with the current transfer balances, failed to reach the equilibrium point. As a result, it generated a remarkable reduction of expenditure in the current account surplus and has accounted for 17% and 15% of the GDP respectively in the past two years.

The healthy economic activity and performance in the market of UAE have managed to attain a comfortable surplus that assists the market players to reduce the negative impact of the downturn, the fiscal and monetary policy faced to revenue earning at a moderate expenditure level with suitable fiscal surpluses and sufficient level of foreign exchange reserve. The gross governmental debt of UAE illustrated more than sufficient and adequate level; satisfactory money supply, moderate fiscal policy, a vigorous stream of capital, strong foreign reserve, and lower inflation rates, as well as rising housing costs, have generated the market dynamics of the country towards an emerging economy.

The general Price Index of the consumers in UAE has jumped at 118.89 in 2013, which is 1.4% above compared with the previous year. At the same time, the banking sector has witnessed tremendous growth with huge capital generation and reached US$ 519.5 billion for the first two quarters of 2013 as a successful outcome of the economic diversification. Furthermore, with the prospect of tremendous growth, Dubai is going to host the World Expo 2020 and aims to turn into the world’s number one business hub for trail and wholesale for commodity and service trading, including the transportation and tourism products.

Dubai Market

Hamid (2013) reported that the male Salon, Barber Shop, and Spa industry of Dubai had been rapidly expanding, were men of Dubai have been spending Dh740 million for their beauty and grooming purpose. However, this information illustrates that investors all over the world would be interested in penetrating this emerging market. The people of Dubai are increasingly willing to get well-groomed and look younger, and they are progressively spending more in male Salons, Barber Shops, and Spas to attain a charming facials impression in order to attract the opposite sex. As a result, male beauty, grooming, hairstyling salon products, such as famous gels, pastes, shaving creams and devices, shampoos, waxes, hair, and skincare products, have been explored significantly in the current years, the market had been Dh 208 million in last year and raised up to Dh 740m in the current fiscal year.

Multinational companies like Unilever have earnestly penetrated in the Dubai market and established male beauty salons in the region with its men’s product lines, such as Dove and Vaseline brands; it conducts many marketing promotions and adverting campaigns by endorsing celebrities, such as Bollywood actors and sports stars. At the same time, there are many other multinational companies in Dubai, such as Procter & Gamble International, British barber Shop Julian Hair Dress Dubai, Turkish barbershop Adres Gents Salon, as well as local players like ‘Beats and Cuts Barbers,’ ‘Chocolate Gents Salon,’ ‘1847 Men’s Salon’, ‘Mankind Barbering and Grooming,’ which are more remarkable for their business performance.

Identifying Competition in Dubai Market

With the mature practice and all the experience gained due to serving in the fifty-six countries, the marketers of L’Oréal Professionnel are going to explore its operation for the products of Male Salon, Barber Shop, and Spa industry in Dubai. Therefore, it is essential for the management of ‘L’Oréal Professionnel’ to learn about the competition and its competitions in Dubai. There is a significant number of multinational companies providing with Male Salon, Barber Shop, and Spa industry services. At the same time, there is a huge number of local Barbershops. However, there is significant competition among the foreign operated Barbershops, while the locally operated Barbershops are enjoying a regional monopoly in their area; so, the competition in this market is not perfect.

The famous US Barber Shop “Beats and Cuts” has a strong presence in the Dubai market with several outlets and other famous celebrity barbers serving the local customers, offering them traditional and contemporary haircutting and male grooming services. Unilever has seriously taken entry in the Dubai market and initiated several male beauty salons in Dubai with its male product lines for two famous brands, ‘ Dove’ and ‘Vaseline.’ It proves that the company has sober marketing and advertising campaign through endorsing celebrities, from the Bollywood actors to sports stars of India.

The barbershop’s supply chain in Dubai includes Procter & Gamble International, while British barber Shop “Julian Hair Dress” is in operation in Dubai, while there is no reason to consider Turkish barbershop Adres Gents Salon as another competitor in the Dubai market. On the other hand, there are huge Male Salons and Spa centers all over Dubai rather than the multinational Barber Shops like 1847 Men’s Salon, Casanova Gents Salon, GQ Men Hair Lounge, Marc Cavalli Salon, Mankind Barbering and Grooming, Julian Hairdressing For Men, Sharp Gent’s Salon and so on; all of them are enjoying significant market share.

