Net Present Value

The net present value is defined as the sum of the future earnings. It is usually important since it enables the management to consider the time value of money it will invest. The Net Present Value concept holds that the value of money increases with time because the chances of earning profits are high in the future. The net present value tells us how much a project contributes to the shareholder’s wealth thus the larger the NPV, the more value the project adds and this translates to a higher stock price (Brigham & Houston 2009).

Calculation of net present value

N.P.V= ∑n ctn – 10 whereas

t=1 (1 + r)n

ctn=cash flows receivable during period n

r = discounting rates

I 0 = initial capital outlay

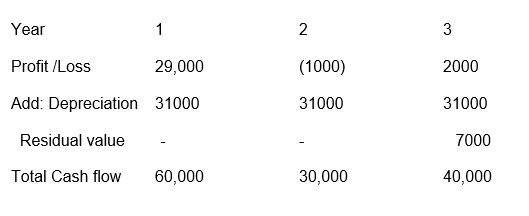

Project 1

Initial capital =100,000

Expected profit;

Year profit/loss

- 29,000

- [1,000]

- 2,000

Working to get depreciation

Depreciation= cost – residual value/Useful life

= 100,000 -7000/3

=31,000

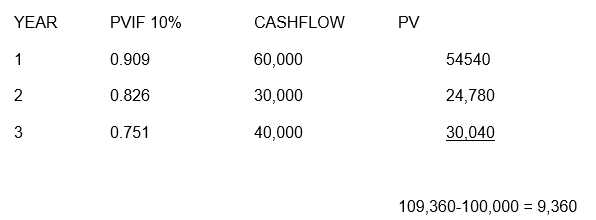

N.P.V= ∑n ctn – 10

t=1 (1 + r)n

1/(1+1)n

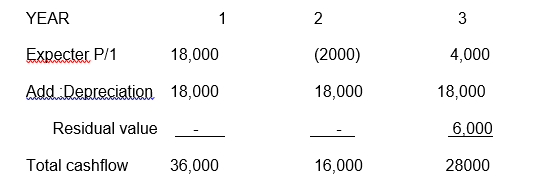

Project 2

10 =60,000

Profit / Loss for each year

Year

- 18000

- (20000

- 4000

Working II to get depreciation

Depreciation = cost – residual value/Useful life

= 60,000 -6000/3 = 18,000

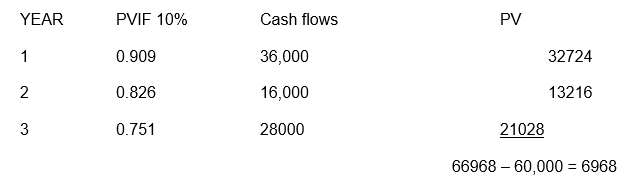

N.P.V= ∑n ctn – 10

t=1 (1 + r)n

1/(1+1)n

IRR: Internal Rates of Return

The Internal Rate of Return on investment also referred to as the Economic Rate of Return (ERR) is the discount rate always used in capital budgeting that makes the net present value of an investment equal to zero. It is a positive number and thus, the higher it is the more desirable or promising the project is if undertaken first compared to the other projects since it shows the project will have higher productivity compared to the others (Hazen 2009).

Calculation of IRR

Project 1

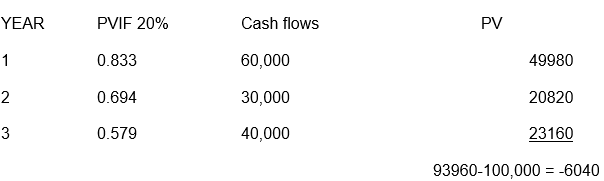

If NPV AT 10% at 10 % is 93,360 choose a higher rate and get the NPV let us use 20%

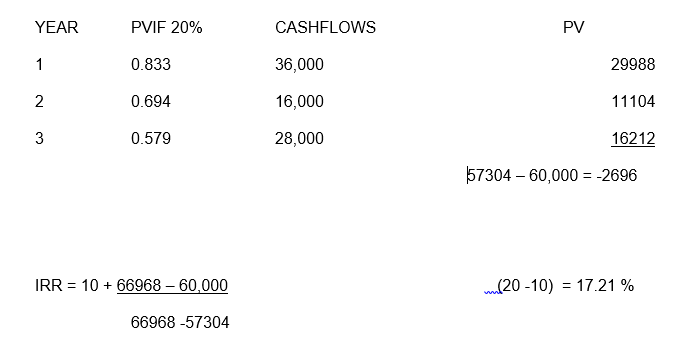

PV@ LDR – I0 (HDR – LDR)

IRR = LDR + PV @ LDR –PV @ HDR

=10 + 109,360 – 100.000 ( 20 – 10)

109,360 – 93960

= 16.08%

IRR Project 2

Payback Period

The payback period is usually defined as the time a project will take to recoup the initial amount of capital invested in the project. It is simply the time the project will give the investor back his money fully and it is calculated as the ratio of the initial investment regardless of the initial source of capital to the annual cash flows for the recovery period. The major disadvantage with the payback method is that it fails to consider the period after the capital has been recovered thus it cannot be used as a tool for measuring the profitability of a project. However, the less time a project will take to recover the initial capital the more preferable it should be (Barthwal 2007).

