Introduction

KIMCO Reality is a REIT (Real Estate Investment Trust) company that is mainly based in the United States, Canada, and South America (Deloitte 4). As a REIT company, KIMCO Reality owns and runs multiple real estate properties that mainly include shopping centres. The backbone of KIMCO operations is in the US where the company operates the largest database of shopping stores in 44 states.

In total, KIMCO operates over 900 shopping stores within North America and South America included in a leasable area of over 120 million square feet. KIMCO Reality trades at the NYSE (Emily 128).

The focus of NYSE includes acquiring, developing, and running multiple shopping centres within the US, North America and South America. Despite multiple challenges in the real estate industry, especially the REIT segment, REIT presents a range of opportunities to investors (Deloitte 4).

Economic Status

The US economy is still recovering from the recession that started a few years back. Multiple sectors of the economy, including the real estate sector, are heavily reliant on the state of the economy. Although some economists are of the opinion that the US economy will need more years to completely emerge from economic recession, a range of indicators predict an improving economy.

The rate of unemployment is now 7%; thus, indicating that thousands of jobs are starting to re-emerge in the market (Deloitte 4). Over the last three years, the US economy has grown by an average of about 2.5% (Deloitte 4). Although such a growth is below the 3% threshold required to create considerable jobs for the economy, a positive growth has contributed to the expansion of the US economy (Andrew 87).

Generally, the US economy provides a good business environment for companies. Here, the US consists of a capital market regulated by appropriate legal provisions and a suitable environment for business growth. The US is mostly an industrial service economy; hence, a relative high wage bill for workers.

Although a high wage bill presents US consumers with a capacity to invest in high expense opportunities such as in real estate, such a direction is resulting in several shortcomings. Multiple multinational companies have transferred operations from the US to cheaper labour markets such as China.

However, although many economies in South America and North America remain affected by the economic crisis, Canada is making significant progress in strengthening her economy; thus, providing a strong base of future investments in real estate. Moreover, despite the economic crisis, the US accounts for a total of about 45% of all real estate securities (Deloitte 5).

Population Trends

The US consists of a large, multi-racial, and multi-ethnic population. The current population of the US stands at about 320 million people. Here, European whites form about 65% of the US population. About 13% of US citizens are African Americans while the Hispanic population is about 16%. However, there are a large number of undocumented immigrants in the US (Deloitte 4).

The estimate number of undocumented immigrants range from 12 million to 30 million (Deloitte 4). The average birth rate in the US stands at about 1.85% (Deloitte 4). The replacement rate is just below 2. Such a direction would imply a decreasing population (Emily 128).

However, the high number of immigrants who enter the United States from Mexico and other parts of the world is contributing to a high population increase in the United States. The proportion of Hispanics is especially projected to increase significantly in the near future.

Despite a high number of Hispanic immigrants who cross to the United States from Mexico, Mexican women have a higher birth rate when compared to white women (Andrew 89).

However, such a projection can change as a result of decreasing birth rates among Mexican women who permanently settle in the US. About 38% of the US population consists of persons aged 25 years and below. On the other hand, senior adults (aged 65 years and above) form about 12% of the US population (Deloitte 8).

Capital

Capital investments in REIT companies are on an upward trend. Here, an array of parameters that include good cash flows in REIT companies, the weakening of the US dollar in comparison to other currencies and partnerships between the US REITS and foreign subsidiaries contributes to high investment in REIT securities (Emily 128).

Currency Risk

Because of its use as the main currency of trade in the international market, the US dollar is a very stable and low risk currency as well. However, currency risks could occur from a necessity to exchange into other forms of currency that are rarely used in the international trade.

Taxation

Usually, REIT companies are under a legal obligation to pay a minimum proportion of 90 percent income to shareholders. KIMCO pays as much as 100% of its income to shareholders (Emily 128). As such, REIT companies are not under an obligation to pay corporate tax (Deloitte 11). However, shareholders pay tax on dividend benefits (Deloitte 7).

Market

The backbone of KIMCO operations (about 80%) is in the US where the company operates the largest database of shopping stores in 44 states. In total, KIMCO operates over 900 shopping stores within North America and South America included in a leasable area of over 120 million square feet (Deloitte 3).

The focus of KIMCO is thus in the operation of shopping canters. In 2009, KIMCO initiated a program of disposing unusable assets. As a result, KIMCO disposed over 80 assets valued at about $850 million.