Understand the Male Salon consumer’s Trends in Dubai

Margolis and Carter (2003, p.3) pointed out that demography of the UAE consists of the migrated people from both the developing and the developed countries, but the culture and consumer trend remind the developing countries for the elderly people are featured with high fertility rate along with rigid traditional viewpoints although the country holds a richer economy. The Euromonitor (2013, p.1) added that the economy of the county had been quick recovering from the recessionary impact of 2009 that had seriously influenced the men’s grooming industry, especially men’s beauty and personal care sectors. As a result, the newly shaped economy has tremendously influenced the customers’ trend in the market.

The changing customer’s trend of men’s shopping illustrated that they would highly shift to purchase hair care products and services from the nearby retailers as part of the weekend shopping. The brand awareness seriously influences their purchasing motivation, although the location of Male Salon, Barber Shop, and Spa industry from their residence is another key factor.

Most of the customers in the men’s grooming and beauty salon industry are willing to be served only by the foreign professionals in hair care as this is the only thing, they are able to gain confidence in such services without bothering to the cost. As a result, the multi-brand hair care specialists in the Dubai market are enjoying a large market share. The hair care specialist retailers have already identified that male customers are enough to brand conscious. Moreover, they prefer to use the known brands, and they are serious about getting their favorite brand. That is why the retail service providers at supermarkets and malls keep different branded products at their shops.

The Brand

Analysis of the Status of L’Oreal Professionnel

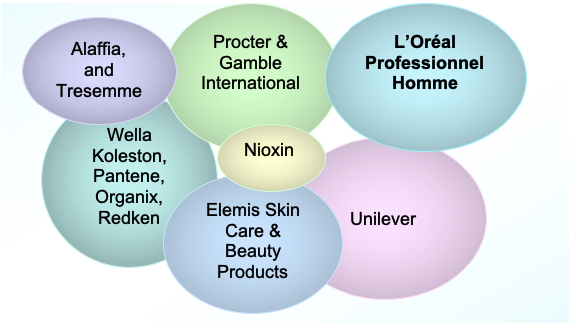

L’Oreal Professionnel Homme is a giant brand that has numerous hairstyling salons all over the world in different markets, and it has a strong presence in fifty-six countries. It has exceptional, historical links with the best hairstylists. As a result, the image and positioning of this brand will be similar to the following figure. However, there are many recognized male beauty products and service providers in the Dubai market, but the brand-positioning map shows that L’Oréal Professionnel Homme is to occupy a major part of the Dubai market. Amongst some other male beauty care products and hair salons positioned in the market, Unilever, Procter & Gamble International, Elemis Skin Care & Beauty Products, Wella Koleston, Pantene, Organix, Redken, Nioxin, Alaffia, Tresemme and Walgreens may be considered to be significant.

SWOT analysis of the L’Oréal Professionnel Homme Brand

Strengths

Men’s interest in the beauty care products had increased for which they would like to purchase beauty products considering brand image. However, brand awareness of L’Oréal Professionnel Homme is one of the main strengths to the marketers so that it is easier for them to start a campaign in the Dubai market (Hamid, 2013; Yeomans, 2013; and Euromonitor, 2012). At the same time, Euromonitor (2012, p.7) reported that L’Oréal Group had the ability to think outside the box to develop innovative products with outstanding features. However, Jouvence (2014) argued that L’Oréal Professionnel Homme would enter into the market for the contribution of human resources, particularly for the research team. Thus it may become a market leader in the hair salon industry in spite of the fierce competition.

In addition, this brand has a large market share in the global market, and it is operated in more than 56 countries as the second leading professional brand (Jouvence, 2014 and Euromonitor, 2012). However, it will assist the marketers in expanding business in Dubai. At the same time, other strong points of this brand include the promotional policy, creative employees with vocational training course holder, diversified distribution channels, sophistication, trendsetter, higher customer loyalty, the ability to adapt to the culture of the different target market, and so on (Jouvence, 2014).

