Introduction

The business environment is dramatically changing; investors are more concise and critically evaluate the trends in the market before channeling their cash into any business projects.

Seitz and Ellison (1995) explain that, before venturing into business projects, investors need to understand investment appraisal methods or capital budgeting techniques; these are regarded as the standard project evaluating methods that help the investor understand the viability of any project.

This paper is aimed at discussing and describing the investment appraisal methods that are essential and most appropriate in evaluating an investment project. Under this paper, we shall look at NPV, IRR, Payback period, and ARR.

Discussion

Net Present Value

Net present value is difference between the present value of cash inflows and the present value of cash outflows. In essence, NPV is the present value of future cash flows minus the purchase price (Arnold, 2007).

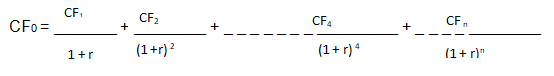

In capital budgeting, NPV is used to analyze the profitability of an investment project. The analysis in this case is tied to the reliability of future cash inflows in relation to an investment project will yield. NPV is calculated using the formula:

CF0 = Cash flow at time zero, CF1 = Cash flow after one year, K = the opportunity cost of capital, and n = number of years

NPV is used in investment decision-making as it helps in calculating how much an investment project will return to the investor in a given period. The criterion for accepting an investment is that accepts all projects that have a positive net present value unless they are mutually exclusive or there is capital rationing.

Consequently, if the cash flow is a negative value, then the project is in a discounted cash outflow status as at that time (Bowlin and Scott, 1990). Investments with a positive NPV are essentially best ones to invest in (accepted). For example if:

NPV > 0 this means that the investment is capable of earning returns to the investor and therefore, the project may be undertaken. In this case, if there is more than one project under consideration, the one with the highest NPV should be given priority.

NPV < 0 this means that the project will require the investor to add in more money for the investment to run. This kind of investment project are unacceptable and hence not worth venturing into them.

NPV = 0 this means that the investment will neither gain nor lose value. This kind of project does not add any monetary value to the investor. Decision on such a project is based on criteria such as strategic positioning.

Internal Rate of Return

As explained by Gitman (2000), this is the discount rate at which the net present value is zero, it is used in capital budgeting which makes the net present value of all cash flow from an investment project equal to zero.

For instance, the higher the internal rate of return, the more profitable the project. In this case, a project with the highest internal rate of return should be undertaken as compared to those with lower IRR. In some cases, IRR is said to be the rate of growth of an investment project is expected to generate.

The IRR is given by r in the formula

In this case if:

K > r; the opportunity cost is greater than the internal rate of return, the investment project should not be undertaken (reject)

K < r the opportunity cost is less than or equal to the internal rate of return, the project should be undertaken.

Payback Period

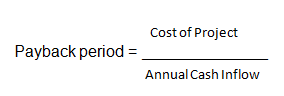

This is the period required for the return on investment to repay the sum of the initial investment (Eisenberg, 1996). It is the length of time required to recover the cost of an investment. It is calculated using the formula

In calculating the payback period, the time value of money is not taken into consideration. Intuitively, payback period measures the time that a project takes to pay for itself. Shorter payback periods are preferred as compared to longer ones.

