Introduction

Industry outlook

Over the years, there has been tremendous growth in the insurance sector of the Gulf Cooperation Council (GCC). The GCC is made up of seven countries. These are, Kingdom of Saudi Arabia, the United Arab Emirates, the Kingdom of Bahrain, the Sultanate of Oman, Qatar, and Kuwait (Moody’s Investors Services, Inc., 2013). The growth in the insurance sector in the Gulf region matches with the growth of the economy, population growth, improved regulatory framework and increased responsiveness of the products offered by the industry in these regions. The growth of the insurance sector in the Gulf region can be explained by the compulsory implementation of the health insurance in member countries. Statistics provided by various groups indicate that the insurance sector reported a decline in the net profit margin over the past five years.

However, in the next five years, the sector is expected to report growth in performance. The growth rate is expected to increase to 18.1% between 2012 and 2017. Within this period, the non-life segment of the business is expected to perform better than the other sectors. Besides, with the extensive sensitization and awareness of the risks that are related to projects, it is expected that the project insurance will grow in the coming years. The size of the industry will reach a size of $37.5 billion (Alpen Capital Group, 2013b). Further, the amount of gross written premium grew on a yearly basis to reach $16.3 million. It is equivalent to 10.4% increase. Out of the $16.3 billion, 86.5% relate to general insurance while the remaining 14.5% relate to the life division. Despite the high growth rate reported in the industry, the sector is considered to be relatively underdeveloped. A number of market indicators show that the performance of the sector is below the world average. For instance, the size of the gross premium equals to the size of the Portuguese insurance market.

The industry is characterized by a low penetration rate. Based on the report generated by Aplen Capital Group, the penetration rate in 2012 was 1.1%. The penetration rate of the sector is lower than the global average which currently stands at 6.6%. However, it is expected that the penetration rate will increase to 2.2% in 2017. The low penetration rate gives room for the existing insurance companies to prosper. This can be explained by the fact that low penetration rate reduced the rate of entry into the market. The low penetration rate has attracted number foreign investors in the market. This has created a high rate of competition in the market. The largest insurance market in the GCC region is the United Arab Emirates followed by Saudi Arabia. The Saudi market is expected to drive the forecasted growth between 2012 and 2017. The industry continues to grow and the various industry drivers indicate that the industry will grow at a faster rate to reach the global standard (Motivate Publishing, 2013).

Aim of the paper

The paper seeks to carry out analysis of the GCC insurance sector. The analysis will focus on evaluation of performance and the process of development in the sector. Data will be collected to evaluate the rate of growth and the rate of return in the sector.

Literature review

Several research studies have been carried out to evaluate the performance, growth and development of the insurance sector in the Gulf region. An example of such study was carried out by Khalid Al-Almri, Said Gattoufi, and Saeed Al-Muharrami (2012). The aim of their research was to analyze the performance of the insurance sector in the Gulf region. The research also carried out a relative study of the member countries in the GCC region. The authors used the “DEA methodology and the Malmquist Productivity Index to evaluate the technical efficiency of insurance companies in the GCC countries” (Al-Amri, Gattoufi, & Al-Muharrami, 2012). The aim of using the two models was to break-down the change in efficiency into two constituents. The first constituent shows the individual change in the technical efficiency. The second component shows the change in market technology on the individual technical efficiency of the insurance companies. Further, the authors used a sample of 39 insurance companies in the GCC region with sample picked from the seven member countries (Al-Amri, Gattoufi, & Al-Muharrami, 2012). The panel data used was collected for a period between 2005 and 2007. The research revealed that the insurance companies in the GCC region are reasonably efficient. Further, the results showed that there is a great opportunity for enhancement. Therefore, based on the findings carried out by the authors, it can be pointed out the insurance companies in the GCC are operating under capacity. It implies that the insurance companies have a great opportunity for growth (Al-Amri, Gattoufi & Al-Muharrami, 2012).