Weaknesses

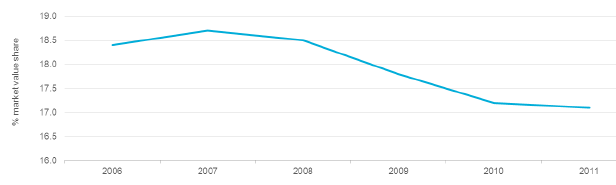

Jouvence (2014) stated that the high pricing of this brand was one of the most evident weaknesses that hindered the company from expanding business in the global market. Therefore, the introduction of this brand in Dubai with a high price could be difficult to build a brand image for the large target group. On the other hand, Euromonitor (2012) reported that renowned beauty care companies like P&G and Unilever had experienced severe problems while having tried to gain profit from men’s hair care products as the market share of such products dropped significantly in 2011. In this context, marketers need to assess the Dubai market condition in order to face future challenges. However, the following figure shows some data that may be valuable for research:

In addition, Jouvence (2014) argued that L’Oreal Group expended large funds on promotional purposes, which directly affected and resulted in the profit margin. At this point, it can be assumed that this group is to allocate a big budget to introduce the L’Oreal Professionnel Homme brand in the Dubai market. At the same time, Jouvence (2014) pointed out that market penetration with only L’Oréal Professionnel and two other brands would not be a fruitful marketing strategy since only two product lines for men would not be able to satisfy target customer group.

Opportunities

Yeomans (2013) stated that the beauty industry of the UAE was flourishing as one of the ten male customers spent more than Dh 60000 per year. In addition, Hamid (2013) stated that the market size of male hair and skincare products was ranging from Dh208 to Dh740 million.

Threats

Hamid (2013) and Yeomans (2013) stated that the male beauty product industry was becoming too competitive day-by-day since many local and foreign companies were introducing beauty products for men. Additionally, many brands have already been able to get established in the Dubai market. Hamid (2013), Yeomans (2013), and Euromonitor (2012) further pointed out that the competitors offered similar products for the same target market with competitive pricing policies. Therefore, it is a certain risk to introduce an L’Oréal Professionnel Homme brand to the Dubai market. However, the customers can easily switch off to the other brand at any time, as most of the major market players offer similar products. Furthermore, advertising and promotions, along with other publicity expenses, are comparatively high (Hamid, 2013; Yeomans, 2013; and Euromonitor, 2012).

There are many other challenges to penetrate in the Dubai market, such as no industrial standards set for this industry, and the existence of product homogeneity. In this context, the marketers need to conduct a market survey to assess the extent to which this brand would be able to create a brand image and fulfill the demand of the target customers.

The Products for Dubai Market

The L’Oréal Group (2013, p.22) mentioned that the company is always attentive to the technological changes and eager to introduce new products taking into account the major developments of the market. Firstly, L’Oréal develops a new product for any market paying attention to the needs and attitudes of the local market and customers. First, the product is to be developed and introduced to the local market, then it goes for global penetration, and to do so, the company needs to conduct research in a continuous process and look for local innovation for new formulas beauty and hair care products. The researchers at L’Oréal have always been attentive to the customers in order to meet their expectations and generate new ideas to increase a new process-driven by advance in knowledge and professional legitimacy within the organizational structure.

Market Share

Yeomans (2013) reported that the male beauty product market would experience the highest growth over the following five years due to the changing lifestyle and social status of the people, increasing purchasing power, improving grooming services, changing men’s attitudes to personal care and so on. Consequently, the L’Oréal Professionnel Homme brand will get positive outcomes from the Dubai market. At the same time, the market size of this industry in the UAE would be 140 million US dollars by the fiscal year 2014 as males pay more attention to how they look. Therefore, the marketers of the L’Oréal Professionnel Homme brand can expect that the Dubai market will be a more prospective market for this brand.