Calculation of Payback Period

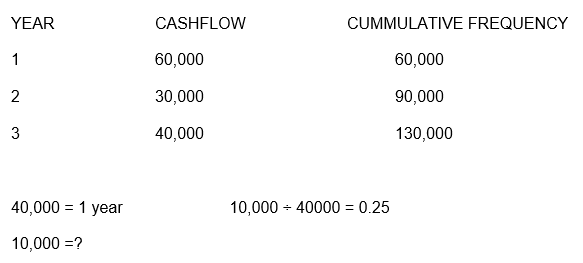

Project 1

Thus Payback period is 2+0.25=2.25 Years

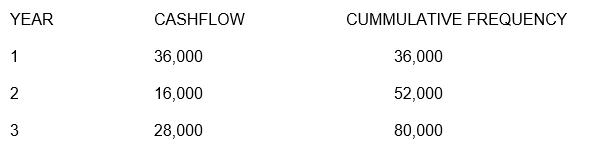

Project 2

60,000 will be recovered within 2 years for the first 52,000 and the remaining 8,000 from third year.

28,000 = 1 year 8,000 ÷ 28,000 = 0.29

8,000 =?

Thus, the Payback period of project 2 is 2+0.29=2.29 Years

The director of XYZ limited should accept project 1 since it has a high net present value compared to project 2 whereas if we were to consider the internal rate of return project 2 will be favorable since it has a higher rate of return compared to project 1. If we were to consider the payback period alone, project 1 is more favorable since its payback period is less than that of project 2. Thus, project one is the most preferred project to be undertaken since it has a higher Net Present Value as well as a shorter Payback Period.

Investment appraisal is a method used to evaluate the viability of a project. For the method to be acceptable and feasible, it should consider the time value of the invested money by discounting the cash flow. The investment appraisal concept attempts to explain why people or investors prefer current cash to future cash. The bias towards the current cash is attributed to the availability of viable investments opportunities, that is, the money received can be re-invested to generate additional cash in form of investments income. The other problem is the optimality of the discount rate and the availability of other resources which might not be available at the present moment (Pettinger 2000).

While considering the time value of money, the issue of uncertainty is a major problem whereby cash is preferred now due to uncertainty of its availability and the availability of the individual to enjoy it. The decline in purchasing power will affect the time value of money due to inflationary tendencies in the future. The urgency of current needs or cash required to meet the immediate need of the firm or individuals is thus more important than what the future holds to most investors. Time value of money is a broad feature that also advocates for the need to take advantage of cash discounts. For example, a cash term of 3/10 net 30 days the received a 3% discount otherwise he has up to 30 days to pay without a discount.

Time value of money of discounting cash flows can either be classified through a non-discounting cash flow method or a discounted cash flow method. Non- discounted cash flow method fails to take into consideration the time value of invested cash. While a discounting cash flow method considers the time value of money by discounting cash flows taking into the fact the risks or loss of value expected in the future of evaluating investment projects and they are: the payback method and the accounting rate of return.

The payback period refers to the number of years required by the investor to recover the initial outlay or initial capital of investment from the cash flow generated by the projects, that is, the number of years in which the net commitment of capital should not exceed payback. The decision methods follow certain criteria, i.e. for mutually exclusive projects, accept the one with a shorter payback period for a single project without a competitor. The acceptable payback period is set by the management depending on the scale.

The accounting rate of return as non discounted cash flow method is computed using the conventional accounting approach and accounting profits. The problem of calculating profits using a non discounted method is that they include noncash items such as depreciation and provision for bad debts (Shapiro 2005)

ARR / ROCE = Average Accounting Profit per annum/Average Investment / Capital

Where Average Investment = Initial Capital + Salvage value/2

The average rate of return decision criteria depends on the project. For example, in the case of mutually exclusive projects, accept the one with a high average rate of return and for a single project average rate of return is usually done by the management.

Among the methods which use discounting is the NPV.

Net Present Value uses the discounted cash flow to determine the total present value of all cash flows or benefits receivable from a project from which the initial is deducted to determine the net present value.

Net present value decision criteria depend on the project; in the case of mutually exclusive projects, it is always important to accept the one with a positive net present value but when both have a positive present value, then accept one with a higher net present value.

