Introduction and Highlights

Introduction

This report analyzes and evaluates NEXT plc to deliver crucial recommendations for current and future investment decisions. The report will explore company highlights to uncover internal and external business perspectives that might affect the firm’s profits, cash flows, and revenues. A thorough company risk assessment is a core segment within the report.

This section will identify and evaluate the impact, likelihood, and potential mitigation risks. The report will further analyze and evaluate the current and potential share prices. Finally, based on the financial analysis and business and risk evaluations, the report will recommend whether to invest in NEXT plc.

NEXT plc is a clothing, footwear and home goods retailer headquartered in Enderby, England. As shown in Table 1.1, the market share has improved over the past five years as the company recorded a 0.32% share of the apparel and footwear market in its year ending January 2022 (Next Plc, 2023). This report divided the company’s total sales by the global industry sales with a conversion rate of one pound at 1.18 dollars to obtain the company’s market share.

Table 1.1 – NEXT plc’s Market Share

NEXT plc’s business model is focused on providing beautifully designed, high-quality clothing and home products that exceed the expectations of its target customers. The corporate model includes reliance on online and retail platforms to reach customers worldwide (Butler, 2021). The firm also collaborates with third-party aggregators like Lipsy to improve its value. NEXT plc’s product line mainly entails footwear, clothing, accessories, and home products sold either in retail or online. The firm operates 37 large combined fashion and home stores, essential for online delivery.

Over the years, the company has continuously restructured and diversified to remain profitable. NEXT Plc has diversified its products since its foundation. In 1985, the company introduced the Interior Home series. Further restructuring came to light in 1986 with the Group’s acquisition of its mail-order business, Grattan plc (Butler, 2021). The company intends to further increase diversity within its product designs, prints, fabrics, sizes, and customer types within its ranges. The Group is committing to extending its ranges in sports footwear and clothing, outdoor clothing and footwear, and introducing children’s nursery ranges.

Since 2018, NEXT plc has been sued by retail store employees arguing for fair compensation. The compensation, which might total £100 million, is primarily the result of female employees at the fashion and homewares retailer’s stores (Next Plc, 2023). The workers claim they are paid between £2 and £6 less per hour than the company’s mostly male staff members, who they believe undertake comparable tasks (Butler, 2021). The case’s success against NEXT plc could open the door for equal pay action against fashion retailers.

Brexit has made NEXT plc susceptible to labor regulations in both the EU and the UK. The COVID-19 outbreak caused significant disruption among high street merchants. The shops faced mandatory store closures and social distancing rules for 20 weeks (Next Plc, 2023). This trend accelerated an already existent inclination toward online buying.

The fashion company lost £85 million in sales due to its plan to close its websites in Ukraine and Russia in 2022 (Next Plc, 2023). The company admitted that the war would reduce its profits by 18 million for the period in question, but that better-performing UK sales would balance the loss (Next Plc, 2023). The soaring inflation and devaluation of the pound in 2022 undermined consumer confidence. This situation had affected spending habits, as evident in 2022 when NEXT plc issued the second profit warning as they expected end-of-year profits to total £840 million, representing a 1.5% drop in sales.

Company Highlights

Various internal and external factors affect the profitability of NEXT plc. The SWOT analysis of NEXT plc offers internal perspectives concerning the firm’s strengths and weaknesses that ultimately affect the business revenue, profits, cash flow, and intangibles. The prevalence of internal strengths like product innovation, strong brand portfolio, strong distribution network, and superb cash flow enables NEXT plc to maintain its market share and profitability.

Internal variables contributing to low responsiveness include the occurrence of a low-profit ratio and NEXT Plc’s Net Contribution being lower than the industry average. External views are influencing the firm’s worth, such as the Ukraine-Russia war, which has reduced the firm’s profitability (Next Plc, 2023). Economic factors such as high inflation and a weakening pound have also slashed the company’s profits. Social factors like consumer expectations on corporate social responsibility pressure the company’s capabilities to remain profitable while meeting society’s social conventions, which might be costly. Though NEXT plc has been performing well in technological aspects, it still needs to keep up with recent developments that its competitors have adopted.

