M&S is one of the UK’s leading retailers headquartered in Westminster, London. The company management is committed to making every moment special for customers through selling high-quality own-brand clothing, home, and food products. Although primarily based in the UK, M&S sells into 57 countries from 1,463 stores and 20 websites around the world (M&S, 2018, p. 1). More than 80,000 workers are employed to serve more than 30 million customers (M&S, 2018, p. 1).

Despite unstable economic conditions, in recent years, M&S recorded tremendous success has become the most preferred brand by the consumers because of focusing on product quality and value for money. Nowadays, however, revenues of Food and Clothes & Home sectors are down due to new global competitors that have grown market share. Currently, the company is committed to a program of transformation to fulfill the potential of the brand and deliver high-quality products to customers.

The NEXT retail chain was launched in 1982 when an exclusive collection of stylish clothes and shoes for women was presented in the first seven shops. Nowadays, NEXT is a UK retailer headquartered in Enderby, Leicestershire trading from 500 UK stores and 200 stores across Europe, Asia, and the Middle East (NEXT Plc, n.d., para 2). Having overtaken M&S, NEXT Plc is now the largest clothing retailer in the UK.

Approximately 40% of NEXT Brand stock is provided from its global supplier base with suppliers from 18 different countries (NEXT Plc, n.d., para 8). NEXT Plc also sells non-competing third-party brands and issues four LABEL catalogs a year. The company management is committed to offering clothing and homeware products of beautiful design and high quality that provide outstanding value to meet and exceed the expectations of customers.

Comparison of Method, Policies, and Presentations

All the information used for further discussion has been taken from annual reports of both companies for the year 2018. According to the consolidated income statement presented in the annual report of M&S, its total revenue after adjusting items is £10,698.2m, and the net profit is £29,1m (M&S, 2018, p. 77). For NEXT Plc, the total revenue after adjusting items is £4,117.5m, and the net profit is £591,8m (NEXT Plc, 2018b, p. 5). For M&S, gross profit is £4,047.3m, whereas, for NEXT Plc, gross profit is only £1,356.2m. Current liabilities of M&S include trade and other payables, partnership liability to the M&S UK Pension Scheme, borrowings, derivative financial instruments, and provisions. Current liabilities of NEXT Plc include bank loans and overdrafts, trade payables, and current tax liabilities.

Non-current liabilities of M&S include retirement benefit deficit, trade, and other payables, partnership liability to the M&S UK Pension Scheme, borrowings, derivative financial instruments, and provisions. Non-current tax liabilities of NEXT Plc include corporate bonds, provisions, and other liabilities. For M&S, the amount of the overall liabilities decreased in 2018 compared to 2017, whereas for NEXT Plc, the amount of the overall liabilities has practically remained the same. For M&S, approximately 40% of all total liabilities are classified under the current liabilities, whereas for NEXT Plc this number stands at 44%.

Non-current assets of M&S include intangible assets, property, plant, and equipment, investment property, investment in joint ventures, retirement benefit assets, trade and other receivables, and derivative financial instruments. Non-current assets of NEXT Plc include property, plant, and equipment, intangible assets, associates and joint ventures, and defined benefit pension assets. The overall total assets of M&S have decreased since 2017, whereas for NEXT Plc this amount has increased. For M&S, approximately 17% of the total assets are classified under the current assets, whereas for NEXT Plc this number stands at 70%. Since current assets with fewer inventories are the most liquid of all assets, one could note that M&S could have a liquidity problem.

Types of accounts used by M&S to record equity include issued share capital, share premium account, capital redemption reserve, hedging reserve, and retained earnings. Types of accounts used by NEXT Plc to record equity include share capital, share premium account, capital redemption reserve, ESOT reserve, fair value reserve, foreign currency translation, and retained earnings. For M&S, total shareholders’ equity is £2,954.2m, whereas for NEXT Plc, total shareholders’ equity is only £482,6m.

For M&S, basic earnings per share are 1,6p, whereas for NEXT Plc, basic earnings are share is 416,7p. Comparing with 2017, the EPS ratio for M&S has significantly decreased (from 7.2p to 1.6p in 2018), whereas, for NEXT, this ratio has decreased only slightly (from 441p to 416.7p in 2018). That is why one could state that investing in shares of NEXT Plc would appear to be more profitable.