For a single project, an acceptable net present value is set by management. The profitability index is another method of discounted cash flow method. It is also known as the benefit-cost analysis method and indicates the returns or profitability in present value terms for every one shilling of the initial capital outlay committed to a project.

It is calculated as follows:

P.I =∑ n t=1 PV/Io

Profitability index decision criteria depend on the project whereby the profitability index of the project is greater than one accept, where is equal to one, you can choose to or not to that making you as the investor to be indifferent and if it is less than one, you should outright reject the project.

An internal rate of return is the rate of return of an individual project independent of all other projects. It is a percentage (%) yield expected from a specific investment given the cost of capital borrowed to finance a project. Like other discounted cash flow methods, it is referred to as the time-adjusted rate of return. To determine the internal rate of return the total present value of the cash flow is equated to the initial capital.

The internal rate of return is computed through interpolation of the net present values and in the case of annuity cash flow, the present value of annuity factors from the tables are interpolated to get the exact internal rate of return. If the total present value at the cost of capital is greater than the initial capital, that is, the net present value is positive rediscount the cash flows again at a higher trial discounting rate to get a negative net present value. However, if the total present value at the cost of capital is less than the initial capital outlay (that is net present value is negative) rediscount the cash flow again at a lower trial discounting rate to get a positive net present value (Greer& Kolbe 2003).

Interpolate the result to get the exact internal rate of return.

Where:

PV@ LDR – I0 (HDR – LDR)

IRR = LDR + PV @ LDR –PV @ HDR

In comparison between non-discounted cash flow and discounted cash flow methods, the most preferable methods to use are the discounted cash flow methods since they take into account the time value of money however, the non-discounted cash flow method has its advantages which include: Both payback period and accounting rate of return has computation simplicity and are easy to understand for management.

They can be used as initial screening tools for the projects before the more complicated discounted cash flow methods are applied. The accounting rate of return can be used to evaluate the performance of divisional managers through DuPont analysis. The payback period is more preferred by risk advance managers who prefer high liquidity through short payback period; it also incorporates the element of risk by ignoring the cash flow after the payback period which is more uncertain and far away from the future (Drummond& Stickler 1983).

Moreover, the above advantages have been offset by discounted cash flow method benefits, since discounted cash flow method considers the time value of money. It gives outright decision criteria in case of a single project and mutually exclusive project; also it incorporates risk in capital budgeting by adjusting the discounting rate to reflect the high risk associated with the project. The methods utilize all the cash flows of the project in evaluating it (Lang & Merino 1993).

However, despite its advantages, the discounted method has a major weakness since it assumes certainty of discounting rate and cash flows such that the discounting rate remains constant throughout the economical life of the project. The method also assumes the risk of the project is only time-based, that is, the uncertainty of future cash but ignores the variability of fluctuations of cash flows during the project economic life.

The best method of an investment appraisal should utilize all cash flows of the project in appraising the project. It should give an outright decision criterion on when to accept or reject a project, distinguishing between mutually exclusive projects (projects which serve the same project purpose since they compete against each other, they are substitutes or alternatives of each other and only one of them can be undertaken). The method should also rank independent projects in order of their ability (these are projects which serve different project purposes and can be undertaken together subject to availability of the capital. The cash flow of one project cannot affect the cash flow of another project). The method must be applied to all conceivable projects available.

In conclusion, among the three methods under discounted cash flow methods net present value is considered to be the most appropriate method for evaluating investment projects since it considers all features to be acceptable and sound. Internal rate of return could not be considered the best since it ranked the projects in relative terms ignoring the size of the project, unlike net present value which ranks projects in absolute terms.

Reference List

Barthwal, R. 2007. Industrial Economics: An Introductory Text Book. California, New Age International.

Brigham, EF & Houston, JF. 2008. Fundamentals of Financial Management. 12th Edition. New York, Cengage Learning.

Drummond, C.S.R & Stickler, A.D. 1983. Current Cost Accounting: Its Concepts and Its Uses in Practical Terms. New York, Taylor & Francis Publishers.

Greer, E.G & Kolbe, P.T 2003. Investment Analysis for Real Estate Decisions. Volume 1 Kaplan Financial Series. 5th Edition. New York, Dearborn Real Estate.

Hazen, G., 2009. An Extension of the Internal Rate of Return to Stochastic Cash Flow. Web.

Lang, H.J & Merino, D.N., 1993. The Selection Process for Capital Projects. New York, Wiley-IEEE Publishers.

Pettinger, R., 2000. Investment Appraisal: A Managerial Approach. New York, Macmillan.

Shapiro A.C 2005. Capital Budgeting and Investment Analysis. Indiana, Indiana University.