A separate research was carried out by A.T. Kearney Korea LLC in 2012 (A.T. Kearney Korea LLC, 2012). The institution is an autonomous legal corporation operating in Korea. The company reviewed the performance of the insurance industry in the GCC between the year 2007 and 2011. Besides, the entity suggested ways that the insurance sector in the GCC can improve its profitability. The company established that the profitability of the industry declined from 27.9% in 2009 to 10.7% in 2010. It declined further to a lower value of 9% in 2011 (A.T. Kearney Korea LLC, 2012, p. 2)

The report further highlighted the three major causes of the decreasing profitability margin. The first cause was the declining technical profitability. The loss ratio of the industry increased from 50% to 60% within a period of four years. However, some insurance companies were able to reduce the loss ratio by using well-organized reinsurance programs (A.T. Kearney Korea LLC, 2012). This action resulted in a moderate increase in the loss ratio. The second reason provided by the company for the decrease in profit margin is that the insurance companies in the regions are operating without a scale. Thus, the firms in the industry reported a significant increase in the operational and staff costs. This also contributed to the massive loss in profit. Economic theories suggest that an increase in size of operation of a company results in a reduction of costs of running the business, economies of scale. However, insurance companies in the GCC region are characterized by disorganized internal processes. Besides, the systems of the insurance sector are not properly integrated. These factors make the insurance companies to experience an increase in operational cost and human resource cost as the scale of operation increases. Statistics provided by the company show that the rate of increase of the administrative and staff expenses was twice as much as the rate of increase of gross written premium. The gross premium grew by 71% while the costs grew by 136% over the four-year period (A.T. Kearney Korea LLC, 2012, p. 3).

The third cause of the decline in profitability highlighted by the report was inappropriate investment strategies used by the insurance companies in the industry. Specifically, the report indicates that “GCC insurers do not typically have a dedicated asset liability management strategy to reduce volatility risk and meet current and future liquidity needs” (A.T. Kearney Korea LLC, 2012, p. 3). The study shows that the insurance companies have opted to “use aggressive risk returns investment strategies with heavy exposure to local equities and property” (A.T. Kearney Korea LLC, 2012, p. 3). However, this strategy was not used by the top tier insurance companies in the industry. The use of aggressive strategy increased the risk exposure of the investment made by the companies. This in turn resulted in a decline of the yield earned from 10.9% in 2007 to 3.3% in 2011 (A.T. Kearney Korea LLC, 2012).

The report further suggested that the insurance sectors in the GCC can change the current status by altering the operating models that they use. The report point out that the insurance sector in the GCC has great potential and the sector can be quite profitable if proper strategies are employed. The report suggests that the profitability of the sector can be improved through sales effectiveness, portfolio optimization, product design and an improvement in pricing, improvement in underwriting, network and claims management enhancement, reinsurance optimization, capacity management, business process reengineering, organizational optimization, asset liability management optimization, and IT process and infrastructure optimization (A.T. Kearney Korea LLC, 2012, pp. 4 – 7). Therefore, the report issued by the company indicates that the insurance sector in the GCC has a great untapped potential. Further, the sector has a great potential for robust growth if right strategies are put in place. Therefore, the research is consistent with the results provided in the research carried out by Al-Amri, Gattoufi, & Al-Muharrami in 2012 (Al-Amri, Gattoufi, & Al-Muharrami, 2012).

Further, Alpen Capital Group provides periodic reports on the performance of the GCC insurance market (Alpen Capital Group, 2013a). The most recent reported was published in July 2013. The report suggests that the growth experience in the sector can be attributed to the mandatory health insurance schemes in the region. The report reiterates that the performance of the company ranks below the global performance of insurance companies. It also indicates that the sector has a high potential for growth. It further points out the growth driver that can stimulate the rate of expansion and development of the sector. Some of the growth factors are demographic factors, investments made by the government, the mandatory health insurance, increase awareness of insurance, and improvement framework for regulation. In terms of performance, the report outlines that the industry experience a declining trend in the profit margin over the past years (Alpen Capital Group, 2013a). Apart from the causes pointed out by A.T. Kearney Korea LLC (2012), the report point out other factors that could have contributed to the decline in profitability of the sector. Some of these factors are small market size, lack of skilled employees, global economic uncertainty, and political instability.