Other financial assets of M&S include investments in debt, equity securities, and short-term investments. Other financial assets of NEXT Plc consist of equity securities, debt investments, and long-term investments in new retail space, online warehouses, furniture, and equipment. NEXT Plc recognizes its revenue as the sum of total sales from NEXT Retail, NEXT Online, NEXT Internal retail, NEXT Sourcing, LIPSY, and property management. M&S recognizes its revenue as the sum of revenue obtained from Food, Clothing & Home, UK, and International sectors.

For both M&S and NEXT Plc, taxation comprises a current and deferred tax. Deferred tax is calculated based on the predicted manner of realization of the carrying amount of assets and liabilities with the application of tax rates and enacted laws. M&S does not have deferred tax assets, and the deferred tax liabilities equal £255.7m. NEXT Plc has deferred tax assets in the amount of £5.8m but does not have deferred tax liabilities. Both M&S and NEXT Plc have retail stores, fixtures, and equipment as leasehold assets. Depreciation on leased assets is charged to the income statements on the same basis as owned assets.

For M&S, funded pension plans are in place for the company’s UK employees and some employees working overseas. The determination of pension net interest income depends on the discount rate, inflation rate, pensionable salary growth, and expected return on scheme assets. The M&S pension scheme is the defined benefit pension scheme or M&S Pension Savings Plan (“The M&S pension scheme,” n.d.).

Defined benefit is a type of pension scheme where a person has earned a pension payable for life based on the time they were in the scheme, final pensionable salary, and the accrual rate. NEXT Plc has implemented the UK’s auto-enrolment pension scheme to which employees are eligible to join after 3 months of service. If a person does not choose to join the “Next plan”, they will be automatically enrolled in the “People’s” pension scheme (NEXT Plc, 2018a). For qualifying employees, the company provides a Pension Salary Sacrifice scheme.

M&S presents its financial statement in the form of an annual report with the income statement, statement of comprehensive income, statement of financial position, statement of changes in equity, and consolidated cash flow statement. NEXT Plc presents its financial statement in the form of an annual report with the income statement, statement of comprehensive income, statement of changes in equity, balance sheet, and cash flow statement. Annual reports, as well as trading statements, trading updates, half-year reports, and other presentations, can be found on the official websites of both companies.

Ratio Analysis

Ten of the most important financial ratios of efficiency, profitability, liquidity, and leverage have been calculated to analyze and compare the financial performance of M&S and NEXT Plc and decide in which company to invest in. All the information used for further calculations has been taken from annual reports of both companies for the year 2018. The obtained ratios have been rounded to the nearest hundreds or tenth.

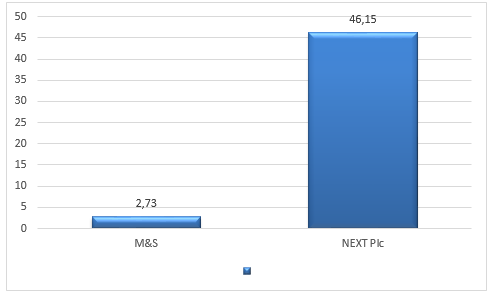

The current ratio is used to compare the current assets of a business with its current liabilities. A current ratio of 1,96 times for NEXT Plc is an indication that the company is well-placed to cover its current liabilities (see Table 1 and Figure 1). However, a current ratio of 0,72% for M&S speaks of the liquidity problem faced by the company and its inability to cover short-term obligations.

Table 1. Current Ratio Calculation.

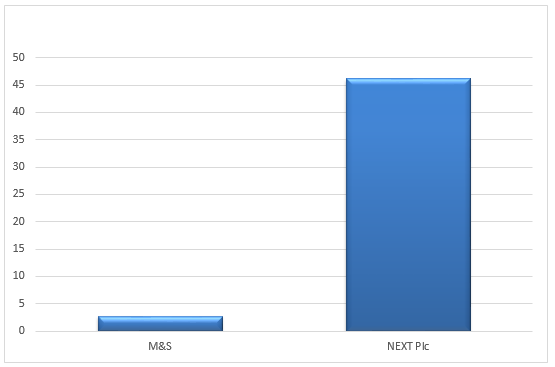

Being almost similar to the current ratio, the quick ratio represents a more stringent test of liquidity. Again, the “liquid” current assets of NEXT Plc cover its current liabilities, whereas the “liquid” current assets of M&S do not (see Table 2 and Figure 2). Based on calculated ratios of liquidity, NEXT Plc has a greater capacity to convert its assets into cash, whereas M&S is a less liquid business.

