Abstract

This paper dispels the misconception that investing in healthcare is not a prudent choice for investors seeking long-term growth and stability. The introduction explains the importance of healthcare real estate to the construction sector and the broader built environment industry. The rationale behind the study is the importance of investing in healthcare, which occupies a significant niche in the construction industry. Next, a review is conducted on some existing investor misunderstandings. In the introduction’s final part, this work’s aims and objectives are indicated.

The central part of the paper is a review of relevant literature. Before reviewing the data from the selected sources, the approach chosen for working with them is announced. The general approach used to examine and review the topic was an analytical synthesis of scientific sources. Following that, the methodology for working with sources and the stages carried out during the study are outlined.

The analysis of materials begins with work on subsequent material, after which the research topic is extensively expanded. Numerical indicators and diagrams are provided for greater clarity. In conclusion, the key points of the study are summarized once again.

The related findings summarize that healthcare real estate is a good alternative investment opportunity in the UK. Essential conclusions are that the healthcare industry contributes a lot not only to global GDP but also to the GDP of the United Kingdom. After that, limitations and weaknesses are critically evaluated, and recommendations are provided based on a carefully conducted analysis. Recommendations for investors suggest that entrepreneurs should consider this area due to its stability and significant dividends. The last stage of the work includes implications for future practice and research, which demonstrate the feasibility of writing this work.

Introduction

Importance to Construction & Wider Built Environment Industry

Investing in healthcare real estate is important because it is a vital component of the UK’s wealth. It accounts for more than 20% of the value of all tangible assets (Hofman & Aalbers, 2019). According to some estimates, the value of all real estate in the UK healthcare sector that meets established quality standards is £ 500 billion.

Healthcare real estate occupies a considerable place in the portfolio of various assets. More than 50% of all individuals in the UK are homeowners, so real estate is included in their personal investment portfolios. Real estate also holds a significant share in the structure of enterprises’ and organizations’ assets, as well as in federal and municipal state budgets (Hofman & Aalbers, 2019). The impressive value of this part of the investment market emphasizes investments in healthcare real estate.

There are several approaches to assessing the capacity of the real estate market as an investment area. They all show that investment in healthcare real estate is vital in the construction and built environment industry. This work demonstrates the feasibility of this process for investors, making it a valuable tool for attracting them (Hofman & Aalbers, 2019). The paper will contribute to the wider built environment industry by attracting new funding in this area.

Misunderstanding

There is a misconception that healthcare real estate is always in demand, partly because it is a valid real estate property as an investment asset. Unlike most other investment assets, healthcare real estate cannot lose value completely. Cases of loss of healthcare real estate in force majeure circumstances, such as fire or natural disasters, must be covered by insurance (Tennison et al., 2021). Suppose there is a risk of bankruptcy of the issuer of securities, and the holder of such securities does not receive tangible assets. In that case, the buyer of healthcare real estate receives real, tangible square meters.

Thus, healthcare real estate is endowed with the properties of protective assets, such as precious metals. However, unlike other protective assets, healthcare real estate can generate both current rental income and income from value gains. Healthcare real estate is similar to other investment assets, such as stocks or bonds, which provide current income as dividends or interest (Gillespie, 2020). Due to the current income, the risks associated with a possible decrease in the cost of healthcare real estate are hedged. The investor can remain in the black, even when selling an object at a price lower than the purchase price, thanks to the accumulated rental income.

However, when choosing an investment instrument, it is essential to consider additional parameters that are often overlooked. These include liquidity and the cost of ownership, as well as the tax burden. From this position, UK healthcare real estate, contrary to existing misconceptions, benefits from such protective instruments as bank deposits (Tennison et al., 2021). In addition to high liquidity, interest income on deposits is not subject to personal income tax.

Rental income from healthcare real estate is subject to personal income tax. The current profitability of healthcare real estate, as measured by rent net of tax payments, often lags behind the profitability of bank deposits (Tennison et al., 2021). In this regard, healthcare real estate becomes a competitive investment asset, as it not only generates rental income but also increases value, contrary to common misconceptions.

Aim & Objectives

The purpose of this work is, first and foremost, to identify the key features of the analysis of the healthcare real estate market in the modern UK. Among the tasks of the paper is also to define the concept of healthcare real estate, as well as its organizational and legal features as an investment object, thereby affecting the effectiveness of investment projects (Tennison et al., 2021). The paper examines the methods and approaches to investment analysis in healthcare real estate.