Financial Analysis

Revenue Growth

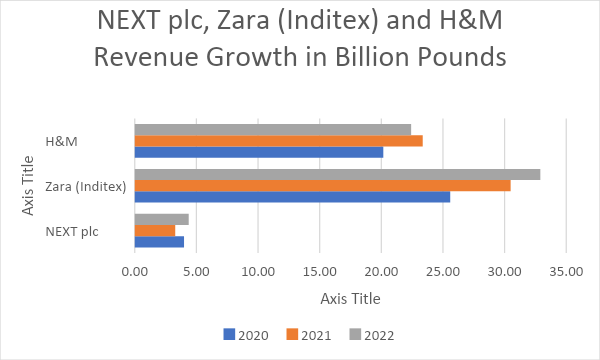

Compared to H&M and Zara (Inditex), the NEXT plc firm’s revenues are generally lower. Table 1.2 below depicts the revenue growth for the three firms, with all the figures expressed in billion dollars. Revenues are derived from Inditex (2021) and H&M Group (2022) annual reports. From the outlook, Zara is the market leader with stable revenue streams that have constantly grown over three years.

Table 1.2 – The Revenue Growth for NEXT plc, Zara, and H&M

For the year ending January 2020, NEXT plc anticipated that the effects of the COVID-19 pandemic would only affect the company’s supply chain. NEXT plc experienced a recovery in the year ending January 2022, when it earned 4.4 billion sales revenue as shown in Table 1.2 and Figure 1.1 above. NEXT plc competitors like Zara experienced a 30.49 billion pounds revenue for the year ending 2021, while the revenues only increased to 32.90 billion pounds in 2022.

Zara’s (Inditex) lower revenue growth in 2022 is owed to the low consumer confidence in Europe (Inditex, 2021). The plans to roll out a fully integrated store and online model for the company will likely pose high competition to NEXT plc, which has been experiencing better sales from online sales. NEXT plc’s response to competing brands scaling at pace entails boosting its own online aggregation business and passing on the value of online infrastructure and technology through Total Platform.

Gross Profit Margin

Gross profit margin offers a way of determining a company’s financial health. Through the metric, investors can ascertain a firm’s profits after deducting the cost of goods sold. Compared with Zara and H&M, a lower margin for NEXT plc can mean the firm is underpricing.

The figures are expressed in billion sterling pounds, and the exchange rate in the calculation includes 1 EUR = 0.88 £ for the conversion of Zara’s revenues and cost of goods sold. The company’s revenues and cost of sales for 2022 are based on nine monthly periods as reported by the company. The cost of goods sold for H&M for the three months ended in Aug. 2022 has been retrieved from Guru Focus (2023). The exchange rate for H&M figures is 1 SEK 0.078 = 1£.

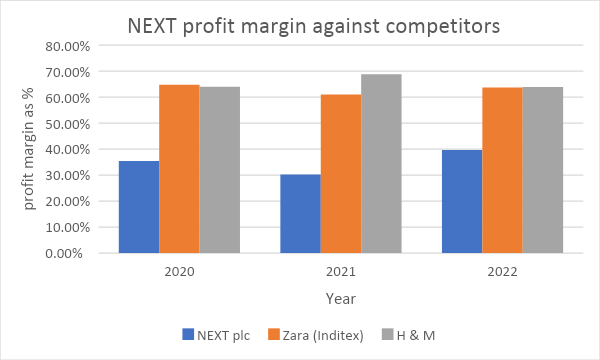

Table 1.3 – Profit Margin of NEXT plc and Its Competitors

Based on the analysis in Figure 1.1 above, 2021 was a tough year for the three corporations. The NEXT plc’s improved sales for 2020 can be attributed to the rise in its prices by 3.7%. In the first half of 2022, there was a 6% increase in the second half due to higher freight rates and increased manufacturing costs.

NEXT plc’s profit margin of 41.36%, as seen in Table 1.3, is relatively lower than that of H&M and Zara (Inditex), which recorded 64.79% and 63.99% respectively. One thing that explains why NEXT plc has a lower margin compared to its competitors is the high cost of goods sold. Remedies available for NEXT plc to reduce its cost of goods sold are through leveraging its suppliers.