Data collection and data analysis

Size of the insurance market in term of the gross written premium

As mentioned in the literature review section above, there has been growth (measured by the gross written premium) in the GCC insurance market since 2008. The combined gross written premium increased from $10.4 billion in 2008 to $16.3 billion in 2012. The table presented below shows the size of gross written premium of each member of the GCC between 2008 and 2012.

Source of data – Alpen Capital Group, 2013a.

It can be noted that the United Arab Emirates has the highest amount of the gross written premium. It takes about 50% of the total industry. The growth of gross written premium over the five-period in the United Arab Emirates was $2.2 billion. It is followed closely by Saudi Arabia. The two countries experienced a steady growth in the value of the gross written premium over the period. The gross written premium in Saudi Arabia increased from $2.9 billion in 2008 to $5.5 billion in 2012. The growth over the period was $2.6 billion. The gross written premium increased from $0.7 billion in 2008 to $1.0 billion in 2012 in Kuwait. Therefore, it can be noted that the growth of gross written premium over the five-year period was only $0.3 billion. In the case of Qatar, the gross written premium increased from $0.8 billion in 2008 to $1.3 billion in 2012. The total growth was $0.5 billion. There was no significant change in the amount of gross written premium in the Bahrain insurance market. The gross written premium increased from $0.5 billion in 2008 to $0.6 billion 2012. Finally, Oman reported a growth in gross written premium of 0.3 $billion over the period. The value increased from $0.5 in 2008 to $0.8 billion in 2012. The bar graph presented below shows the make up of the GCC insurance market measured in term of gross written premium.

The composite bar graph above displays growth in the gross written premium over the years. The graph shows that the United Arab Emirates and Saudi contribute significantly to the total growth of the GCC insurance market. The composition can also be drawn as presented below.

The graph above gives a better display of the size of the insurance market in each of the countries. The table presented below shows the shows the percentage composition.

Source of data – self generated.

Based on the table above, it can be pointed out that the United Arab Emirates take the highest percentage in term of the gross written premium followed by Saudi Arabia, Qatar, Kuwait, Oman, and finally Bahrain. It can also be observed that the market share of the United Arab Emirates declined by about 4% while the market share for Saudi Arabia increased by about 5%. It is anticipated that the Saudi insurance market will grow and overtake the United Arab Emirates. Therefore, it can be noted that the insurance industry in the GCC is dominated by insurance firms in the United Arab Emirates and Saudi Arabia. The size of the two regions is over 75% of the total industry. The statistics are presented in the table below.

Source of data – self generated.

Further, it can be observed that the contribution of the two regions has been increasing over the period. The remaining, about 25%, is shared among the four remaining regions. The statistics are presented in the table below.

Source of data – self generated.

It can also be observed that the contribution of the four countries declined over the period. The statistics above can give an indication on the uptake of insurance products over the period. The percentage composition for the year 2012 is presented in the pie chart below.

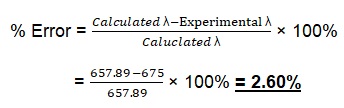

The percentage growth of gross written premium in each country in the Gulf region can also be analyzed. The table presented below shows the percentage growth over the five years.

Source of data – self generated.

The table presented above shows that the highest percentage growth was reported in Saudi Arabia (89.66%). It is followed by Qatar (62.50%), then Oman (60%), United Arab Emirates (44.00%), Kuwait (42.86%) and finally Bahrain at 20%. The total growth in gross written insurance premium the industry amounted to $5.9 billion. It is equivalent to 56.73%. About 50% of the growth in insurance industry came from the growth in in the Saudi market. The graph presented below shows the trend of growth of the various markets.

Therefore, it can be pointed out the no country displayed a continuous rate of growth over the years. The countries displayed no specific trend in percentage growth over the years. The trend can be attributed to the several challenges that face the insurance sector in the Gulf region. The first challenge is that the insurance sector in the Gulf region is overcrowded. It implies that there are several insurance companies in the market chasing a few customers. It creates competition in the industry and makes the insurance companies to charge aggressive prices. The small market size limits the ability of the insurance firms to grow continuously. Secondly, it can also be noted that the small market size is not well informed of the insurance products offered by the company. Therefore, the uptake of the insurance products has not reached its potential. Further, the global economic instability creates uncertainty in the performance of the insurance sector. It significantly affects the operations of the insurance companies. Other non economic factors also affect the growth of the insurance sector. Finally, the gross written premium for the market can be analyzed based on the life and non-life insurance premium. The table presented below shows the proportion of life and non-life insurance premium for the region.