To achieve this goal, it is necessary to solve the following tasks. Understanding the fundamentals and core concepts of investing in healthcare real estate is essential. Next, it is necessary to analyze the features of healthcare real estate of an investment nature (Gillespie, 2020). After that, it is necessary to characterize the main financing participants in healthcare real estate. It is then worth exploring the primary forms and tools of investing in healthcare real estate. After that, it can be traced how the market value of the assessed healthcare real estate object is calculated.

Review of Relevant Literature

Approach Chosen

The chosen approach – analytical synthesis of scientific literature – is based on a change in the sequence of presentation of the author’s thoughts. As part of the study, selecting the material carefully, including fragments at appropriate moments, and referencing the source were necessary. At the same time, the main idea had to be intertwined with the proven hypotheses of other authors, and the position had to be described in a reasoned manner.

The analytical synthesis method is based on principles such as evaluating a scientific text and interpreting its content without distorting its meaning. In fact, this technique is designed to select the most significant and appropriate fragments. At the same time, it is essential to preserve the context and meaning of the source and use it correctly and appropriately in scientific research.

Research Stages

First, the actual material was qualified for various reasons, and statistical sequences and distribution polygons were formed. Furthermore, trends in the development of stability and jumps in forming the qualities of the experimental object and research subject were revealed. Inductive and deductive generalizations of factual material were constructed in accordance with the requirements of representativeness, validity, and relevance.

Based on objectively recognized patterns, a retrospective revision of the proposed hypothesis was conducted to elevate it to the level of a theory, which proved to be sound. What followed was the formulation of general and particular consequences in this theory. Then, there was an assessment of the adequacy of research methods and initial theoretical concepts to enhance and improve methodological knowledge and integrate it into the general system of scientific methodology. At the final stage of research, the applied part of the theory, addressing various categories of investors, was developed.

Analyzing Subsequent Material

The subsequent material was analyzed by comparing it with what is already available in science. The results were described in a text referencing statistical indicators, including the values of correlation coefficients and statistical criteria for differences, which indicated the reliability of the differences or relationships obtained. When describing the results, attention was paid to the sequence of presentation of the facts. Since there was a large amount of empirical material, the data were grouped according to theoretical concepts and progressed from the general to the particular in the description.

Thus, the correlation analysis of the subsequent material should have revealed a large number of significant correlations. Mechanically enumerating and describing each relationship separately was laborious. Therefore, general patterns emerged in the resulting correlation pattern. This was achieved by selecting the columns or rows of the correlation matrix that yielded the largest number of relationships and analyzing them collectively. Such an analysis of the subsequent material helped to discover and reveal meaningful patterns.

Expanding Research Topic

Investment Attractiveness

Investment attractiveness is a set of factors and indicators that characterize the features of the investment climate, including production, commercial, financial, and managerial activities, and provide evidence of the feasibility and necessity of investment. Investments are the allocation of material, information, or management resources in various activities to generate a profit (Bailey et al., 2021). A competent investment policy enables you to attract additional investments on favorable terms and effectively strengthen and utilize your financial position.

Healthcare is the most important, socially significant, and comprehensive branch of any country’s economy, and the level of its development significantly determines the state’s overall development. The healthcare system covers all levels of the UK’s economy (Horton, 2019). It is closely related to ecology, social programs, and labor protection, and these characteristics determine the investment attractiveness of this industry.

Healthcare needs an increased inflow of investments to create and ensure an optimal level of services and interaction with citizens. The presence of favorable conditions for the positive reproduction of human capital determines the current state of the entire economy. It follows that the key to success is investment in human capital (Joghee et al., 2020). They will significantly enhance the quality level of medical organizations and develop new programs that address various problems in this industry.

Healthcare has long been a field of activity that was strictly regulated by the state. The reason for this is that the services and programs of the healthcare system are directly related to human life and health. State regulation of the activities of institutions in this industry, including control over management and pricing, as well as attempts to fully finance healthcare from the state budget, have caused the late and incomplete introduction of modern methods and management techniques, including marketing (Fenech & Buston, 2020). However, healthcare cannot exist only at the expense of the state. Therefore, a significant portion of the costs is shifted to service consumers and insurance organizations, resulting in changes in the financing of healthcare institutions that serve as a prerequisite for the adoption of new economic methods for managing medical organizations.