Return on Capital Employed (ROCE)

ROCE is an essential ratio for determining how efficiently a company generates profits from its capital. However, this metric is particularly effective when analyzing firms within capital-intensive sectors like gas and oil. Figure 1.3 below shows the asset turnover for NEXT plc, Zara, and H&M.

Based on the findings in Table 1.4, NEXT plc ROCE has been increasing steadily, with 2021 being the lowest. This decrease can be attributed to the reduction in sales, as the COVID-19 pandemic meant most of the firm’s investments had to remain underutilized (Donthu & Gustafsson, 2020). Compared to the competitors, it indicates the ability of the firm to maintain profits stable within a volatile environment. NEXT plc can improve its ROCE by increasing sales, paying off debts, and improving operational efficiency.

Table 1.4 – ROCE of NEXT plc and Its Competitors

Current Ratio

The current ratio is essential in comparing the ability of NEXT plc and its competitors to meet their short-term obligations. Based on the analysis depicted in Table 1.5 below, NEXT plc’s current ratio has remained the same over the three years. H&M’s current ratio is below one, indicating the firm might not be capable of meeting its short-term obligations. NEXT plc can improve its current ratio by selling off capital assets that might not generate revenue.

Table 1.5 – Current Ration of NEXT plc and Its Competitor

Accounts Receivable Days

The accounts receivable days help determine how efficiently NEXT plc collects debts. Table 1.6 reveals that for 2020, the firm collected its debts two days earlier, while in 2021, NEXT plc took around 22 days to collect its debts. Due to the COVID-19 pandemic, most of the debtors could not pay on time (Jomo & Chowdhury, 2020). For Zara (Inditex), the firm takes an average of eight days to collect its debts, while H&M has reduced its accounts receivable days to one day. NEXT plc needs to optimize the procurement and sales process to shorten the time.

Table 1.6 – Accounts Receivable Days of NEXT plc and Its Competitors

Inventory Days

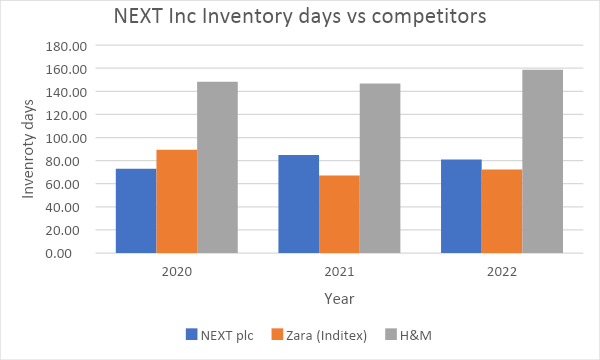

Inventory days are essential in determining a firm’s sales efficiency. Table 1.7 below shows that NEXT plc recorded the highest inventory days in 2021, which can be attributed to the disruption in the supply chain. As the pandemic winds down, the firm reduced the days it took to convert its stock into sales from 84.8 to 80.9, as shown in Figure 1.3. The challenge to reduce the days to the 2020 record may be due to holding stock meant for the Russian market.

Table 1.7 – Inventory Days of NEXT plc and Its Competitors

Debt-To-Equity Ratio

The gearing ratio will compare the financial stability and leverage of NEXT plc, Zara (Inditex), and H&M over the past three years, as shown in Table 1.7. For the past three years, the debt-to-equity ratio of NEXT plc has been reducing from 251.6% in 2020 to 59.4% in the year ending January 2022. Over the last three years, NEXT recorded free cash flow worth a fulsome 90% of its EBI, thereby being able to pay its debts. Zara is also stabilizing its debt-to-equity ratio, though above 100%, which means it is financing its operations through debt. NEXT plc needs to keep its debt modest as it converts its EBIT to free cash flow faster.

Table 1.8 – D/E of NEXT plc and Its Competitors

Interest Rate Coverage

The interest coverage ratio shows how efficiently a company can pay interest on its outstanding debt. From the results in Table 1.9, Zara (Inditex) has the highest interest coverage ratio. NEXT plc’s interest coverage ratio has also been good over the three years; in 2022, it was 25.8, indicating the firm could cover its interest cost approximately 26 times. NEXT plc can improve the ratio by paying or refinancing its long-term debts.

