Introduction

In surfacing and enhancing economies investors are often challenging political risk due to the risk of expropriation, disturbances in market admission, adverse governing, currency, debt and economic faults, policy turnarounds, political disturbance, etc… Shareholders in advanced economies are also depicted as the disputes on outsourcing expose. But there has not been much work in quantifying the consequence of political risk on real investment conclusions.

Literature mainly examines the collision of political risk on foreign direct investment (FDI) streams and investment flight. In his provocative article, Lucas (1990) regards political risk as one of the matters behind the perplexing lack of capital flows from rich to poor countries. Svensson (1998) disputes that the lack of political stability outlines in lowering of the investment, as political instability obstructs the inducement to create a well-organized scheme rights. Lensink, Hermes and Murinde (2000) observe that after managing macroeconomic and policy changeables, political risk arouses the amount of capital flight.

Janeba (2002) regards the investment conclusion of a transnational firm in a politically risky world and highlights the trade-off between lack of reliability and low cost in the purpose of FDI judgments. Political risk observing the future of European Monetary Union is also widely recognized as affecting the performance of financial markets. Remolona, Wickens and Gong (1998) find that the real risk premium on UK bonds fluctuated considerably since the exit from the ERM, replicating indecision about the real economy.

Risk in investment decisions

Political risk is the jeopardy that an autonomous host administration will suddenly change the “rules of the game” under which industries operate. This has a deep impact on the international corporation, as unsteadiness in a host country’s government, or monetary and fiscal policies results in more doubtful investment results. Political risk affects the value of an international invested object through changes in future cash flows and investors’ required return. The cash flow impact of political risk is clearly of concentration to shareholders and supervisors. This paper explores the less apparent, but often significant, impact of political risk on investors’ required return, and hence on the multinational corporation’s cost of capital.

Whether an exacting political risk is diversifiable or not depends on the pertinent market portfolio against which methodical risk is measured. This, in turn, depends on the extent of integration (or segmentation) in the capital markets in which the multinational corporation operates when capital markets are integrated; the relevant market portfolio is the global market portfolio. When a domestic market is segmented from other capital markets, the relevant market portfolio is the domestic market portfolio.

Empirical evidence suggests that real-world capital markets lie anywhere between the limits of integration and complete segmentation. As of country-specific discrepancy in the extent of capital market segmentation, the choice of market portfolio against which to measure the diversifiability or non-diversifiability of a particular political source of risk must be made on a case-by-case basis.

Political Risk Measurement

A rational, complicated advance to foreign speculation decision procedure necessitates a cautious assessment by the firm of frequent factors which relate to both the general surroundings of a proposed speculation and the specific operating occupations of the firm in that surroundings. A significant component of the environmental study is the question of political risk. The majority of studies of dealing with political risk focus on determining the variables composing that specific risk, or aim to find an association between political events and foreign investment. While the significance of political risk is generally acknowledged, the studies aiming to analyze it are too often vague and complicated to examine and apply in performing.

Analysts providing political risk assessments to MNEs have attempted to conquer the matters of precisely predicting future situations which integrate the dualistic, and often mismatched, components of academic theory and business clarity.

Frequent political risk analysis advances are utilized, either by domestic or foreign professionals. These range from qualitative, subjective, and discursive meetings by respected “specialists” at one end of the range, to quantitative computer-grounded appraisals drawn from an arithmetical position of various societal changeables. The more complicated quantitative advances are not significantly dissimilar from econometric forecasting used by economists; however, political risk investigation instead tracks political tendencies with multivariate data analysis methods. Sargent (1980) integrates objective and subjective slants which allows for the best characters of organization discipline to be incorporated with approaches and intuition of local specialists.

In political risk studies, general advance can cause imprecise determinants. As Harms, P. (2000) stated customary investigations assessing political risk and its relation with exterior investment have contemporarily taken into account a variety of data from dissimilar states and industries. This generic viewpoint has led to a failure in determining dependable estimations of the dimension of political risk and its relations with investments from outside the host state. The author states that political risk assessment must tackle both the abnormal features of the host country and attribute of the investment project. The project play plays a critical role in formative potential risks as different projects can be another way prejudiced by the political occasions of a host state.

Fascinatingly some industry kinds may be more susceptible than others to specific matters in a country’s financial system, especially if political stability is the key concern. The study led by Johnson and McIlrath (1998) has discovered that multinational corporations belonging to dissimilar industries do not perceive the same degree of risk when facing the same political disorder in a given state. Therefore, to classify and charge political risk in global investment, a new structure grounded on the detailed changeables of the hotel business and its exclusive features is essential.