Results

Option A

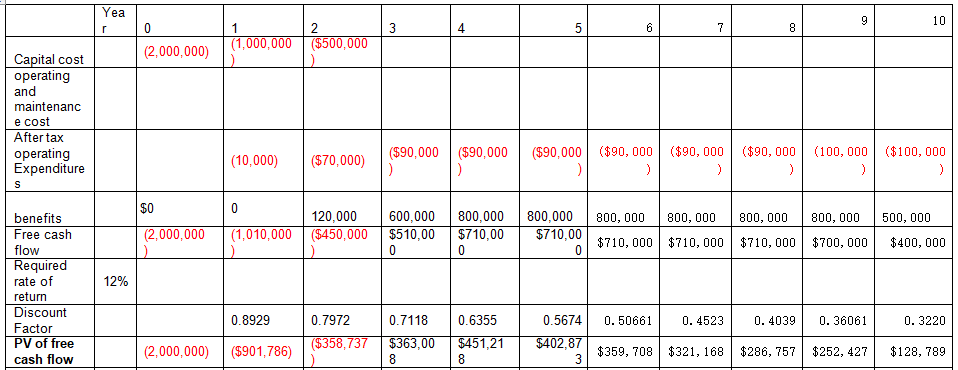

Payback Period – This is the time needed in order for the project to pay for initial capital. It has its limitations but it is an easy gauge to add to an analysis of how profitable and good a project is. The shorter the payback is, the better it is as an investment for the company. In option 1, the payback period is 6.15 years as shown in Table 1 and critical acceptance level is 2.75 years. Using this criterion, the project is not acceptable.

Internal Rate Return – The internal rate of return is 7% that is rates that will yield zero NPV when compared with the negative cash flow of 2.5 million or initial outlay for the project. From this vantage point, it is not a good idea to go ahead with the project simply because the rate of return is lower than the cost of capital at 12% already.

Net Present Value – The net present value of a project represents how profitable it will be for the company by using its future cash flow and discounting its value. If its value is bigger than the initial investment, then it is a good investment.

The length of years used to calculate the net present value however could affect the NPV that is why it is also of critical importance to determine the correct length of years to use in the analysis. In this case, the option 1 seems to be unprofitable from the NPV point of calculation that is negative of $694,575 as shown in Table 1.

Option B

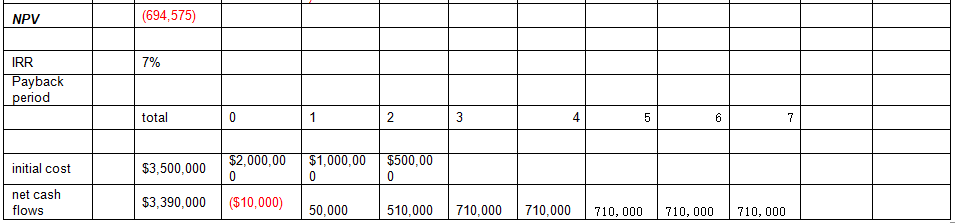

Payback Period – the payback period as indicated in Table 2 is 3.54 years and critical acceptance level is 2.75 years. According to these criteria, the project is not acceptable as the Payback period is lower than critical acceptance level of 2.75 years.

Internal Rate Return – the IRR of the project is 18% as shown in Table 2 and the cost of capital is 12%. According to this criterion, the project is acceptable.

Net Present Value – The expected NPV is $ 64,656. The figures of present are already higher than the initial capital outlay by $ 64,656. The only flaw in this analysis would be the length of time used to determine the computation. According criteria the project is acceptable.

Table 2. Option 2

Recommendation

It can be said that the best method for appraising investments is the discounted cash flow methods. This implies that the IRR and NPV provide best options. Gitman (2000) as noted since payback method ignores cash flows occurring after the payback period, it cannot be applied alone because it only gives a general view. On the other hand, IRR is simple to understand but full of shortcomings.

Accordingly, it is NPV, which is the best and most reliable appraisal method since it provides a detailed approach. In view of the above assertions, the best option in this case is option B because it has a positive net present value and IRR that is greater the cost of capital of 12%. Option A will not be acceptable using any of the three criteria considered in the analysis.

References

Arnold, G. (2007). Essentials of Corporate Financial Management. London: Financial Times / Prentice Hall.

Bowlin, M. & Scott, G. (1990). Guide to Financial Analysis. New York: McGraw-Hill.

Eisenberg, R. (1996). The Money Book of Personal Finance. New York: Warner Books, Inc.

Gitman, L. (2000). Principles of Managerial Finance. London: Addison Wesley Longman.

Seitz, N. & Ellison, M. (1995). Capital Budgeting and Long-term Financing Decisions. Houston: Dryden Press.