Apart from disposing non usable assets, the management of KIMCO is acquiring strategic properties in the international REIT market. Such a direction is leading to the strategic growth of KIMCO. Indeed, KIMCO’s path for growth has remained clear over the past years.

MOAT/ Competitive Advantage

A critical requirement for companies to grow is a recognition and use of competitive advantages against rivals. One if the most distinct factors present in KIMCO, unlike other REIT companies in the US, includes its low cost capital. KIMCO utilizes low cost funds in strategic investments. Such a direction is leading to a high return to capital ratio; thus, increasing the value of KIMCO shares (Andrew 87).

Here, KIMCO has a knack of disposing non critical assets as well as obtaining new strategic assets. Because the shares of KIMCO are projected to continue in an upward trend in the coming years (due to an effective use of cheap capital there), the idea of a MOAT holds in KIMCO.

Investors can thus buy KIMCO shares at the current price (cheap) with an expectation that the shares will significantly increase in value in the following years (Deloitte 4). The latest report of the 2012 first quarter financial results indicate a robust management of resources. Here, the total asset value of KIMCO stores stands at just over one billion dollars.

Moreover, KIMCO sold over 1.6 million square feet of leasable space for undisclosed value. The management of KIMCO consistently evaluates low performing stores with a view of increasing income. Robust management and investment at KIMCO is leading to a significant increase in the total value of the company (currently valued at about 16 billion dollars).

Issues of Control

All important indicators of performance such as growth in profits, increase in share price, and a high income to capital ratio point to good results at KIMCO. The high performance KIMCO is mainly as a result of an effective management team which is not deterred by the main shareholders.

The interest of the management to increase the value of KIMCO mainly aligns with the interest of shareholders to increase the value of their assets (Andrew 87). No series conflicts of interest have been reported between the KIMCO management and major shareholders. Still, there are clear provisions on the handling of disputes that could arise between the management and the major shareholders.

Top Shareholders

A number of institutions form the top ten shareholders of KIMCO group. About 7 billion of the total equity at KIMCO is from institutions while about 4 billion is from mutual funds. On the other hand, insiders contribute about 230 million dollars of the total equity at KIMCO. The table below provides the detail of major shareholders at KIMCO group (Deloitte 15).

Table 1: Current Top Ten Shareholders at KIMCO

Source: Investors.morningstar.com

As indicated in the table above, there is no institute/individual that is currently holding shares worth over 7%. However, a number of major shareholders offloaded significant amounts of KIMCO shares in previous trading. Such a direction is inevitable due to the ever increasing price value of KIMCO shares.

Short Positions

As of mid October 2012, about 20.5 million shares were sold short. Here, the number of short position shares reduced by about 2% from the previous session of trade.

Incentive for Managers

Like any other large corporation, KIMCO group is designing programs that compensate the top management for performance. KIMCO management is paid on two variables. Therefore, part of the salary for KIMCO management is fixed. On the other hand, part of the salary for KIMCO management is based on performance.

The high level of performance witnessed at KIMCO in the past years is a direct result of effective management. A program that adequately compensates the top management to improve performance is therefore fruitful in enhancing the capacity of KIMCO.

Benchmark

In comparison with other REITs companies in the US market, the performance of KIMCO is top class. The consideration of performance parameters such as stock value, profits, ratio of income to capital, among others indicates a top performance at KIMCO group (Andrew 87).

KIMCO remains among the high yielding REITS at the New York Stock Exchange. Besides, KIMCO is among the best performing REITS that specialise in the management of shopping canters. KIMCO has a healthy leverage ratio. Here, the ratio of debt to equity is about 0.8 (Deloitte 4).

Analysis

Performance

As noted earlier, the financial performance of KIMCO has generally been good. The use of cheap capital to invest in strategic properties is paying off for KIMCO management. The balance sheet of KIMCO group is generally good. Although KIMCO group is among the highest yield performers in the US REITs, dozens of other REITs produce better yields than KIMCO.

However, KIMCO is among the best performing REITs in terms of low leverage ratio. Investors that buy KIMCO shares are thus guaranteed of consistent (about 0.2 dollar per share) returns on their shares over a long-term period (Emily 128).