Table 1.9 – Interest Rate Coverage of NEXT plc and Its Competitors

Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio is a crucial element that estimates a firm’s share price relative to the company’s earnings per share. This metric is essential in understanding whether a given firm is overvalued or undervalued. The trend analysis in Table 2.0 shows that an investor needs to invest £0.27 in receiving £1 of NEXT plc earnings, implying that the firm is currently undervalued. There is a likelihood that the increased price-to-earnings ratio for H&M could be due to the overvaluation of its shares. To obtain a better price-to-earnings ratio, NEXT plc can improve the ratio by increasing earnings and sales, operating profit margin, and net margins or return on equity.

Table 2.0 – P/E of NEXT plc and Its Competitors

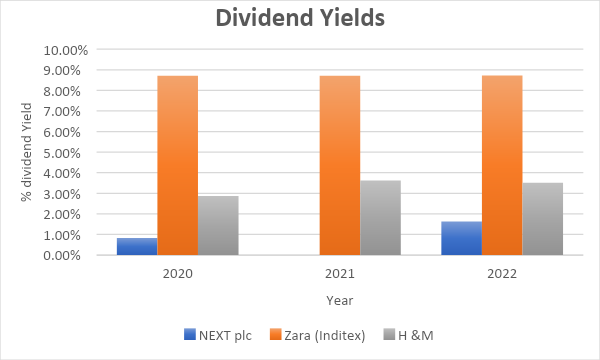

Dividend Yield

NEXT plc did not pay dividends in 2021 due to the impacts of the COVID-19 pandemic on its finances. In 2020, H&M, a close competitor of NEXT plc, also declared it would hold off paying out dividends due to the pandemic. Zara (Inditex), another competitor in the industry, managed an 8.7% dividend yield for the past three years (Scribd, 2020). Based on the analysis in Figure 1.4 and the representation in Table 2.1, NEXT’s dividend yield is low compared to its competitors. The company must develop a model that cuts costs and improves sales to attain a steady revenue flow.

Table 2.1 – Dividend Yield of NEXT plc and Its Competitors

Risk Assessment

In their operations, businesses experience widespread risks that affect different parts of the organization. For instance, these risks affect the firms’ employees, assets, reputation, sales, or general security. Understanding strategies to mitigate these risks is crucial for a company’s success.

The retail industry is volatile to market dynamics, and organizations like NEXT plc, specifically within clothing, footwear, and home products, find themselves at great risk. This section evaluates different risks facing NEXT plc. The impact of the risks, the likelihood of happening, and potential mitigation strategies will provide a comprehensive assessment of the firm’s risks. Risks can emanate from political, social, strategic, economic, or legal spheres.

Cyber Security Risk

Cybersecurity risks are criminal activities undertaken through computers, the internet, or a digital network. These incidents include cybercrime, data breaches, outages or IT failures, penalties, or fines. These risks may significantly affect the normal functioning of the Group’s operations.

Some operational risks are concentrated at logistics centers and third-party operators transporting goods. The concepts of clothing, footwear, accessories, and household products are distributed from different logistics centers. These centers are owned by the Group and operated by third parties. They are located throughout Spain and are complemented by a logistics connection hub in the Netherlands. There are additional smaller logistics centers located in other countries and operated by third parties, which carry out small-scale distribution operations.

Cybersecurity risk is highly likely as NEXT plc continues relying on the internet for online sales and commissions from third parties. According to Statista, cybersecurity occurrences were the prominent risks to businesses globally for 2023 (Rudden, 2023). A report by Vojinovic (2022) indicates that cybercrime caused $6 trillion in damages in 2022, and in 2023, an estimated 33 billion accounts will be breached. This data represents the magnitude of cybercrimes, and it is highly likely that NEXT plc will experience them.

NEXT plc can mitigate cybercrime risks through digitalization and adapt broadly to technological innovations and evolutions. This strategy will ensure the Group’s commercial success in a highly competitive environment. The firm should further ensure strict access control and invest in cybersecurity personnel, encryption, and security hardware.

Reputational Risk

Reputational risk can hurt the good name of a firm, eroding the trust that the company has built up with customers, suppliers, and other stakeholders. As a result of globalization, reputation damage can even happen due to a link with the company from a faraway region. NEXT plc is a multinational with stores globally. One factor that might bring a reputational risk to NEXT plc is its automation initiative.