Table 2. Quick Ratio Calculation.

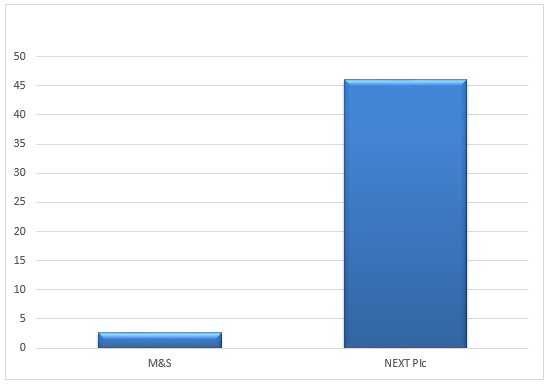

The consolidated income statement of M&S reveals a rather low net profit for the year 2018. As a result, the net profit margin ratio for M&S is low, too (see Table 3 and Figure 3). It shows that for every £100 in revenue, the company pays £99,73 in costs directly. The net profit margin ratio of NEXT Plc indicates that for every £100 in revenue, the company pays £85,6. The low net profit margin ratio of M&S can be explained by the implementation of a five-year program of strategic transformation.

Table 3. Net Profit Margin Ratio Calculation.

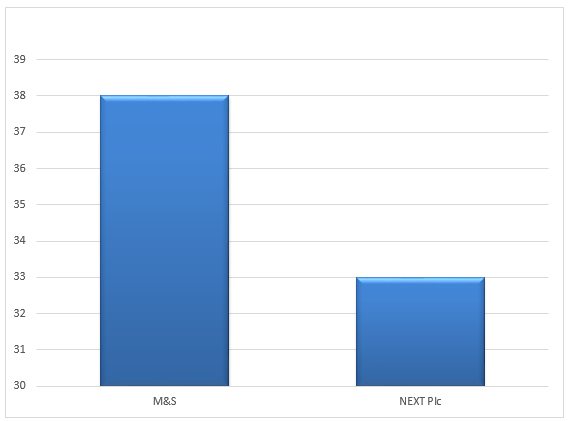

The gross profit margin relates to the gross profit of the business to the sales revenue generated for the same period. The ratio thus represents the relationship between sales revenue and gross profit. Gross profit margin ratios of M&S and NEXT Plc are almost the same, though M&S has a slight competitive advantage over NEXT Plc (see Table 4 and Figure 4). This may be explained by the pricing decisions of M&S and its production costs.

Table 4. Gross Profit Margin Ratio Calculation.

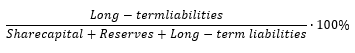

The gearing ratio measures the contribution of long-term liabilities to the long-term structure of the business. As shown in Table 5 and Figure 5, both M&S and NEXT Plc utilize loan finance. Based on its gearing ratio, NEXT Plc has excessive long-term liabilities which may be explained by NEXT’s store expansion. In comparison with NEXT Plc, the gearing ratio of M&S is considerably lower. Therefore, NEXT Plc is more susceptible to downturns in the economy.

Table 5. Gearing Ratio Calculation.

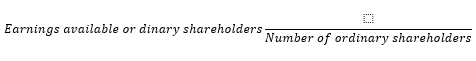

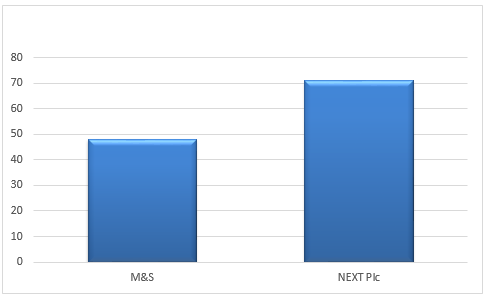

EPS ratio is considered to be a fundamental measure of share performance. This ratio is the bottom-line measure of a company’s profitability which shows the amount of net income that has been earned by each share of common stock. The EPS ratio of M&S is considerably lower than that of NEXT Plc (see Table 6). Therefore, it is possible to state that shares of NEXT Plc have greater potential to earn more net income than shares of M&S.