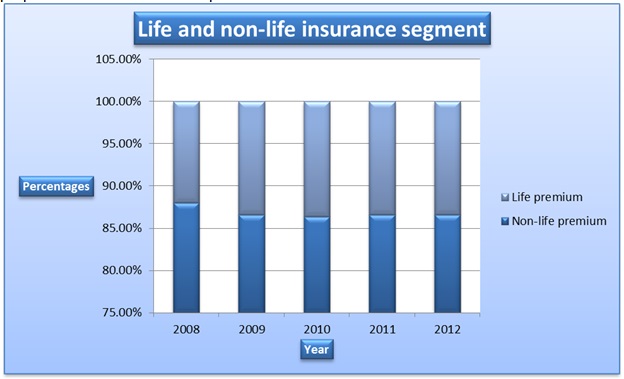

Source of data – Alpen Capital Group, 2013a.

It can be noted that the proportion of non-life insurance premium has higher than the percentage of the life insurance premium over the five year period. The lower level of life premium can be attributed to the high per capita income in the gulf region. Further, such covers did not exist in some countries such as Saudi Arabia due to their non-conformance with the Islamic law. Health covers and motor insurance dominates the non-life insurance premium. The composite bar graph presented below shows the proportion of life and non-life premium.

Insurance density

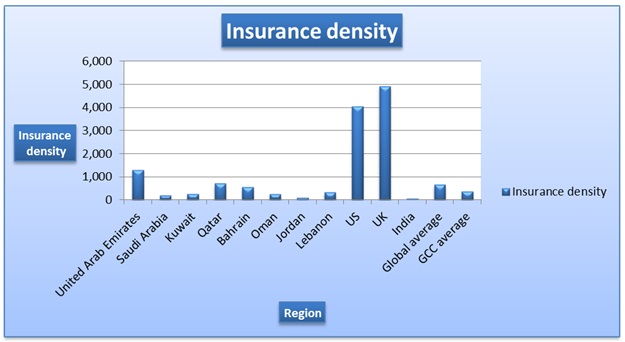

The performance of the GCC insurance market can also be analyzed based on the insurance densities. Insurance density can be defined as the premiums per capita. Statistics show that the insurance density in the gulf region is slightly higher than that of most emerging economies. However, the insurance density of the GCC insurance market is much lower than the density in developed economies such as the United States. For instance, the population of Netherland is about thirty percent of the total population of the GCC region. However, the total insurance premium of Netherland is about seven times higher than that of the GCC. The table presented below shows that insurance density on the GCC insurance market. It also shows the density for developed economies and emerging economies for comparison.

Source of data – Alpen Capital Group, 2013a.

It can be noted that Saudi Arabia has the highest insurance company in the Gulf region. This can be attributed to the high uptake of insurance products especially life insurance. Qatar follows at 707. However, it can be pointed out that Saudi Arabia has the least insurance density in the Gulf region despite having the second largest amount of gross written premium as discussed above. The low insurance density can be attributed to the high population in the region. The average insurance density of the GCC region is 367. The value is way below the global industry average of 656. The difference is 289. Further, it can be pointed out that the GCC average is slightly greater than some emerging economies such as Jordan and Lebanon. However, the value is quite lower than the industry average for developed economies such as the United States and the United Kingdom. The high ratio in developed economies can be attributed to low restriction on insurance activities, a well developed regulatory framework, government policies that make certain types of insurance mandatory and high uptake of insurance products. The low insurance density in the Gulf region can be attributed to the low insurance coverage in the region. The information in the table above can be presented in a graph as shown below.