Reasons for the Growing Popularity of Investments in Healthcare

Investments in healthcare facilities in the UK are becoming more popular for several reasons. First of all, this is an increase in older adults. According to Joghee et al., the number of older adults in the UK is expected to increase by one and a half times from 2020 to 2050, with every sixth resident being over 60.

Another reason is an increase in life expectancy (2020). According to forecasts from statistical agencies, life expectancy in the UK is expected to increase from 2020 to 2050, from 85 to 88 years for women and from 81 to 86 years for men. By 2065, the average life expectancy in the UK may reach 98 years (Newell & Marzuki, 2018). Additionally, the growing popularity of investments in healthcare may also contribute to the prevalence of insurance and subsidies.

In developed countries, most of the population uses health insurance, so the healthcare industry is capital-intensive. Government subsidies are also available — both in the form of direct payment of part of citizens’ expenses and in the form of preferential loans and support programs for market participants (Horton, 2019). All these factors contribute to the growing interest in and popularity of investments in healthcare in Great Britain.

Definition of Healthcare Facilities

Healthcare facilities are an alternative asset class. Real estate of this type includes any premises where medical services are provided. These are outpatient treatment centers, intensive care facilities, emergency departments, various hospitals, specialized centers, offices of private doctors, centers for the care of the sick and elderly, health and wellness centers, pharmacies, and more. The share of such investments in the UK market is 10-15% (Horton, 2019). Funds wishing to diversify their portfolios invest mainly in healthcare facilities.

Many client investors are actively interested in nursing homes, some of which are pharmacies. There are many borderline-type objects in this segment: for example, medical office buildings, which, in fact, are office real estate, with the only difference being that doctors occupy offices. Medical institutions often become tenants in the facilities of such large retail chains (Fenech & Buston, 2020). This trend is called the retailing of healthcare. Medical centers are often located in mixed-use complexes along with shops and offices.

Factors Taken into Account When Choosing a Healthcare Property

When choosing a property in the healthcare facilities market, it is worth paying attention to the demographic situation on the market, namely, the growth in the number of older adults in the UK. It should also consider the number of similar, successfully operating institutions and how the profitability of the purchased object correlates with the profitability of competitors’ organizations (Newell & Marzuki, 2018). It is necessary to pay attention to the proportion of clients treated under insurance or government programs during the contract period between the insurance company and the medical institution.

There are also individual features for each type of healthcare facility. For example, suppose we are discussing clinics, rehabilitation centers, and facilities that care for the sick and elderly. In that case, it is recommended to invest in facilities that are not a complex of individual buildings, but rather a single building with at least 150 seats and several wings (Ahmad et al., 2021).

It will also be advantageous if the facility meets the service standards of four-star hotels, has open public spaces, modern security systems and infrastructure, and a pharmacy, cafe, and parking on the territory. The optimal proportion of single wards is 95%, the room area is more than 16 m2, so that, if necessary, it can be turned into a double room (Ahmad et al., 2021). It is recommended that the wards have bathrooms and balconies with a minimum occupancy rate of 80%. When choosing a healthcare facility for investment, one should consider whether it is possible in the future to convert it, for example, into an office.

When investing in medical offices in shopping malls, the room should be suitable for conversion so it can be rented to retailers or other suppliers if the medical services operator moves out. If the room is equipped for a specific tenant and he suddenly moves out or becomes bankrupt, there is a risk that it will be costly to adapt the object to a new tenant, and rental rates will drop significantly (Newell & Marzuki, 2018). On the other hand, this risk is offset by the fact that both the number of service users and the industry as a whole will grow, which means that the welfare of tenants will also improve. This and other information about the object can be obtained with a comprehensive check of the property with the participation of lawyers.

Nuances of Choosing Investment Object

The main problem of investors investing in healthcare facilities is the lack of information about the operator and the business. Unfortunately, this real estate sector is not as transparent as office or retail, so it is essential to learn as much as possible about the specifics of investments. Experts recommend choosing reliable countries for investments in healthcare facilities.

Austria, Germany, the USA, France, and Switzerland are among them. The UK is also included in this list, as it is distinguished by a high standard of living, good purchasing power of the population, and a large proportion of older adults (Horton, 2019). When choosing a local market, it is necessary to pay attention to the demographic situation and the demand for medical services, transport accessibility, and the availability of a sufficient number of qualified personnel in the region. It is worth choosing objects away from noise sources, railways, highways, factories, and nearby residential areas.