Investment in Opportunialand

Periods of political stability and political risk: Sample statistic

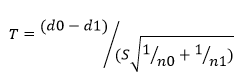

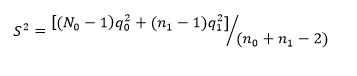

where;

Table 1 offers a simple test of the impact of political risk on investment in Opportunialand by testing for the parity of the standard investment capital store ratio for Opportunialand in comparison with Disney Land across eras of political risk and political constancy. To net out the effect of factors such as the recessions, the second incident of political risk is contrasted with political stability. Define the random variable, where j=0 refers to political stability and j=1 refers to political risk, correspondingly. Let μo and μ1

point to the individual inhabitants denotes. Under the null theory, the plausible appraisal of djt should be comparable crossways of political constancy and political risk. From the table, the null hypothesis that μo = μ1 versus the deputy that μo > μ1 can be unwanted at the 5 percent for UK investment. (The t-worth for a one-sided test of the theory that μo = μ1 is 1.76 at the 5 percent level of connotation.) The assessment statistic for structures conjecture in enhanced investment is positive and imperative at the 10 percent level but not 5 percent. Though, when we regard the broadly distinct business sector and total industries, it is probable to find that null suggestion of μo = μ1 in favor of μo > μ1 may be rejected as structures of investment for wider industry groupings staying high in Opportunialand owing to the large conjecture boom in developed arrays, due to a strong reaction to the Opportunialand – UK Free-Trade.

Thus, having calculated according to formulas, the following data arises:

Table 1. Calculations and dealing with risks.

UK here is regarded as a monopolistically competitive and risk unbiased part which makes changeable input and investment alternatives each period. At time t it makes output, Yt, using its beginning-of-period assets stock, Kt, and a variable labor input, Lt. The firm’s manufacture gathering is given by Yt=F(Kt,Lt,At), where At is a stochastic technology distress and F is twice relentlessly differentiable, escalating, hollow, and satisfies the situations. Let pt indicate the stochastic manufacturing price. It is assumed a steady agility demand function:

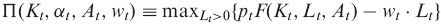

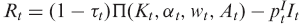

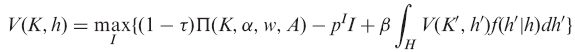

where ” ε <-1 is the cost plasticity of demand and αt t is a stochastic stricture representing the state of command. Denoting the wage by wt define the short-run profit function at t as

Where ∏ is incessant; increasing in Kt, At, and _t, decreasing in wt; strictly concave in Kt, αt, and At and bounded for finite Kt, αt, and At. Let r denote the real rate of interest. Define the tax-adjusted price of investment as

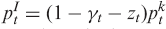

where p denotes the purchase price of investment goods, zt is the present value of tax deductions on new investment at date t, and _t is the investment tax credit at time t as a percentage of the price of the investment good. The firm’s after-tax cash flow at time t, Rt, is given by

where Tt is the corporate tax rate, and It is the firm’s rate of gross investment gauged in physical units at time t. Let ht = (At, αt). Assume that ht takes on values in the finite set H and define

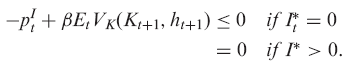

Is subject to the law of motion for the capital stock K=(1 – δ) K + I the irreversibility restraint I≥0 and K given, where V denotes the value function 0 < δ < 1 is the reduction rate, and β = (1+r)¹ is the discount factor. Reverting to time subscripts, the first-order necessary and sufficient circumstances for the optimization problem at t are

where Et shows that expectations are taken qualified on information available at time t and Vk (Kt+1h1+1) denotes the partial unoriginal of V with respect to K or the shadow value of capital.

High risk is related to both high probability and significant consequences. The probability that you will step on a crack today is high but the consequences are low. On the other hand, the likelihood that you will be hit by lightning today is low but the consequences could be great. Great risks link high probability with significant negative consequences. For example, an investment in any single, unproven stock might yield a great return, but there is also a high probability of significant loss. Note that high risk is not coupled with the probability of a great return but a great loss. A great return is possible but not probable.

Controlling investment risk requires a firm purpose, a reasonable approach, and a steady hand. It also requires the avoidance of unnecessary costs and questionable strategies. It should not be conducted as a knee-jerk reaction to sudden economic events but rather as a long-term growth process based on a purposeful allocation and diversification of resources. The ultimate object is to position your investments so as to sustain continual real growth in keeping with your goals, risk-tolerance, and time horizons and without regard to temporary market fluctuations. If you wake up in a cold sweat whenever the market dips, perhaps you need to understand your risks better and establish a strategy that will be more settling and consistent over the long haul.