In 2021, the firm commissioned KNAPP to automate its new e-commerce warehouse in the UK (Wögerer, 2021). The new online distribution center will combine a shuttle system with advanced pocket sorter technology, providing rapid lead times and maximum flexibility. The swift rush to automation, in retort to the necessity for efficiency and reduced on-site labor, may expose the firm to unforeseen ethical risks. This situation is likely due to more socially activist consumers and workforces concerned about job losses and willing to take their talents elsewhere.

The NEXT plc can adopt some strategies that can help mitigate reputational risks affecting the firm. For instance, the organization can focus on what customers and employees say about the company online and offline. Additionally, the Group can commit to providing a quality product or service and ensuring that workers are trained to deliver excellent customer service. The firm can also mitigate the risks by resolving customer complaints, offering refunds, and issuing apologies when necessary.

Compliance and Legal Risks

Organizations experience Compliance or legal risks when they violate government or regional laws and regulatory standards. Such risks could result from failure to follow environmental regulations, failure to pay fair wages, failure to honor contracts, failure to provide safe and healthy working conditions, or unfair employment practices. The current lawsuit against its female workers, who accuse the firm of low pay and limited bonuses compared to male counterparts, could see the firm pay up to £100M (Butler, 2021). Additionally, this lawsuit can lead to losing customers or investors who might distance themselves from the firm, hurting its profitability.

There is a high likelihood that NEXT plc can be subject to legal risks, as the workers have already won the first round of the lawsuit. The organization can counter these threats by sourcing legal consultants and developing a human resource team familiar with labor laws. The tea should be reliable to stand for the firm in the event of lawsuits or any other cases from its suppliers, clients, employees, or any other stakeholders. Additionally, NEXT plc can turn to technological alternatives that can assist in making it adhere to set regulations. For instance, the use of timekeeping software enables the firm to ensure fair payments of wages and working hours.

Financial or Economic Risks

Managing risks is tied to business and financial profits, often analyzed by shareholders and investors. Financial risks result from multiple factors, which could involve market movements, product price changes, interest rates, and foreign currency exchange rates, among other factors. Financial risks can be categorized as market, credit, operational, or liquidity.

Based on the earlier analysis, it is evident through the low dividend yield, WACC, and NEXT plc’s high cost of goods sold that the firm is facing market risk. Market risk relates to the probability of incurring a loss due to increased interest rates, market volatility, and changes in foreign exchange values (Georgiev et al., 2022). NEXT plc’s financial analysis for the past three years has revealed a high probability of experiencing market risk. The ongoing war in Ukraine and global inflation are forecast to increase the market risks to firms like NEXT plc.

NEXT plc can adopt different strategies that aim to ease cash flow issues and mitigate the firm’s financial risks. Some of the strategies include diversifying its income streams by developing a wide product portfolio that suits each customer’s choice (International Finance Corporation, 2020). Additionally, the organization can obtain insurance to cover unforeseen financial risks in the volatile market.

The Russia and Ukraine war and tensions in China, coupled with the repercussions of Brexit, represent substantial risks for NEXT plc today and in the future (Bouoiyour et al., 2019). Having an insurance plan against such unseen risks can help the company manage its operations profitably, without any distraction resulting from such risks. NEXT plc can also mitigate the financial risks by developing policies that limit the tenure or amount of loans the firm can source.

Operational Risks

Businesses are exposed to operational risks when conducting their day-to-day operations, which can reduce their profits. Operational risks within NEXT plc can emanate from employee errors that could result in inventory shrinkage or missing merchandise (Su et al., 2021). In some cases, the customer experience could take a hit. For instance, if shoppers can’t find products in the right place or are always receiving the wrong items, it could be a sign that something is amiss behind the scenes.

A pandemic that forces people to shelter in place or work from home is also another classic example of operational risks facing NEXT plc. The COVID-19 pandemic exposed businesses globally to operational risks (Zhu et al., 2020). Though the pandemic risk is easing on economies, businesses like NEXT plc still stand at risk of future pandemics.