Positioning and image

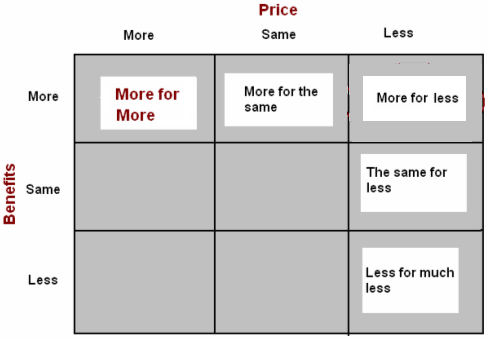

Positioning is a vital attribute of a firm’s strategy, which means that the marketers of L’Oréal Professionnel Homme Brand will be able to attract the target groups to generate more value by applying a positioning strategy. Therefore, it needs to develop a clear focus on the possible value proposition of the campaign. However, the next figure shows a different option:

L’Oréal Professionnel Homme will pursue a “more for more” strategy though few items will come in the market with that approach. However, it has a strong financial position, and the L’Oréal Group is the second leading beauty and personal care producer in the globe.

Marketing Mix

Product Analysis

The new products range for the present market of Dubai has consisted of two products “Aloe Vera Hair Regeneration Cream” and “Aloe Vera Aftershave Lotion.” The first product mentioned is the cream that includes the composition of Aloe vera extracts, Neem concentrate, Vitamin E complex, t is also free of any chemical preservatives. At the same time, the Aftershave lotion consists of the same ingredients of growth cream along with the extracts of Astragalus Root, Cranberry, and Olive Leaf. The marketing campaign will focus on the benefits and attributes of this herbal use, the historical contribution of herbs to the human race, and point to the higher toxicity of chemical cosmetics, which are associated with harmful chemicals composed of the animal as well as toxic substances that seriously damage body cells.

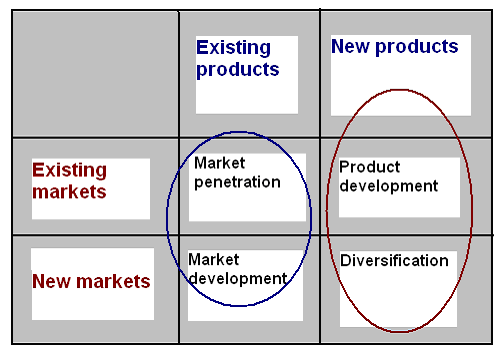

The proposed hair regeneration cream and aftershave lotion for the Dubai market has various unique properties. However, there is no other natural source of amino acid found in Aloe Vera that is easily absorbed by the human body cells; it also provides anti-aging vitamin E, along with antioxidants that improve skin excellence and smoothen it, while Neem leaves have antiseptic properties. However, the next figure shows designing product following the Ansoff Matrix:

Table 2: Ansoff’s model for L’Oréal Professionnel Homme. Source: Self-generated.

Price

The marketers will take into consideration a number of factors before fixing the price of the new product range of L’Oréal Professionnel Homme, such as manufacturing costs of hair regeneration cream and aftershave lotion, packing costs, increasing demand for male grooming products in the UAE market and boosting consumer’s expenditure in Dubai. Another vital consideration of pricing strategy for Dubai and other GCC countries is to take into account the cost of Halal certification, while cost of promotion and advertising, price of raw materials, rising household incomes, price of substitution products, import tax, and duties, societal, demographic attributes and workplace status, and competing for product prices should also be considered.

As the market is expanding quickly, and the neighboring Arab countries of GCC have the duty free re-exporting opportunity, the L’Oréal Group has to adopt an economic value estimation model with the aim to settle the price of L’Oréal hair regeneration cream and aftershave lotion at a price level where the company could maximize its ROI and attain the highest profit.

Distribution Channel or Place

The new product range of L’Oréal Professionnel Homme will be distributed mostly in the Dubai market for newly rented office space, not so far from its regional headquarters at Jebel Ali Free Zone. At the same time, the marketer of this proposed product range would like to penetrate the nearest GCC markets very soon. Since the consumer behavioral trends in the Arab region are very similar and popular to the men’s grooming and beauty products, when the marketing campaign in Dubai meets its organizational objectives, the company will proceed with the global expansion with bursting confidence to distribute the new products range directly to the target customers.

