Executive Summary

This paper is an audit report of Cloud nine Pty Ltd. The paper shows that the company is faced with three inherent risks touching on the company’s susceptibility to legislative changes, a compromise on managerial integrity, misstatement of stock values and the influence of the company’s operations, arising from its structure of control.

This paper also identifies the company’s gross profit is the main base of materiality and subsequently, it rates its level of materiality as ‘moderate’. Finally, this paper notes that, Cloud Nine Pty Company has an articulate accounting process, but its heavy reliance on the SWIFT system poses several risks to the same process.

Planning The Audit

Cloud nine Pty is a Sydney-based company founded in 1980 with the aim of manufacturing basketball shoes for various markets across the globe (Einker and Robertson, 2009). The current structure of Cloud nine Pty is a product of an acquisition of the original company ‘Cloud nine Inc.’ by an American company.

After the acquisition, the initial company owner was later absorbed into the new company as part of the managerial board. Cloud nine Pty Company has for long thrived under the product concept of ‘durability and comfort’. Also, the athletic shoe company mainly sells its shoes through a wholesale market retail chain, but majority of its customers are Rebel Sports, David Jones and their subsidiaries.

Cloud nine Pty receives most of its stocks from China and the US through shipping consignments which give ownership of the stock to the company once the shipping company accepts the goods on its behalf. On receipt of the goods, the company keeps the goods it is Sydney warehouse, after which it distributes it to its retailers through an online inventory system.

The company operates a just-in-time inventory system but this system has been observed to pose several problems including the determination of the ideal stock quantities and the theft of company stocks (Einker and Robertson, 2009). To mitigate the second shortcoming, the company has installed surveillance cameras. To complement its supply system, the company uses its trucks to supply goods if their inventory falls short of the optimum standards.

Over the years, cloud nine Pty has entered several contracts to supply shoes to various organizations and personalities including Kevin Mc Donald of the Queensland Thunder (an Australian soccer company). However, its primary consumers have been located in Germany, United Kingdom (UK), and the United States (US). The wide extent of the company’s operation is however not operable if the company’s 52 full-time employees are ignored.

The 52 full-time employees are further supplemented by additional part-time employees contracted to operate the company’s retail stores (Einker and Robertson, 2009). The part-time employees are further complemented by a team of casual employees who are employed during peak periods.

At the helm of the company’s financial service sector is the financial director, financial controller and the business systems manager. The same group of managers also sits at the board and their roles include the determination of the share purchase plan and the determination of stocks options (Einker and Robertson, 2009).

This report is divided into three segments. The first segment includes the preparation of the audit report, which aims at assessing the company for any business or inherent risks.

Some of the issues addressed in this section, include the General and Industry-specific economic trends and conditions, competitive environments, product information, customer information, supplier information, the effect of technology on the industry and the Laws and regulations affecting the industry.

The second section of this paper includes the calculation of the bottom-line of materiality. Here, a determination of the ‘base’ will be done, and the percentage to use in this base will also be ascertained. In this segment of materiality, the calculation of the principal assessment of materiality will be done.

The last section of this report includes the development of the accounting flow chart, where three questions regarding the implementation of accounting procedures will be asked to clarify the entire process. Finally, areas of control weaknesses will be identified as areas requiring more attention in the company’s audit process.

Business and Inherent Risks

Cloud nine Pty operates in an environment that is characterized by business and inherent risks. These risks define the uncertainties that the company operates in, but indeed, all companies also operate under conditions of the same risks. Cloud nine Pty operates under an uncertainty of change in legal procedures which often occur unexpectedly.

This risk is often extensive and may cover almost all aspects of the company’s operations including accounting, marketing, production and such like departments. Considering the fact that the company operates on a global scale is evidence of the business risk that the company poses to its own existence (Sungard, 2011, p. 12).

For instance, as mentioned in earlier sections of this study, the company relies on China and the US for its main stocks. Moreover, the company’s products are sold in overseas markets including Germany, UK and other countries. These countries have various legislative provisions that affect the company’s operations, either directly or indirectly.