NEXT plc can mitigate operational risks by establishing time for relevant employee training to minimize internal mistakes. Additionally, the organization can develop contingency plans to shield against external events like a pandemic that may impact operations. The plan should outline how to respond and recover from certain operational risks.

Business Analysis and Valuation of NEXT plc

Share Price Trends

NEXT plc’s share price was GBX7694 before the COVID-19 pandemic in 2021, and the share price stabilized at GBX7788 in 2022. By March 2023, the NEXT plc share price had increased to GBP 6890 after the prices dropped rapidly towards the end of 2022 (Next Plc, 2023). The Russia-Ukraine war has also affected the global economy, with most European nations recording high costs or inflation. The NEXT plc’s downward price trend per share can be due to investors selling off their shares to invest in more stable economies, assets, or businesses, with promising returns.

Current Price

The current share price of NEXT plc is GBX 6,807.32, which gives the firm a total valuation of 8.71B GBP. The intrinsic value for the stock is £114.79, above what the market is valuing the company at the moment. The volatility of the firm’s shares in the market indicates its value could change shortly, given the prevailing high cost of living (Umar et al., 2021).

NEXT plc is currently undervalued; it may be a great time to accumulate more of one’s holdings in the stock. With an optimistic outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, other factors, such as financial health, could also be considered, which could explain the current undervaluation. A major drawback of using share price for valuation is that the measures are highly dependent on forecasts. These forecasts are frequently wrong, as cases of overestimating and making the shares look cheaper than they actually are.

Net Asset Value

The NEXT plc annual reports show that the firm’s net asset value has improved. In 2020, the net asset value was £36.75 billion, while in 2021 and 2022 it was £37.58 billion and £39.981 billion, respectively. Next’s online assets enable the company to profitably enter new regions because the online business model means it’s not encumbered by the customer density required to justify physical store investments.

Next, logistics assets, a legacy of their old catalog business, allow the company to offer next-day delivery, a standard in the UK. Under Total Platform, Next makes all these assets, this distribution network, and the lending business available to third-party brands, earning a 39% commission on brand partner sales. The company’s investment in profit-generating assets has enabled it to remain profitable in tough economic times. One drawback of asset valuation is that the method neglects a firm’s prospective earnings.

PE Multiples

The price-to-earnings ratio shows a relationship between NEXT plc stock price and earnings per share. Based on earlier calculations, the NEXT plc price-to-earnings ratio averaged 27. The ratio has remained constant over the years due to stagnation in the rise of sales or earnings of the firm as a result of the COVID-19 pandemic and the rising cost of living.

NEXT plc’s volatility in the market might also have influenced the firm’s changes in the price-earnings ratio. A drawback of this method of valuation is that it does not give investors any information regarding the prospects of the earnings per share (EPS). This information is critical as investors might be okay with investing in a company with a high P/E ratio, but with stronger chances of increasing their EPS.

Dividend Yield and Investor Ratio

In 2022, Next plc’s dividend yield of 1.63% was lower compared to industry competitors such as Zara (Inditex) and H&M, who recorded 8.7% and 3.5%, respectively, as seen in Table 2.2 below. NEXT plc earnings are highly sensitive to market volatility, as evidenced by the 2021 avoidance of issuing dividends. Though NEXT re-introduced the dividend yields in 2022, the firm has only issued an interim dividend of 66 pence, which is only 1.11% of its current share price as of January 2023.

Given the firm’s sales forecast, the dividend yield for the year ending January 2023 will likely change only slightly. Factors likely dampening demand include inflation in essential goods, particularly energy, rising mortgage costs as consumers’ fixed interest rate deals expire, and Continued price inflation in products. Dividend yield weakness as a valuation technique is that it is conservative, as it fails to consider stock buybacks.

Table 2.2 – Dividend Yield of NEXT plc

Free Cash Flow

Free cash flows refer to the money a company has left over after paying its operating expenses (OpEx) and capital expenditures (CapEx). NEXT plc’s 2021 free cash flow increased from 337.1 million pounds to 742.7 million in 2022. This trend shows the company has more funds to allocate to dividends, paying down debt, and growth opportunities.