Market Entry Threshold

In the UK, healthcare facilities on the secondary market cost around 1.5 – 2 thousand pounds/m2, and healthcare facilities on the primary market cost around 2.6 – 3.1 thousand pounds/m2 (Fenech & Buston, 2020). Individual medical offices in the UK can be purchased for less than 1 million pounds (Newell & Marzuki, 2018). Small hospitals outside the central districts are sold for 2 million pounds, and higher-quality ones can be purchased starting from 9 million (Ahmad et al., 2021). In London, for 15 million pounds, one can buy a modernized plastic surgery center leased to a large tenant for 10 years, possibly extending the contract for another 10 years (Joghee et al., 2020). The yield is 5.56%, and the annual income is about 800 thousand pounds (Alam et al., 2021).

Profitability

In general, healthcare facilities are more profitable than offices because the former have higher depreciation risks, and as such, real estate becomes obsolete faster. Premium-class premises in the best locations of significant cities bring 4-6% per annum (Joghee et al., 2020). The profitability of lower-quality facilities in peripheral locations of provincial cities can reach 8-10% (Newell & Marzuki, 2018).

In the UK, the average profitability of healthcare facilities is 6.8%, but it can vary in regions from 5 to 8% (Horton, 2019). Premises in elite office buildings bring about 4.6% per annum, and less expensive hospitals leased for 20 years, about 7% (Ahmad et al., 2021). Primary care centers and nursing homes bring an average of 5.6%, inpatient facilities — 6%, and specialized medical centers — 6.6% (Ahmad et al., 2021). At the same time, the maximum initial yield for modern facilities with a reliable operator reaches 8.6% (Bailey et al., 2021). The minimum investment threshold for healthcare facilities in the UK is, on average, 1 million pounds (Bailey et al., 2021).

Management and Rental Features

In the UK, many healthcare facilities are built and managed by large international companies and are often built for a specific tenant. Private investors invest the main funds in such projects, and the state acts as a guarantor and ensures that agreements on loan repayment and rental income are observed (Newell & Marzuki, 2018). Such a scheme makes it possible to provide the population with medical care without public funds.

There are medical centers that are rented out to one large tenant and facilities that are rented out to many tenants. For example, 50% of the premises can be rented by network employees, a provider of medical services, and 50% by independent private doctors (Bailey et al., 2021). Often, such facilities are leased to medical institution operators.

When choosing a healthcare facility, getting detailed information about the operator is essential. It includes the number of clinics under management and the share of rent from total revenue; at the same time, the recommended share is 14-23% (Joghee et al., 2020). The rate of return at the same time is at least 43.5% per annum, with rental indexation of up to 5% per year (Horton, 2019). It is also necessary to find out the profit amount and the recommended rental ratio of profit before taxes, interest, depreciation, amortization, and rent, which is 1.6 – 3 (Horton, 2019). It is also necessary to identify upcoming personnel costs, compensation, and risks in the long term.

The lease term is usually 4-6 years for small premises and 20-25 years with the possibility of extension or indefinitely for medical centers (Newell & Marzuki, 2018). Fixed-term contracts for more than 100 years, called leaseholds, are standard in the UK (Ahmad et al., 2021). For example, in 2020, the American company Alpha Estate bought a nursing home in the UK with medical care, concluding a lease agreement for 150 years (Alam et al., 2021).

Forecasts for the Healthcare Facilities Market in the Future

Among the main trends in the healthcare facilities market are the increase in private clinics and the emergence of medical coworking. The demand for private clinics will grow in those countries where, due to the large public debt and the need to reduce social security programs, there will not be enough public clinics to meet the demand from an increasing proportion of the population over 60 years old (Bailey et al., 2021). These countries include Spain, Italy, France, and the United Kingdom (Newell & Marzuki, 2018). In addition, medical coworking, which is shared premises for the provision of medical services, will become more and more popular. Rental of facilities is becoming more expensive, and many healthcare sector workers are already ready to save money and rent premises on timeshare or shared workspace terms.