Insurance penetration rate

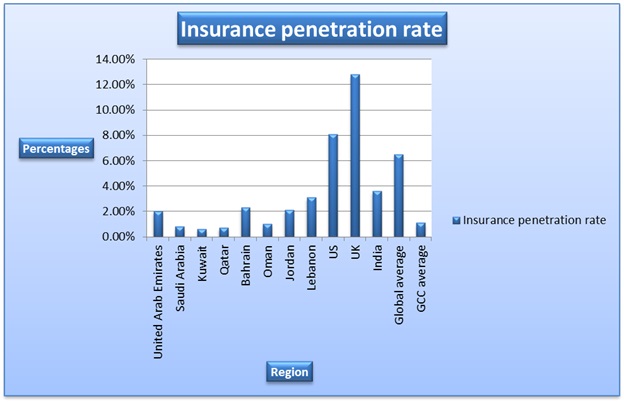

The development and performance of the GCC insurance market can be evaluated in terms of penetration rate. The penetration rate is the ratio of gross written premium to the GDP. The insurance penetration rate is important because it gives an indication on the rate of development of the insurance industry. Statistics indicate that the insurance premium in the Gulf region has been growing at a faster rate than the rate of growth of GDP. This has contributed to the growth of penetration level in the region. Further, the insurance penetration of non-life insurance is higher than that of life insurance. The table presented below shows the insurance penetration rate of the GCC insurance market. It also shows the penetration rate for developed economies and emerging economies for comparison purposes.

Source of data – Alpen Capital Group, 2013a.

In the Gulf region, Bahrain had the highest penetration rate at 2.3%. The value is quite low when compared to the penetration rate of some countries such as Lebanon and India. Further, the value is much lower than the penetration rate of developed economies such as the United States and the United Kingdom. Despite the high penetration rate, Bahrain reported a low amount of gross written insurance and low rate of growth over the five-year period. Therefore, it can be observed that the high penetration rate can be attributed to the low amount of GDP in relation to the gross written premium. The United Arab Emirates follows closely with a retention rate of 2.0%. The retention rate indicates a high level of development in the region. Oman follows at 1.0%, Saudi Arabia at 0.8%, and Qatar at 0.7%. Kuwait had the least amount of retention rate (0.6%). The average insurance penetration rate in the Gulf region was 1.1%. The value was much lower than the global penetration rate of 6.5%. Further, it can be noted that the penetration rate of developed countries such as the United States and the United Kingdom are much higher than the global average. The graph presented below gives a pictorial depiction of the insurance penetration rate of the various regions.

Rate of return

The rate of return on investment in the region has been quite volatile. This can be explained by the investment strategies adopted by the firms operating in the insurance sector. The rate of return on investment increased from 7.9 percent in 2010 to a higher rate of 9.0 percent in 2011. However, the rate of return decline in the year 2012 to a lower value of 8.7%. Analysts estimate that the investment return will remain volatile in the future because the current portfolio of most insurance companies is made up of a large proportion of equity and real estate.

Takaful Market

Takaful insurance follows the principles of the Islamic religion because it does not focus on generating profit. It aims at sharing risk with the customers. The market also has non-life and the life segment. The market has been growing at a faster rate due to the conformance to the Islamic faith. The annual average rate of growth has been 28.4% since 2006. Further, the estimated size of the market in terms of gross contribution was $7.6 billion in 2012. The Saudi insurance market takes more than 75% of the Takaful market share.

Future outlook

The research conducted by Aspen Capital Group outlines the future trend of the market. First, the report states that a massive inflow of foreign investors is expected in the region. The region will benefit from “higher technical know-how, distribution capabilities, customer orientation, and financial strength” (Alpen Capital Group, 2013). Secondly, the report outlines that the completion of enterprise risk management will guide the insurance businesses in risk management. Further, there is the development of modern distribution channels such as Bancassurance. Finally, the report outlines that efforts are being put in place to mitigate the volatility that causes fluctuations in the amount of returns expected (Nader, 2010). There are a number of other factors that will play a significant role in the development of the sector. The first factor is the growth of insurance products that are Shariah compliant especially in the Takaful segment. Further, the invention of the captive insurance model will also play a key role in the growth of the sector. Finally, the development of surety bond markets will also encourage investment in the insurance sector because the market will minimize the volatility of expected returns. The forecasts presented in the subsequent tables are based on the assumption that the GDP will grow at a rate of 4.2%. Further, the GDP per capita will grow at 1.7%. Finally, the total population of the Gulf region will increase from 43.3 million reported in 2011 to 49.9 million reported in 2017. The estimated growth of the gross written premium between 2012 and 2017 is presented in the table below.