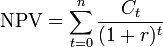

Formula: Each cash inflow/outflow is discounted back to its PV. Then they are summed. Therefore

Where

- t – the time of the cash flow.

- n – the total time of the project.

- r – the discount rate.

- Ct – the net cash flow (the amount of cash) at time t.

Appropriately risked projects with a positive NPV be accepted. This does not necessarily mean that they should be undertaken since NPV at the cost of capital may not account for opportunity cost, i.e. comparison with other available investments. In financial theory, if there is a choice between two mutually exclusive alternatives, the one yielding the higher NPV should be selected. The following sums up the NPVs in various situations.

Exchange rate forecasts

The theory of purchasing power parity (PPP) is based on the idea of a law of one price that means that in an efficient market identical goods should have equal prices. The theory was developed by Gustav Cassel in 1920 and it is used to equalize the purchasing power of two currencies with the help of the long-term equilibrium exchange rate. According to this theory “the exchange rate between two currencies is related to the relative prices in the two countries so that exchange rate-adjusted prices will be equal between the two countries” (Norrbin, Connover, 27).

Purchasing power parity is an important mechanism of international economic modeling. It exists in two versions: the absolute version of PPP (APPP) and the relative version of PPP (RPPP). The APPP establishes a long-run relation “between the bilateral exchange rate and price levels of two relevant countries, while relative PPP suggests comovements of changes in the exchange rate with the inflation differential of two countries” (Zhou, 13). Werner Antweiler suggests the following example of APPP:

…a particular TV set that sells for 750 Canadian Dollars [CAD] in Vancouver should cost 500 US Dollars [USD] in Seattle when the exchange rate between Canada and the US is 1.50 CAD/USD. If the price of the TV in Vancouver was only 700 CAD, consumers in Seattle would prefer buying the TV set in Vancouver. If this process (called “arbitrage”) is carried out at a large scale, the US consumers buying Canadian goods will bid up the value of the Canadian Dollar, thus making Canadian goods more costly to them. This process continues until the goods have again the same price (Antweiler, 2007).

As far as this case is concerned there are three caveats with the law of one price here:

- Transaction costs can be significant;

- Both countries should have competitive markets for the goods and services;

- This law can be applicable to tradeable goods only, whereas many goods cannot be traded between countries.

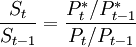

RPPP denotes the relation between the inflation rate in each country and the change in the market exchange rate:

where St stands for Foreign/Domestic Currency and Pt for the price level in period t, P*t stands for foreign values. From this equation it comes out that the change in the exchange rate is determined by price level changes in both countries. The rate of appreciation of a currency equals the difference in inflation rates between the foreign and domestic country. For example,

…if Canada has an inflation rate of 1% and the US has an inflation rate of 3%, the US Dollar will depreciate against the Canadian Dollar by 2% per year (Antweiler, 2007). The practical application of the PPP is that it serves as a guide for monetary authorities when they move the exchange rate of the foreign exchange market toward the level that is consistent with PPP.

On practice PPP theory means the following: to buy as much in the UK as in the USA the price of a basket of goods in pounds in the US should be equal to the price of the same basket priced in the USA currency. If the price of a basket in pounds in the UK is denoted like £P, the spot exchange rate like $/£ and the price of a basket in dollars like $P the exchange rate that equalizes the value of a dollar of PPP would be ($/£) = $P/£P. Two situations are possible here: if the actual spot rate is greater, the £ is over-valued against the $ and, on the contrary, if the actual spot rate is less, the $ is over-valued against the £.

One should keep in mind that PPP does not determine exchange rates in the short term as they are news-driven. Such factors like announcements about interest rate changes, changes in perception of the growth path of economies are the factors that drive exchange rates in the short run. PPP describes the long run behavior of exchange rates. Equalizing the purchasing power of currencies usually takes many years; in fact, it may be about 4-10 years.

When the business community resorts to PPP technique it is necessary to compare the price of the good that is identical in both countries. The problem that arises is that in different countries people prefer different sets of goods and services; therefore, it is difficult to compare the purchasing power between countries under analysis.

To sum it up we should say that purchasing power parity helps to understand exchange rate differentials, whereas exchange rates do not always correspond to the predictions of the PPP theory.

Conclusion

The made calculations denote, that the success of the investment depends only on the stability of the inner situation. First of all, to gain profits for the invested capitals, it is necessary to persuade, that the invested systems and industries would work properly. Thus, depending on the preliminary actions, such as instilling the inner order, providing reasonable changes as the necessary step for ensuring safety of the capitals, potential results may be both positive and negative.

Another conclusion, that may be raised from the calculations and observations of similar investments may be that the investment of the Opportunialand most probably, would occur successful, as the development if the infrastructure in undeveloped country necessarily increases industrial potential, and incomes form the dividends in future.