The present value of both the dividend and free cash flow relies on the estimate of the cost of equity and the cost of debt, both of which are subject to some uncertainty. The cost of equity has assumed a risk-free rate of 1.3% and a market risk premium of 5.6% but different estimates may be equally valid. The company’s equity beta is a measure of the risk compared with the overall equity market and has been derived from past movements. They do not consider unsystematic or specific risk and would understate the risk and overstate the value for an undiversified investor.

Weighted Average Cost of Capital

NEXT plc’s weighted average cost of capital (WACC) was 6.95% in 2021 and increased to 7.56% in 2023, as evident in Table 2.3. Next, it generates higher returns on investment than it costs the company to raise the capital needed for that investment, earning excess returns. A firm that expects to continue generating positive excess returns on new investments in the future will see its value increase as growth increases. The increase in NEXT plc WACC can be attributed to the increase in financial risk for its shareholders, who require a higher return to compensate for the increased risk. This trend, therefore, increases the cost of equity, thus leading to a high WACC.

With the current inflation increasing, the Bank of England raised the interest rate to keep inflation under control. Interest rates are a significant element as they affect a company’s WACC. An increase or decrease in the rate affects a company’s WACC because the risk-free rate is an essential factor in calculating the cost of capital. NEXT plc’s WACC is anticipated to fall at the end of 2023 based on a statement by the Bank of England. The Bank has an inflation target of 2%, giving hope for a reduced WACC for NEXT plc, among other corporations.

Table 2.3 – Weighted Average Cost of Capital of NEXT plc

Conclusions and Recommendation

According to the studies and statistics provided earlier, NEXT plc has created a vibrant brand in the United Kingdom retail sector. The company has shown a strong commitment to overcoming the current difficulties and being profitable. Except for 2021, the corporation has been profitable to shareholders by ensuring a consistent dividend cycle. In 2022 and 2023, the company returned to its pre-pandemic dividend cycle to ensure that its shareholders could continue to receive dividend payments and build trust. The company had previously decided not to declare dividends in 2021 due to the detrimental effects of the pandemic on its cash flows.

The durability of NEXT plc, as evidenced by sales growth during and after the COVID-19 pandemic, is due to its effective flexibility and brand. Today, having a distinct brand is critical since shoppers are willing to pay a premium for products from distinctive brands (Vehmas et al., 2018). Firms such as Marks & Spencer, for example, have extensively invested in developing a distinct brand in order to sell more in a competitive market. The experience has strengthened NEXT plc’s will to continue developing. The company cannot afford to take a break; instead, it must work tirelessly to achieve its current goals while addressing challenges and shortcomings.

According to the most recent balance sheet data, NEXT plc had obligations of UK£1.46 billion due within the next 12 months and liabilities of UK£1.76 billion due after that. To compensate, it had UK£296.7m in cash and UK£1.26b in receivables due within the next 12 months. As a result, its liabilities exceed its cash and short-term receivables by £1.66 billion. While this debt may appear to be significant, NEXT plc has a market valuation of 8.64 billion GBP as of 2023, according to Google Finance. As a result, it could presumably enhance its balance sheet by adding capital as needed.

However, it is important to keep a watch on the firm’s debt because it carries a high risk. This study obtained the firm’s net debt in order to assess its debt in relation to its earnings. The debt was divided by EBITDA (earnings before interest, tax, amortization, and obsolescence), and EBITDA was divided by interest expense. This way, the report could take into account both the total amount of debt and the interest rates paid on it.

As seen in Table 2.5, NEXT plc has a low net debt to EBITDA ratio of 0.18, and its EBIT of £823 million covers its interest expense of £30.9 million, a whopping 27 times over. As a result, it is prudent to declare that NEXT plc’s debt is no longer a threat. NEXT plc also has an advantage in that its EBIT in the preceding period climbed by 140%, making it easier to settle future debts. The balance sheet is essential for identifying a company’s debt levels. However, future earnings are the most important factor in determining a company’s capacity to maintain a solid balance sheet.

The EBIT is an important factor to consider because a company cannot meet its obligations with paper profits. As a result, determining whether existing EBIT is the primary influence on available free cash flow is critical. NEXT plc’s free cash flow has accounted for 90% of its EBIT during the last three years, which is greater than predicted. This indicates that the company has a healthy capacity to meet its responsibilities.