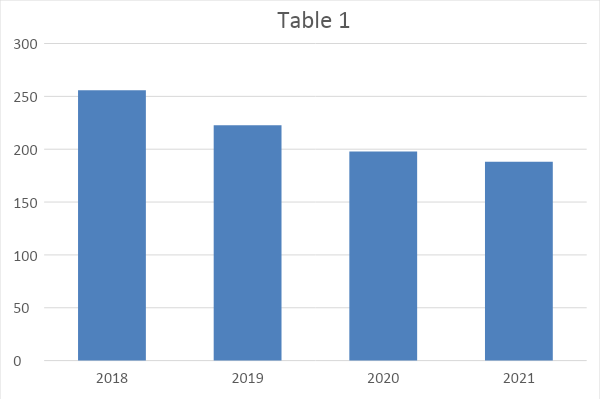

Dynamics of the Size of Investments in Real Estate Healthcare

For a comprehensive analysis of this topic, it is necessary to investigate the dynamics of the size of investments in the UK healthcare sector, presented in Table 1. Based on the analyzed data, it can be concluded that investment levels in UK healthcare real estate are generally rising. This indicator reached its maximum in 2018 and amounted to 255.9 thousand pounds at comparable prices (Newell & Marzuki, 2018).

Currently, there is a concept of socio-economic development of the UK for the period up to 2020, where methods and ways of developing a strategic partnership between the state and business are formulated (Bailey et al., 2021). One of the main issues is eliminating unequal competition between public and private companies. Increasing the attractiveness of investment in the healthcare sector remains a key task. As a result, public-private partnerships are being formed in this area, which makes it possible to reduce mortality from controlled factors and causes, increase the birth rate, modernize the medical care provided, increase life expectancy, and save budget funds.

The positive impact of investing in healthcare real estate is difficult to overestimate, and its profitability for investors is obvious. It follows that the growth of investments in healthcare real estate significantly affects the development of this industry. It improves the quality of medical services provided and allows the use of modern technical developments (Newell & Marzuki, 2018). In addition, the investment contributes to the introduction of reliable treatment programs for various diseases and improves the management corps.

The public-private partnership in healthcare real estate is as follows. The state undertakes to purchase long-term services from a private partner and pay for the high-quality services they provide. The private partner, in turn, undertakes to provide services in accordance with the criteria of the established state order. They must also maintain, modernize, or create new assets necessary to maintain the quality and quantity of services provided (Alam et al., 2021). This approach will enhance the appeal of investing in the healthcare real estate industry and significantly boost the sector’s development in the UK. Thus, increasing the investment attractiveness of healthcare real estate and, as a result, creating public-private partnerships in this area is the most critical state task that will ensure the country’s population has high-quality medical care.

Conclusion

Key Points

According to the literature analysis conducted, the growth of investments in private medicine will continue. The share of medical services in the structure of all paid services provided in the UK is steadily increasing, which means the industry’s attractiveness is growing in connection with the aging of citizens, and diseases that they had not lived with before have become relevant. Therefore, a private clinic can combine the desire to be a successful commercial institution and be where new life meanings are formed in severe cases, including cancer patients. Patient satisfaction will become the most crucial attractive factor for investment. All these factors make healthcare real estate in the UK more attractive to investors.

Limitations & Weaknesses

The primary consideration in the collection was to ensure the accuracy of the information provided by the organizations. Firstly, the collected data relate to different years because they were obtained from various studies, the frequency of which varies, and some are even single. Such a situation could create some distortion in the studied dependencies.

Secondly, not all the data were available to the UK since the primary data were collected as part of various studies conducted on a sample of EU countries. However, not all of the variables were necessary for regressions, and some of them were insignificant. In addition, this problem was solved by constructing several regressions. Finally, some measurable variables, such as investment profitability measurements and the interest index itself, are subjective and may not reflect the real situation.

Another limitation in the work is the possible endogeneity. Most of the personal characteristics of investors cannot be measured by numerical indicators; that is, each variable is influenced by other factors, such as reputation, investor character, and others. It is possible to assume that the independent variables may be influenced by other factors embedded in the explanatory variables. There are various methods of combating endogeneity.

Firstly, the fixed effects method is used in the work, allowing us to consider implicit relationships between factors; thus, the probability of endogeneity is reduced. Moreover, instrumental variables can be used in the model; the difficulty lies in selecting suitable ones. These variables must meet the validity and relevance conditions, which are difficult to find.