For instance, China is largely a communist state and the US is not. Based on this fact, Cloud Nine Pty’s operations may be affected if China or the US changes their legislations regarding exports, because a change in legislation (which negatively affects the company’s operations) would mean that the company would experience shortfalls in its stock system.

This may ultimately affect its production and subsequently, the company’s supply of goods to the main markets. Cloud nine Pty therefore does not operate in a vacuum because it is guided by legislative frameworks from various countries. Unfortunately, a negative legislative change in any of these countries may negatively affect the operations of the company.

However, this does not mean that such legislative changes cannot positively affect the company’s operations. This is the greatest business risk facing the company.

Cloud nine Pty is however also faced by several inherent risks. The difference between these inherent risks and the above mentioned business risk is the fact that, inherent risks do not directly affect the company’s operations. However, business risks affect the company directly.

The first inherent risk which Cloud nine Pty faces is the stock overstatement risk. So far, we have understood that the company experiences shortcomings in its stock inventory system. These shortcomings cause many problems which mainly affect the correct valuation of stocks (Cosserat, 1999, p. 2).

As a result, the company is likely to experience the inherent risk of stock misstatement. Here, instances of incorrect valuation of company stock values, allocation of indirect materials, ascertainment of labor costs, manufacturing overheads (and the likes) are likely to occur.

The second inherent risk likely to be experienced by the company is the integrity of the managerial team. The management board has a strong influence on almost all sectors of the company’s operations and therefore, if its integrity is in dispute, it is likely to affect negatively almost all sectors of the company’s operations.

Very few companies have the immunity to this type of risk because if the management team is compromised in any way, it is likely to influence the wrongful publication of the company’s incorrect results (Arens, Best, Shailer and Fiedler, 2010). For instance, if the management team is under pressure of performing, it is likely to change the company’s profit and loss accounts to show that the company is generating profits. This may not be the correct ascertainment of the company’s position.

The third inherent risk which is likely to be experienced by Cloud nine Pty is the company’s structure of control. The structure of the company has a direct impact on its control environment because the company’s structure shows the framework which the auditors and the company’s shareholders exert pressure on the overall running of the organization.

Cloud nine computing exhibits a strong managerial influence over the operations of the company and this framework greatly compromises the working environment of the company’s auditors. This is a strong inherent risk that the company faces.

Assessment for Materiality

In assessing the materiality of financial information in this paper, the company’s gross profit will be used as the main base. The company’s gross profit is used as the main base because Cloud nine Pty is mainly a global business and it serves the interests of various stakeholders who are interested in the company’s growth.

The gross profit is used as a base of materiality because it determines the company’s efficiency, basis for future profit planning, company’s growth and the overall managerial decision making process (Sharma, 2011, p. 2). Other bases were not chosen because they do not affect the company’s operations singlehandedly. For instance, the company’s equity is not deemed as the main basis of materiality because Cloud nine Pty does not only depend on its shareholders to finance its operations.

Other sources of funding such as the company’s reserve and profits are also used to finance the company’s operations. Other bases of materiality, such as the company’s turnover, are affected by operating seasons because Cloud nine Pty sells athletic shoes which have a seasonal demand. The total assets and total liabilities are not used as bases of materiality because they are complex. For instance, the computation of total assets and liabilities depends on many factors including intangible assets which are difficult to ascertain.

To determine the correct percentage to use on the company’s gross profit, the nature of the company’s operations; the level of financial risk and the legislative environment of the company need to be correctly determined.

This paper proposes a gross profit materiality percentage of 3.0 because the company seems to be on the expansion stage as it tries to open new outlets across its main markets. For instance, the company recently opened a new retail store in its Sydney market.

This is an indication that the company is still in its expansion stage and therefore, the profitability of the company is highly crucial in determining the extent that it can go in financing its expansion strategy. This is the main reason for the increase of the base percentage.