This analysis does not consider NEXT plc to be in a dangerous situation due to its moderate debt load. There should be no concern regarding the firm’s balance sheet using minimum leverage. When examining corporate debt levels, the balance sheet is a popular place to examine. However, outside of the balance sheet, every organization may manage risks.

The company’s shares have gotten a lot of attention recently due to a significant price fluctuation on the LSE. The shares reached a high of UK£84.26 before falling to a low of UK£65.12. Some share price swings may provide investors with a better opportunity to enter the stock and maybe purchase it at a lower price.

NEXT plc is still trading at a low price. The fair value of the stock, according to this report’s appraisal, is £70.47, yet it is presently selling at UK£65.12 on the share market, indicating that there is still time to buy (Simply Wall St, 2023). What’s more, the share price of NEXT plc is extremely volatile, allowing investors more opportunities to buy because the share price could fall or climb. This pattern is supported by the stock’s high beta, which reflects how much the stock changes in relation to the rest of the market.

References

Bouoiyour, J., Selmi, R., Hammoudeh, S., & Wohar, M. E. (2019). What are the categories of geopolitical risks that could drive oil prices higher? Acts or threats?Energy Economics, 84, 104523. Web.

Butler, S. (2021) Next retail store workers win first stage of Fight for Equal pay, The Guardian. Guardian News and Media. Web.

Donthu, N., & Gustafsson, A. (2020). Effects of COVID-19 on business and research. Journal of business research, 117, 284-289. Web.

Em, O., Georgiev, G., Radukanov, S., & Petrova, M. (2022). Assessing the market risk on the government debt of Kazakhstan and Bulgaria in conditions of turbulence. Risks, 10(5), 93. Web.

Google Finance (2023) Next plc (NXT) stock price & news, Google Finance. Google. Web.

Guru Focus (2023) Hennes & Mauritz AB (OSTO:HM B) Cost of Goods Sold, Hennes & Mauritz AB (osto:HM B) cost of goods sold. Guru Focus. Web.

H&M Group (2022) Annual & sustainability report 2021, H&M Group. H&M Group. Web.

Inditex (2021) 2021 Inditex Annual Report, Inditex Memoria 2021. Inditex Memoria 2021. Web.

Corporation (2020) How firms are responding and adapting during COVID-19 and Recovery – IFC, International Finance Corporation (IFC). International Finance Corporation. Web.

Jomo, K.S. and Chowdhury, A. (2020) “Covid-19 pandemic recession and recovery,” Development, 63(2-4), pp. 226–237. Web.

Next Plc (2023) Share price centre, Next Plc. Next Plc. Web.

Rudden, J. (2023) Biggest business risks globally 2023, Statista. Statista. Web.

Scribd (2020) 2020 Inditex Annual Report, Scribd. Scribd. Web.

Simply Wall St (2023) Estimating the intrinsic value of Next Plc (Lon:NXT), Simply Wall St News. Simply Wall St. Web.

Su, H.C., Rungtusanatham, M.J. and Linderman, K. (2021) “Retail inventory shrinkage, sensing weak security breach signals, and organizational structure,” Decision Sciences, 54(1), pp. 8–28. Web.

Umar, Z., Gubareva, M., & Teplova, T. (2021). The impact of Covid-19 on commodity markets volatility: Analyzing time-frequency relations between commodity prices and coronavirus panic levels. Resources Policy, 73, 102164. Web.

Vehmas, K., Raudaskoski, A., Heikkilä, P., Harlin, A., & Mensonen, A. (2018). Consumer attitudes and communication in circular fashion. Journal of Fashion Marketing and Management: An International Journal. Web.

Vojinovic, I. (2022). More Than 70 Cybercrime Statistics—A $6 Trillion Problem. DataProt. October, 4. Web.

Wögerer, M. (2021) The next platform for growth: Next expands its online ‘next platform’ fulfilment capability with Knapp’s innovative systems solution, KNAPP. Knapp. Web.

Zhu, G., Chou, M. C., & Tsai, C. W. (2020). Lessons learned from the COVID-19 pandemic exposing the shortcomings of current supply chain operations: A long-term prescriptive offering. Sustainability, 12(14), 5858. Web.