Target Customers

Margolis and Carter (2003, p.9) added that the elderly people of Dubai are assessed as in the age group of 65 years. However, they are economically sound and emotionally stable for which they are willing to spend on mail beauty and hair care products and services. Eighty-five percent of the population in this wealthy society consider that hair care spending is a means of keeping them younger and attractive, and most part of them goes to the male Salon, Barber Shop, and Spa industry regularly. At the same time, the number of younger people from 20 to 30 years use hair care products and services daily. Thus, to introduce a new product under the banner L’Oréal Professionnel Homme in Dubai, the marketer will prefer to choose elderly people of Dubai as target customers.

Advertising or Promotional strategy

The advertising campaign for the new product range of L’Oréal will obviously support the positioning strategy of the new product range that will emphasize higher prices per unit due to unique feelings of grooming for men. However, the global giant for the male salon experiment will incorporate its ads with commitments and product benefits. The new products range along with other core facilities in the marketing campaign program, are aimed to generate a strong and recognizable brand image of L’Oréal and the beauty conscious people of Dubai for their new salon experiment.

Case Study

Business performance

Professional’s Legitimacy for New Product

Deephouse and Suchman (2008, p.1) explored that in the organizational theory as well as in the literature of social science, ‘Legitimacy’ is an essential perception for organizational institutionalism, where legitimacy indicates to the explanatory conception rather than investigating its associated experimental attributes. Besides the traditional concept of ‘Legitimacy,’ the concurrent theories indicate that empirical consideration of legitimacy pointed to the ‘exploratory investigation’ in order to justify the hypothesis, whether it becomes successful or failure. However, the conceptual framework of professional legitimacy demonstrates enough flexibilities in order to formulate any new processor to transform the existing one with a new product or service. The L’Oréal group is going to promote a new product in the Dubai market for which the company is eager to justify whether the product would be suitable for the Dubai market and the UAE as a whole.

New Salon Experiment

Following the development of the new products range, that consists of “Aloe Vera Hair Regeneration Cream” and “Aloe Vera Aftershave Lotion,” the company will select fifty new salons in Dubai for experiment through a product launch program, and the range of new products will principally conceive the absolute beauty conscious gents of Dubai. The new products range of L’Oréal Group for Dubai market will bring proven success with the best fit for Emirati people by proving multi-functionality resourcefulness of the products, such as heat reducing feelings, enjoyable sensorial characteristics, and quick effectiveness rather than the chemical cosmetics for male grooming industry with more realistic and convenient salon experiences.

Attractiveness for New Product Range in Dubai

L’Oréal is one of the established brands in the Dubai market with its regional headquarters at Jebel Ali Free Zone. The brand has already attained a huge base of loyal customers for its active cosmetics, consumer and professional products, body soap, along with L’Oréal Luxe (L’Oréal Group 2014, p.1). The existing product range of L’Oréal has already earned its legitimacy in the excellence of quality that is strongly harmonized in the Dubai market competing with the products conventionally presented there, but the new products range (that L’Oréal is going to promote) is unique in its preparation, application, and male grooming success. Thus, the “Aloe Vera Hair Regeneration Cream” and “Aloe Vera Aftershave Lotion” of L’Oréal’s would generate higher attractiveness among the health-conscious males.

How Attractiveness for New Product Assessed

In the most competitive world, assessing the market attractiveness is the most fundamental job that must be conducted before starting spending for new product development. Without the measurement of market attractiveness, any initiatives for introducing new products will be the wrong use of organizational resources, and the five forces analysis of Porter is the perfect tool for it.

Table 1: Porter five forces of L’Oréal Professionnel Homme Brand.

New Product Range

In order to formulate new product development for L’Oréal Professionnel Homme in Dubai, this study will consider that there is brand loyalty at a satisfactory level, but the target group is very health conscious, they are willing to reduce health risks and the challenges of using artificial colors and chemicals. The idea of efficiently developing the new product range for Dubai is aimed to introduce the “Aloe Vera Hair Regeneration Cream” and “Aloe Vera Aftershave Lotion” by emphasizing the use of natural ingredients. Professionals have conducted vast secondary research with the herbal quality and attributes of “Aloe Vera” that could regenerate hair features.