Source of data – Alpen Capital Group, 2013.

The compounded annual growth rate for the period is expected to be 18.1%. Further, it is expected that the Saudi Arabia market will outgrow the United Arab Emirates market. The expected insurance penetration rate and insurance density are presented in the table below.

Source of data – Alpen Capital Group, 2013a.

Findings and conclusion

The countries in the gulf region have been known to have a substantial amount of national income. This can be attributed that the fact that the country has a rich endowment of natural resources. The performance of the region can be likened to the economic status of the developed economies. Thus, a well-developed insurance sector is required to facilitate the rate of development and diversification. The insurance sector will eliminate the risks that businesses face and improve overall economic performance of the country. However, the discussion above indicates that the GCC insurance sector is disorganized. The sector lacks a proper regulatory framework. Besides, it has a low penetration rate and a high potential for growth.

The discussion above indicates that there has been continuous growth in the amount of GDP over the years. Further, the rate of growth of GDP is lower than the rate of growth of the insurance premium. However, the rate of growth of the insurance premium misleads because the region lacks insurers who are based domestically. Therefore, the impact of the growth is not felt in the regions. Further, the insurance density and the penetration rate of the GCC insurance market lie below the global average. Further, the performance of the region, in terms of insurance density and penetration rate, lies below those of the developed economies by a large margin. Therefore, based on these two indices can be it can be observed that the GCC insurance market is underdeveloped. In terms of profitability, it was observed that the industry has experienced a declining trend in profitability over the years. This can be explained by factors that relate to the internal operation of the firms in the insurance sector. Therefore, it can be pointed out the GCC has a weak insurance market. This can be explained by a number of factors. First, it can be pointed that the region has a high savings rate. This limits the uptake of insurance products. Further, the proportion of the life insurance market segment is quite low. This segment is a key driver of growth in the insurance sector. Thirdly, the region has a low retention rate. The rate is much lower than the world’s average. Also, the cession rate is quite high, about 46% of the gross written premium. Further, high competition also impacts negatively on the performance of the sector. It results in low profit margin due to low pricing (Rettab, & Bakheet, 2006). Further, the industry faces lack of skilled workers. Therefore, some products cannot be offered in the market due to the lack of expertise. Finally, the Islamic laws act as an impediment to the growth of the sector.

Despite the dismal performance of reported in the sector, there is high potential for robust growth in the future. This can be attributed to a number of factors. First, it is anticipated that the current population will grow in the future by about ten percent. This will increase the current market size. Further, the region is made up of a young population. Secondly, the government is investing in infrastructure that will support the insurance sector. Finally, the implementation of the compulsory insurance by the government will enhance growth in the sector (audio & Groen, 2013). Therefore, the players in the industry have to put in place several measures that will change the current state of the sector.

References

A.T. Kearney Korea LLC. (2012). GCC Insurers at the crossroads in 2012: Rebound or collapse. Web.

Al-Amri, K., Gattoufi, S., & Al-Muharrami, S. (2012). Analyzing the technical efficiency of insurance companies in GCC. The Journal of Risk Finance, 13(4), 362 – 380.

Alpen Capital Group. (2013a). GCC insurance industry. Web.

Alpen Capital Group. (2013b). Robust growth potential for the GCC insurance sector, says Alpen Capital’s latest industry report. Web.

Ayadi, R., & Groen, W. (2013). Banking and insurance in the GCC countries: Is there regulatory Convergence with the EU? Web.

Moody’s Investors Services, Inc. (2013). Moody’s: GCC insurance industry continues to evolve, with rapid premium growth expected.Web.

Motivate Publishing. (2013). Special report: The future of GCC insurance. Web.

Nader, F. (2010). Regulatory challenges in the Levant and GCC insurance market. Web.

Rettab, B., & Bakheet, B. (2006). Impact of market access on the UAE insurance sector. Web.