Thirdly, standard variables, most often used in this research, were taken as model control variables. However, as the regression analysis showed, not all of them turned out to be significant; therefore, there are further ways to improve the quality of models. Perhaps more control variables should have been added to the work, allowing for more accurate results.

Recommendations

For investments in healthcare real estate to bring income, it is necessary to follow a specific algorithm. First, it is worth studying the market situation, namely, what real estate is in demand, what buyers are looking for, and what the average prices are for objects with interesting locations or areas with developing infrastructure. In addition, one should make sure that sellers, developers, tenants, and intermediaries are reliable. It is necessary to check the documentation, reviews, rating, reputation, and the presence of litigation and downtime. To purchase, one should choose a liquid object. Generally, the healthcare real estate sector in the UK is stable, and if these recommendations are followed, it is possible to increase capital with its help.

When choosing objects for investing in healthcare real estate, it is necessary to study the legal aspects. Lack of attention to this side of investing is one of the most serious mistakes that even experienced investors often make. The acquisition of an object with incorrect documentation may lead to the investor being unable to get the expected profit and implement their projects, making them illiquid. At the same time, it is necessary to follow the news and trends in the healthcare real estate industry in the UK to understand what events can affect prices and demand for properties.

Implications for Future Practice & Research

The future practice of problem research is the possibility of applying the results in the activities of investment profile organizations. The success of a business in a market economy is primarily determined by the quality of information on which responsible financial decisions are made. That is why the collection and analytical processing of information, including market information, in this work are the subject of a separate study from a scientific and methodological point of view and the subject of independent business.

For future research, this paper can help track the parameters necessary to justify adopting specific investment decisions. For example, its use may be necessary when calculating the market and investment value of a healthcare property, which depends on the value of the property. It, in turn, is conditioned by the ability of the object to meet specific needs and ensure the rights and benefits of the owner as a result of the ownership of this real estate object.

The combination of these factors, taking into account the costs of creating or acquiring an object of ownership, determines its value. In the property valuation theory, the following is a brief definition of the market value of an object. The market value of an object is a measure of how much a hypothetically typical buyer is willing to pay for an appraised property. This parameter, touched upon in this paper, can be considered more deeply in further studies.

References

Ahmad, W., Kutan, A. M., & Gupta, S. (2021). Black swan events and COVID-19 outbreak: Sector level evidence from the US, UK, and European stock markets. International Review of Economics & Finance, 25(7), 546-557. Web.

Alam, M. M., Wei, H., & Wahid, A. N. (2021). COVID‐19 outbreak and sectoral performance of the Australian stock market: An event study analysis. Australian Economic Papers, 60(3), 482-495. Web.

Bailey, Z. D., Feldman, J. M., & Bassett, M. T. (2021). How structural racism works: Racist policies as a root cause of U.S. racial health inequities. The New England Journal of Medicine, 384(11), 768-773. Web.

Fenech, M. E., & Buston, O. (2020). AI in cardiac imaging: A UK-based perspective on addressing the ethical, social, and political challenges. Frontiers in Cardiovascular Medicine, 7(16), 648-650. Web.

Gillespie, T. (2020). The real estate frontier. International Journal of Urban and Regional Research, 27(1), 599-616. Web.

Hofman, A., & Aalbers, A. B. (2019). A finance- and real estate-driven regime in the United Kingdom. Geoforum, 100(4), 89-100. Web.

Horton, A. (2019). Financialization and non-disposable women: Real estate, debt and labor in UK care homes. Environment and Planning A: Economy and Space, 54(1), 494-513. Web.

Joghee, S., Dubey, A. R., & Alzoubi, H. M. (2020). Decisions effectiveness of FDU investment biases at real estate industry: Empirical evidence from Dubai smart city projects. International Journal of Scientific & Technology Research, 9(3), 3499-3503. Web.

Newell, G., & Marzuki, J. (2018). The increasing importance of UK healthcare property as an alternate property sector. Journal of Property Investment and Finance, 36(3), 1-31. Web.

Tennison, I, Roschnik, S., Ashby, B., Boyd, R., Oreszczyn, T.,Owen, A., Romanello, M., Ruyssevelt, P., Sherman, J. D., Smith, A. Z., Steele, K., Watts, N., & Eckelman, A. B. (2021). Health care’s response to climate change: A carbon footprint assessment of the NHS in England. The Lancet: Planetary Health, 5(2), 84-92. Web.