Brown (2014) mentioned that Aloe Vera has a marvelous capacity to treat burns and skin irritations; it also has a wonderful aptitude to protect hair fall, nourish them by developing scalp cells, and can ensure healthy growth of hair removing dandruff and dead cells from the roots of hairs. “Aloe Vera Hair Regeneration Cream” and “Aftershave Lotion” would be best for the Dubai market.

Strategy 2: IMC Campaign of L’Oréal Professionnel Homme Brand

The products of this brand have been introduced for the use of men, particularly to meet the specific needs of men’s hair. However, men’s behavior towards and usage of hair salons differ from nation to nation. For instance, in many places, men might go to hair salons, but other men might go to a barbershop. Therefore, it produces product range considering the social and cultural environment of the place and needs of the target customers of that place.

Objective

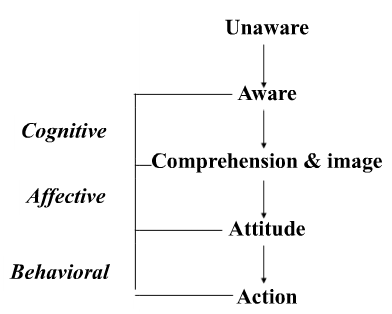

This IMC campaign will be designed in accordance with the DAGMAR Model. However, the next diagram shows this model:

The main objective of this campaign is to promote awareness among male customers regarding the existing product range as well as the new product range.

Research and Development

The L’Oréal Group has already proposed to establish a new division for biomedical research in order to test and maintain the quality of existing herbal products and identifying further development of the new product range in order to bring more and more satisfactory products for grooming industry and new male salon experience.

Demographic Research

The National (2012, p.1) published the statistics of the DSC and reported that the population of Dubai has already reached 2 million, among them 1 536 380 are male and 2 003 170 are female, although the daily population of the city reaches 3 million due to the floating people, who visit the city, but not stay at night. Due to a large number of foreign workers in the city and taking into account demographic measures, there is an imbalanced gender ratio; there are 329 males per every 100 females. The most rising and largest age group is 20 to 39 years, and they constitute two-thirds of the population, the second largest age group is 40 to 65 years, and the smallest age group is 66 to 75 years.

Social and Cultural Factors

Dubai is a modern and Muslim city. Dubai Smart Government (2013) reported that the people of this city consider religious issues as religion plays an important function in the culture of Dubai. Therefore, L’Oréal Professionnel Homme Brand needs to focus on these factors to design advertising and promotional strategies.

Media Selection

In the modern business world, selecting the right media for the advertising campaign is a very difficult task, especially for the male grooming products in the Dubai market. While the L’Oréal group is the top largest spender for advertising and media selection in the world, the company has already curtailed its advertising expenditure for following the global financial crisis. Thus, the marketer of the proposed new product range of L’Oréal Professionnel Homme will select an array of media that will best reach the target customers with the lowest investment for adverting; 35% of the advertising budget would be invested in advertising in print media, 45% – in television advertising. The remaining 20% of the advertising budget would be engaged in radio advertising, outdoor advertising, and the Internet to conduct an IMC campaign.

Table 3: Evaluation Criteria of IMC campaign marketing strategy. Source: Self-generated.

Reference List

Bank Audit. (2014). UAE Economic Report. Web.

Brown, D. (2014). Aloe Treatment for Hair Loss and Re-Growth. Web.

Deephouse, D. L. & Suchman, M. (2008). Legitimacy in Organizational Institutionalism. Web.

Euromonitor (2012). L’oréal company profile – SWOT analysis. Web.

Euromonitor (2013). Men’s Grooming in the United Arab Emirates. Web.

Hamid, T. (2013). Modern males keep Dh740 million UAE grooming market looking good. Web.

L’Oréal Group. (2014). L’Oréal around the world: United Arab Emirates. Web.

Margolis, S. A. & Carter, T. (2003). Prescribing behavior for the elderly in the United Arab Emirates: psychotropic medication use remains low despite rising overall appropriate and inappropriate medication use. Web.

The field of advertising management. (2010). Web.

The National. (2012). Dubai population rises to 2 million. Web.

Yeomans, M. (2013). UAE cosmetics market to reach €104m by 2014 as Caviar builds momentum. Web.