Table 6. Earnings per Share (EPS) Ratio Calculation.

The price-to-earnings ratio measures a company’s current price per share relative to its EPS. The P/E ratio of M&S indicates that an investor can expect to invest £154 in the company to receive £1 (see Table 7). The P/E ratio of NEXT Plc indicates that an investor can expect to invest £12,2 in the company to receive £1. THE high P/E ratio of M&S can be explained by big investments which the company makes using its recent profits. It can be assumed that investors are more confident in the future earning power of M&S than that of NEXT Plc.

Table 7. P/E Ratio Calculation.

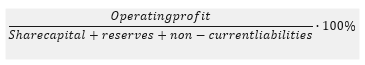

Return on the capital employed ratio is a crucial measure of a company’s performance and profitability. The effectiveness with which funds have been used is revealed by comparing inputs (capital employed) with outputs (earnings before interest and tax). The capital of NEXT Plc has been deployed with greater efficiency than that of M&S, even though the amount of M&S’s assets and sales is much greater (see Table 8).

Table 8. Return on Capital Employed (ROCE) Ratio Calculation.

Inventories often represent a significant investment for any kind of business. For both M&S and NEXT Plc, inventories account for a substantial proportion of current assets (59% and 27% respectively). AITP ratio of M&S means that, on average, the inventories held are being “turned over” every 43 days, whereas for NEXT Plc this ratio is higher and equals 67 days (see Table 9). In other words, significant AITP ratios of both companies can be explained by the fact that businesses use various inventories to satisfy customers. AITP ratio of M&S is better than that of NEXT Plc since it is costly to hold inventories.

Table 9. Average Inventories’ Turnover Period (AITP) Ratio Calculation.

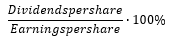

The dividend payout ratio is an investment ratio that is used to assess the returns on shareholders’ investments. The dividend payout ratio of M&S looks fairly alarming, though its dividend payout ratio for the year 2017 is needed for a reasonable comparison (see Table 10). However, one could mention that M&S uses cash reserves to pay the dividend, and this would be wisely regarded as imprudent since earnings could not be adequately invested back in the business.

Table 10. Dividend Payout Ratio Calculation.

Conclusion

Based on the above analysis, one could state that NEXT Plc is a more viable option to invest in. The financial position of NEXT Plc is better than that of M&S in terms of leverage, efficiency, profitability, and liquidity. The great restructuring campaign initiated by M&S’s chief executive Steve Rowe has not come cheap, and the one-off list for the year 2018 was long. As a result, even though the revenue generated is great, the net profit margin ratio of M&S is less than 1%. This does not allow for predicting how M&S will perform in the long run.

Currently, significant restructuring costs are associated with great strategy changes in M&S following a five-year strategic program aimed at the transformation of UK store estate, organization, IT structure, logistics, payments, and pensions. As M&S is only in the initial stage of reorganization, its consequences can hardly be predicted. Other reasons why it is not feasible to invest in M&S include problems with liquidity and funding that are well reflected in ratio analysis.

NEXT Plc is a more liquid and profitable business than M&S. Potential problems which NEXT Plc may face in the long run are associated with its excessive borrowing for store expansion. Since the gearing ratio of NEXT Plc is high, the company should consider increasing the asset base by using investment opportunities. In other respects, NEXT Plc shows better financial performance than its competitor. In particular, the business is fairly liquid, shares of NEXT Plc have great potential, and funds have been deployed appropriately.

References

The M&S pension scheme. (n.d.). Web.

M&S. (2018). Transformation underway. Web.

NEXT Plc. (n.d.). At a glance. Web.

NEXT Plc. (2018a). Distribution staff handbook. Web.

NEXT Plc. (2018b). Results for the year ending January 2018. Web.