The article under consideration is Inflation Rise Hits US Consumers posted at bbc.co.uk, 29 February 2008. The main focus of the article’s concern is the inflation rise that US economics experiences now and the impact it has on US consumer spending.

It is stated in the article that personal spending rose 0.4% during January 2008 that significantly succeeds the economists’ expectations, whereas “a key gauge of inflation rose 0.4%, with shoppers spending more on food and fuel.” (bbc.co.uk.)

Parkin and Bade suggest the following definition of inflation in their Foundations of Economics:

Inflation is an upward movement in the average level of prices. Its opposite is deflation, a downward movement in the average level of prices. The boundary between inflation and deflation is price stability (12).

In general, inflation is usually seen as an increase in the price of a basket of goods and services that serves as a representative of the economy as a whole.

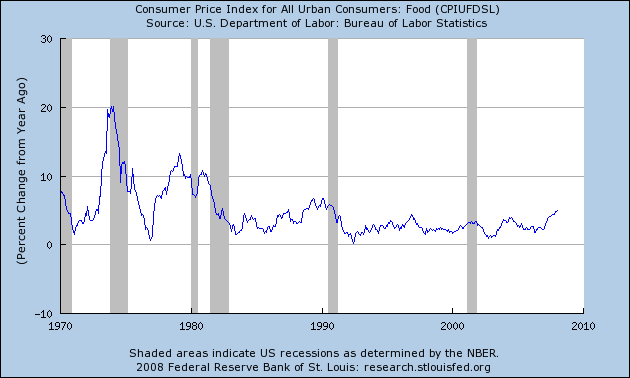

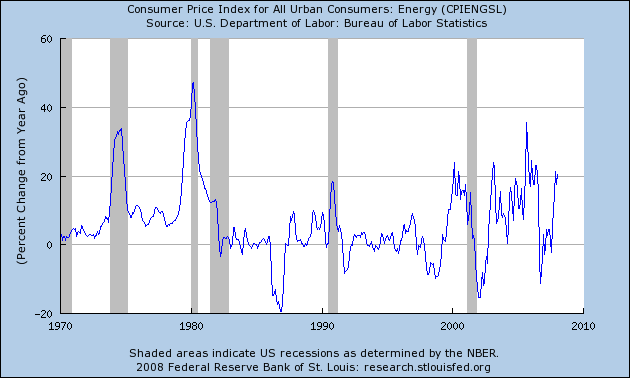

The graphs below suggest a graphical demonstration of the current US inflation in food and energy.

US economists predict a danger of stagflation in the state. This concept is a neologism of the 1970s formed by combining stagnation with inflation; it implies the situation where the economy is not growing, accompanied by high inflation.

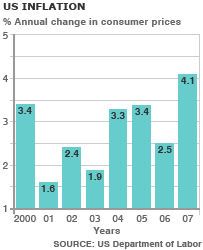

The current situation in the US economy is that it faces “significant inflationary pressures because of record oil prices which have pushed up the price of petrol and heating oil. “ (One-Minute World News) Below is the diagram that characterizes US inflation in general:

However, as the article goes on, Federal Reserve chairman Ben Bernanke states that no stagflation should be expected, instead, oil, metals, and food prices will rise.

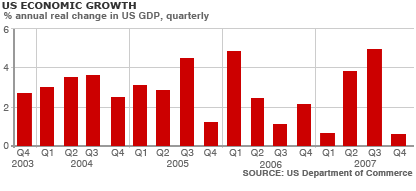

The article informs that US economic growth dropped sharply in the last three months of 2007 after spending on new housing collapsed. Here is the situation with US economic growth:

BBS claims that

In the past few years, the US economy has been growing strongly. But recent troubles in the housing and credit markets have hit the economy hard, with growth slowing sharply at the end of 2007. Economic forecasts suggest that the US growth in 2008 could be cut by half to about 1.5% (One-Minute World News).

Freddie Mac and Fannie Mae which deal with mortgage lenders to help people get lower housing costs and better access to home financing (and guarantee about 45 % of US mortgages) report huge net losses for 2007 and forecast further bad news because of the increase of the glut of unsold homes. As a result of this situation house prices, drop and mortgage defaults stack up.

Analysts claim that consumer spending should remain robust in order to prevent the economy from a recession. Still, the article suggests that consumers are being squeezed too far. It ends with Robert Brusca of FAO Economics’s saying that.

It is a weak picture of the consumer. Income growth, the raw material for spending, is fading (bbc.co.uk.).

Works Cited

“Inflation Rise Hits US Consumers.” bbc.co.uk. 2008. BBC News. Web.

“US Economy at a Glance.” One Minute World Use. 2008. BBC News. Web.

Parkin, Michael, and Robin Bade. Foundations of Economics. Pearson Custom Publishers, 2004.