In determining the preliminary assessment of materiality, the materiality scale needs to be established (Rosner, 2006, 4). The materiality scale ranges from a low of 0.0 to 5.0. A scale of 0.0 to 1.0 is deemed ‘very low’ and a scale of 1.1 to 2.0 is deemed ‘low’. A scale of 2.1 to 3.0 is deemed ‘moderate’ and a scale of 3.1 to 4.0 is deemed ‘high’ and a scale of 4.1 to 5.0 is deemed ‘very high’. As mentioned in earlier sections of this study, the materiality for the gross profit is 3.0 and it is therefore ‘moderate’.

Flowcharting and Accounting Process

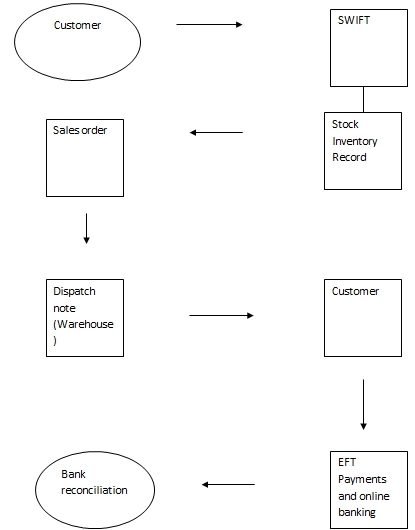

Cloud nine Pty mainly relies on the SWIFT inventory system to process its orders. The SWIFT inventory system processes many orders (from customer requests to the dispatch orders). After customers place an order for goods, the orders are processed in the stock inventory record to ensure that the company can be able to supply the customers with the goods.

The stock inventory record makes note of the goods that are in the company’s warehouse to ensure that, customers do not place orders for goods which are not there.

After it is ascertained that the goods are available, the SWIFT system generates a sales order which is processed by the company’s warehouse manager as a dispatch note. Here, the warehouse manager ensures the goods are packaged according to the customer’s requirements before a dispatch note is generated.

The dispatch note guarantees that the goods to be sent to the customer is according to the customer’s specifications. The goods are later delivered to the customers. Payments are made through the EFT payment methods and online banking. After every month, the company’s accounts are balanced and reconciled. This process is affirmed through the following flowchart.

Though the above flowchart seems to be articulate on the presentation of the ordering, delivery and payment processing systems, there are several questions that can be asked to further clarify the system. First, it is crucial to clarify if customers make any initial payments to the company before they place any new orders.

Here, it is important to clarify if the payments made through the EFT system is the first payment to be received by the company. If so, there seems to be a high likelihood of the company processing fictitious orders that may be placed by illegitimate customers. The second question to be asked is, if there is an electrical shutdown, like the finance manager fears, does the company’s operation grind to a halt?

If not, is there a backup order or payments system which supplements the above mentioned system? Lastly, it is crucial to clarify what procedure the company undertakes if the customer declines the goods, based on grounds of wrong specification or the supply of defective goods. To what extent will such an event affect the above flow chart?

One area where there is likely to be an internal control weakness regards the heavy reliance on the SWIFT system. Considering the admission of the finance officer that, if there is an electrical system, the company’s system will be severely affected, there is a strong internal control weakness regarding the back up of the information contained in the SWIFT system.

There is no evidence of the company backing the data in a secondary system which resets the information if any system faults are experienced. Moreover, if there is any instance of system breach, the company will be unable to verify its information because it assumes that everything that the SWIFT system projects, is the correct data. This scenario exposes a high reliance on the SWIFT system, which can be effectively used to compromise the company’s system if it is breached.

References

Arens, A., Best P., Shailer, G. & Fiedler, B. (2010). Auditing, Assurance Services and Ethics in Australia. Sydney: Pearson.

Cosserat, G. (1999). Inherent risk and the control environment. Web.

Einker, S. & Robertson, W. (2009). Cloud 9 Pty Ltd: An Audit Case Study. Milton: John Wiley and Sons.

Rosner, R. (2006). Assessing Materiality. Web.

Sharma, O. (2011). What is the importance of Profit and Loss Account? Web.

Sungard. (2011). Business Risk. Web.