Since the yield on KIMCO shares is consistent over a long period of time, KIMCO shares offer a better alternative to investment that treasury rates. Figure 2 shows the value of 10 year bond treasury rates in previous years. As it can be seen below, the value of treasury rates has significantly decreased over the past years.

On the other hand, the value of KIMCO shares is steadily increasing due to increasing equity there. It is therefore more profitable to invest in performing REIT shares, such as KIMCO shares, than in treasury bonds.

Short term investors can exploit the large MOAT capacity at KIMCO to sell shares at a much higher price in the future. The cap rate of KIMCO stands at a healthy 6%. Moreover, long term investors can hope for consistent returns on invested shares.

Still, it is important to note that at an average of 20 dollars, KIMCO shares remain overvalued. A theoretical valuation of KIMCO shares yields a market value of about 15 dollars. Since KIMCO shares are currently trading above their theoretical value, some stock market analysts are advising investors to wait for the stock value of KIMCO shares to fall before buying.

However, a consistent and a high dividend payout may contribute to a high value of REIT shares (Emily 128). Although a fluctuation in real estate prices (as it happened at the start of the US economic crisis) may affect real estate companies including REITs, the focus of REITs on property management can help to limit the risk of property fluctuations (they can always generate income by running business properties).

Figure 2: Graph showing the value of treasury rates (10 year) from 1980-2010

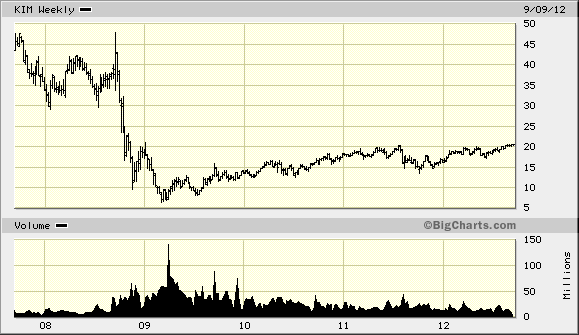

Figure 3: Five Year Share Chart

Key Ratios

As observed earlier, KIMCO is among the US REITS with a low leverage ratio. Currently, KIMCO’s leverage ratio stands at a healthy 0.8%. KIMCO is showing signs of improvement over the past years due to a falling leverage ratio.

For example, the leverage ratio has decreased from 1.25 in 2008 to just 0.8 in 2012. KIMCO’s cape rate (return on capital rate) is also very healthy at 6.0%. On the other hand the WACC (Weighted Average Cost of Capital) discount rate for KIMCO group is 10.0%.

Financial Recap

Figure 4: Financial Recap for KIMCO: 52 Weeks Period

Generally, the data above shows a healthy financial performance at the KIMCO group. Importantly, multiple parameters above ascertain the capacity of KIMCO group to perform consistently in the coming years. For example, the share price of KIMCO group is within a stable range.

Besides, most of the shares at KIMCO group (97%) are held by institutions; thus, helping to stabilize the share price of KIMCO shares due to the long term interest of institutions. Apart from having a significant rate of yield return, KIMCO returns considerable dividends from yields; hence, offering a good opportunity for real security investment (Andrew 87).

Legal Risks

Like other business corporations, REITs can encounter multiple legal risks. Since KIMCO and other US REITs are mainly international companies, a conflict in different legal provisions within countries of operation can frustrate their operations.

Besides, the business of acquiring and running properties can easily result in multiple legal disputes on ownership. To mitigate legal risks, REITs functionalities must limit themselves to legal procedures, rules, and provisions in areas of operation (Emily 128).

Conclusion

Because of their versatility and capacity to serve business communities, REITs provide a better alternative of investing in real estate than other segments of the real estate such as the housing segment. Moreover, REITS provide a framework where the input of the management has a great bearing on performance than other real estate investments.

REITS will thus continue to offer multiple opportunities for investment in real estate securities. The success of REITs can be enhanced through the creation of economies that have necessary support infrastructures such as non-hostile tax rates, a suitable legal environment, and a robust business environment.

Works Cited

Andrew, Robert 2012. Investors, PDF file. 7 Nov. 2012 <Investors.morningstar.com>

Deloitte. REITs and Infrastructural Projects: the next Investment Frontier, New York: McMillan, 2011. Print

Emily, Jones. The risk of REITs Securities, Washington: McMillan, 2011. Print