Permitting for actual characteristics of the electoral procedure that control the regime change, it is stated, that expectations regarding demand, productivity, or interest rates in a future unnoticed government in formative current investment outlines. The present analysis is in the spirit of a ‘‘overturn calibration’’ implement.

It is found that when the regime shift probabilities are particular by making use of the nature of the actual electoral procedure and the results of estimation poll data, decline in demand and output in the ‘‘bad’’ regime is adequate to lead to a decline in investment that is in line with regarded investment. Allowing for increases in risk premia in the ‘‘bad’’ regime causes larger potential declines in investment today. In the absence of expectation effects, we find that the investment shortfalls due to increases in interest rates in the current regime.

References

Abel, A.B. and J. Eberly, ‘‘The Effects of Irreversibility and Uncertainty on Capital Accumulation’’, Journal of Monetary Economics 44, 339–77. 1999.

Antweiler, W. 2007, ‘Purchasing Power Parity’.

Boyacigiller, Nakiye. “The Role of Expatriates in the Management of Interdependence, Complexity and Risk in Multinational Corporations.” Journal of International Business Studies 21.3 (1990): 357.

Butler, Kirt C., and Domingo Castelo Joaquin. “A Note on Political Risk and the Required Return on Foreign Direct Investment.” Journal of International Business Studies 29.3 (1998): 599.

Dreyer, J. S. et al.,1978 Exchange Rate Flexibility, American Enterprise Institute.

Grosse, Robert, and Len J. Trevino. “Foreign Direct Investment in the United States: An Analysis by Country of Origin.” Journal of International Business Studies 27.1 (1996): 139.

Habib, Mohsin, and Leon Zurawicki. “Corruption and Foreign Direct Investment.” Journal of International Business Studies 33.2 (2002): 291.

Harms, P. (2000), International Investment, Political Risk, and Growth, Kluwer Academic Publishers, Boston, Dordrecht, London.

Howell, Llewellyn D. “Foreign Investors Confront Political Risks.” USA Today (Society for the Advancement of Education). 1999: 33. Questia.

Janeba, E., ‘‘Attracting FDI in a Politically Risky World’’, International Economic Review 43, 1127–55. 2002.

Johnson, D. and D. McIlrath, ‘‘Opinion Polls and Canadian Bond Yields during the 1995 Quebec Referendum Campaign’’, Canadian Journal of Economics 21, 411–26. 1998.

Kilian, L. & Taylor, M. 2001, Why Is It So Difficult to Beat Random Walk Forecasts of Exchange Rates?, Unpublished manuscript.

Lensink, R., N. Hermes and V. Murinde, ‘‘Capital Flight and Political Risk’’, Journal of International Money and Finance 19, 73–92. 2000.

Lucas, R.E., ‘‘Why Doesn’t Capital Flow from Rich to Poor Countries?’’, American Economic Review 80, 92–6. 1990.

Mark, N. ‘Exchange rates and fundamentals: Evidence on long-horizon predictability’, American Economic Review, vol. 85, no 2, pp.201-18.

Meese, R. & Rogoff, K. 1983 a, ‘Empirical exchange rate models of the seventies: Do they fit out of sample?’, Journal of International Economics, vol. 14, no 1, pp. 3-24.

Meese, R. & Rogoff, K. 1983 b, The Out-of-Sample Failure of Empirical Exchange Rate Models: Sampling Error or Misspecification?, Chicago: NBER and University of Chicago Press.

Neely, C. J. & Sarno, L. ‘How Well Do Monetary Fundamentals Forecast Exchange Rates?’. Web.

Norrbin, C.S. & Conover, C.M. 1998, ‘How Much Is Purchasing Power Parity Worth?’, Quarterly Journal of Business and Economics, vol. 37, no.1, pp.27-46.

Remolona, E., M. Wickens and F. Gong, ‘‘What Was the Market’s View of UK Monetary Policy? Estimating Inflation Risk and Expected Inflation with Indexed Bonds’’, Federal Reserve Bank of New York, Staff Report 57. 1998.

Svensson, J. ‘‘Investment, Property Rights and Political Instability: Theory and Evidence’’, European Economic Review 42, 1317–41. 1998.

Sargent, T., ‘‘ ‘Tobin’s q’ and the Rate of Investment in General Equilibrium’’, Carnegie-Rochester Conference Series on Public Policy 12, 107–54. 1980.

Zhou, Su 1997, ‘Purchasing power parity in high-inflation countries: a cointegration analysis of integrated variables with trend breaks’, Southern Economic Journal, vol. 64, no.3, pp. 13-17.